Tammi Jeka – Commitment, no charges yet

July 30th, 2021

Probable cause hearing is next Monday.

Who is Tammi Jeka? She’s the woman who was doing donuts on the St. Paul Capitol lawn:

Woman waving Trump flag shouting she’s a white woman drives onto Minnesota state capitol mall

I have conflicting thoughts about this. It is framed as “mentally ill and chemical dependent” case type. Her thinking is clearly dysfunctional, but to brand waskadoodle tRumpists with “mental illness” labeling is off. This delusional dysfunctional thinking is different, but I don’t have the knowledge or training to explain. To me, it seems that intervention is necessary, and that it’s more of a chemical dependency affliction, which is the other part of the “case type” above. I’ve read some articles along this line, will try to find. We’ll see how this plays out.

Giuliani suspended, temporarily…

June 24th, 2021

6 or more states’ legislators part of fracas in D.C.

January 9th, 2021

At least 6 GOP legislators took part in Trump-inspired protests

Other state’s legislators were in Washington D.C. participating in that fracas listed here — click name for contact info:

West Virginia state Rep. Derrick Evans – RESIGNED. WV Delegate Derrick Evans resigns from House of Delegates

Tennessee state Rep. Terri Lynn Weaver

Virginia state Senator Amanda Chase

Missouri state Representative Justin Hill

Transition? Contact GSA!

November 17th, 2020

Emily Murphy’s email and the Government Service Administration (GSA) contact page are working again, so you can contact her!

Or if that’s not working (and just now it looks like it’s down again, as down as the White House comment line, it’s been chugging along for 15 minutes now):

Why? Because she’s the one who has to sign the “transition papers” for Biden’s administration so the transition team can start work. She’s supposed to be an independent signer but instead she’s furthering the denial of the Mango-in-Chief.

Trump appointee refuses to sign document allowing Biden transition to officially get to work: report

I first tried the GSA site, and her email when the GSA site didn’t work, back on November 9, and the email bounced, “too much traffic” it said… so I tried again on the 12th, both the “Contact” form, which did come up, and a direct email. Got this form response — so it did get through:

She’s getting the message, well, a message:

The Trump Appointee Blocking Biden’s Transition Is Reportedly Trying to Line Up a New Job for 2021

… but if she did her job, that might help her get another!

Here’s how transitions work:

Presidential Transition Act Summary

What’s the Center for Presidential Transition… hmmmmm… damned if they don’t have that front and center on their home page!

STrib article: Trump administration allows deferral of Social Security tax

It’s real – the U.S. Department of the Treasury has issued guidance allowing employers to not withhold the 6.2% for Social Security AND employer share will not be paid in either.

Within this notice above, IN A FOOTNOTE (!), is a heads up that employers also do not have to pony up their share:

The deposit obligation for employee social security tax does not arise until the tax is withheld. Accordingly, by postponing the time for withholding the employee social security tax, the deposit obligation is delayed by operation of the regulations. Thus, this notice does not separately postpone the deposit obligation.

So not only is this not deducted from an employee’s paycheck, but the employer does not pay in either. If every employer did this, that would mean that the employer and employee funding for Social Security would drop to zero and end!

It would? Check this “analysis of the implications of hypothetical legislation that would change the tax rate paid by employers, employees, and self-employed individuals to zero percent for the Federal Insurance Contributions Act (FICA) payroll taxes and Self-Employment Contributions Act (SECA) taxes that fund Social Security’s Old Age and Survivors Insurance (OASI) Trust Fund and Disability Insurance (DI) Trust Fund.”

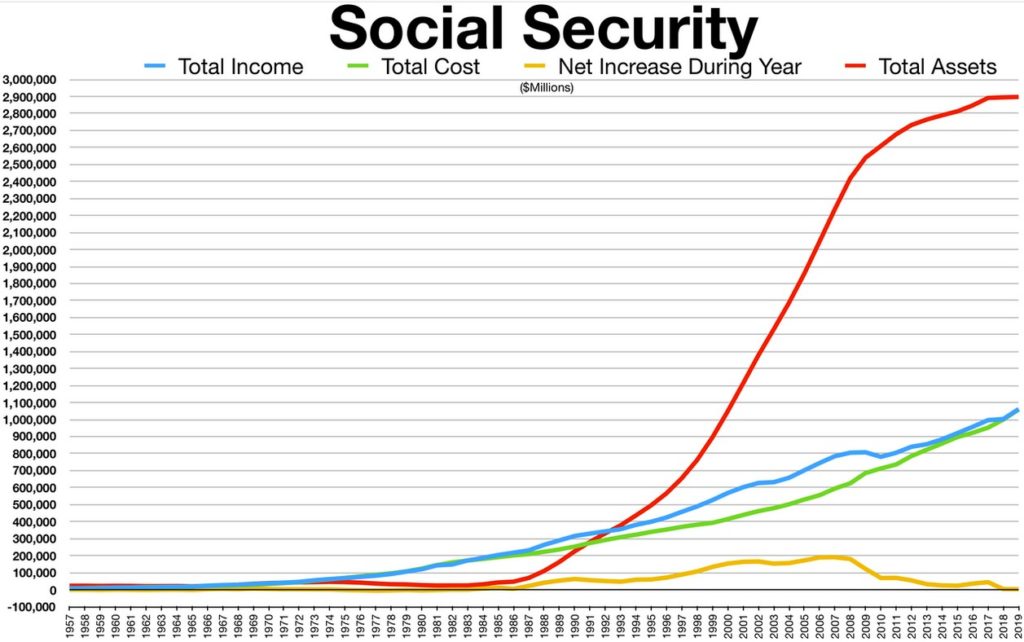

Where does Social Security stand, what’s the income, outgo, Trust Fund balance? From the Wiki on Social Security:

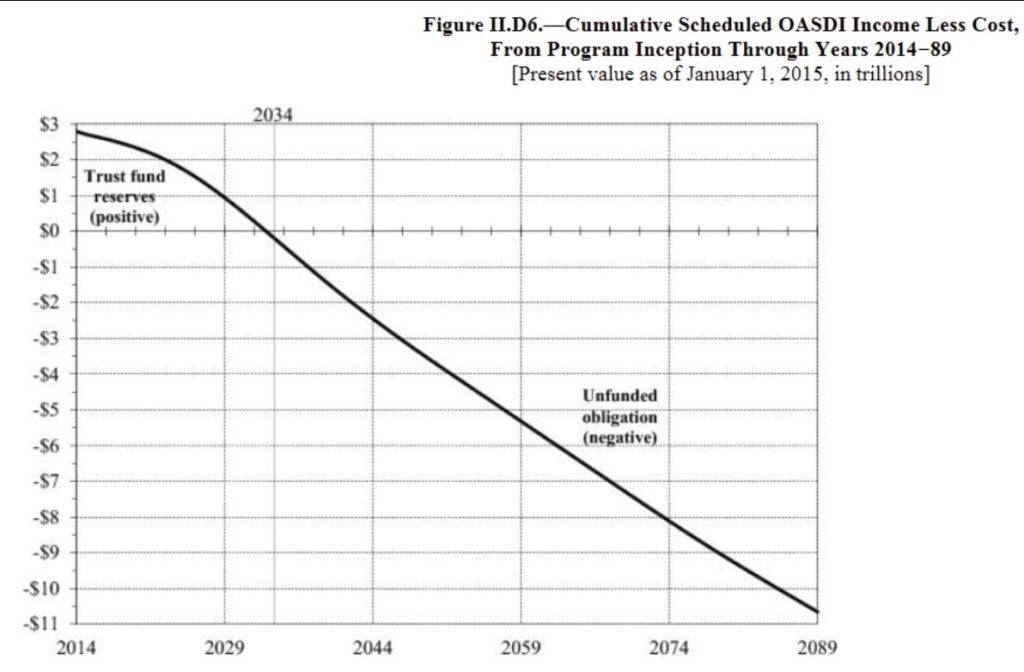

Note income and outgo are evenly tied now. There’s a lot of $$$ that the government owes the Trust Fund, and it can’t make interest on what isn’t there (not that interest rates now mean anything). What’s expected to happen? Unless something changes, it goes into the negative circa 2034:

Where does Social Security get its revenue from? According to the Social Security Administration:

In 2019, $944.5 billion (89 percent) of total Old-Age and Survivors Insurance and Disability Insurance income came from payroll taxes. The remainder was provided by interest earnings $80.8 billion (7.6 percent) and revenue from taxation of OASDI benefits $36.5 billion (3.4 percent).

Removing $944.5 billion PLUS (presuming it’s ever increasing) from the Social Security income stream, EIGHTY-NINE PERCENT, would have a tremendous impact on both revenue and the interest earnings.

From Reuters:

Trump’s coronavirus payroll tax cut would punch hole in Social Security, Medicare budgets

AND what they’re not saying in BIG BOLD FONT is that this money has to be recouped in 2021. This “tax cut” really isn’t, and employees and employers would have to take a significant hit in 2021, paying their current 6.2% plus another sum to make up for the cut. How do they propose to do that? Not said… and if tRump had his way, he’d cut the payroll tax altogether.

As one who is 65 next year, and as one who is self-employed paying in the full 12.4% share for Social Security, putting the Social Security system at risk like this is not acceptable. Just NO! I’ll keep up with my pay-ins to Social Security, no balloon payment for me, but as one who will have to keep working forever before starting to collect Social Security, I’m royally pissed at these efforts to undermine Social Security. What they should be doing is putting back the money that has been borrowed, increase the income ceiling for Social Security deductions, and eliminate Social Security payments to those who have no need of it (that’s the “entitlement” that should be cut, the 1%, the 5%, the 10%, why on earth would they need Social Security payments?)

Destabilizing Social Security? This is something you’d think working stiffs and those collecting Social Security and Social Security Disability would care about.

When I’m 65?