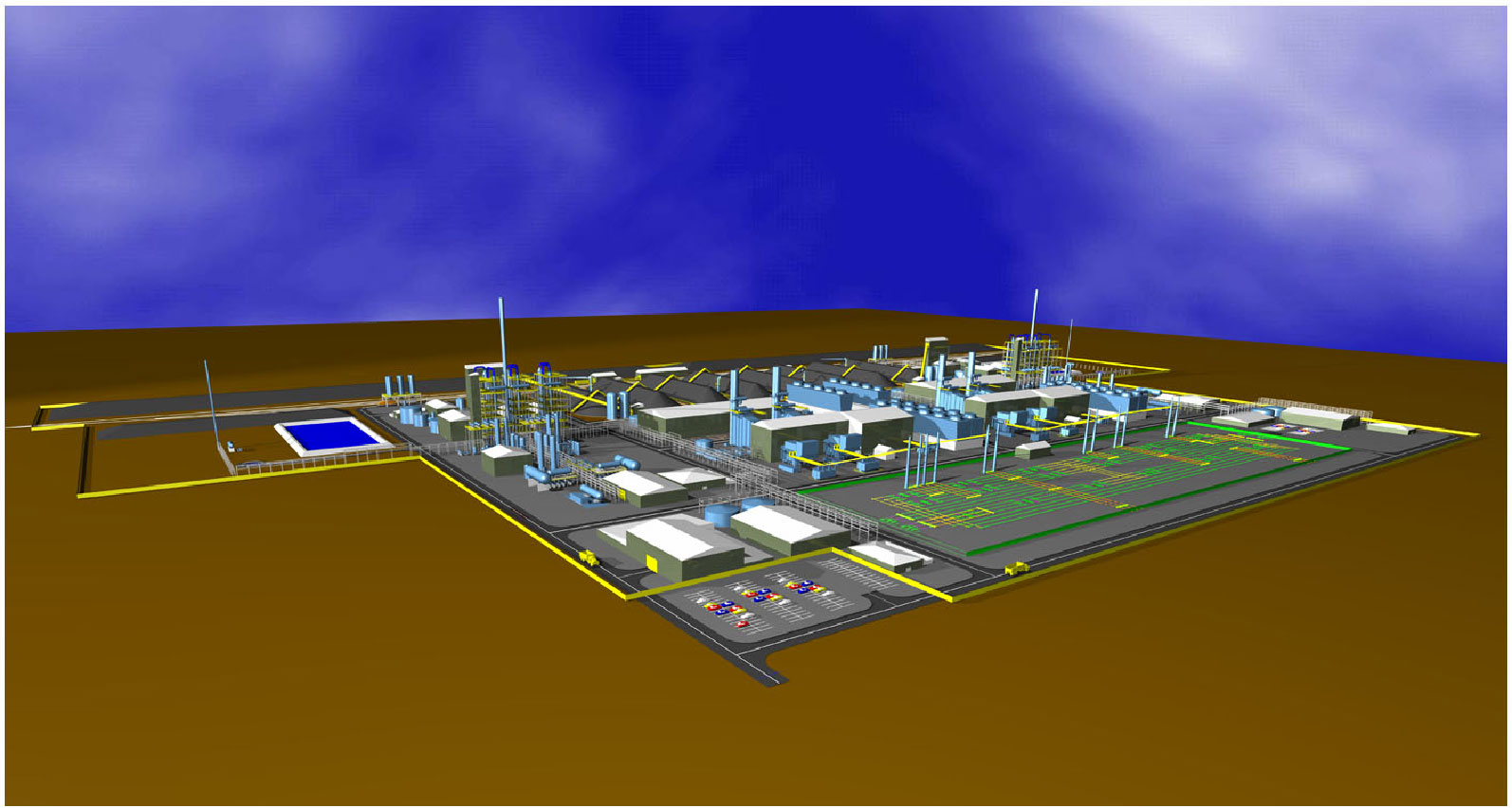

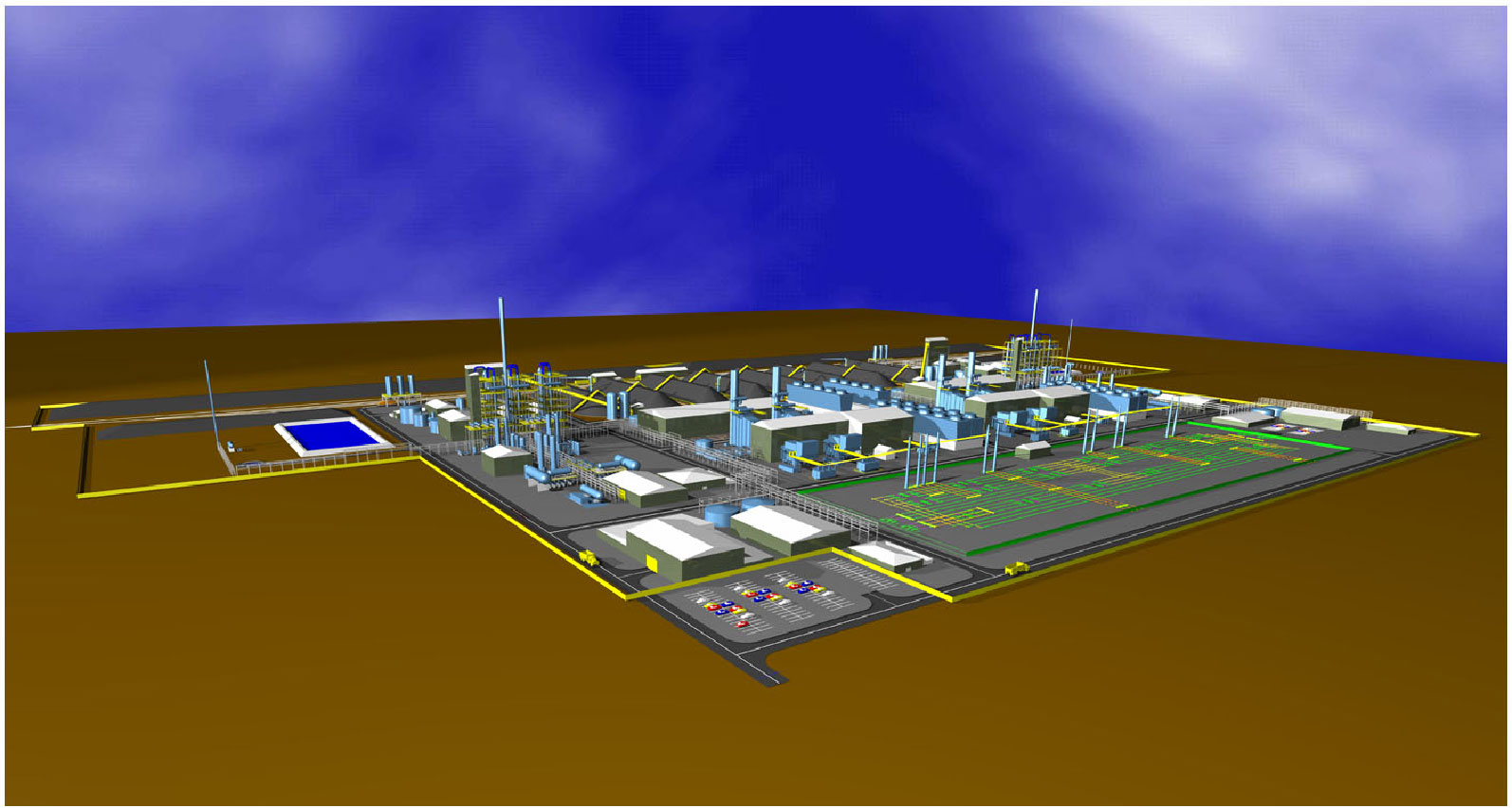

Remember the Excelsior Energy Mesaba Project (see Legalectric posts and Citizens Against the Mesaba Project’s “Camp Site”), the boondoggle coal gasification plant that almost was, the project that got every legislative perk possible, got financing and grants based on wishful thinking and that “something else” that we just can’t identify (without which, who would think this was a good idea? That plant that was to be built, according to the special legislation for this project, on a site WITH INFRASTRUCTURE? This site… dig the infrastructure!

Anyway, it wasn’t built here. But a similar plant WAS built in Indiana, the Edwardsport plant owned by Duke Energy. As with the Mesaba Project it was proposed at a reasonable price, legislators were first told $700 million, and then it went upwards of $2.11 billion. For Edwardsport, same story, and that price kept going up, up, up, and in Indiana, it was so extreme that costs recoverable from ratepayers were capped by the Indiana Public Utility Commission at $2.9 BILLION. It was allowed to be built, and it started operating, sort of… Average output has been 41%, when an 80+% capacity factor was promised. Repairs? That’s putting it mildly. Now they’re going to try to get cost recovery for that.

Problems pile up at Edwardsport 06-14-2015

Now, let’s not all forget all the money given by the Joyce Foundation to support this nonsense.

+++++++++++++

Here’s a specific and eloquent comment from Michael Mullet, very involved in opposition to the Edwardsport fiasco:

You raise what is definitely the “bottom line” question for Edwardsport given the huge subsidy which almost 800,000 Indiana ratepayers have been paying and are continuing to pay to Duke Energy every month for Edwardsport generation.

Based on what DEI customers had paid to the Company for Edwardsport and the plant’s net generation through March 2014, the cumulative cost since Edwardsport costs (including CWIP charges) began appearing in customer rates in 2009 was approximately 57 cents per kwh and the current cost for only the twelve month period under review in pending Cause No. 43114-IGCC-12&13 was approximately 33 cents per kwh. See Direct Testimony of Ralph C. Smith, Joint Intervenors Exhibit A, IURC Causes Nos. 43114-IGCC-12&13, filed December 15, 2014, pp. 48-54.

Complaints by Duke Energy and other Indiana IOUs that the costs of energy efficiency under Energizing Indiana were “excessive'” resulted in the Indiana General Assembly abruptly terminating that program in 2014 even though an impartial third party concluded that its costs were approximately 4 cents per kwh of electricity saved. Complaints by Duke Energy and other Indiana IOUs that the costs of customer credits for rooftop solar power in the range of 9 to 13 cents per kwh represent an unfair and unaffordable subsidy to approximately 500 net metering customers statewide also resulted in serious legislative consideration of a bill (thankfully not resulting in any enacted legislation to date) to terminate that program as well.

In this context of sustainable resources being “too costly” at a level of 4 to 13 cents per kwh, it would seem long overdue for Indiana’s regulators (or, alternatively, its legislators and its Governor) either to impose a reasonable “operating cost cap” on Edwardsport charges to customers or, failing that, to shut the plant down as grossly uneconomic and a monumental waste of scarce ratepayer resources in the face of Edwardsport costs for millions of mwh of coal gas generation with no carbon capture let alone sequestration which are multiple orders of magnitude greater than those for end-use efficiency under Energizing Indiana or rooftop solar under Net Metering.

This incredible “double standard” to subsidize Indiana’s favorite “crony capitalists” at Duke Energy and Peabody Coal (whose Bear Run mine in southwest Indiana supplies 100% of Ewardsport’s coal) in order to permit them to spew millions of tons of unregulated CO2 annually into the global atmosphere should end ASAP.

Michael A. Mullet

Leave a Reply