PJM Demand is DOWN!

November 15th, 2012

But we knew that…

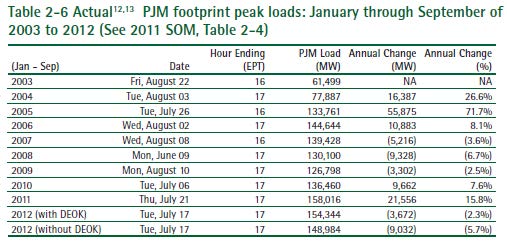

Here’s the part I’m most interested, demand is DOWN, from the intro, summarizing p. 23 of the report linked above:

The PJM system peak load for the first nine months of 2012 was 154,344

MW, which was 3,672 MW, or 2.3 percent, lower than the PJM peak

load for the first nine months of 2011. The DEOK Transmission Zone

accounted for 5,360 MW in the peak hour of the first nine months of

2012. The peak load in 2012 excluding the DEOK Transmission Zone was

148,984 MW, a decrease of 9,032 MW, or 5.7 percent, from the peak load

for the first nine months 2011. (See page 23)

2.3%, 5.7%, DUH! Demand is DOWN! Here’s the specifics:

Not-So-Great Northern Transmission

November 8th, 2012

Got that? NO hockey sticks in the hotel!

Yesterday, both meetings, in Hermantown and in Grand Rapids, were well attended. The Hermantown municipal building is new, nothing like that was there last time I was in town, it’s been a while. Very nice building, wonder if Minnesota Power’s Arrowhead transmission line had anything to do with that?

Here are copies of what I’ve been handing out:

Notice Plan Comments are due November 19, 2012, and Reply Comments due December 10, 2012. Send to burl.haar@state.mn.us, with “Great Northern Notice Plan Comments – Docket 12-1163” in subject line.

Minnesota Power’s Notice Plan for Great Northern Transmission Line

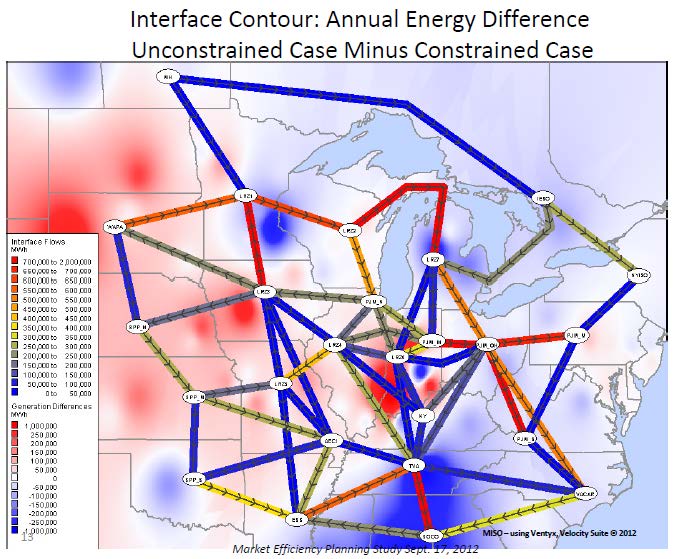

I’ve been looking for the studies that support this line, made some progress, but not enough, MISO has a page on the Northern Area Study. Here’s the kind of map I find interesting, one that shows the flows and areas where they want more, from 20120921 Northern Area Study Transmission Design:

Here are the docs listed (hey MISO, don’t bother deleting them, I’ve got them saved…):

Susquehanna-Roseland update – lawsuit v. NPS !!!!

October 15th, 2012

The Delaware Water Gap is one of the few National Park Service Wild and Scenic Rivers, and it’s in a struggle to stay that way. I represented Stop the Lines before the New Jersey Board of Public Utilities administrative proceeding, which ended with a permit issued to PSEG. Boooo-hisssss.

TODAY, a lawsuit was filed by National Parks Conservation Assoc., Appalachian Mountain Club, Appalachian Trail Conservancy, Association of New Jersey Environmental Commissions, Delaware Riverkeeper Network, New Jersey Highlands Coalition, New York-New Jersey Trail Conference, Rock the Earth, Sierra Club, Stop the Lines versus Ken Salazar as Secretary of the Interior and head of National Park Service, and Dennis Reidenbach as Northeast Regional Director of National Park Service:

Complaint – National Parks Conservation Assoc., et al. v. Salazar & Reidenbach

GOOD! Serves them right, after caving to Obama’s transmission fast-tracking!

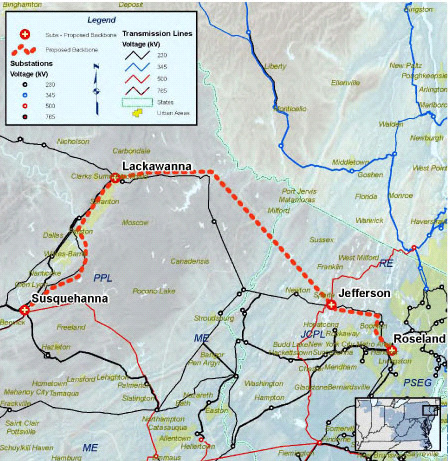

So what’s the scoop? PSEG and PPL have targeted the Delaware Water Gap for a crossing of its Susquehanna-Roseland transmission line. Here’s the NATIONAL PARK SERVICE PAGE for the project.

Here’s the full map:

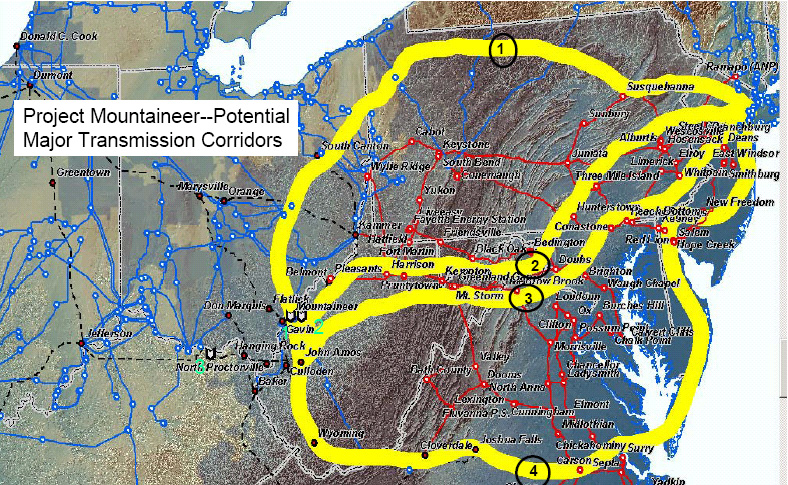

Which is a small part of the bigger picture, part of line #1 on this Project Mountaineer, the transmission for coal scenario hatched at a top secret FERC meeting in 2005:

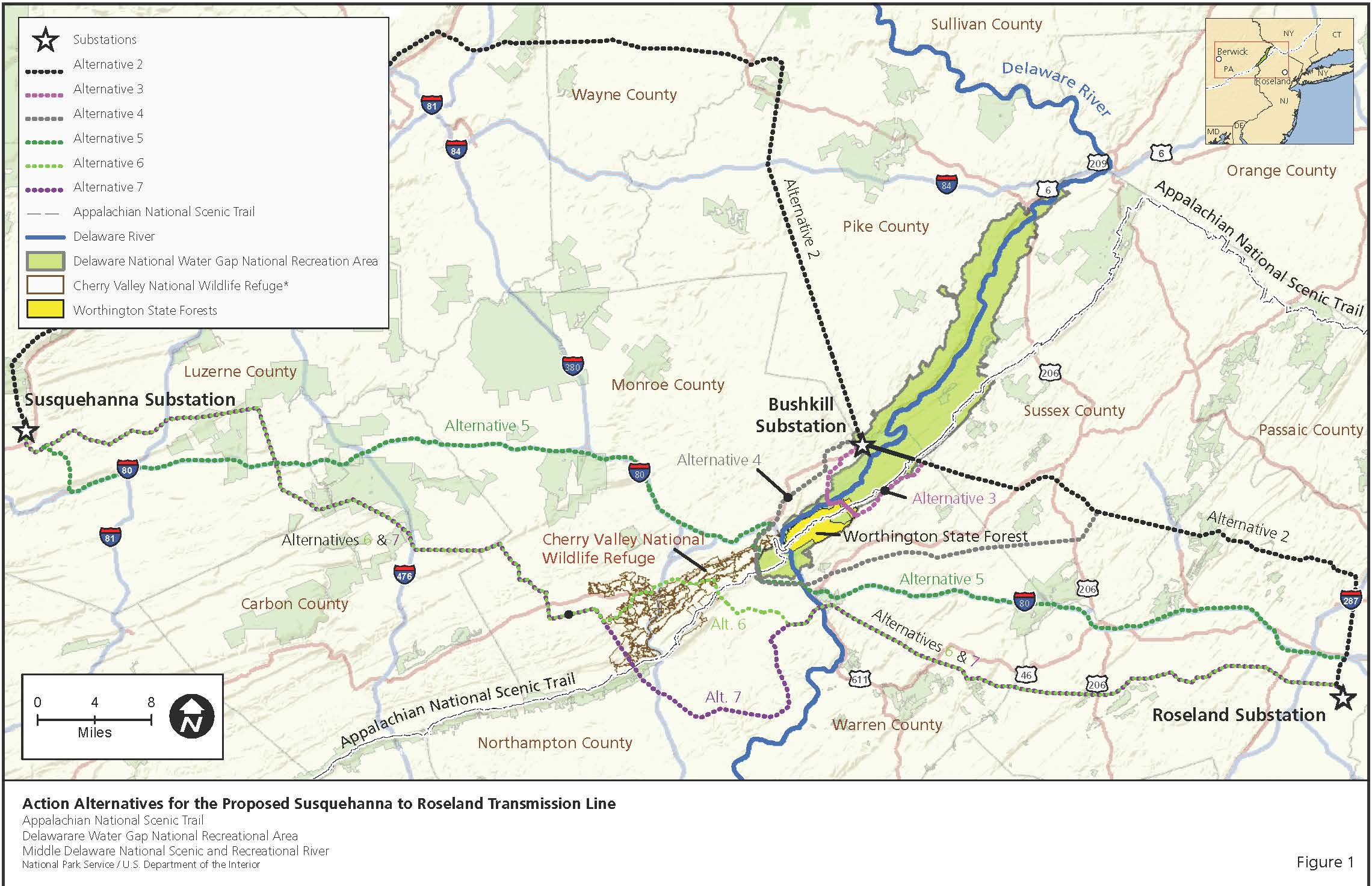

The alternatives evaluated by the National Park Service’s Delaware Water Gap in their EIS looks like this (click on map for larger version):

Here’s the link to the National Park Service’s Final EIS. Inexplicably, National Park Service went from identifying the “no action alternative” as the Environmentally Preferred Alternative, to a (rolling over) “STICK IT HERE!” Oh, and a payoff of $30-40 million. And then there’s “pre-approval” of the project by NPS…

Stay tuned!

Xcel’s 2Q reports – sand mining increases sales

August 14th, 2012

Xcel Energy’s 2Q report came out almost two weeks ago (where DOES the time go?!?!), and one part stuck out:

This came from their transcript, on Seeking Alpha, linked above. So who is looking at the impacts of frac sand mining on energy use, sales and peak demand?

The earnings call and other info is available on Xcel’s Investor site at www.xcelenergy.com. CLICK HERE FOR THEIR INVESTOR RELATIONS PAGE (may need to agree to their “Safe Harbor Statement” to get here) Xcel’s demand isn’t anything to write home about, this from their 8/2/2012 Xcel Energy Second Quarter 2012 Earnings Report:

And from the SEC:

And in this filing, an amazing tidbit that I’d not noticed before — Firm Transmission Rights are regarded as COMMODITY DERIVATIVES:

< ![endif]–>

“Financial Transmission Rights” which “entitle the holder to one year of monthly revenues or charges based on transmission congestion across a given transmission path.” SAY WHAT?!?!?!

Now please, correct me if I’m wrong, but wasn’t “derivatives” in a tanking market what got Xcel’s NRG into bankruptcy?

MAPP is dead, dead, dead

August 8th, 2012

Just in today from PEPCO:

All,

I am writing to provide an update on PHI’s proposed Mid Atlantic Power Pathway (MAPP) project.

Today PJM issued the final results of its 2012 transmission analysis and due to factors such as lower load growth from the sluggish economy, the installation of new gas fired power plants, and the increase in demand response programs, no reliability violations were identified within the transmission planning window. As a result, the PJM Transmission Expansion Advisory Committee (TEAC) issued a recommendation that the MAPP project be canceled. On August 24, 2012, the PJM Board of Managers will meet to make a final decision on the TEAC’s recommendation.

I would like to express my sincere appreciation for your interest and participation in the MAPP project over the past few years.

Thank you,

Mark Okonowicz

MAPP – Environmental Coordinator

Pepco Holdings, Inc.

P – 302-283-6115

C – 302-463-5438

mark.okonowicz@pepcoholdings.com

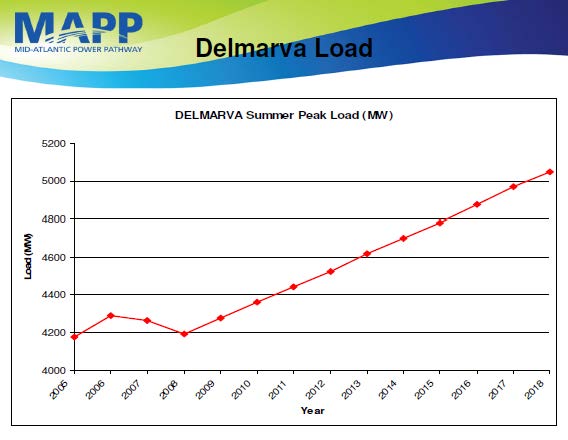

This is after their bogus claims, in 2008, of skyrocketing peak demand (utterly unsupported by fact) from a June 25, 2008 MAPP Presentation found on the DNREC site — this “forecast” is so outrageous, and cancellation is SO HILARIOUS in light of Todd Goodman’s objections to my chalenging demand:

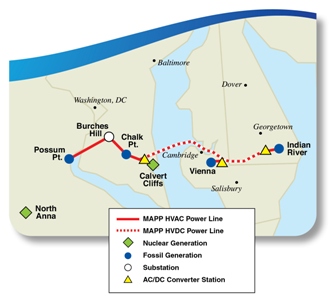

So let’s take a step back – what is MAPP?

No, this isn’t about the Mid-Continent Area Power Pool… it’s the Mid-Atlantic Power Pathway (MAPP), and it is DEAD!

The Mid-Atlantic Power Pathway, a transmission line that was part of “Project Mountaineer,” a coal transmission web that was hatched at a 2005 FERC meeting. MAPP was the NE part of line 4, below (Susquehanna-Roseland is the eastern part of line 1):

Here’s the transcript of that meeting, too scary, but it’s important to read this:

They tried and tried and tried, against evidence, to ram all these projects through. The did manage to get the first one through, the TrAIL (Trans-Allegheny Interstate Line) project, but PATH (Potomac-Appalachian Transmission Highline) is dead, Susquehanna-Roseland is permitted but not yet built…

Slowly but surely, PJM is admitting that transmission is not “needed” by any measure. With MAPP, first they planned it as above, in the first map, and then they eliminated the part in Delaware from Indian River to Salem/Hope Creek nuclear plants:

Despite this, Delaware’s DNREC issued permits for part of this project in Sussex County, Delaware! Whatever for? Why would they do this? Aren’t they paying attention to things electrical? DNREC should know this is not needed

Here is today’s good news — PJM’s latest review, just released, showing NO THERMAL VIOLATIONS — DUH:

Here are two slides that say it all, the first focused on PATH but including MAPP, and the second, the “MAPP Project Analysis” results:

And the bottom line? Another DUH, GOODBYE PATH AND GOODBYE MAPP:

Once again, we’re proven right. How long have we been fighting all these transmission projects, how much time, effort and money showing it’s not needed, even when using INDUSTRY studies, documentation, forecasts. All their claims of need are fabricated, reverse-engineering to get the result they want, billions of dollars of PRIVATE INTEREST, not PUBLIC interest, projects, built on the backs of landowners, with a FERC guaranteed 12+% rate of return for the owners/builders/developers.

The down side is the ratepayers are probably going to be hit with all these development costs because so many jurisdictions allow recovery for “CWP,” construction work in progress. So we get screwed, but not as badly as if they had built the projects.

Like CapX 2020, this project was another of those personal projects. MAPP was originally heading up through Delaware to the Salem/Hope Creek nuclear plants, and the Delaware part would have gone near us in Port Penn, we’re right across the Delaware River from Salem/Hope Creek. They should know better than to try something like that!