Duluth News Tribune on Excelsior Energy scams

August 24th, 2011

For years and years, I represented mncoalgasplant.com opposing this wretched boondoggle of a pipe-dream of “clean” and “green.”

The project lingers on, on life-support, and pulling the plug is long overdue.

The good news is that the Duluth News Tribune is finally paying attention, and looking into the financial irregularities. Duluth News articles are here, and next will be some responses.

It started with an article in Duluth News Tribune, first in a series, the second below:

Published August 21, 2011, 09:40 AM

Millions in public money spent, but Iron Range power plant still just a dream

By: Peter Passi, Duluth News Tribune

Yet Micheletti said he’s stopped making predictions as to when Excelsior will build its first plant.

How much more pay Micheletti and Jorgensen have received since 2006 has not been publicly disclosed.

Part II of the Duluth News Tribune series on Excelsior Energy:

Published August 22, 2011, 12:30 AM

Iron Range energy project seeks lifeline in more funding, new fuel source

By: Peter Passi, Duluth News Tribune

* EARLIER: Millions in public money spent, but Iron Range power plant still just a dream

Gone are state funds, including:

# $10 million from the Minnesota Renewable Development Fund.

“We’ve got staying power to see our way through this,” he said.

Sen. Tom Bakk, D-Cook, supported Excelsior’s request.

“There’s much less risk from an investor standpoint,” he said.

But Anzelc said Excelsior still lacks one essential: a customer.

“To my knowledge, no on in the power business is supportive of this project,” he said.

Even the revamped natural gas plant plan could be a tough sell, however.

Minnesota Power’s Mullen described what he considers “a flat market” for power generation,

But he’s not counting Excelsior out.

“You have to give them credit for their tenacity,” Mullen said.

OAH’s continuing efforts to chill participation

June 28th, 2011

You may remember prior posts about that but I’ll start from the beginning and try to make it quick. There’s a pattern at the Office of Administrative Hearings that is disturbing…

Way back on the MinnCan pipeline, members of U-CAN had tried to intervene and were refused. They got late notice and were not represented, stumbling through the administrative process pro se. MPIRG showed an interest and started working on it, among other things, submitting a Petition for Intervention:

Despite the late notice and their attempts to “work within the system,” the Petition of MPRIG individual U-CAN members was denied:

And when they appealed, they were tossed out, as if they had not even tried to intervene:

So when CapX 2020 hit, and they filed a Certificate of Need and landowners learned it wasn’t just the pipeline, but now transmission TOO (how much can a landowner stand?) they got right to it, and intervened as United Citizens Action Network (U-CAN), participating pro se as they had no resources to hire an attorney and were in condemnation and appellate court at the time. They Petition, and were admitted as full parties. So what happens?

Judge Heydinger, the same ALJ in the CapX Certificate of Need case as in the MinnCan pipeline case, files sua sponte (on her own initiative, not a Motion brought by parties) a demand that they explain why they, and the Prairie Island Indian Community, should remain intervenors:

This had been done before in the Excelsior Energy Mesaba Project siting docket, where ALJ Steve Mihalchick booted out Xcel Energy, Minnesota Power, and my client, Public Energy – Mesaba, because no testimony had been provided:

This docket went forward, there were two days of hearings, first in Taconite, where ALJ Mihalchick rammed through 4 witnesses and where we weren’t provided adequate opportunity for questioning, and, I swear, when I tried to get a table, he said, “Whatever would you need a table for?” Really… after much hassle, Bill Storm of Commerce found one (thank you!!). Since that day, I bring my own. Anyway, the second day, it was -30 in Hoyt Lakes and the hearing was in the unheated gym next to the hockey rink.

That day, Judge Mihalchick rammed through … what… 16 witnesses?… in one day, and left saying, “I’m not coming back here.”

Travesty doesn’t begin to characterize that hearing. And worse, Excelsior Energy got a permit for a vaporware project:

Fast forward to 2011, where ALJ Heydinger has now again issued a similar Order to Show Cause regarding two intervenors, Energy Cents and Verso Paper:

Here’s Verso Paper’s response:

Just filed: Order Confirming Party Status – Verso Paper

Where’s the Energy Cents Coalition?

Anyway, I’ve submitted a Rulemaking Petition to OAH about Minn. R. Ch. 1400 & 1405 to try to address some of this. We shall see…

The Tammens featured in Session Weekly

March 25th, 2011

It’s hard to miss the Tammens — they are EVERYWHERE!!! Saw them up in Clouqet about a year ago at an IATP Biomass love-fest, and they have been at every meeting and hearing for the Excelsior Energy Mesaba Project. Good to see they’ve been noticed!!!

Here’s the profile in Session Weekly — thanks to Darrell Gerber for pointing this out:

Soudan snowbirds

Published (3/25/2011)

By Sue Hegarty

You might not notice Bob and Pat Tammen sitting in the House hearing rooms. Bob, clothed in a crisp, pressed dress shirt and necktie, blends in with the lobbyists, deputy commissioners and expert testifiers. Pat sits next to her husband, alert to the day’s agenda.

Bob and Pat met after he returned from Vietnam in 1965.

They don’t always agree with some DFL legislators who say mining brings prosperity to a community.

When the legislative session ends, they’ll drive north again and park the camper on

From Colorado’s San Luis Valley

January 20th, 2011

Here’s my “Day 2” presentation at Alamosa, Colorado last Wednesday (a week ago already? How can that be?):

And a report from the Valley Courier:

Proposed transmission line gets a little TLC

Posted: Friday, Jan 14th, 2011

TLC is opposed to the proposed new power line, and the speakers during

the Wednesday forum questioned the motives and rationale behind the

proposal. They questioned that the line was necessary and encouraged

attendees to seek legislative action, pursue the NEPA (National

Environmental Policy Agency) process and “get loud” in their opposition

to the line.TLC plans to host another forum in the Valley on April 20 with the utility companies as guest speakers.

Fort Garland resident Sally Keller described TLC as a coalition of

concerned citizens and independent member groups who support

environmentally sound alternatives that rely on upgrades to the existing

corridor.“We do not support the transmission line,” she said.

TLC encompasses such groups as the Land Rights Council, Save La Veta

Valley, SLV Ecosystem Council, Sangre de Cristo Homeowners Association

and Majors Ranch Homeowners Association as well as individuals.Keller reminded the group of some of the history of the line and efforts

to oppose it and said several matters are pending right now so “stay

tuned.”Carol Overland, author of “Transmission Lies” and legal counsel

representing groups opposing transmission lines in the Midwest and East

Coast, questioned the need for new transmission lines anywhere in the

U.S. because demand has decreased.“Demand is way down,” she said. “If demand is down, what’s the driver?”

She said one of the reasons power demands have decreased is the loss of big industry in this country.

“That kind of need is not coming back anytime soon,” she said.

“I have never met a transmission project that was for the reasons they say it is,” she said.

“The biggest lie of all is that we need it.”

Overland said she was not as familiar with Colorado processes and the

Valley’s proposal as she was with those in the Midwest where she works,

but she encouraged the audience to question the stated purposes for the

new line here. She said completing the circuit is a legitimate reason

but there might be other ways to accomplish that other than a new line.She suggested upgrading existing corridors and infrastructure rather

than building new, and she advocated replacing fossil-fueled power with

renewable energy. As utility companies are required to implement

renewable energy standards, at the same time they should be backing off

from traditional power sources, she said.Overland said new transmission lines are being constructed not to address need or renewable energy mandates but to sell power.

She encouraged Valley residents to push for legislation that allows them

to become part of the public input process early on (“typically the

public does not get involved until too late”) and that requires utility

companies to consider the people who are directly affected by proposed

transmission lines, such as the landowners over whose property the lines

will cross.“It’s built on the backs of landowners … and on the backs of ratepayers.”

Overland also said just because an area might provide the best resource

for renewable energy such as solar does not mean it should be used over

an area that might provide adequate resources and less disturbance to

landowners.“This isn’t rocket science,” she said. “It’s only electrical.”

She urged local residents to “get loud,” “raise hell” and become involved politically and publicly.

“Get active at all levels,” she said. “You’ve got to be proactive. They are not going to come to you.”

Colorado Open Lands President Dan Pike urged utilization of the NEPA

process in connection with this project. He said he has never seen a

better, more comprehensive process. NEPA looks at both sides of an

issue, benefits and drawbacks and considers all types of impacts from

economic to environmental, he said.Pike, whose organization holds 20 conservation easements in the

transmission line study area (the largest of which is on Trinchera

Ranch), described processes and players involved in transmission line

projects and said it can be very complicated, with decision makers

involved at all levels from local to federal levels.“The day of utilities making proposals for transmission lines in isolation is about over,” he said.

Pike said environmental analysis decisions could be appealed first

administratively and ultimately legally if necessary. The latter is

something most government agencies want to avoid, he said, so they want

to make sure the process is conducted properly.He said as it stands now, environmental analyses have not been

comprehensive enough, and if more information and more impacts are not

considered, “they have got an imminently challengeable decision.”Going back to NEPA, he said, “I am really a fan of NEPA as a decision

making tool … It requires you have the adequate information to make

decisions. I don’t think we have got the adequate information.”The third speaker at Wednesday night’s TLC forum was Gary Graham, Ph.D.,

transmission project director for Western Resource Advocates, an

environmental group that came out in support of the La Veta line. His

main focus was climate change, and he talked about warming trends and

the effect on wildlife habitat, particularly at higher elevations.Graham advocated replacing “dirty energy” with renewable energy, with that energy requiring transmission.

“We don’t know how much renewable energy is going to be needed,” he said.

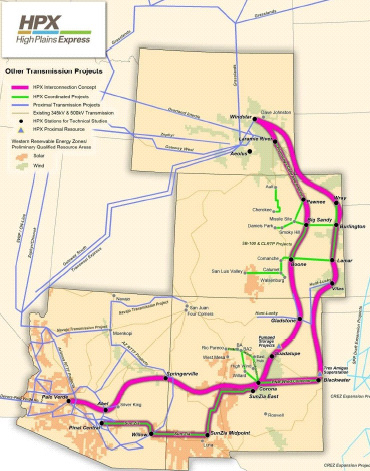

Unfortunately, Graham did not disclose that in the last two Energy Foundation grant cycles, Western Resource Advocates received ~$500k to advocate FOR transmission, a la Wind on the Wires (linked HERE). Look what they have to say about High Plains Express (HPX):

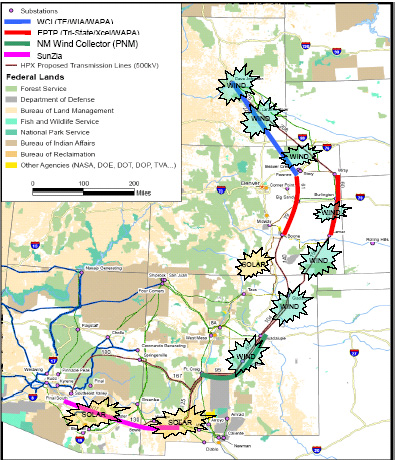

Hs should have, and I should have outed him then, because what their transmission advocacy only increases ability of utilities to move that coal generated electricity around — they are NOT advocating to shut any plants down to make room for renewables! Of course, they’re advocating the same pro-transmission positions as the Izaak Walton League’s “Wind on the Wires” which is no surprise because the $$$ comes from the same place! They’re assuming transmission is necessary and promoting federal authority and NIETC designated transmission corridors, and rather than shut down coal, saying that emissions should be “captured and sequestered” and use the same corridor for a CO2 pipeline! Obviously they did not know/admit what we all in Mesaba Project land knew about the farce of “sequestration.” (click HERE for search of Legalectric on “gasification” for info on IGCC and carbon capture) Once more with feeling — CO2 capture and storage is NOT happening, case on point is the recent release (snort!) of information about the leaking CO2 experiment with “Enhanced Oil Recovery” by piping CO2 into the ground in Weyburn, Sask. It is NOT happening, and the DOE admits that in their environmental review for these projects. And transmission “for renewables” is not, it’s all about export, the San Luis Valley line and particularly the HPX line which starts at the Dave Johnston coal plant in Wyoming, tying into Xcel’s Comanche plant, which the San Luis Valley line would connect into as well. Yes, it’s all connected… transmission, the foundation grants… maybe it’s time to concertedly expose those Energy Foundation grants for what they are?

And exactly a year earlier, look what was happening in New Mexico:

Pawlenty’s legacy…

December 29th, 2010

It’s on the MN eDemocracy Forum, it’s in the STrib, and his dreams of being President are my nightmare.

From the STrib:

My take is another matter:

Pawlenty’s legacy — I was reminded of it yesterday as I testified for the 13, 14 or15th time at the PPSA Annual Hearing and spent too many hours in prep, reminded of the changes over his tenure.

Pawlenty is the “Green Chameleon,” all the PR of being “green” yet promoting the most environmentally devastating options.“Green Chameleon” for his promotion of the Excelsior Energy Mesaba Project, a coal gasification boondoggle on the range, throwing tens of millions of state (IRRB, RDF, DEED) money at it, illegally because environmental review wasn’t completed;

“Green Chameleon” for his promotion of the biggest and most costly transmission line build-out in Minnesota history, so big that Phase I required notification to over 80,000 landowners;

“Green Chameleon” for his promotion of ethanol as it stunk up St. Paul and drained one southwestern MN city’s aquifer dry;

“Green Chameleon” for the shift of “environmental review” of utility infrastructure projects to Dept. of Commerce under his watch;

“Green Chameleon” for promoting the 2005 Energy Omnibus Bill (Ch. 97) that substituted “regional” need for “Minnesota” need as a criteria for utility infrastructure, allowed transmission only companies (another step of deregulation);

“Green Chameleon” for, in 2006, signing off on the changes to Minn. Stat. 117.189 that exempted utilities from the landowner protective provisions in eminent domain;

“Green Chameleon” for no new taxes and failure to adequately fund agencies during a time of unprecedented number of permit proceedings, including a Commerce Dept. that doesn’t even have an electrical engineer on staff(!);

“Green Chameleon” for ushering in relicensing of Monticello and Prairie Island nuclear plants and increasing dry cask storage of high level nuclear waste on the Mississippi River at Monticello and Prairie Island at a time of unprecedented decrease in demand for electricity, Xcel alone down nearly 1,500MW since the 2006 peak;

“Green Chameleon” for doing everything possible through his agencies to limit, hamstring, thwart and silence public participation and fully informed decisions by Public Utilities Commission.

Can you tell I’m disgusted? I could go on… it’s been a long 8 years. The legacy of his energy policy, agency direction and muzzling of the public should have him aspirating on his aspirations. We shall see…

And unfortunately I’m not confident it will be much different going forward. Again, we shall see…

Carol A. Overland

Attorney representing citizens groups and landowners in utility infrastructure proceedings at PUC and local governments.

Living and officing in City of Red Wing, County of Goodhue, home of the Prairie Island Nuclear Generating Plant, the Goodhue County Wind Ordinance, and two garbage burners