Coalition files Motion to Dismiss

November 6th, 2009

Our coalition of the “Municipal Intervenors,” Stop the Lines! and “Environmental Intervenors” has filed a Motion to Dismiss in PSEG’s Susquehanna-Roseland proceeding in New Jersey.

Here it is – enjoy!

Nutshell version:

NO!

… ahem… really, it’s that simple!

The hearing is set to begin on the Monday after next, November 16th, and we’re having a phone conference next Monday. They ought to just toss it out, and tell them to come back when they’ve really got something. I kinda feel sorry for PSEG, because they’re having to carry the water here when it’s not even their project. PJM’s the one that should be in the hot seat.

New Jersey’s BPU delays Susquehanna-Roseland hearing

September 10th, 2009

Just in, the New Jersey Board of Public Utilities has delayed the Evidentiary Hearings for PSE&G’s (and PJM’s!) Susquehanna-Roseland transmission line, from the week of October 19 to the week of November 16!

Even better, the Discovery that was due right now is now not due for two more weeks! Two more weeks of figuring out how to torture those poor witnesses for PSE&G!!

For more info, see STOP THE LINES!

And that fits well with the CapX 2020 Brookings hearings, that were supposed to begin November 23 but now probably starting the week after.

PJM demand down… AGAIN

August 17th, 2009

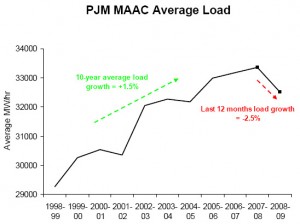

From WSJ article below, the chart says it all…

Another great Wall Street Journal article came out, again noting that demand is DOWN, DOWN, DOWN. This is pretty important given the massive infrastructure rush by the utilities. It’s showing what we’ve known all along, the 800 lb. gorilla in the corner that could/should stop any new infrastructure buildout.

Rebecca Smith, Wall Street Journal, wrote this piece, published last week:

Here’s the PJM Report it’s based on:

There are some choice snippets in the WSJ article, such as:

On Friday, the nation’s largest wholesale power market serving parts of

13 states east of the Rockies is expected to report that electricity

demand fell 4.4% in the first half of the year. That helped to push

down spot market prices by 40% during the first half of this year.

… and…

The price declines in this market, which extends from Delaware to

Michigan, come on top of a 2.7% drop in energy use in 2008 over 2007.

… and…

Power demand in Texas is down 3.2% so far this year due to business

contraction and reductions in employment which are causing many

households to economize.

… and …

But the flagging economy has resulted in a slump in demand that has jolted some energy markets. American Electric Power Co. and Southern Co., for example, both reported double-digit drops in industrial electricity use for the past quarter.

… and…

“There’s more supply than demand and prices are really low so it

doesn’t make sense to build anything,” says John Shelk, president of

the Electric Power Supply Association in Washington, D.C., a group that

represents power generators.

Once more with feeling… SUSQUEHANNA-ROSELAND TRANSMISSION IS NOT NEEDED!

7th Circuit tosses out FERC & PJM cost apportionment

August 13th, 2009

I was a big Posner fan in law school, mostly because he was so much fun to pick on, I so hate the “Chicago school.” But here’s another Posner, doing good! It’s a hilarious opinion, all the better because it so clearly tells FERC and PJM what to do with their rate shifting cost apportionment. GO POSNER!

Here’s the decision:

Two issues in this case:

1) PJM/FERC pricing based on marginal cost v. pricing including sunk costs. That one went for PJM/FERC, and American Electric and others lost in just a few paragraphs.

2) Where the action is — Ohio and Illinois Commissions objected to the 500+kV cost allocation on a pro rata basis, that “their rats should be raised by a uniform amount sufficient to defray the facilities’ costs.”

What’s particularly interesting to me is that this is all about “Project Mountaineer,” which PJM doesn’t even want to acknowledge exists! the Susquehanna-Roseland line that I’m working against is the NE part of line 1, and the MAPP line through now “just” a part of Delaware is the NE part of the southern line, line 4. Here’s the magnitude of Project Mountaineer – the Susquehanna-Roseland line is QUAD 500kV plus double circuiting the existing 230kV line, that’s one big project:

FYI, in the Cudahy dissent, he did some digging, and there is a Project Mountaineer tootnote quoting PJM stating that Project Mountaineer “would bring about substantial congestion relief and reliability improvements increasing Midwest-to-east transfers by 5,000 MW.” See Ventyx, Major Transmission Constraints in PJM (2007).

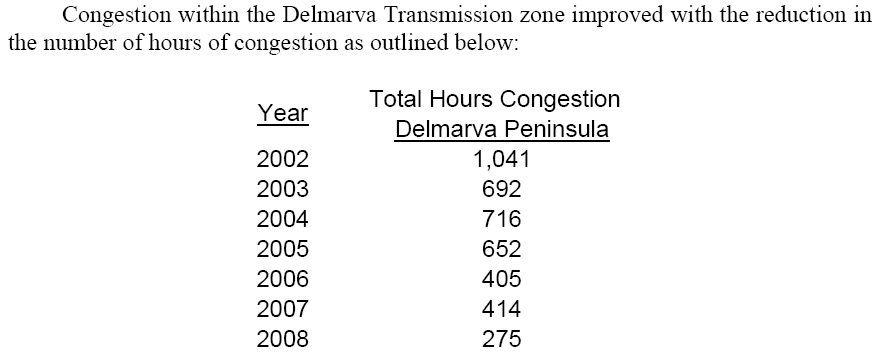

A quick sidebar… FYI, from Delaware Electric Cooperative 2009 Energy Plan – “CONFIDENTIAL”, arguing for the MAPP transmission project…

… and they report that transmission congestion is down 75% to 275 hours ANNUALLY! Really… so for that 275 hours we should build the $1.2 MAPP project? HOW STUPID DO YOU THINK WE ARE?

OK, back to Posners 7th Circuit decision. It was PJM’s idea, approved by FERC, to hit up all the utilities, and Illinois, a BIG example of the problem, would have had to pay out some $480 million while not receiving one dime of benefit. PJM used the theory that, well, PJM used to do it this way all the time before in massive infrastructure buildouts, but as Posner reminded them, that was then and this is now, PJM is a lot different now, Illinois wasn’t even part of the picture.

Posner was pissed off that there was no data at all to support their desired allocation, no data, no specifics about difficulties in assessing benefits, no lawsuits about inequities, no particulars, “[n]ot even the roughest estimate of likely benefits to the objecting utilities… oh yes, he let them have it… for page after page… and notes that FERC “brief devotes only five pages to the 500kV pricing issue.” FERC seems to presume a similar brainwashing in the courts that they and utilities presume of Commissions and legislatures, one that I see to often, that frantic claim of URGENT need, ‘WE’RE GOING TO FREEZE IN THE DARK IN AN INCUBATOR WITHOUT A JOB” theory, presented despite documented long term decrease in demand across the country. Once more with feeling, HOW STUPID DO YOU THINK WE ARE?

Oh, these guys irritate me. Anyway, check out this decision and consider the impact on all the 500kV and above projects applied for or waiting in the wings.

… and PEPCO demand is down too…

August 10th, 2009

(gotta get some mileage out of it, what with the same theme today on NoCapX and Legalectric)

PEPCO’s 2nd Quarter 2009 8-K popped into the inbox today (if you register at the SEC site, they’ll show up the minute they’re filed), and here’s a couple choice graphics:

(click on graph to get a larger one)This is PJM, no PEPCO specific info anywhere. Note the scale here, it starts at 29,000, and note that the downward trend for PJM starts the same time as Xcel’s — in 2007. This is not a little blip of last fall’s economic implosion, it’s a longer-term symptom of our economic disaster that is capitalism.

And here’s the PEPCO dollar specifics:

Is that hilarious or what…