MISO bars access to planning meetings

May 24th, 2017

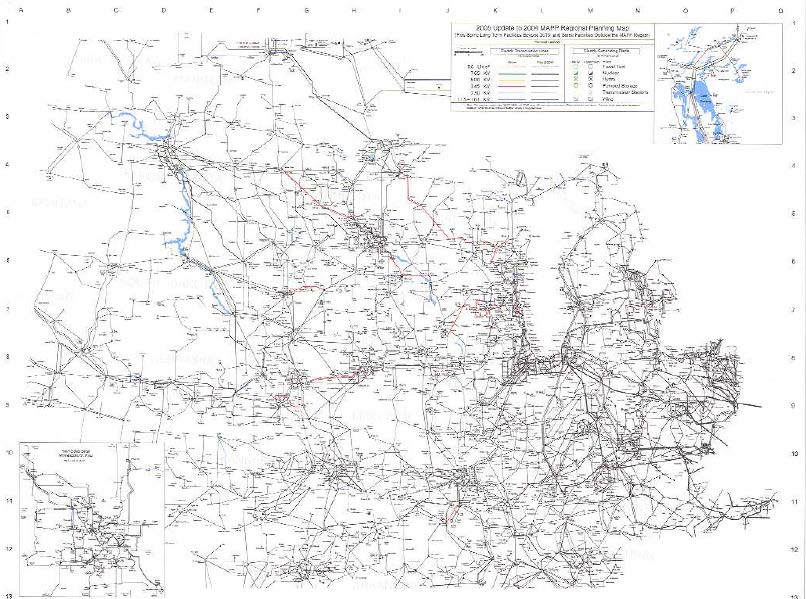

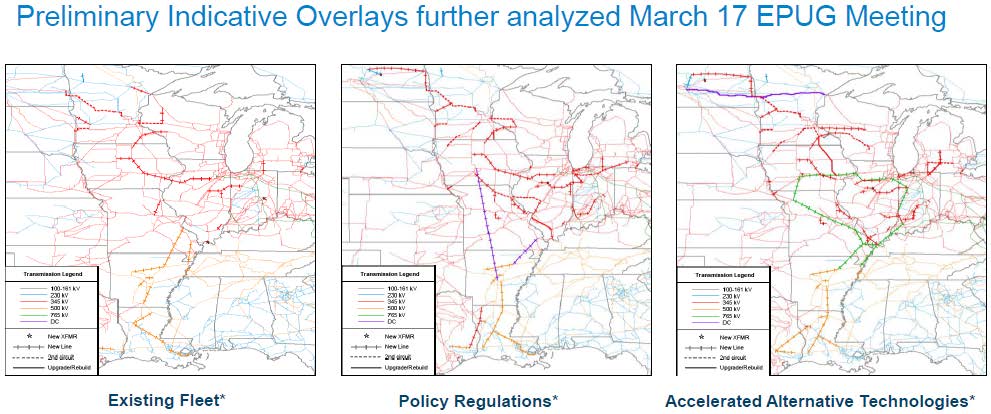

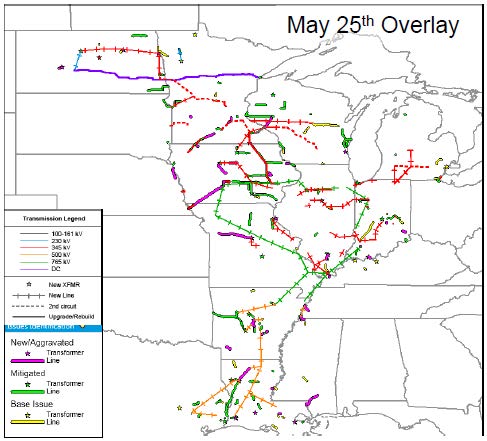

From the public meeting materials, here’s what they’re looking at, above. These are significant additions to the transmission grid in Minnesota and Wisconsin.

MISO’s Economic Planning Users Group is planning a “Regional Transmission Overlay Study” and they’re having another meeting tomorrow, May 25, 2017 down in Metatairie, Louisiana.

Here’s the call in info:

WebEx Information

Event Number: 966 575 350

WebEx Password: Ts824634Participant Dial-In Number: 1-800-689-9374

Participant Code: 823713

Meeting Materials from the MISO site:

- 20170525 EPUG Item 01 Agenda 5/23/2017 05:24 PM

- 20170525 EPUG Item 02 Regional Transmission Overlay Study Overview 5/22/2017 05:47 PM

- 20170525 EPUG Item 03 Preliminary Overlay Indicative Concepts 5/23/2017 05:29 PM

- 20170527 EPUG Item 04 Explore New Benefit Metrics RECB Survey 5/22/2017 04:42 PM

- 20170525 EPUG Item 05 Michigan Exploratory Transmission Study Transmission_Ideas 5/22/2017 04:44 PM

- 20170525 EPUG Item 05 Michigan Exploratory Transmission Study Update 5/22/2017 04:44 PM

- 20170525 EPUG Item 06a Indicative Overlay Design Work Session West 5/24/2017 02:20 PM

- 20170525 EPUG Item 06b Indicative Overlay Design Work Session Central 5/24/2017 02:21 PM

- 20170525 EPUG Item 06c Indicative Overlay Design Session Sub-regional Connections 5/24/2017 02:22 PM

- 20170525 EPUG Item 06d Indicative Overlay Design Work Session South public 5/24/2017 02:23 PM

- 20170525 EPUG RTOS Issues List 5/23/2017 05:45 PM

- 20170525 EPUG RTOS Ideas Tracking Sheet 5/23/2017 05:44 PM

Here’s the problem — they close the meeting, and people like me aren’t allowed to attend. First I was told, back in January when I tried to register:

Thank you for registering for the Economic Planning Users Group (EPUG) on Jan 31. The afternoon portion of this meeting will be held in CLOSED session and reserved from MISO Members or Market Participants only. Please feel free to attend the morning session from 11:00 am to 12:45 pm ET / 10:00 am to 11:45 CT.

I filled out their “CEII – Non-Disclosure Agreement” form and fired it off. But noooooo…

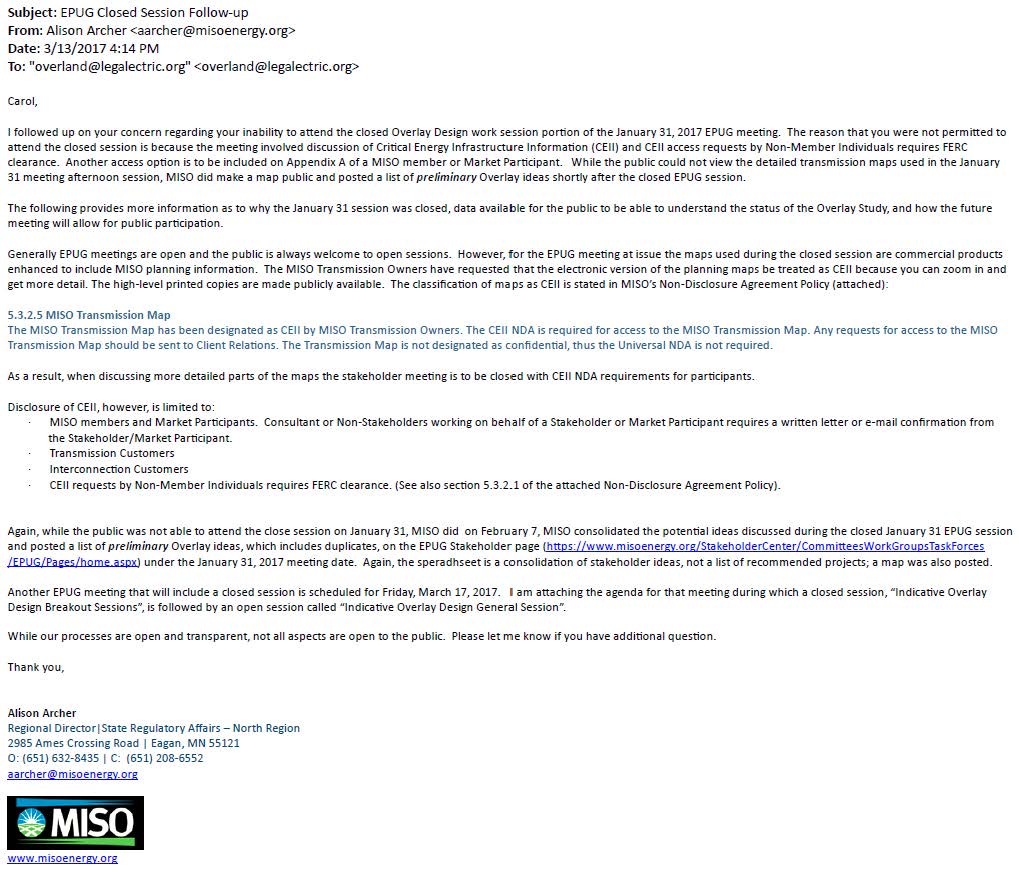

So next I went to the PUC’s Quarterly MISO update, where I was assured that we could make arrangements so that I could attend. I resent the “CEII – Non-Disclosure Agreement” and went back and forth and it came to this (click for larger version). Note this “explanation” of options to be able to attend:

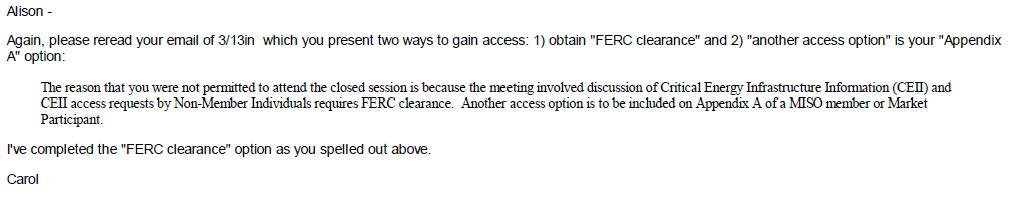

The reason that you were not permitted to attend the closed session is because the meeting involved discussion of Critical Energy Infrastructure Information (CEII) and CEII access requests by Non-Member Individuals requires FERC clearance. Another access option is to be included on Appendix A of a MISO member or Market Participant.

So that says there are two ways to gain access, 1) get “FERC clearance” or 2) “Another access option is to be included on Appendix A of a MISO member or Market Participant.” One or the other. Emphasis added. Here’s the email (click for larger version) laying out those two options:

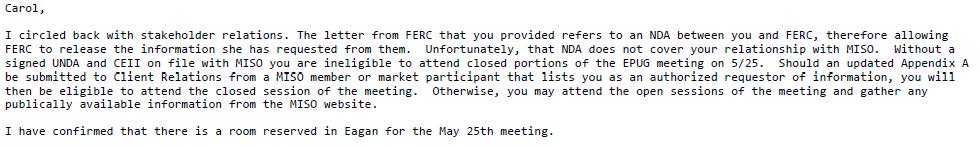

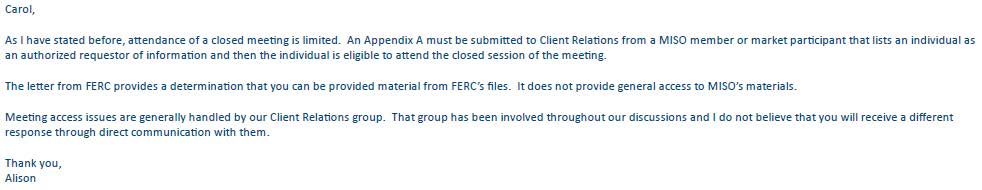

Oh, I says to myself, off to FERC. I sent in the requisite paperwork to FERC, and got “FERC clearance” and they shipped me the CEII information, including but not limited to the map. I let MISO know I’d obtained “FERC clearance,” and here’s the response (click for larger version):

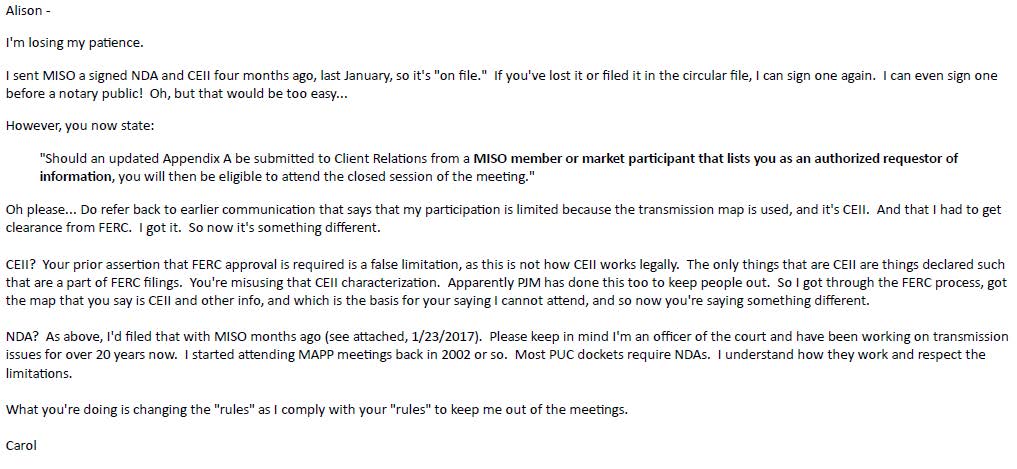

ARRRRGH, they have my CEII NDA on file, have had it since January 23, 2017. I resent it to the writer of these emails on March 4, 2017, and I sent it again today, and objected to yet another change in their “rules” (click for larger version):

So the plot thickens — from MISO (click or larger version):

And from moi (click for larger version):

Rulemaking Initial Comments – Minn. R. Ch. 7849 and 7850

May 12th, 2017

The Minnesota Public Utilities Commission rulemaking for Minn. R. Ch. 7849, Certificate of Need, and 7850, Routing and Siting, is slowly moving forward. Here are the final drafts up for review before they go to the Commission for a rubber stamp and release for general comment:

Final initial comments on drafts were due on Monday and here they are, in alphabetical order:

20175-131687-01_Goodhue Wind Truth – Marie McNamara

20175-131650-01-1_Great River Energy

20175-131683_ITC Comments and Attachments

20175-131686-01_NoCapX – U-CAN – NRG & GWT

Reply comments are due by 4:30 p.m. on May 31, 2017. eFiling is preferred! If you need to register to eFile, GO HERE! It’s easy, quick, and makes filing a breeze. Get to work — there’s a lot here to comment on!

More Clean Line whine… and their Motion DENIED!

January 17th, 2017

THE GOOD NEWS:

| (This is a TEXT ENTRY ONLY. There is no pdf document associated with this entry.) ORDER: The motion, No. 25 , is denied without prejudice. We’ll see how the briefing goes. Signed by Judge D. P. Marshall Jr. on 1/17/2017. (slb) (Entered: 01/17/2017) |

Here’s the NPR report, as above, the Motion was denied today, without prejudice:

Clean Line Wants Landowners’ Hearing Expedited, Says Delays Imperil $2 Billion Project

Here are the filings leading up to this, from the Eastern Arkansas Federal Court site:

DownwindLLC&GoldenBridgeLLC-v-CleanLine

FirstAmendedComplaint-Exhibits_20-1

02713946136_DefendantFeds-AnswerAmendedComplaint

02713945742_P&ECL-AnswerAmendedComplaint

And as above, the simple text denial of that Motion:

| (This is a TEXT ENTRY ONLY. There is no pdf document associated with this entry.) ORDER: The motion, No. 25 , is denied without prejudice. We’ll see how the briefing goes. Signed by Judge D. P. Marshall Jr. on 1/17/2017. (slb) (Entered: 01/17/2017) |

Transmission…

August 21st, 2016

In the inbox today from an activist cohort, a poem by Thomas Lux:

Cucumber Fields Crossed by High Tension Wires

The high-tension spires spike the sky

beneath which boys bend

to pick from prickly vines

the deep-sopped fruit, the rind’s green

a green sunk

in green. They part the plants’ leaves,

reach into the nest,

and pull out mother, father, fat Uncle Phil.

The smaller yellow-green children stay,

for now. The fruit goes

in baskets by the side of the row,

every thirty feet or so. By these bushels

the boys get paid, in cash,

at day’s end, this summer

of the last days of the empire

that will become known as

the past, adios, then,

the ragged-edged beautiful blink.

What surprises me is when someone notices transmission, and in this case, Lux is jarred enough to think and write about it. It’s such a common part of our landscape that most people don’t notice it… that is, most people don’t notice it until they’re affected, and suddenly wake up to the reality of transmission, criss-crossing our country with its insidious web, noticing that it’s EVERYWHERE! Once your eyes are opened to transmission, it’s impossible to disregard.

Public participation? Tough in Xcel rate case

July 14th, 2016

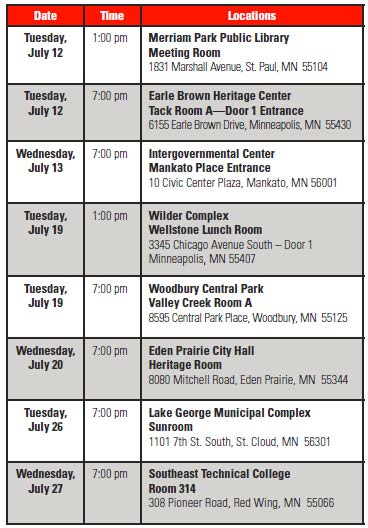

Last night there was a hearing in Mankato on the Xcel Energy rate case (Docket E002/GR-15-826). Public participation in Public Utilities Commission dockets is supposed to be a happenin’ thang… But there were no witnesses to question yesterday at the public hearing, and the Xcel representative who was there could not answer questions. Worse, there was no commitment to have witnesses available to the public at the public hearings, and only advice that the public could attend the evidentiary hearing. ATTEND?!? When might we be able to question witnesses?

Sent this Data Practices Act Request this morning to round up the Information Requests and Responses regarding transmission, transmission riders, MISO and FERC:

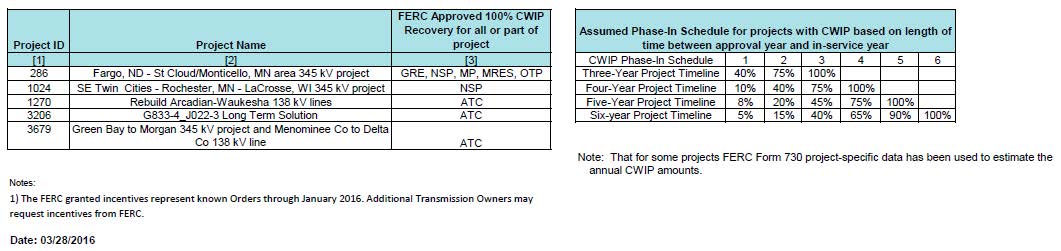

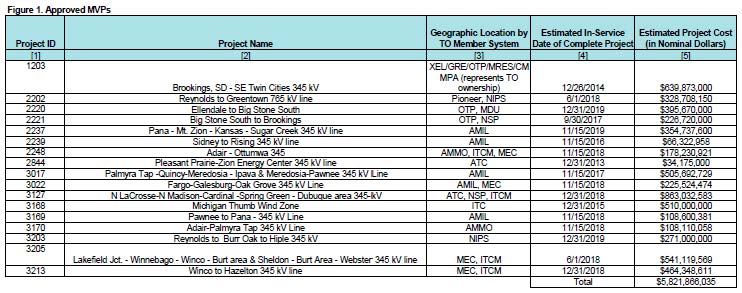

Xcel Energy wants to shift its transmission rate recovery from CWIP and AFUDC to general rates, but there was no one there to talk about it. These are the MVP projects at issue, in Schedule 26A, below, which are worked into MISO tariff and FERC blessed:

And here’s the projects in Schedule 26, below, but hmmmm, no project costs shown (click for larger view):

And here’s the projects in Schedule 26, below, but hmmmm, no project costs shown (click for larger view):

Exhibit 1A – XcelCover_e21_Request for Planning Meeting and Dialogue – PUC Docket 14-1055

Exhibit 1B – e21_Initiative_Phase_I_Report_2014 – Xcel Filing PUC Docket 14-1055

Exhibit 2_MISO Schedule 26A Indicative Annual Charges_02262014

Exhibit 3 – FERC EL-14-12-002_ALJ Order – ROE on MISO Transmission

Next meeting I’ll have some more:

e21_MikeBull_Center for Energy and Environment

MISO Schedule 26 Indicative Annual Charges

1Q_Earnings Release Presentation_5-9-2016_1500085150

Investor Presentation – NYC-Boston_3-1-2=16_1001207698

Back to last night’s hearing…

Check the rules about public participation:

1400.6200 INTERVENTION IN PROCEEDINGS AS PARTY.

Another, the PUC practice rules:

And yet another:

And this one (though they’ll say it isn’t applicable because a rate case isn’t part o the Power Plant Siting Act):

1405.0800 PUBLIC PARTICIPATION.

At all hearings conducted pursuant to parts1405.0200 to 1405.2800, all persons will be allowed and encouraged to participate without the necessity of intervening as parties. Such participation shall include, but not be limited to: