2018 MISO forecast released, under 1% for our area… DOH!

December 18th, 2018

Hot off the press… MISO‘s forecast, much like my all-time favorite industry report, the NERC Reliability Assessment! Because each region sends its forecasts to NERC, odds are that this is the basis for the MISO part of the next NERC Reliability Assessment. The NERC reports have showed for a long time that reserve margins are way higher than needed, sometimes 2-3 times higher than needed, and that demand is not at all what has been predicted. DOH!

HERE IT IS — READ IT:

2018 MISO Energy and Peak Demand Forecasting for System Planning302799

Bottom line? And remember, this is the industry “forecast” which consistently overstates:

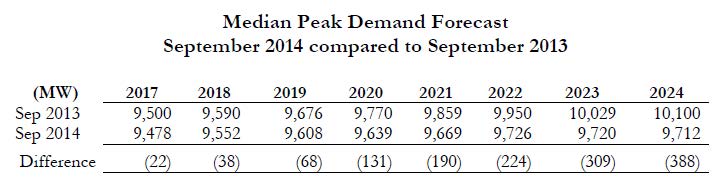

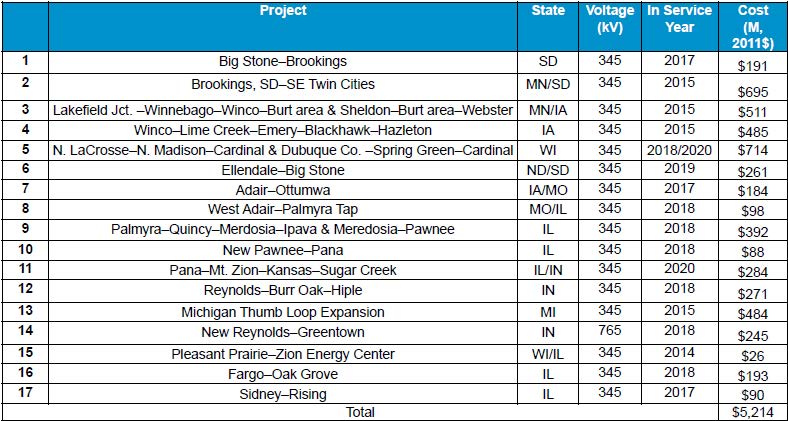

Remember CapX 2020 “forecast” of 2.49% used to justify that transmission build-out? And all that’s happened since, is happening now, like the MISO MVP 17 project portfolio?

Or more correctly, all that HASN’T happened since, like increase in demand?

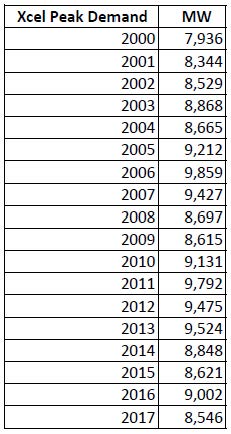

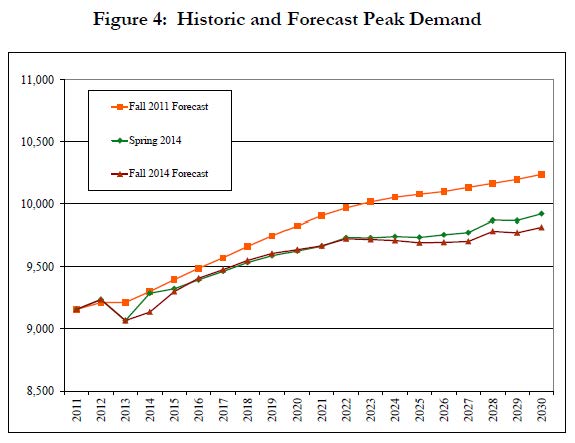

This has been an historical, systematic misrepresentation, Xcel’s “business plan” is based on these lies. From Xcel’s IRP (Docket 15-21), p. 45 of 102:

That Xcel IRP docket continues, and compare peak demand with their bogus chart… what can we expect?

That Xcel IRP docket continues, and compare peak demand with their bogus chart… what can we expect?

Xcel demand down, down, down

September 28th, 2014

I’ve been saying this for so many years, that electric demand is down, down, down, and instead, Xcel Energy (and all the others) have been saying it’s going UP, UP, UP (even though Mikey Bull said years ago that they wouldn’t need power for a while), and they’re applying for and getting Certificates of Need for all these permits for utility infrastructure that are obviously designed to market and sell the surplus, and the Public Utilities pretends to be oblivious (I say “pretends” because I cannot believe they’re that unaware and uninformed.).

This is a must read:

Here’s the short version from Xcel:

2024 is expected to be about what it was back in 2007, the industry peak year. DOH! But note this — there’s a “small capacity surplus in 2016.” DOH!

And given the surplus which we’ve known has been present and looming larger, that’s why they then ask for withdrawal of the Certificate of Need for the Prairie Island uprate because it isn’t needed (and really, that was just what, 80 MW or so? Or 80 MW x 2 reactors, 160 MW?). If they don’t need that small uprate, why on earth would they need so much more?

But what do I know…

Hollydale Transmission Line was clearly not needed, and they withdrew that application…

CapX 2020 transmission was based on a 2.49% annual increase in demand, and for Hampton-La Crosse in part supposedly based on Rochester and La Crosse demand numbers, yeah right, we know better, but that was their party line. Again, DOH, it didn’t add up to needing a big honkin’ 345 kV transmission line stretching from the coal plants in the Dakotas to Madison and further east, but who cares, let’s just build it…

ITC MN/IA 345 kV line — the state said the 161 kV should be sufficient to address transmission deficiencies in the area, but noooooo, DOH, that wouldn’t address the “need” for bulk power transfer (the real desire for the line).

Here’s a bigger picture of the bottom line (I’m accepting this as a more accurate depiction, not necessarily the TRUTH, but close enough for electricity), keeping in mind that these are PROJECTIONS, and that they’re adding a “Coincident Peak adjustment” which should be included in the “peak” calculations):

Notice the only slight reduction in coal capacity, just 19 MW, nuclear stays the same, a 320 MW decrease in gas, a 128 MW reduction in Wind, Hydro, Biomass, which I hope includes garbage burners and the Benson turkey shit plant , slight increase in solar of 18 MW, and Load Management also a slight increase of only 80 MW. This is Xcel Energy with its business as usual plan, which has to go. We can do it different, and now is the time.

Will someone explain why we paid so much to uprate Monticello, and paid to rebuild Sherco 3?

From the archives:

500+ give LS Power a piece of their mind

October 20th, 2009

2012 NERC Long Term Reliability Assessment

May 7th, 2013

PJM Demand is DOWN!

November 15th, 2012

Transmission? It’s NOT needed!!!

October 18th, 2012

Xcel shelves projects, admitting demand is down

December 3rd, 2011