Electric demand is down… down… DOWN!

October 28th, 2013

What’s new? Well, Xcel Energy has announced its 3Q results and the 2013 demand just keeps going down!

From Seeking Alpha, the 3Q call transcript (emphasis added):

Kit Konolige – BGC Partners, Inc., Research Division

On the — your sales growth outlook, I believe you said that you are expecting 0% to 0.5% in 2013. Can you discuss the breakdown by states on that and maybe any color about commercial versus industrial versus residential? And also give us a view of the longer term sales outlook that you’re seeing at this point?

Teresa S. Madden – Chief Financial Officer and Senior Vice President

Well, sure, Kit. Let’s start with the 2013 by the states. Minnesota, we’re still projecting a decline of about 1.2%. In NSP-Wisconsin, just a slight decline. And then the other 2 jurisdiction, PSCo slightly up and SPS at about 1.2% range. But all of it netting to within the — up to 0.5%. When we look to the future, we’re looking at about, as we indicated in our guidance up to 0.5%, those are narrowing, not such a great degree in terms of the decline in NSP-Minnesota. In terms of the various classes of customers, it does vary by jurisdiction. I will say that C&I, we see the most growth in Texas with the oil and gas industry boom.

CLICK HERE FOR FULL TRANSCRIPT.

Let me repeat that tidbit:

Minnesota, we’re still projecting a decline of about 1.2%. In NSP-Wisconsin, just a slight decline.

And as we know too well, the CapX 2020 transmission project taking over Minnesota is based on their wishful-thinking projections of a 2.49% annual increase.

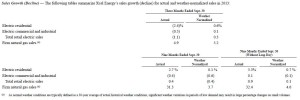

From Xcel Energy’s own investor page (click to enlarge):

Here’s the full 10-Q (above from p. 50):

Someone remind me — why are we paying to build this CapX 2020 transmission project?

Leave a Reply