TANC transmission line “gasping”

July 3rd, 2009

The NYRI line in New York was turned down, PJM has eliminated the Indian River, DE to Salem, NJ segment of MAPP, and TANC is imploding before us! YEAAAAA!

This week, SMUD pulled out of TANC. What does that mean? It means SMUD is paying attention to demand and financing, YEAAAAA, and it means that over 1/3 of the project’s $$$ is MIA, YEAAAA!!!!

From the Modesto Bee:

Power project gasping for cash

Partners don’t see survival without a $525M transfusion

By Ed Fletcher

efletcher@sacbee.com

The Western Area Power Authority is a federal partner.

On Thursday, those partners grappled with questions about the project’s vitality.

PSE&G’s PR machine

July 2nd, 2009

Here’s their PR machine:

Here’s the poop:

New Poll Finds Strong Public Support for PSE&G’s Transmission Line UpgradeJul 1, 2009 12:38 AM

Public Service Enterprise Group Inc.A recent poll finds that the majority of people in Morris and Sussex counties in New Jersey favors PSE&G’s plan to upgrade the Susquehanna-Roseland transmission line to ensure reliability of the electric grid.

The poll, conducted by the firm of Luntz, Maslansky Strategic Research, showed approximately 3-to-1 support for the project, with 60 percent of those surveyed saying they “strongly support” or “somewhat support” it, compared to 22 percent who “strongly oppose” or “somewhat oppose” the line. Support for the line was equally strong regardless of the respondent’s proximity to the line.

“It is evident that most people understand that the existing line, which went into service in 1931, can’t be expected to handle today’s demand for safe, reliable electric service without an upgrade,” said Ralph LaRossa, president and COO of PSE&G.

“If we don’t act, Morris and Sussex counties, as well as all of northern New Jersey, could experience widespread brownouts and blackouts by the summer of 2012,” LaRossa said. “That’s not our judgment at PSE&G. It’s the verdict of the independent experts empowered by the federal government to manage the electrical grid. It’s a warning we take very seriously.”

The poll showed that 81 percent of the people in these counties see America’s energy situation as either a “crisis” or “major problem.” LaRossa added, “Most people who live in this area clearly understand the need to do what is required to maintain and ensure reliability.”

PSE&G, which funded the poll, is seeking permission to invest $750 million on the upgrade, adding a 500-kilovolt line to the existing 230-kilovolt line, within an existing transmission right-of-way. The project would create the equivalent of nearly 4,000 jobs lasting one year each, according to a recent report by senior economists at Rutgers University. And by relieving some of the congestion that drives up electric rates in New Jersey, it would help contain electricity costs for homes and businesses in the region.

The Board of Public Utilities is considering PSE&G’s petition to upgrade the line and is expected to make a decision by the end of the year. Public hearings were held on June 11 and 18 in Sussex County; a third hearing will be held June 30 in Morris County. In addition, the New Jersey Highlands Council is expected to vote on PSE&G’s request for an exemption for the project at its June 25 meeting.

The Luntz, Maslansky survey was conducted by telephone with 525 utility ratepayers across Morris and Sussex counties. The survey captured a statistically significant population of each county. To make sure the survey elicited the opinions of those ratepayers most likely to be affected by the project, the survey included an oversample of 100 respondents self-selected as living near the current transmission line, as well as an oversample of 100 respondents who lived in towns known to be near the existing transmission line. All respondents were registered voters. The survey was in the field June 4-11 and has a margin of error of plus or minus 4.3 percent at the 95 percent confidence level.

PEPCO may not finance MAPP transmission line

June 27th, 2009

And that’s a good thing, because their SEC filings show that demand is down from 2007-2007, as it is everywhere. It’s looking like utilities are unable to sustain their drive for long distance market dispatch, and if this trend is the reality, and their stock continues to be in the toilet, they can’t build their transmission dream — this is good news! Chalk up one for the economic depression!

All of us participating in the Delmarva Power IRP have to make sure the PSC knows about the tanked market, after all, they’re addressing how Delmarva Power will fulfill its demand, and for sure we don’t need new generation (need different generation, to be sure) or any transmission. As to needing different generation, it’s particularly important at this time to attach a requirement to SHUT DOWN FOSSIL FUEL to any RES. Without that, they’ll just sell it elsewhere, and we won’t gain anything.

Here’s one example of how the economy can have an impact on electric infrastructure and market. Hot off the press — PEPCO may not be selling stock to finance projects, and the biggest project they’re looking at is the much-detested Mid-Atlantic Power Pathway, electric transmission known as the MAPP line.

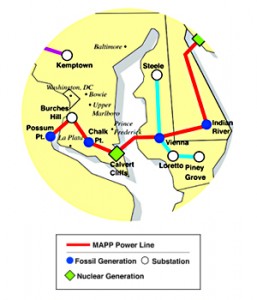

And remember, not that long ago, PJM cancelled the part from Indian River to Salem, NJ, at the Salem & Hope Creek nuclear plants. Here’s what it looks like now, supposedly:

HA! THEIR MAPS DON’T EVEN REFLECT THAT CHANGE!!

The Press Release says:

According to Gausman, PJM has also reviewed the need for the section of the line that would run from Delmarva Power’s Indian River substation near Millsboro, Del., to Salem, N.J., and has decided to move this portion of the line into its “continuing study” category. This means that the reconfigured MAPP line will now extend approximately 150 miles from northern Virginia, across southern Maryland and the Chesapeake Bay, and terminate at Indian River. The change would likely reduce the total project cost from $1.4 billion to $1.2 billion.

(Emphasis added). Hee hee hee hee hee — “… terminate at Indian River.” No Indian River to Salem, NJ section. Cutting a section out is just one more step to tanking the project. What’s the point of a radial line to Indian River? Some would say that “hey, there’s transmission there, it’s not a radial line,” but there’s NOT transmission there to facilitate the bulk power transfers coming in on a 500kV line. The system there is comparatively VERY low voltage. Others would note that the Indian River plant has two units shutting down, but folks, they’re the smallest units, totalling about 150MW or so, that will not make a big electrical difference, though it has a significant impact on our ability to breathe the air in southern Delaware! Taking the small Indian River units most probably means that Bluewater Wind should have no problem interconnecting — lets see the interconnection studies with Indian River units off line!

Anyway, here’s the poop — and look at the PEPCO price: $13.39, about half of what it was a year ago ($26.25) (for month, YTD, year and 5 year, go HERE) If you look at the 5 year trend, it’s the same reflected in Xcel’s demand — everything goes south in 2007. THIS IS NOT A “BLIP” FROM LAST FALL’S CRASH, this is a 2 year, nearly 3 year trend. (For Xcel month, YTD, year and 5 year, go HERE).

From PEPCO’s 2008 SEC 10-K, here’s their 2007-2008 energy delivery numbers (DOWN), regulated and default:

|

Regulated T&D Electric Sales (Gigawatt hours (GWh))

|

||||||||||

|

2008

|

2007

|

Change

|

||||||||

|

Residential

|

17,186

|

17,946

|

(760)

|

|||||||

|

Commercial

|

28,739

|

29,137

|

(398)

|

|||||||

|

Industrial

|

3,781

|

3,974

|

(193)

|

|||||||

|

Other

|

261

|

261

|

–

|

|||||||

|

Total Regulated T&D Electric Sales

|

49,967

|

51,318

|

(1,351)

|

|||||||

|

Default Electricity Supply Sales (GWh)

|

||||||||||

|

2008

|

2007

|

Change

|

||||||||

|

Residential

|

16,621

|

17,469

|

(848)

|

|||||||

|

Commercial

|

9,564

|

9,910

|

(346)

|

|||||||

|

Industrial

|

640

|

914

|

(274)

|

|||||||

|

Other

|

101

|

131

|

(30)

|

|||||||

|

Total Default Electricity Supply Sales

|

26,926

|

28,424

|

(1,498)

|

|||||||

Here’s PEPCO 2007-7008 SEC 10-K info, 2006-6007, regulated and default – these numbers should be the same for the same years, and they’re not, what does that mean:

|

Regulated T&D Electric Sales (GWh)

|

||||||||||

|

2007

|

2006

|

Change

|

||||||||

|

Residential

|

17,946

|

17,139

|

807

|

|||||||

|

Commercial

|

29,398

|

28,638

|

760

|

|||||||

|

Industrial

|

3,974

|

4,119

|

(145)

|

|||||||

|

Total Regulated T&D Electric Sales

|

51,318

|

49,896

|

1,422

|

|||||||

|

Default Electricity Supply Sales (GWh)

|

||||||||||

|

2007

|

2006

|

Change

|

||||||||

|

Residential

|

17,469

|

16,698

|

771

|

|||||||

|

Commercial

|

9,910

|

14,799

|

(4,889)

|

|||||||

|

Industrial

|

914

|

1,379

|

(465)

|

|||||||

|

Other

|

131

|

129

|

2

|

|||||||

|

Total Default Electricity Supply Sales

|

28,424

|

33,005

|

(4,581)

|

|||||||

Here’s the PEPCO 2006 SEC 10-K info, their 2005-2006 energy delivery numbers (DOWN), first regulated sales:

| Regulated T&D Electric Sales (gigawatt hours (Gwh)) | |||||||||||

|

2006 |

2005 |

Change |

|||||||||

| Residential |

17,139 |

18,045 |

(906) |

||||||||

| Commercial |

28,638 |

29,441 |

(803) |

||||||||

| Industrial |

4,119 |

4,288 |

(169) |

||||||||

| Total Regulated T&D Electric Sales |

49,896 |

51,774 |

(1,878) |

||||||||

| Default Electricity Supply Sales (Gwh) | |||||||||||

|

2006 |

2005 |

Change |

|||||||||

| Residential |

16,698 |

17,490 |

(792) |

||||||||

| Commercial |

14,799 |

15,020 |

(221) |

||||||||

| Industrial |

1,379 |

2,058 |

(679) |

||||||||

| Other |

129 |

157 |

(28) |

||||||||

| Total Default Electricity Supply Sales |

33,005 |

34,725 |

(1,720) |

||||||||

CLICK HERE – PEPCO’s SEC 10-K filings for lots of years to do your own looking!

From Bloomberg:

Pepco CFO May Postpone Investment to Avoid Share Sale

Pepco fell 3 cents to $13.39 in composite trading on the New York Stock Exchange.

To be sure, it will be ugly.

June 21st, 2009

It’s time to tank the TANC project. I love the irony of beautiful shots of transmission lines, particularly where the media is finally getting it right:

“To be sure, it will be ugly.”

Yeah! That’s a direct quote, see the article below…

This 600 mile long and $1.3 billion (somebody better put a new battery in that calculator, that estimate is WAY off) project has wrapped up every ugly aspect of transmission all in one (like almost every other project I’ve seen these days!). Let’s see, yes, it will visually be butt ugly. Landowners didn’t get reasonable notice. It will have massive impact on environment, economics, and public health. Oh, and need we mention, like the others, it’s not needed. Look where it starts and guess how far it is from the nearest coal plants, online or on the drawing board.

Now notice all the back and forths, this isn’t just one line, each segment has at least two, if not three lines (their type gets in the way of ID’ing what’s planned. CLICK HERE FOR THEIR MAP PAGE.

Heard enough? Ready to do something about it?

PRE-MEETING RALLY

HOLIDAY INN — REDDING, CA

Wednesday, July 8, 2009 at 2:00 PM

then

PUBLIC MEETING WITH TANC:

CASCADE THEATRE – MARKET STREET

REDDING, CA

Wednesday, July 8, 2009 at 6:00 PM

ALL LANDOWNERS ATTEND

Need more information:

Here’s the TANC site

Here’s WAPA’s TANC site

Here’s the STOP TANC site

*******************************************

From the Modesto Bee:

Big power line controversy

What’s happening?

June 19th, 2009

Public meetings all over southern Minnesota, that’s what!

Hop over to www.nocapx2020.info

It’s been a busy week…