Grand Rapids yesterday, Taconite today…

April 24th, 2013

Greetings from the Range. Today’s first Not-so-Great Transmission Line meeting was in Taconite. This is near where my Exclesior Energy Mesaba Project clients own property:

I got there late, but hey, got there before teardown, and had time for a chat with the GIS guy and a fleet of engineers. There wasn’t quite the passionate standing-room-only turnout that there was against the Excelsior Energy Mesaba Project:

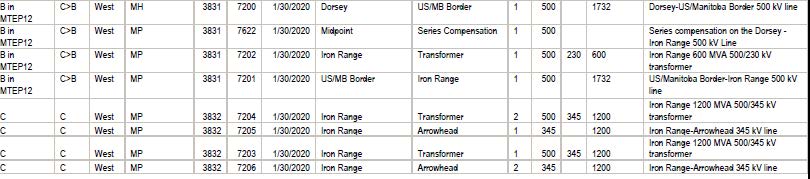

This project is moving slowly, and the application for the Certificate of Need has yet to be filed. That makes sense because it was only last year that it moved from a C to a B project at MISO. Here’s the listing (click for a larger view):

Today what I wanted to find out was “What’s happening at the border?” so I went over that with Mr. GIS. Click HERE to pull up maps at the Minnesota/Canada border. What I found was that none of the transmission corridors proposed have transmission lines in them, and there’s no corridor of any other sort either. ???

And further south, north and near Taconite, there’s a funnel where all options end up in a narrow area with three narrow corridors: one corridor has a line that they told me had been taken out; one corridor has no road or transmission line, nothing; and the other one has a line going smack dab down the corridor. Hmmmm, I wonder where they plan to put this new line?

(and each time I try to pdf them for posting, firefox crashes, AAAAAAAAAGH!)

… one moment please… or three… or four… I may never get that posted!

Anyway, I also had a chat with a fleet of engineers, because in considering “need” for the line, I want to know the capacity of the line, meaning emergency rating, so that I can get an idea what the claimed need represents compared to potential capacity. So far, they say there’s a need for 250MW due to a PPA with Manitoba Hydro. OK, lovely, but what’s that got to do with a 500 kV line? I asked them what the emergency rating was of the line that’s there now, the 500 kV, and it took a while, they didn’t want to answer, giving waffly excuses about liiting factors. I know all about limiting factors and things change, upgrades are happening all the time, so just out with it. I finally was told that the existing 500 kV line was 1732 MVA. OK, that makes sense. Although it doesn’t make sense to me why Minnesota Power uses low capacity lines. Xcel uses ACSS conductors, a higher capacity line, but MP uses ACSR, a lower capacity. Why? Why go through all the rigamarole of certifying and getting a route permit for a little line? One engineer pointed out the Arrowhead as an example and yes, that’s a good example of planning that makes no sense, or a business decision that makes no sense. If they’re going to go for it, why not make it worth their while? Well, other than that there’s that pesky issue of needing to demonstrating need. But one thing that was disturbing was that when asking for info on the existing line, to consider why that line wasn’t being upgraded, or double circuited, etc., one engineer said that they didn’t know that for the current line yet because they’re not there. I was referring to the existing line and made that clear, but what I didn’t get into was that I know what the rating is for their planned line, that it’s in the MISO filing (see chart above, it’s also 1732 MVA). He should know better than to think that I’d believe they don’t know what the emergency rating would be for the line they’re proposing!!! AAAARGH. Anyway, I’ll post that chart one more time so we’re clear the project and rating we’re talking about here:

That’s a 1732 MVA (A rating) for a line where all they’ve got to justify need so far is a 250 MW PPA with Manitoba Hydro.

Another cut to Excelsior Energy

March 12th, 2013

Dying the death of a thousand cuts, here’s one more paper cut for our good friends at Excelsior Energy.

Excelsior Energy’s Mesaba Project, the creme-de-la-creme of vaporware projects, was slashed again by a Midwest Independent System Operator filing with FERC that the project had breached its transmission interconnection agreement and was in default. MISO has asked FERC to terminate the agreement:

The state has been unreasonably and inexplicably reluctant to kill this non-project. Maybe the feds are willing?

Hyperion Refinery one step closer to GONE!

October 2nd, 2012

The Hyperion project, an 800 pound gorilla, an oil refinery PLUS a coal gasification (IGCC) plant (it morphed quite a bit over the years), proposed for agricultural land west of Sioux Falls, South Dakota, has been looming for a long time, but there’s evidence that the stakes through it’s slimy heart are having an impact.

In the Argus Leader:

Hyperion declines to renew options with Union County landowners

The stake in Hyperion’s slimy heart is that there’s no money:

There’s no money to build Hyperion, no investors, another vaperware project sounding a lot like the AWA Goodhue wind project here in Goodhue Count, or Excelsior Energy’s Mesaba Project, coal gasification on the Iron Range. It’s the lack of money that’s the real news:

Industry analysts question Hyperion

“Nobody would finance it,” he told Platts. “It would take forever to build.”

Rough road

Building pipeline

Romney’s Energy Plan – much ado about nothing

August 23rd, 2012

.

FULL DISCLOSURE: I’m a bumper-sticker carrying member of Dogs Against Romney.

A link to Romney’s Energy Plan, “The Romney Plan for a Stronger Middle Class: ENERGY INDEPENDENCE,” showed up in the inbox today, so I printed it out, got out the highlighter… but I was SO disappointed, there’s hardly anything in it, about half of it is quotes and links from news articles. For the most part, this is about oil. OIL, not ENERGY. Oil is only one piece of our energy use and needs. That’s not a plan. It looks like something written by a campaign intern not yet graduated. The structure is a heading, a few bullet points, and a narrative paragraph, followed by the news articles. But the good news for me this morning is it left much less to read, highlight and critique!

T. Boone Pickens apparently doesn’t like it:

Pickens got an early look at the outline for the 21-page Romney plan, which will be introduced during a speech in Hobbs, N.M. Thursday.

“I was disappointed that he didn’t mention natural gas,” Pickens said, referring to the Romney plan. “The United States has more natural gas than any other country in the world…I cannot believe an energy plan that I saw, and I know I saw the outline, but there was no mention of natural gas.”

But TBP, it DOES mention natural gas, often, do a search (but there’s not much of substance about it, or anything else).

Let’s take a look. The first sentence is where I start having problems with it:

A crucial component of Mitt Romney’s Plan for a Stronger Middle Class is to dramatically increase domestic energy production and partner closely with Canada and Mexico to achieve North American energy independence by 2020.

So he’s talking “North America” and more importantly, INCREASE energy production. I would guess that “partner closely with Canada and Mexico” means to take their oil. There’s also a focus on “lower energy prices” which is not going to do anything but create more energy dependence through increased use and reliance on a cheap, illusory “plentiful” supply.

The focus on this “plan” is oil, and increasing domestic production. There is not a word about decreasing non-domestic imports.

Back to the “plan” area by area, all 9 sections, 31 bullet points and 16 paragraphs (not much of substance):

- An Achievable Goal: Energy Independence by 2020. (there’s ONE paragraph) It’s not US Energy Independence, it’s using Canadian and Mexican oil. And it’s about open access — I don’t see anything about the impacts of the ND oil rush, the gas rush in PA, NY and subsequent waste injections in Ohio and elsewhere, destruction of the aquifers and exploding wells and flammeable tap water nothing.

- The Result: The Emergence of an Energy Superpower. (here we get TWO paragraphs) This section makes claims of over 3 million jobs, $500 billion addition to GDP, reduced trade deficit, $1 trillion in revenue for federal state, and local governments, lower energy prices for “job creators and middle-class families,” and national security because we’re not beholden to unstable but oil-rich regions. What I want to see are the assumptions, how much of what has to be extracted to achieve this, show me the numbers. I also want to see numbers on use of federal lands, OUR lands, not oil company lands.

- The Result: Resurgence in American Manufacturing. (here we’re back to ONE paragraph). Stresses that manufacturers will benefit by lower energy and feedstock prices. ??? Most manufacturers use electricity, not oil, to power their operations. What are these assumptions based on? One article cited is about a steel plant opening up in Youngstown, Ohio, with 350 jobs making seamless pipes for fracking, the same fracking that has been pumping in fracking waste near Youngstown and causing earthquakes in the area. Is this a reasonable tradeoff? Steel plant and 350 jobs for waste and earthquakes? Has anyone checked the aquifer lately?

- The Romney Agenda: Federal Lands. (WOO-HOO, TWO paragraphs here). Yes, let’s talk about federal lands. State jurisdiction over federal lands within a state? State regulatory process “deemed to satisfy all requirements of federal law” ???? It pushes “STRONGER” and “IOGCC” and if you google “STRONGER” nada, have to get to “State Review of Natural Gas Environmental Regulation” to have it come up. Look at the formation of “STRONGER.” And IOGCC — I come up with the Interstate Oil and Gas Compact Commission in Oklahoma, and a big focus of theirs is CO2 Capture and Storage and we know what a scam that is. The narrative brags that “The state of North Dakota can permit a project in 10 days, Colorado does it in twenty-seven.” The articles cited notes that “In Ohio, it takes 14 days.” In talking about ramping up use of federal lands, there is no recognition in his “We Built It” mindset that this is about exploitation of FEDERAL lands, OUR land, blatant corporate welfare. Corporate welfare? Well, what else would you call it where Peabody buys for $0.25/ton and sells for $80-100/ton export? No, Peabody, you’re not building it, you’re stealing it from us.

- The Romney Agenda: Offshore Areas. (here we get TWO paragraphs again). There is no mention of the BP spill and its impact on feasibility and reasonableness of offshore drilling. Oh, and COST, because the cost of spills needs to be in that cost/benefit analysis. And again, whose land is this, who owns the oceans? Not the oil companies. Romney is all for “opening greater access and streamlining permitting…” and we know what that means.

- The Romney Agenda: North America. (here we get another TWO paragraphs) This is about Canada and Mexico, the XL pipeline, objecting to Canada exporting it, without mention of intent of exporting much of that oil from U.S. if it got down to the Gulf in the pipeline. Romney says it outright, at the top, “Approve the Keystone XL pipeline.” It also bullet-points “Institute fast track regulatory approval processes for cross-border pipelines and other infrastructure.” Pipelines and transmission, probably under the Dept. of State as with XL pipeline. The “plan” claims that Canada and Mexico are wanting partnership and collaboration, and that if we do that, “…America can guarantee itself a reliable and affordable supply of energy while also opening up new opportunities for American businesses and workers in the region.” Region — opening up new opportunities for American busniesses and workers in Mexico and Canada. Oh… right..

- The Romney Agenda: Resource Evaluations. (here we get another TWO paragraphs) This section is about assessment and inventory. Offshore resource exploration it seems would be encouraged and maybe performed by the feds and extraction of Canada and Mexico’s resource information as well. Note the references to “seismic” on this page. Messing with the earth creates seismic impacts, as evidenced in Pennsylvania, Oklahoma and Ohio related to fracking and waste injection. (Oh, and I’ve not seen waste mentioned anywhere here, BIG issue.)

- The Romney Agenda: Regulatory Reform. (here we get yet another TWO paragraphs). This is more of the strengthen environmental protection through gutting regulation, the angle I find SO offensive. Gutting regulation guts jobs, and regulation creates jobs both for industry and regulators! And the projects typically get permitted and get built. What are they complaining about? The MPCA doesn’t even look at expired permits, only new ones, because they don’t have the staff or budget, and because they haven’t been directed to by their boss, the Governor. But more importantly, without environmental review and regulation, we’d have more really stupid projects than we’d otherwise have. In Minnesota, MPCA is responsible for federal review delegated to the state, yet how often do they deny a permit? The PUC is responsible for need determinations and routing/siting permits, and the only projects they’ve denied have been vaporware projects that don’t have a PPA or a project to speak of. Without Minnesota environmental review and regulation, we’d have vaporware Excelsior Energy’s Mesaba Project on the Range, we’d have Kenyon and Goodhue wind projects here in Goodhue County, and we’d have the utterly unnecessary Big Stone II coal plant up and running. From what I can see, the PUC has never met a transmission line it didn’t like. Romney has accused Obama of bankrupting the coal industry, but Obama has been a friend of coal, promoter of IGCC, he’s from a coal state and is in the pockets of coal lobbyists. EH? The “plan” goes on: “But statutes and regulations that were designed to protect public health and the environment have instead been seized on by environmentalists as tools to stop development altogether.” OK, tell me what projects were stopped by “environmentalists” and tell me what projects were stopped because by regulatory agencies because they’d violate regulatory provisions? I’ve been looking at this in association with Dayton’s “review of environmental review” and note that the MPCA only rarely denies a permit, but permits expire and the plants spewing pollution are allowed to continue operating without a renewal application or any review! There is no pattern of delay in issuing permits. Romney, show me the data! He wants disclosure of “federal funds spent reimbursing groups for lawsuits against the government.” DUH, where anyone sues the government for flagrant violations of federal law, and where fees and costs are paid as part of the win, that is public information, just look at the settlements! How else would federal law be enforced? They’ve gutted the agency budgets and they’re not doing review, so it’s up to the citizens. Romney says that “laws should be carefully crafted to support rather than impede development.” It is not an agency’s job to SUPPORT development, it is their job to impartially review permits, conduct analysis. What Romney is promoting is the MN Dept. of Commerce style of regulation, where according to PUC Commissioners, it looks like Commerce is representing the project applicant. “Repetitive reviews and strategic lawsuits should not be allowed to endlessly delay progress or force government into imposing rules behind closed doors that it would not approve in public.” Examples please, because I haven’t a clue what you’re talking about! An article cited states that “individuals have accounted for just 7% of Plaintiff cases filed under the EAJA while Environmental Groups have accounted for 30%. First, what’s the other 63%? Second, is it the Romney position that Environmental Groups are suing too often? That individuals should sue the government more? How would we do that? Please let me know, I’d be happy to comply!

- The Romney Agenda: Innovation. (and we get another two paragraphs). “The federal government has a role to play in facilitating innovation in the energy industry.” Please explain. Isn’t it the Romney position that government should not insert itself into business? “Instead of distorting the playing field, the government should be ensuring that it remains level.” Level? When has it been level? “… success should be defined as eliminating any abrriers that might prevent the best technologies from succeeding on their own.” This is straight out of the Wind on the Wires playbook, always looking to eliminate barriers, particularly to transmission (she says, admittedly a barrier to transmission herself!). Are they looking at cutting 1703(d) coal perks anytime soon? See the “End Polluter Welfare Act of 2012” for specific examples of coal perks (GO Bernie!). And last but not least, last but everlasting, Romney is promoting nuclear power, to “revitalize nuclear power by equipping the NRC to approve new designs and to license approve reactor designs on approved sites within two years.” Even Xcel admits it has no desire to build a nuclear power plant. And new plants are not needed, there is a glut of electricity that is leading utilities to close down their smaller dirty coal plants and recently, even some larger ones. So why would he promote nuclear after Fukushima Dai-ichi? Our Monticello plant is the same design. Earth to Mars…

Responses to Excelsior Energy articles in DNT

August 24th, 2011

For background on this Excelsior Energy scam known as the Mesaba Energy Project, just search on that link and here on Legalectric for Excelsior, Mesaba, gasification, boondoggle, etc.!!!!

If you search their site, what is most noticeable is the changes, lots is missing, for example, on their “About Us” page, their “Our Team” is missing a lot of people. Here’s what it used to say:

| Excelsior Energy | |

Excelsior’s executive team has significant utility and power plant experience including all of the following aspects of large energy projects, planning, development, engineering, financing, permitting, construction and operation.

Executive Team Julie Jorgensen Co-President and CEO Thomas Micheletti Co-President and CEO Thomas Osteraas Senior Vice President and General Counsel Dick Stone Senior Vice President, Development and Engineering Robert Evans Vice President, Environmental Affairs Kathi Micheletti Vice President, Government Relations William Ruzynski Vice President, Development Mary Day Controller

Additional Senior Personnel

The following senior industry experts work with Excelsior Energy on a regular basis

Stephen Sherner Sherner Power Consulting Bruce Browers Browers Consulting

It’s just a remnant of its former self.

Anyway, the Duluth News Tribune articles were published:

Millions in public money spent, but Iron Range power plant still just a dream

Iron Range energy project seeks lifeline in more funding, new fuel source

… and then came some responses, first from the paper’s editors standing up against this boondoggle (finally!), and then from Julie and Tom:

Published August 23, 2011, 12:02 AM

Our view: Taxpayers have right to answers on Excelsior

What happened to our more than $40 million?Even then, what was reported often was incomplete.

And, perhaps most pressing of all to taxpayers, what happened to our more than $40 million?

Here’s what Julie Jorgensen and Tom Micheletti had to say in response:

Published August 24, 2011, 12:00 AM

In response: Excelsior Energy project is an important energy option for state

By: Julie Jorgensen and Tom Micheletti, Duluth News TribuneThe Mesaba Energy Project, under development by Excelsior Energy, is a unique public/

We at Excelsior Energy take our obligations under our

The project is nearing the end of this complex governmental-

Julie Jorgensen and Tom Micheletti are co-CEOs of Excelsior Energy Inc.