Missouri Supreme Court ends Ameren’s Transmission plan

June 29th, 2017

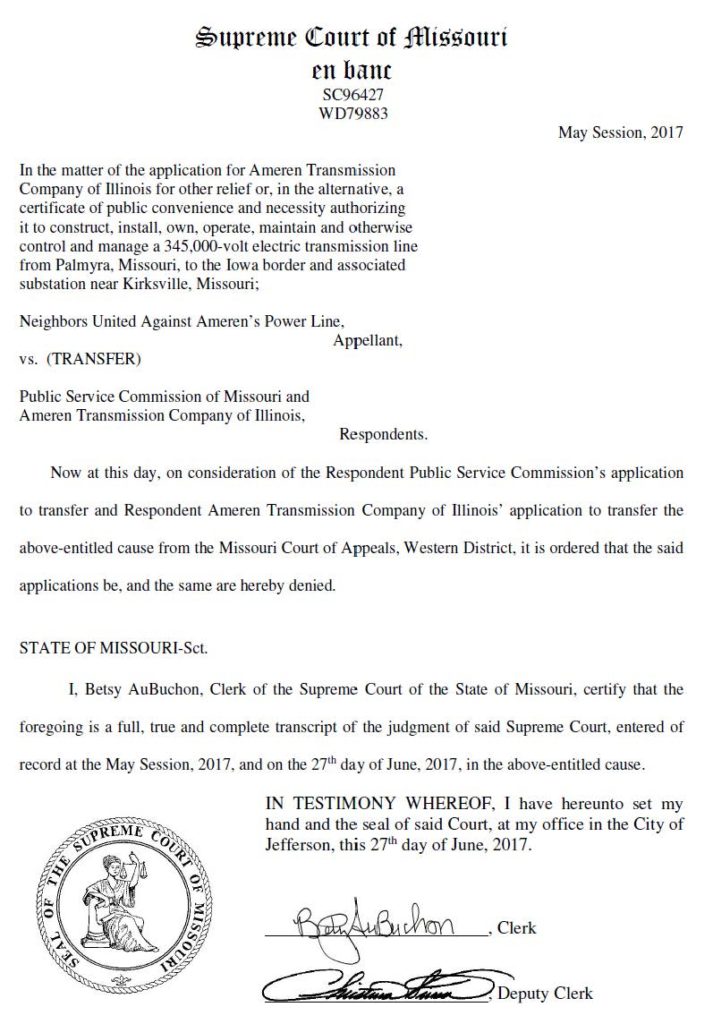

click for larger version

click for larger version

Congratulations to Neighbors United Against Ameren Power Line, and to their attorney, Paul Henry, on this victory against Ameren’s Mark Twain Transmission Project (How dare they name something like this after Mark Twain, he”d be rolling in his grave). The Missouri Supreme Court will not take up the Court of Appeals decision that Missouri does have jurisdiction over Ameren’s transmission project. Here’s the decision from the Court of Appeals:

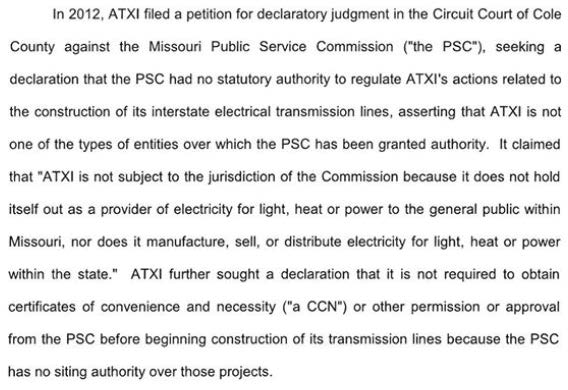

Ameren claims were bizarre:

And the Missouri Court said, “We don’t think so.” Ameren tried to get it before theMissouri Supreme Court, and failed.

As recently as April, Ameren was proposing new routes through Missouri. Guess again!

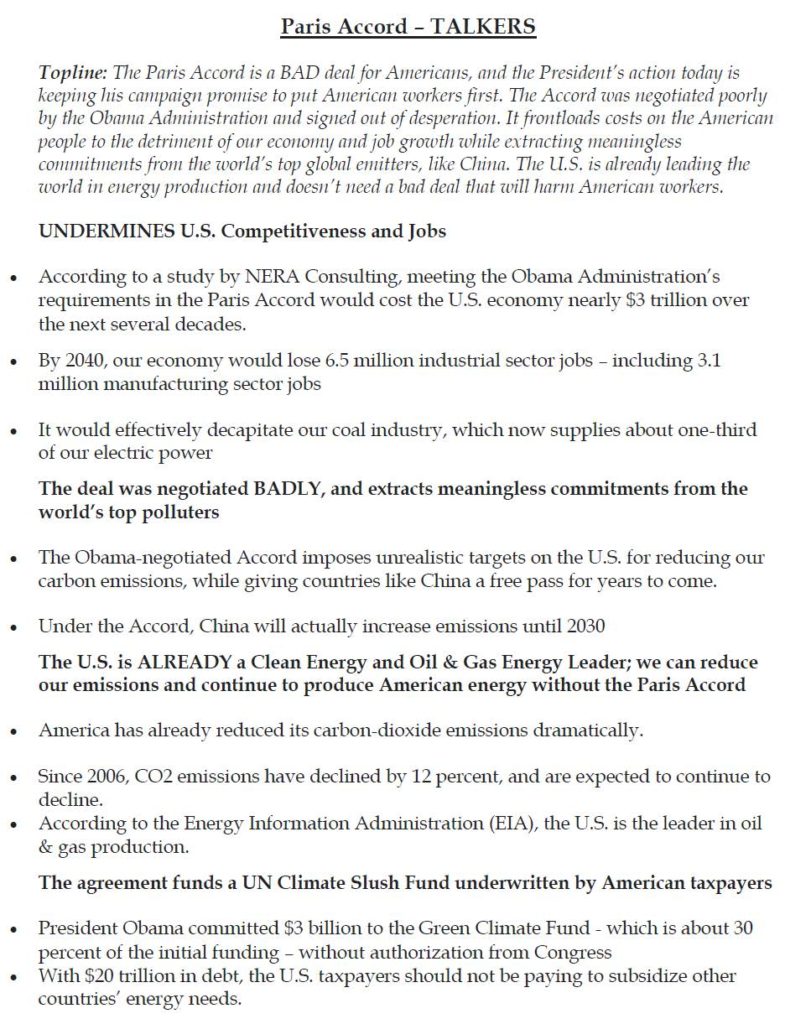

tRump on Climate Change – Withdraw from Paris Accord

June 1st, 2017

Listening to him speak is painful. This idiot is talking about “Clean Coal.” Claims that the Paris Accord stops development of “Clean Coal.” DOH, IT’S THE ECONOMY STUPID!

He’s again blathering about 3-4% growth. Delusional.

The Paris Accord hamstrings America? The Paris Accord limits the American economy?

His points in the speech are insane. A load of covfefe!

Here are tRumpe’s talking points handed out prior to today’s announcement:

Reply Comments on Minn. R. Ch. 7849 & 7850

June 1st, 2017

At long last, the final round of Comments on the 5+ year long rulemaking have been filed. A five year long process to enact the changes consistent with legislation passed in 2005, 12 years ago. WHAT!?!?! Yes, that’s how long it’s taken. These are rules based on the Minnesota statutes for Certificate of Need (Minn. Stat. 216B.243) and the “Power Plant Siting Act” (Minn. Stat. Ch. 216E), which is transmission routing and power plant siting.

Here are the Reply Comments, and note there are very few:

Public Intervenors – No CapX 2020, U-CAN, North Route Group & Goodhue Wind Truth – FINAL_May 31 2017

McNamasra GWT Reply_20175-132415-01

Commerce EERA Reply_20175-132345-01

ITC Midwest_Reply_20175-132421-02

Next step — on the agenda at a future Public Utilities Commission meeting, where they’ll discuss changes, hopefully we’ll have oral argument of the parties and comments from the public, and then the rules are formally released to the public for public comment, a hearing before an Administrative Law Judge, and then back to the Commission for approval. Probably it will be August… given the public comment period and hearing, this will be at least a SIX YEAR PROCESS!

MISO bars access to planning meetings

May 24th, 2017

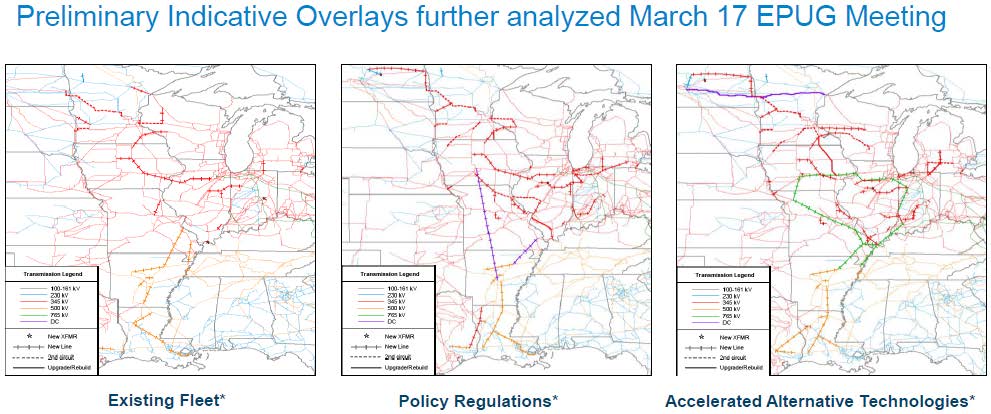

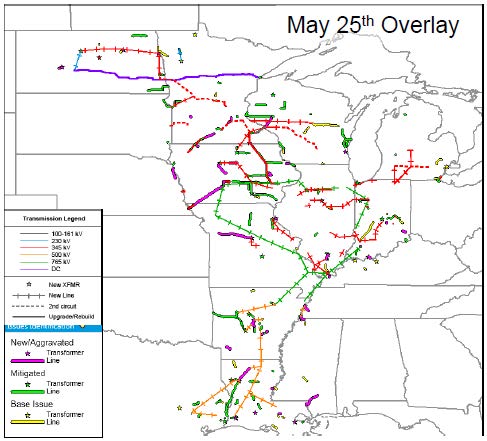

From the public meeting materials, here’s what they’re looking at, above. These are significant additions to the transmission grid in Minnesota and Wisconsin.

MISO’s Economic Planning Users Group is planning a “Regional Transmission Overlay Study” and they’re having another meeting tomorrow, May 25, 2017 down in Metatairie, Louisiana.

Here’s the call in info:

WebEx Information

Event Number: 966 575 350

WebEx Password: Ts824634Participant Dial-In Number: 1-800-689-9374

Participant Code: 823713

Meeting Materials from the MISO site:

- 20170525 EPUG Item 01 Agenda 5/23/2017 05:24 PM

- 20170525 EPUG Item 02 Regional Transmission Overlay Study Overview 5/22/2017 05:47 PM

- 20170525 EPUG Item 03 Preliminary Overlay Indicative Concepts 5/23/2017 05:29 PM

- 20170527 EPUG Item 04 Explore New Benefit Metrics RECB Survey 5/22/2017 04:42 PM

- 20170525 EPUG Item 05 Michigan Exploratory Transmission Study Transmission_Ideas 5/22/2017 04:44 PM

- 20170525 EPUG Item 05 Michigan Exploratory Transmission Study Update 5/22/2017 04:44 PM

- 20170525 EPUG Item 06a Indicative Overlay Design Work Session West 5/24/2017 02:20 PM

- 20170525 EPUG Item 06b Indicative Overlay Design Work Session Central 5/24/2017 02:21 PM

- 20170525 EPUG Item 06c Indicative Overlay Design Session Sub-regional Connections 5/24/2017 02:22 PM

- 20170525 EPUG Item 06d Indicative Overlay Design Work Session South public 5/24/2017 02:23 PM

- 20170525 EPUG RTOS Issues List 5/23/2017 05:45 PM

- 20170525 EPUG RTOS Ideas Tracking Sheet 5/23/2017 05:44 PM

Here’s the problem — they close the meeting, and people like me aren’t allowed to attend. First I was told, back in January when I tried to register:

Thank you for registering for the Economic Planning Users Group (EPUG) on Jan 31. The afternoon portion of this meeting will be held in CLOSED session and reserved from MISO Members or Market Participants only. Please feel free to attend the morning session from 11:00 am to 12:45 pm ET / 10:00 am to 11:45 CT.

I filled out their “CEII – Non-Disclosure Agreement” form and fired it off. But noooooo…

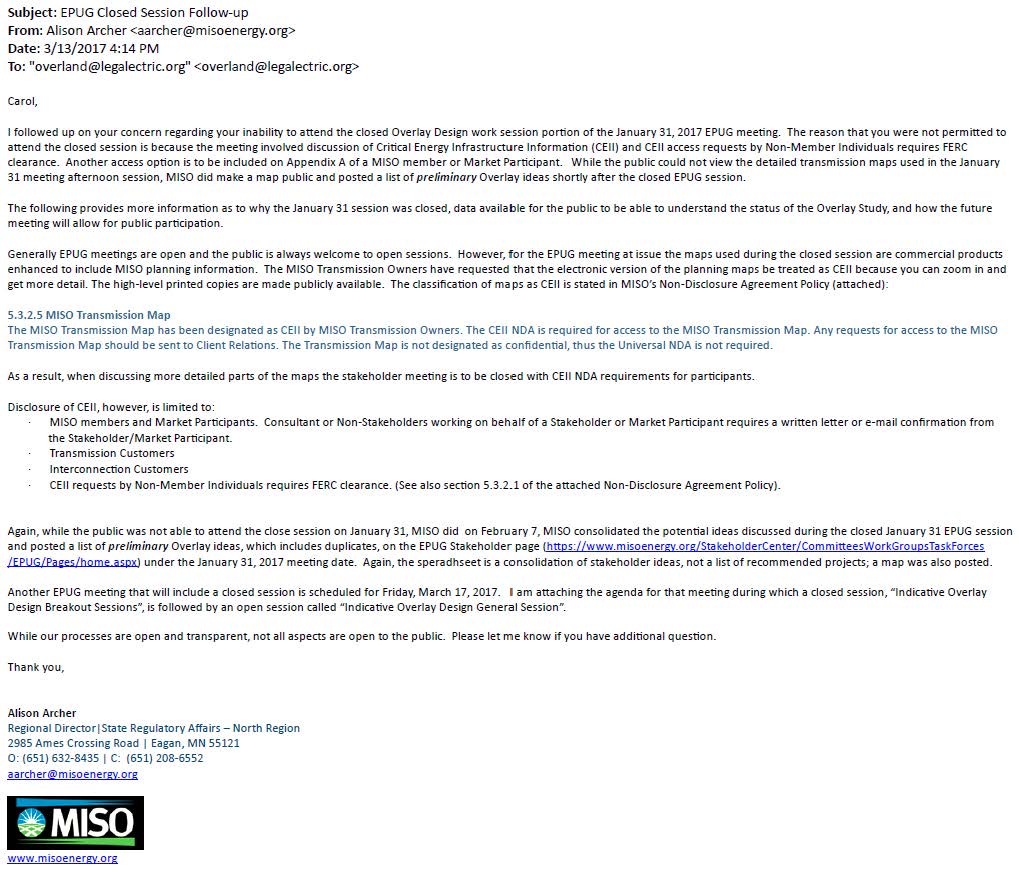

So next I went to the PUC’s Quarterly MISO update, where I was assured that we could make arrangements so that I could attend. I resent the “CEII – Non-Disclosure Agreement” and went back and forth and it came to this (click for larger version). Note this “explanation” of options to be able to attend:

The reason that you were not permitted to attend the closed session is because the meeting involved discussion of Critical Energy Infrastructure Information (CEII) and CEII access requests by Non-Member Individuals requires FERC clearance. Another access option is to be included on Appendix A of a MISO member or Market Participant.

So that says there are two ways to gain access, 1) get “FERC clearance” or 2) “Another access option is to be included on Appendix A of a MISO member or Market Participant.” One or the other. Emphasis added. Here’s the email (click for larger version) laying out those two options:

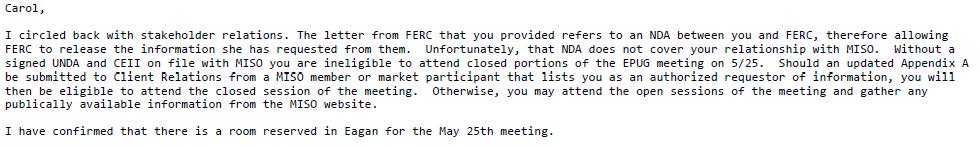

Oh, I says to myself, off to FERC. I sent in the requisite paperwork to FERC, and got “FERC clearance” and they shipped me the CEII information, including but not limited to the map. I let MISO know I’d obtained “FERC clearance,” and here’s the response (click for larger version):

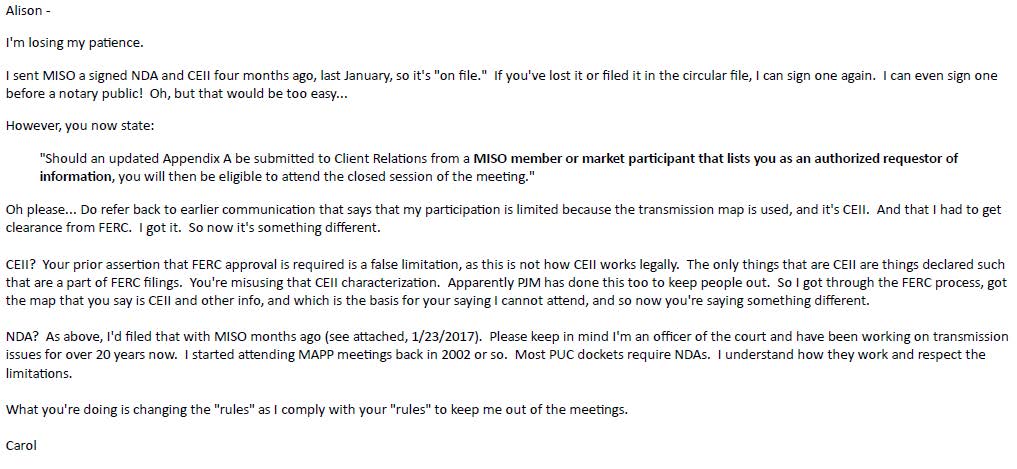

ARRRRGH, they have my CEII NDA on file, have had it since January 23, 2017. I resent it to the writer of these emails on March 4, 2017, and I sent it again today, and objected to yet another change in their “rules” (click for larger version):

So the plot thickens — from MISO (click or larger version):

And from moi (click for larger version):

RCMP cleared in shooting of Site C dam activist

May 23rd, 2017

James McIntyre was shot outside an open house for a dam project, “Site C” for the dam. You know, those open houses they hold to tell the public what they’re going to do before they do it… There was an investigation of the shooting by Canada’s “Independent Investigations Office,” and I’d had an alert and checked now and then, particularly a year after the shooting, but didn’t find the articles on the IIO’s November release of information until yesterday! Here’s the report from the IIO:

Here are some press write ups:

Police ‘begged’ Site C activist to put down knife before shooting him, witness says

IIO clears RCMP in shooting of James McIntyre

RCMP officers cleared in shooting death of Site C protester in Dawson Creek

Look at the way the press framed this article:

RCMP officer cleared in shooting death of B.C. activist that sparked Anonymous revenge campaign

This shooting of McIntyre hit home for me because of my routine of going to the open houses and hanging out at the door, and I know so well how angry people get when there’s infrastructure proposed in their community, on their land. They published my LTE about this in the Alaska Highway News:

Here are my older posts about the shooting, including a video of the shooting by someone in the hotel who was looking out the window:

RCMP shoots hydro dam protester? Nope, misidentified!

James McIntyre ID’d as man shot by RCMP

It’s been a year since McIntyre was shot in BC