FERC cuts transmission ROE largess

December 4th, 2019

Since pre-CapX 2020, and lately in MISO’s MVP 17 project portfolio, it’s been clear that cost apportionment and return on equity were primary drivers of transmission. But for the massive return on equity to the transmission owners, would there have been, would there be, a transmission build-out?

And at last, there’s good news!!!

FERC applies new transmission ROE policy to MISO, slashes rate to 9.88%

YES!!!

Here’s the FERC Order:

FERC originally approved a 12.38% ROE for transmission projects in 2003 (see Midwest Indep. Transmission Sys. Operator, Inc., 99 FERC ¶ 63,011 (2002)), There were two complaints filed by MISO customers, lots of them, saying the rates were unreasonable:

It was set for hearing in 2014… yes, 2014, five years ago:

And the timeframe that this was bubbling is a material factor. The FERC Order authorizing all these perks was 2006, when the CapX 2020 Certificate of Need was filed, when the Minn. Stat. 117.189 eminent domain provisions were passed in prelude to CapX 2020 condemnations, the big transmission build-out was beginning, waiting for the stars to align. And align they did, not just with Minnesota legislation, but federal legislation and agency Orders and rules.

FERC authorized that many other perks be made available to transmission owners, based on premises in its Order 679:

The “incentives” included return on equity (established at 12.38% for MISO with the exception of ATC, set at 12.20%) in a series of decisions from 2002-2004), Construction Work on Progress, or CWIP (also covered in Minnesota statute), and a guarantee of recovery of costs of abandoned facilities. From Order 679’s table of contents, the list:

Have you ever heard of a transmission project abandoned? I can think of only a couple… the risk of that happening is not high.

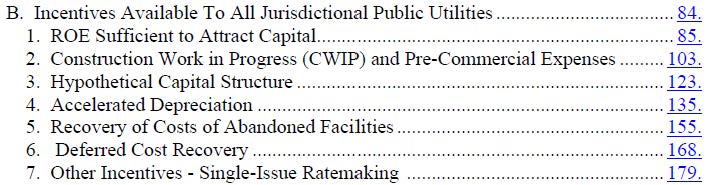

And whew, did transmission project costs skyrocket (though I’d like to see the full chart 2006 to present!):

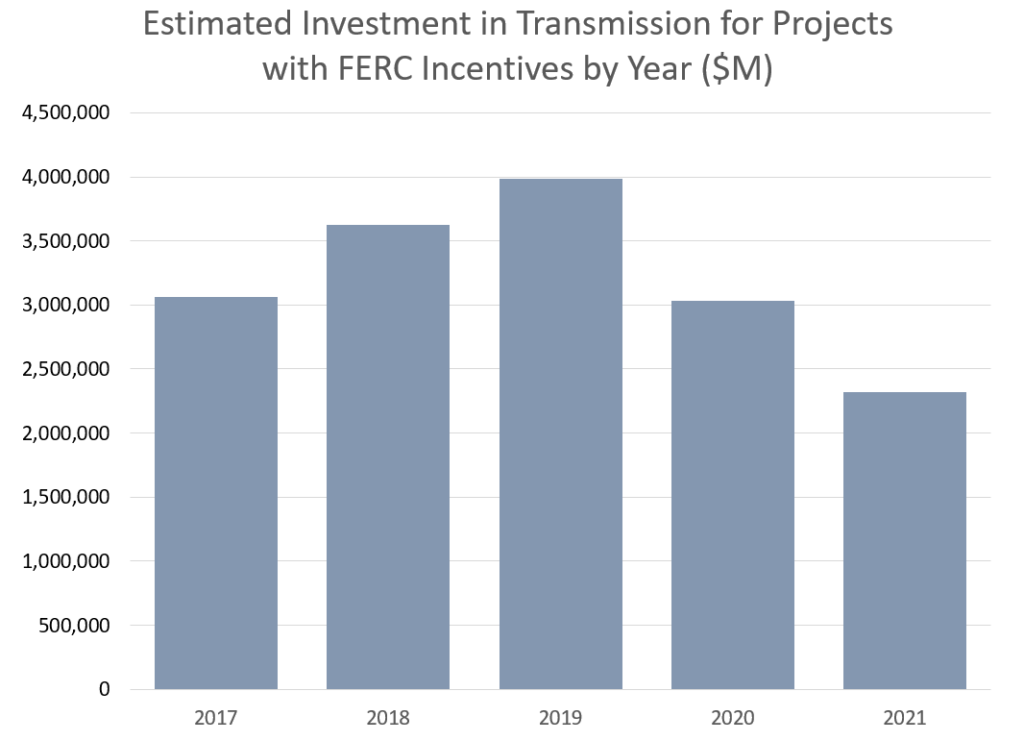

Beyond the rate of return on equity, here’s another example of a perk provided:

This Recovery of Costs of Abandoned Facilities “incentive” was approved for American Transmission Company (ATC) and ITC’s recently permitted (in Wisconsin) Cardinal-Hickory Creek transmission line.

FERC established the rebuttable presumption for approval of “incentives” for a project:

From: T&D World, Before FERC Order 1000 There Was Order 679 $53 Billion and Counting, which notes that:

The purpose and hoops to jump through to qualify for these “incentives” were laid out in the Notice – note the highlighted parts:

As far as “special risks or challenges” the FERC Notice stated:

Risks and challenges? Congestion? Let’s take a look at the MISO MVP 2011 Report and subsequent Triennial Reports — what are the so-called “benefits” of these projects? Risks? Do you see risks?

MISO’s MVP Triennial Reports show that the benefits to eastern Wisconsin, Zone 2, have consistently dropped since the 2011 MTEP MVP Portfolio Report, with sharply increasing benefit/cost ratio ranges focused on the western generating states in zones 1 and 3. See below, Figure E-3, Ex.-MISO-Ellis-3, MTEP 2017 Triennial Review, p. 8 (PSC REF# 364903) (to view primary documents in the Cardinal-Hickory Creek transmission docket, go to PSC DOCKET SEARCH and search for Docket 5-CE-146). The economic focus of the MVP projects and the region-wide cost sharing makes them different from reliability justified transmission projects. The benefit/cost ratio is greater, and on an increasing rather than decreasing curve, for those states to the west of Wisconsin, and decreasing curve in Wisconsin. Is this project, much less the entire MVP 17 project portfolio good for Wisconsin?

Let’s walk through it step by step…

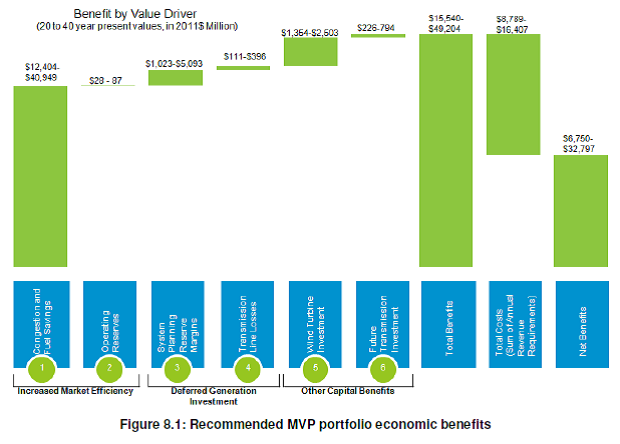

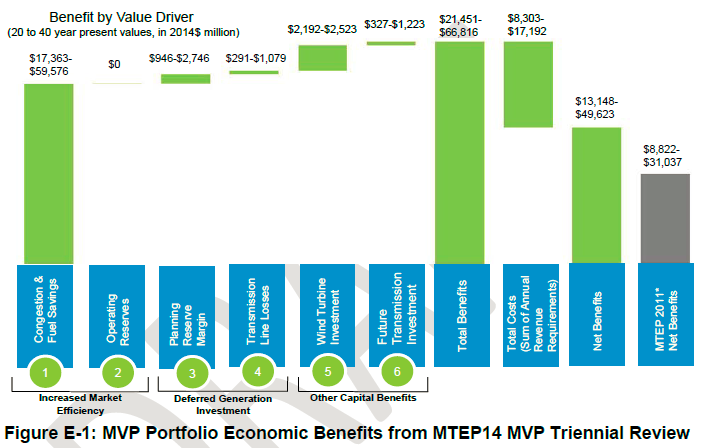

First, let’s look at the “value drivers.” In the three graphs below, they are, from left to right in the graph, Congestion and Fuel Savings, Operating Reserves, Planning Reserve Margin, Transmission Line Losses, Wind Turbine Investment, and Future Transmission Investment. Watch the changes over time. The ones underlined are particularly difficult to justify as “benefits” to Wisconsin – benefits to the “customers” and/or producers, but Wisconsin? These benefits are not accrued to ratepayers!

Let’s start with the 2011 Multi-Value Projects (MVP) Report published January 10,2012 following 2011 MISO approval, linked above. “Congestion and Fuel Savings” is on the left side, $12,404-$40,949, 20-40 year values in 2011 $million:

Note that “Congestion” is not a separate item. We have no way of knowing what the claimed “Congestion” benefits are! Also note the totals in the right-hand columns.

Now on to the MISO 2014 MVP Triennial Review, “Congestion and Fuel Savings” of $17,363 – $59-576:

And the MISO 2017 MVP Triennial Review, “Congestion and Fuel Savings” of $20,121 – $71,353:

See PUC Docket 5-CE-146, Ex.-MISO-Ellis-3, p. 4, 23((PSC REF# 364903). And each year, the numbers are smaller and smaller — by the time Cardinal-Hickory Creek (C-HC) got before the Public Service Commission, in 2018, C-HC was the last project, the only MISO MVP project remaining for permitting. PSC staff analysis found that it was not certain that benefits would be provided, and that as engineering judgment, if the project were not built, and as the last of the MVP projects under consideration, if the project is not individually of much, or of no, benefit, the balance of MISO MVP Portfolio benefits may increase if not built. Tr. at 1469.

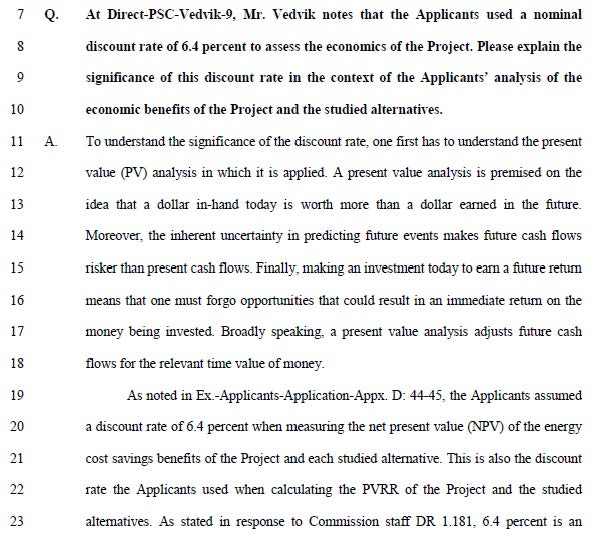

In that Wisconsin hearing, Applicant’s attorney set up a witness with a discussion of the risk of the project, and basing the discount rate on claimed benefits:

Degenhardt’s testimony was reinforced by Direct on prompting by ATC’s attorney:

That didn’t make much sense to me, so I had to ask:

So he didn’t consider the impact of the “Abandoned Plant” incentive? Seems to me that would significantly reduce the risk, the whole point of it is to increase the ROE sufficiently to arguably be able to attract investors. ??? What is the risk of this project? That it couldn’t find financing, probably! Oh, right, the point is to have ROE sufficient to “attract capital.” So on its own, it wouldn’t.

And if the project did “attract capital” but nonetheless wasn’t built, they’re covered (for proposing a project that was not needed or not constructible?

ATC and ITC’s Orders to recover $$$ if the Cardinal-Hickory Creek project were abandoned:

And the Applicants’ witness claims not to be familiar with the ATC and ITC FERC Incentive Orders?

Seems to me this perk should be considered in any discussion of risk. PSC Bacalao’s testimony, drawing on PSC’s Vedvik’s testimony, was about how to calculate the discount rate, whether it had been done correctly, that there were two ways to do it… whether incentives should be included in the calculation. Bacalao testified that depending on how Applicants’ used “incentives” in their calculations, in evaluating “risk,” in their FERC applications, there could be a problem:

Again, the FERC Order 679:

What is the impact of FERC’s Order on the risk of these MVP projects? What is the impact of FERC’s Order on the cost of these MVP projects, even the CapX 2020 projects?

What is the impact of FERC’s Order on the utility attempt to shift from a cost-based rate calculation to a “business plan.” Methinks it’s a material impact. We shall see…

It seems to me one thing needed is to take a serious look at FERC’s presumptions, both for integrity AND for what impact the presumption’s blessing of MISO study and “approval” does to state jurisdiction. From FERC Order 679, the presumptions explained:

FERC Order 679 p. 34-37

3. Rebuttable Presumptions

57. As we discussed above, we will not adopt the variety of preconditions recommended by the commenters. However, we are nonetheless required to make findings that a particular investment falls within the scope of section 219. In making that finding, we have chosen to rely on existing processes to the extent practicable in determining whether a particular facility is needed to maintain reliability or reduce congestion. We describe these processes below and find that, if an applicant satisfies them, its project will be afforded a rebuttable presumption that it qualifies for transmission incentives. Other applicants not meeting these criteria may nonetheless demonstrate that their project is needed to maintain reliability or reduce congestion by presenting us a factual record that would support such findings. Once we determine that the project is eligible for incentives, we would, as described below, consider whether the particular incentives being proposed are appropriate for the particular investments being made.

58. The first rebuttable presumption we will adopt relates to regional planning. Although we will not require participation in regional planning processes as a precondition for obtaining incentives, as section 219 does not require such a precondition, we believe that regional planning processes can provide an efficient and comprehensive forum through which those seeking to make transmission investments can have their projects evaluated to see if they meet the requirements of section 219. Regional planning processes can help determine whether a given project is needed, whether it is the better solution, and whether it is the most cost-effective option in light of other alternatives (e.g., generation, transmission and demand response). It does so by looking at a variety of options across a large geographic footprint; thus, regional planning can allow for a broad assessment of loop flows and impacts on neighboring systems. Regional Planning also can serve as a forum in which states can readily participate.37 This benefit of a regional planning process is difficult to duplicate on a utility-by-utility basis. It may prove difficult for applicants, on an individual basis, to timely gain access to all the information that might be required to make a showing that the project ensures reliability and/or reduces the cost of delivered power by reducing congestion. The Commission expressly recognized the value of regional planning when it proposed to amend the pro forma Open Access Transmission Tariff of jurisdictional public utilities to require regional planning to ensure that transmission is planned and constructed on a nondiscriminatory basis to support reliable and economic service to all eligible customers in a region. 38 Consistent with our actions in that NOPR and our belief that power markets are regional in nature and that the transmission systems supporting those markets must be supported by regional planning, we will create a rebuttable presumption for projects that result from regional planning. Thus, the Commission will rebuttably presume that transmission projects that result from a fair and open regional planning process that considers and evaluates projects for reliability and/or congestion and is found to be acceptable to the Commission satisfy the requirements of this Rule.39 In addition, the Commission will adopt the following other rebuttable presumptions. We will also attach a rebuttable presumption that an applicant has met the requirements of section 219 if a proposed project is located in a National Interest Electric Transmission Corridor or where a project has received construction approval from an appropriate state commission or state siting authority.

Once more with feeling:

…the Commission will rebuttably presume that transmission projects that result from a fair and open regional planning process that considers and evaluates projects for reliability and/or congestion and is found to be acceptable to the Commission satisfy the requirements of this Rule.”

FAIR AND OPEN?!?! Hardly.

Now that they’re tweaked one of the perks, making ROE more realistic, more “reasonable,” it’s time to look at the others, and the foundational presumptions FERC makes in granting “incentives.” FERC, while you’re at it, consider the impacts of these federally granted “incentives” on state rate-making authority and state permitting authority.