Transmission from La Veta, Colorado

January 12th, 2011

Above is my view of La Veta, Colorado. As I drove in, I saw two deer sauntering, yes, SAUNTERING across a farm field at the edge of town. And in town, they were just walking around like they owned the place, fat and happy. This one above was a buck escorting two of his does, maybe one and last year’s progeny, and they were walking down the streets, through yards, hanging out oh-so-casual.

There are some days, well, most days, I confess, when I really love my job… yesterday was another!

Yesterday was a forum held by TLC, Transmission Line Coalition, last night in La Veta and tonight in Alamosa:

Here’s some of what I had to say:

Xcel, of course, was there, and I’m sure they’ll be there tonight!

Here’s the ALJ Recommendation, this will sound very familiar to those in Minnesota:

As we say in transmission, “IT’S ALL CONNECTED.”

(Pretend there’s a link here to USDA’s RUS EIS page – it’s DOWN DOWN DOWN) NEVERMIND, it’s now UP UP UP! From RUS (note this San Luis project is about 4 months behind Dairyland/Capx:

Tri-State Generation and Transmission

San Luis Valley-Calumet-Comanche Transmission Project – Huerfona, Alamosa and Pueblo Counties, CO – The agency has decided to prepare an Environmental Impact Statement on this proposal; the original level-of-review was an Environmental Assessment.

- Federal Register Notice to hold Scoping Meeting and the intent to prepare an Environmental Assessment (August 3, 2009 – 47 KB)

- Calumet-Comanche Electric System Improvement Project – Macro Corridor Study (May 2009 – 24 MB MB)

- San Luis Valley-Calumet-Comanche Transmission Project – Alternatives Evaluation (June 2009 – 510 KB)

- San Luis Valley Electric System Improvement Project – Alternatives Evaluation and Macro Corridor Study (June 2008 – 14.2 MB)

- Public Scoping Report (November 16, 2009 – 28.6 MB)

What I want to know is WHY they are using lower capacity ACSR conductor for these projects — and the claimed “need” is SO low, why aren’t they just reconductoring the whole system — ACSR, euwwww, that is SO 1960s:

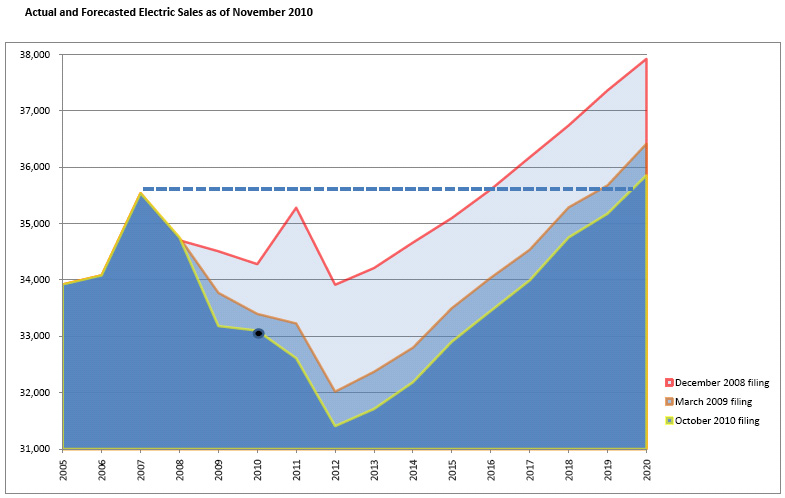

And demand forecasts? Need a good laugh? Here’s the sales forecast for Public Service of Colorado, our good friends at Xcel:

I’ve just learned that this area is mushroom country — methinks that this “forecaster” has been dabbling in some of the more exotic varieties to come up with this chart!

Time to subpoena Mike Bull!!!

December 21st, 2010

Let me see if I understand this… we’ve got Ingrid Bjorklund, a wind industry lobbyist/employee now Commerce employee and Deb Pile, also Commerce, using Affidavits to argue LEGISLATIVE intent based on statements by Mike Bull, Commerce employee working under Pawlenty’s roof now working for Xcel. EH? LEGISLATIVE intent based on industry lobbyist/employee & Exec agency employee hearsay affidavits of Pawlenty’s Energy Boy. Where’s the LEGISLATURE in legislative intent? And what does Mike Bull have to say about this?

Duck and cover, Mikey! Commerce has trained their sights on you!

HUH? What’s going on? Well, we just had a deadline for submittals in response to the First Prehearing Order in the AWA Goodhue Wind contested case regarding application of Goodhue County’s Wind Ordinance. for the whole docket, go to www.puc.state.mn.us and click on “Search eDockets” and search for docket 08-1233.

Here’s the prelude to yesterday’s filings:

Staff Chart of Differences between Goodhue Ordinance & State Standards prepared for PUC Chair Boyd

After a Prehearing Conference and the ALJ’s request for our positions in this case, we submitted memos and then the ALJ issued a Prehearing Order:

In that order we were asked to set out the differences between county and state standards; whether county ordinance is a conflict, supplement, or something new; whether it should be applicable to this project; material facts regarding this issue; and what evidence we’d introduce. and here’s what was filed — where’s everybody else? Anyway, read the Deb Pile and Ingrid Bjorklund Affidavits and note who’s sayin’ what, whose interests are at issue, whose intent is couched as “LEGISLATIVE” intent, and while you’re at it, ask just what role they had at that time. Seems to me they’re putting it all on Mikey Bull. Hey Mikey?!?! Get ready!

Goodhue Wind Truth 2nd Prehearing Memo

Belle Creek Township 2nd Prehearing Memo

MOES Comments – PUC Briefing Papers on Goodhue

Leslie Glustrom featured in High Country Press

November 1st, 2010

Last week, Lesie Glustrom, a cohort via “No New Coal Plants,” was featured in a big spread in her home state:

The last word is action

by Nathan Rice – High Country NewsName: Leslie Glustrom

Age: 55

Vocation: Mother of two, founding member of the nonprofit group Clean Energy Action

Past Jobs: Biochemist, science teacher, science writer

Favorite activity on her half-day weekends: “Being in the woods alone, talking to the trees.”

Favorite sport: Ice hockey

Thoughts on coal: “I’m a climate change activist who is worried that we don’t have enough coal. That’s an ironic place to be.”Few people get excited about public utility meetings. But at the Tri-State Rural Electric Co-op in Westminster, Colo., on a spring night, Leslie Glustrom is squirming in her seat. Eager to address the Tri-State executives, she scribbles notes about obscure energy data, her brown hair short above broad shoulders.

“Tri-State is sitting on top of world-class wind and solar resources,” Glustrom says. The co-op powers rural electric utilities in Colorado, New Mexico, Wyoming and Nebraska — “the Saudi Arabia of wind and solar,” she says, gesturing emphatically. Glustrom, a clean energy advocate, believes it’s Tri-State’s duty to exploit those resources.

In the circular boardroom, about 40 advocates and industry representatives in business attire mingle under fluorescent lights, munching donuts and drinking coffee. Glustrom offers firm handshakes but abstains from refreshments. “I want to maintain my independence,” she explains. Tri-State’s managers sit behind a row of microphones, lending a diplomatic air to the co-op’s first attempt at officially inviting the public to comment on its planning process.

Read the rest of this entry »

GRE & Xcel are hustling for $$$$$

October 20th, 2010

Apparently Great River Energy and Xcel Energy are outlooking for money. Gee, I wonder why? I remember the snorts and hoots that broke out in the room way back during the CapX Certificate of Need hearing when they admitted to presenting their CapX 2020 financing dog & pony show to Lehman Brothers.

As for GRE, from Monday’s article in Finance & Commerce:

Xcel just made an SEC filing that shows some creative efforts:

“Secondary purpose of the Plan…” (click the quote for the full filing) “Secondary purpose…”

Yup, uh-huh… …WHAT… EVER!

Here’s the full article from Finance & Commerce about GRE’s capital raising efforts:

Great River Energy to sell $450M in mortgage bonds

Posted: 4:35 pm Mon, October 18, 2010

Faced with declining power-usage revenues and rising utility-plant costs, Maple Grove-based Great River Energy (GRE) on Monday issued $450 million in taxable first mortgage bonds to meet costs and pay down debt.

The mortgage bonds are intended to fund capital spending for the utility’s power generation and transmission as well as paying off $325 million of GRE’s $2.4 billion outstanding debt, said Susan Brooks, GRE treasury director.

“It’s part of our long-range plan to meet member costs in the most cost-effective manner,” said Brooks, who expects bond pricing to be set today.

The mortgage bond sale is the second such transaction in 2010 by GRE, which in April announced it would sell $106 million in tax-exempt first mortgage bonds issued by McLean County, N.D.

It’s not unusual for utilities to sell mortgage bonds to help make ends meet at a low cost. Such financing makes sense because GRE is making additions to its system and paying for generation and transmission improvements in the wake of the recession.

For example, GRE’s 2009 revenues fell $42.1 million to $787.8 million at the same time the utility was paying to develop a coal-fired plant in North Dakota and helping develop the CapX2020 system of transmission lines with 10 other state utilities.

Fitch Ratings assigned an A- credit rating to the $450 million mortgage bond sale. Fitch noted that, “while GRE’s debt level remains a concern, (it) has been effective in managing the higher debt loads, even in what has been a difficult operating environment.”

Background information on GRE’s mortgage bond offering from Fitch stated that GRE is working to lessen its debt-load by paring its five-year capital spending plan by $350 million.

GRE serves more than 645,000 residential and small-commercial customers through 28 member cooperatives. The utility maintains 3,647 megawatts of generation capacity, of which 2,751 megawatts is owned by GRE.

Additional capacity is expected to come online in 2012 when Spiritwood Station, a coal-fired plant near Jamestown, N.D., begins operation.

The start-up of Spiritwood, which has a peaking capacity of 99 megawatts, was delayed until early 2012 earlier this year because plans for an ethanol plant to use steam from the nearby coal plant failed to materialize.

Therese LaCanne, GRE spokeswoman, said Spiritwood also will provide steam for a Cargill Malt plant in the industrial park.

Of GRE’s 2009 power generation, 78 percent was coal-fired, with the remaining 22 percent coming from 7 percent renewable energy, 1 percent natural gas and 14 percent other energy sources.

Combined with the planned firing up of Spiritwood and wind energy contracts, GRE projects it will have adequate capacity to meet its member needs beyond 2020.

The utility projects compounded average annual peak load growth of 1.4 percent from 2010 to 2020, according to Brooks.

ALJ: Underground Hiawatha Project

October 9th, 2010

Underground Xcel’s Hiawatha Project transmission. That’s BIG, it’s good news, except for one thing — “Who pays?” is still a question:

ALJ Heydinger’s Recommendation for Xcel’s Hiawatha Transmission Project

Problem is, cost allocation isn’t dealt with specifically, only explained, so no recommendation regarding that.

If the PUC went ahead, would it be spread across the Metro area, the full Xcel rate base, or???

For the SE Metro, and for the Chisago Transmission Project, if they cities would have agreed to shoulder the cost, undergrounding was no problem. But that’s not feasible for a city to pay. So now what? Will the PUC actually order undergrounding, with a broad rate base recovery?