AG’s Office tells gas utilities where to go!

July 6th, 2021

The Office of Attorney General’s Residential Utility Division (OAG-RUD) has told the gas utilities in search of recovery for its EXTREME supply expenses during the natural gas price spike in February where to go… or more correctly, where NOT to go — that this should NOT come out of ratepayer pockets — that it’s the on the shareholders. YES! Love it when this happens.

The Minnesota Public Utilities Commission has an “investigation” into the massive gas price spike in February, and how the huge price spike and increased costs should be handled (Many other states’ Commissions have opened an investigation too). Thus far, it’s appeared that the Commission’s intent is to pass it on to the ratepayers and spread it out so it’s not so painful. But not so fast folks! It’s so heartwarming to read a pleading, particularly one filed by Office of Attorney General – Residential Utilities Division, where they say “NO!”

Read it HERE:

There are three ongoing dockets at the Minnesota Public Utilities Commission looking at the “gas crisis” from February.

Now pay attention, because this HUGE gas spike was only 2-3 days:

Some background Legalectric posts:

Texas — it’s a gas — natural gas… DOH! February 17th, 2021

It’s still a GAS! February 28th, 2021

The PUC is looking at a few questions, but what troubling is that the Commission seems to presume that the utilities will recoup from ratepayers! This presumption was evident in previous Commission meetings, and was disturbing, to put it mildly!

There are three dockets trudging along on the same path, and to look at all the filings go to eDockets and look up the dockets:

- 21-135

- 21-138

- 21-235

In May, the Commission issued another Notice of Comment Period and noted these issues, followed by a laundry list of topics for comments:

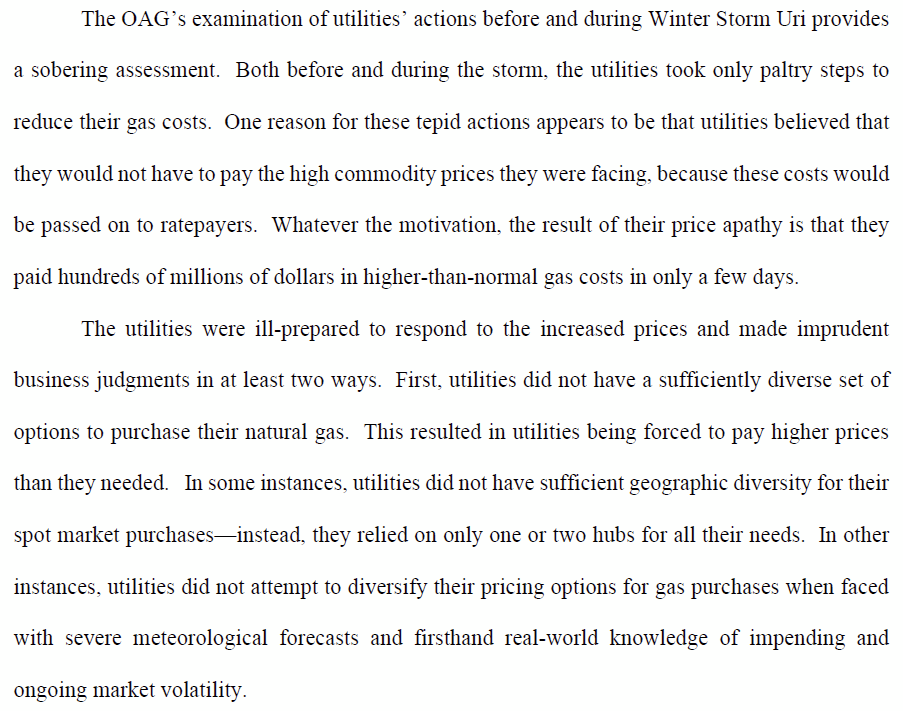

The AG’s Office minced no words and told them “NO!” For example:

Once more with feeling — ENJOY!

OAG_20217-175863-02

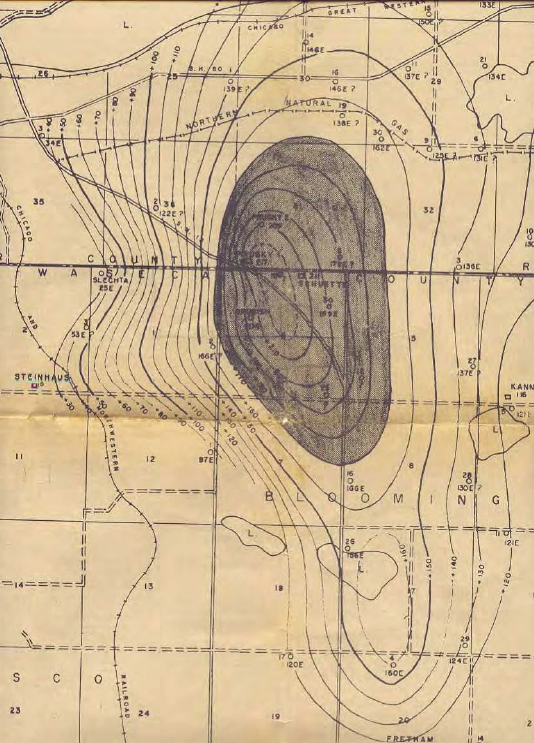

I’m particularly interested in storage, because a client lives above Minnesota’s only gas storage dome, an at least 10 square mile just north of Waseca, with 7 billion c.f. of natural gas stored below. A gas intermediate (not peaking) plant was proposed there, first a very small one, then one 10 times that in MW, and thankfully neither was built.

Knowing about that storage (and too many Minnesotans do not), storage was the focus of my comment in this docket last February:

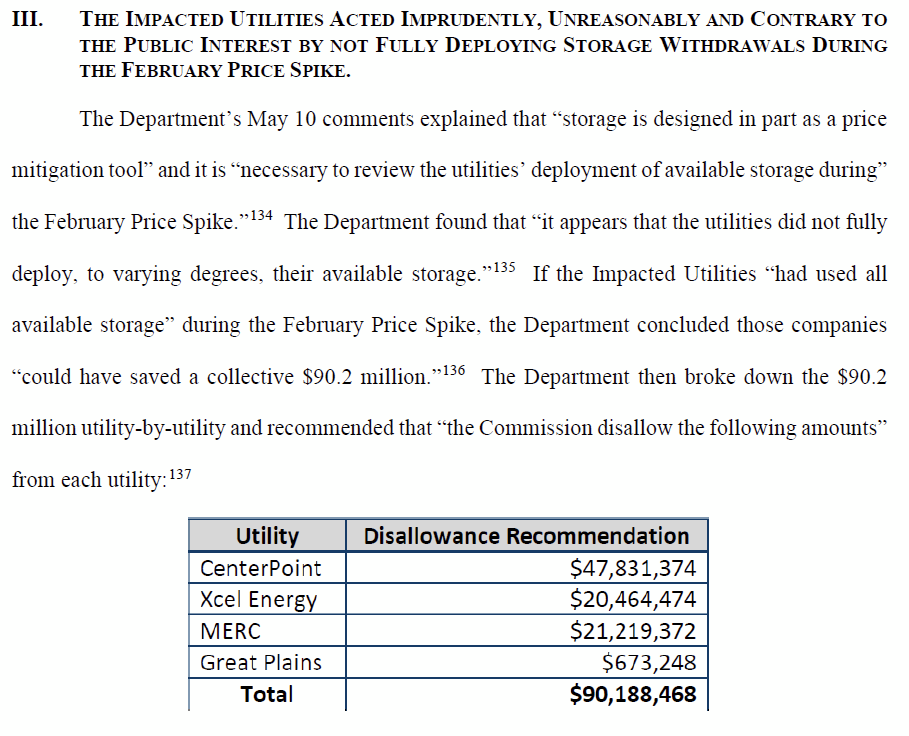

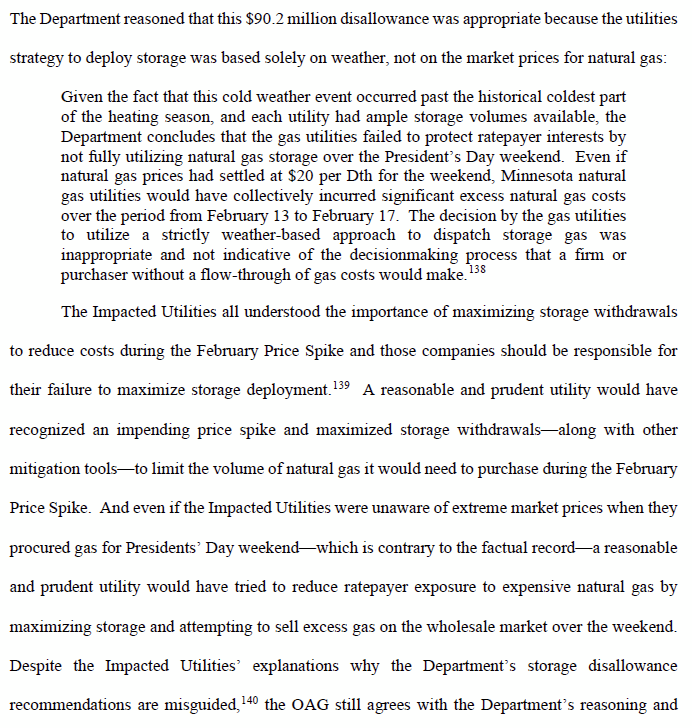

OAG-RUD did address the failure of the gas utilities to utilize storage:

Bottom line to the OAG-RUD?

Property tax relief for transmission lines

August 5th, 2015

My clients have a tendency to hang around like bad habits — once awake to utility schemes, they take a bite and won’t let go. I’ve been blessed with an active bunch, and today I woke up to another example. Nancy “BOOM!” Prehn is one of my faves, she lives on top of the only natural gas underground storage dome in Minnesota, under about 10 square miles north of Waseca. She singlehandedly got an EAW on how the gas company was handling water. At the time, they were releasing water from wells onto their fields, and it wasn’t helping the corn and beans any. Turns out it wasn’t seriously polluted, and the gas company had to build a water treatment facility and storage tanks at each well to contain the water, and then suck it out, bring it over to HQ and run it through the treatment system before releasing it.

Nancy has a way of being ahead of the curve, and when she starts digging, look out. Now she’s working on tax credits for those with utility infrastructure on their land, like a natural gas dome! It’s needed for gas and oil pipelines too!

Here’s what she found today, from the 1979 legislative session, check Article 2, Section 20, a tax credit for landowners living under transmission lines — how did I not know this?

| Chapter 303 | HF1495 |

And it’s still law today:

How much is this tax credit? Well, it’s complicated… and there’s a ceiling, see the statute for specifics:

It was enacted during the last transmission build-out, circa 1979, and has been changed many times over the years:

History:

(2012-3) 1925 c 306 s 3; 1949 c 554 s 3; 1978 c 658 s 4; 1979 c 303 art 2 s 20; 1980 c 607 art 10 s 3; 1Sp1981 c 1 art 2 s 15; 1982 c 523 art 16 s 1; 1Sp1985 c 14 art 4 s 70; 1Sp1986 c 1 art 4 s 24; 1987 c 268 art 6 s 35; 1Sp1989 c 1 art 2 s 11; 1990 c 604 art 3 s 22; 1Sp2001 c 5 art 3 s 44; 2003 c 127 art 5 s 21; 2014 c 275 art 1 s 90

Note this one that changed it from any “high voltage transmission line” as defined by then PPSA 116C.52, Subd. 3, to a high voltage transmission line “with a capacity of 200 kilovolts or more”

which also happened in the Buy the Farm statute:

Bottom line — it’s good people affected by transmission get a tax credit for their burden, but it’s bad that it’s not assessed to the ones that took that easement. It should be assessed to utilities/energy companies, the ones causing it and benefiting from it, not the rest of us taxpayers who have to make up the difference for local governments who need the tax revenues.

TO DO: We need to make this tax credit applicable to all energy infrastructure (Note I said “energy” and not “utility” because there’s a lot of infrastructure being built that is NOT utility. but oil companies, and those “transmission only” private purpose companies.) and to assess the entity that burdened the property for the amount of that tax credit.