LIARS – 9,504 MW is NOT record peak demand for Xcel

July 19th, 2011

Read the STrib today? Xcel has 9,500 record peak.

Xcel, how dare you… the 9,500MW peak you report is exaggerated… naughty, naughty. You didn’t deduct for the interruptible service customers’ megawatts, and you’re including electricity you’ve generated and sold elsewhere, that the number represents the totals Xcel put on the grid, and not accounting for the demand that they’ve shed, not wholesale sales in other markets. THIS IS NOT PEAK DEMAND!!! YOU’RE CHEATING, XCEL… sigh… what’s new…

Thanks for clearing that up, little birdie!

But even considering that sleight of hand, it’s no record, it’s not even up to the 2006 peak… and that was FIVE years ago. Your CapX 2020 transmission is predicated on 2.43% (is that right, 2.4 something…) increase annually, but folks, we’re not even close to that.

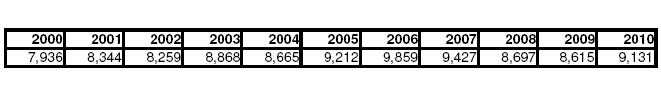

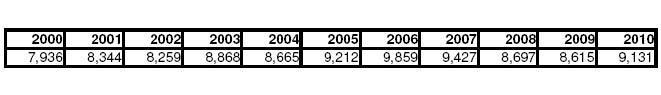

Here’s the peak demand over the last 10 years:

And here’s what the STrib said today, what they said that Xcel said, blah blah blah, 9,500 my ass:

Xcel had 9,083 peak in June?

June 29th, 2011

(Yes, that’s Summer grrrrrrrrrrl.)

Remember how hot it was back a couple of weeks ago? Xcel’s Tim Carlsgaard was again bragging about Xcel’s peak:

9,083 MW

There’s plenty of time this summer to ramp it up higher, but so far, 9,083.

Here’s Xcel’s peak demand for the last decade, taken from their 10-Ks filed with the SEC:

Carlsgaard’s number came from an informal calculation or two, interruptible service was part of it, and I think it was deducted, but you never can be sure with a PR shill!!! Anyway, 9,083MW is nothing to write home about. If you remember, Capx 2020 was based on a 2.4% increase ANNUALLY. If we’d done that, starting from 2005, we’d be at:

Carlsgaard’s number came from an informal calculation or two, interruptible service was part of it, and I think it was deducted, but you never can be sure with a PR shill!!! Anyway, 9,083MW is nothing to write home about. If you remember, Capx 2020 was based on a 2.4% increase ANNUALLY. If we’d done that, starting from 2005, we’d be at:

10,620 MW

So we’re down about 1,600MW from their projections, and from what CapX was based on…

Their projections of a 2.4% increase annually add up quickly:

2005 – 9,212

2006 – 9,433

2007 – 9,659

2008 – 9,891

2009 – 10,128

2010 – 10,371

2011 – 10,620

In 2006 they jumped ahead of projections by a couple of years, but since then have dropped further and further behind, now with a peak trailing behind the peak of 2005…

So one way of looking at it is that they’ve pushed the “need” for additional power out for years.

Another way of looking at it is that they’re about three 500MW coal plants shy of what they projected.

Another way of looking at it is that they 1,600MW short is about Prairie Island’s and Monticello’s three nuclear reactors short.

Another way if looking at it is that it’s 1,00MW of cheap generation for wholesale and there’s plenty of room on 2,050-2,211 MVA (4,100-4,422 MVA double circuited) CapX 2020 transmission to ship that over to points east… (see MCEA, ME3, Waltons Schedin IR3)

So Tim, do tell, where am I off here??? p.s. Always check my math, I’m an attorney, not a vet, because my brain has grey sponge in the math department.

Xcel’s 2010 10-K is out!

February 28th, 2011

Yes, you know you’re one sick puppy when you get excited about those SEC alerts in the inbox! Xcel’s 2010 10-K has been filed:

Check p. 11 for the Peak Demand info – yes, it’s up a bit, but we’re lower than 2005, and there’s a long ways to go to the peak in 2006:

Peak demand is not exactly what we should be planning for these days, well, probably anytime, because peak is so rare, and they just try to sell that excess in the valleys, not that there’s a market anywhere else either!

Delmarva Power IRP Tomorrow Night!

July 13th, 2009

That’s Idiocy Returning on Parade…

Tomorrow night in Dover, the Public Service Commission is opening the doors and it’s your turn to let them know what you think about Delmarva Power’s energy policy, how they’re getting their electricity, what sort of generation it’s coming from, what they’re doing (not) about conservation and efficiency, and what sort of generation you want them to use, i.e., get wind on line NOW! And tell them we don’t need no stinkin’ transmission!

This is your opportunity. They won’t let parties testify, so it’s your turn to step up to the plate.

Now for some background. All the PSC blurbs call this the 3rd Delmarva Power IRP, but it’s not, it’s their third attempt to get it right, and the last one was so bad that they spent years trying and last November submitted a redo as asked by PSC, then a month later, they send a lame cover letter saying that they want to count that November redo attempt as the one due December 1, 2008.

So the PSC grabs that November 2008 attempt and accepts it. EH???

Right… whatever.

You might remember Delmarva Power’s Todd Goodman’s outrageous behavior at the last IRP meeting in December, 2008. AWARD FOR TODD GOODMAN, DELMARVA POWER.

Well, the Delmarva Power IRP saga continues, and the Workshop, Public Comment session…. whatever it is, it’s tomorrow night.

Tell the PSC that it’s time Delmarva Power get serious about conservation, that we want coal plants shut down, that it’s time to get wind on line, and that we do NOT want the Mid-Atlantic Power Pathway transmission line (you know, that line that runs from coal plants SW of Delaware, up through Indian River and to Salem. PJM admits that the Indian River to Salem part of it is not needed, and it’s time to get the WHOLE truth out, that the entire line is not needed. See Mid-Atlantic MAPP line cut short).

COME TO THE PSC’S DELMARVA POWER IRP WORKSHOP… PUBLIC COMMENT SESSION… JUST COME AND TELL THEM WHAT YOU THINK?

ruth.price@state.de.us

Delmarva Power’s IRP is based on an annual increase in demand of 1.9%. Uh-huh… right…

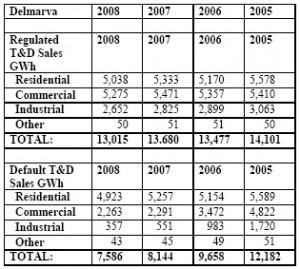

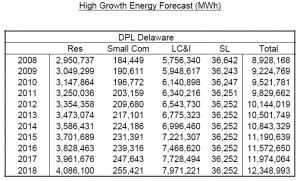

Look what has been happening to electrical use:

Hmmmmmmmmmm, do you see what I seeeeeeeeeeeeee…

Regulated T&D Sales have gone down.

Default T&D Sales have taken a significant dive.

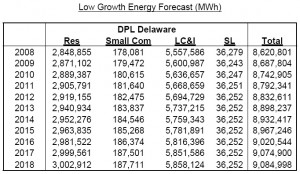

Despite that, what do they project in the IRP? From their IRP Appendix A:

Energy use, measured in MWh, has been dropping significantly for years… but we knew that…

Now what about peak? The Delmarva peak isn’t in their 10-Ks, but here’s PJM:

2008 Peak 136,310MW

Projected Peak 134,430MW

DOWN 1,880MW

DOWN 1.4%

And with 165,200MW of generation and a reserve margin of 28.6% (15% necessary) which even PJM describes as “well in excess,” suffice it to say PJM doesn’t need new power anytime soon.

Read it all here:

And here’s some history – PJM’s revenue decreased 8% in 2008 (p. 9 of 44):

And remember, PEPCO, Delmarva Power’s parent, says that it may not sell shares to finance the MAPP line — so how would they finance it… or would they just admit that it’s not needed and not build it?

Pepco CFO May Postpone Investment to Avoid Share Sale

Pepco fell 3 cents to $13.39 in composite trading on the New York Stock Exchange.