Aurora Solar referred for hearing

September 28th, 2014

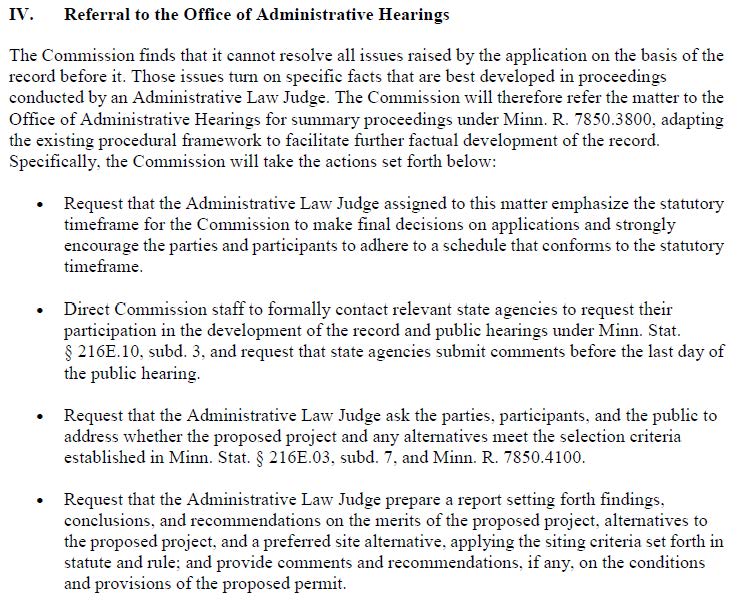

Lots of interesting filings last week — in this case, the Public Utilities Commission has deemed the Aurora Solar application complete and has referred it to the Office of Administrative Hearings for a “summary” proceeding, but more specific and detailed than that:

Lots of interesting filings last week — in this case, the Public Utilities Commission has deemed the Aurora Solar application complete and has referred it to the Office of Administrative Hearings for a “summary” proceeding, but more specific and detailed than that:

Short version:  And they’ve not appointed a Task Force, although there is an opening if people interested in one want to request it. See p. 4 of the order above. Now how will this be affected by Xcel Energy’s filing looking for essentially reconsideration of their resource plans and acquisitions:

And they’ve not appointed a Task Force, although there is an opening if people interested in one want to request it. See p. 4 of the order above. Now how will this be affected by Xcel Energy’s filing looking for essentially reconsideration of their resource plans and acquisitions:

Here’s the Application:

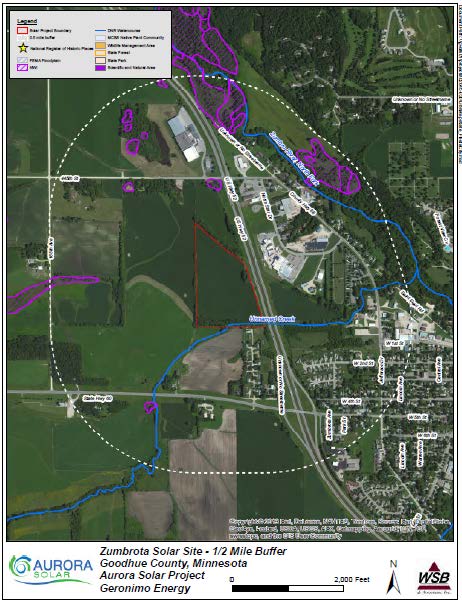

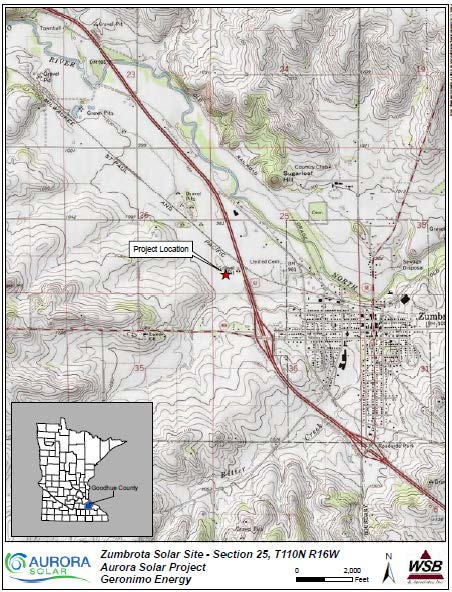

The files with the maps are TOO LARGE to post, so here are links, I’ve got them in two pdfs, but there there are many broken down. Just go to the docket via PUC SEARCH DOCKET LINK, and then search for 14-515 (“14” is the year, “515” is the docket).

There was interest and concern here in Goodhue County originally when it was proposed for an industrial park that was developed, with infrastructure in, but not yet constructed with buildings. Zumbrota didn’t think that was the best use for that area, and I’d agree. It’s now been sited in a corn field to the north of the northwest quadrant of the Hwy. 52 and Hwy. 60 interchange. Much better!

It apparently used to be a gravel pit:

Xcel demand down, down, down

September 28th, 2014

I’ve been saying this for so many years, that electric demand is down, down, down, and instead, Xcel Energy (and all the others) have been saying it’s going UP, UP, UP (even though Mikey Bull said years ago that they wouldn’t need power for a while), and they’re applying for and getting Certificates of Need for all these permits for utility infrastructure that are obviously designed to market and sell the surplus, and the Public Utilities pretends to be oblivious (I say “pretends” because I cannot believe they’re that unaware and uninformed.).

This is a must read:

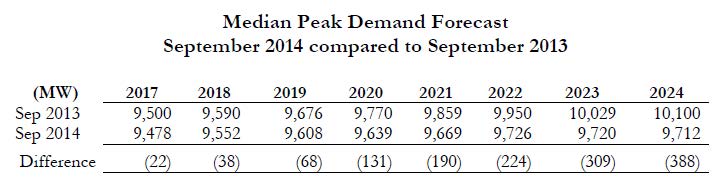

Here’s the short version from Xcel:

2024 is expected to be about what it was back in 2007, the industry peak year. DOH! But note this — there’s a “small capacity surplus in 2016.” DOH!

And given the surplus which we’ve known has been present and looming larger, that’s why they then ask for withdrawal of the Certificate of Need for the Prairie Island uprate because it isn’t needed (and really, that was just what, 80 MW or so? Or 80 MW x 2 reactors, 160 MW?). If they don’t need that small uprate, why on earth would they need so much more?

But what do I know…

Hollydale Transmission Line was clearly not needed, and they withdrew that application…

CapX 2020 transmission was based on a 2.49% annual increase in demand, and for Hampton-La Crosse in part supposedly based on Rochester and La Crosse demand numbers, yeah right, we know better, but that was their party line. Again, DOH, it didn’t add up to needing a big honkin’ 345 kV transmission line stretching from the coal plants in the Dakotas to Madison and further east, but who cares, let’s just build it…

ITC MN/IA 345 kV line — the state said the 161 kV should be sufficient to address transmission deficiencies in the area, but noooooo, DOH, that wouldn’t address the “need” for bulk power transfer (the real desire for the line).

Here’s a bigger picture of the bottom line (I’m accepting this as a more accurate depiction, not necessarily the TRUTH, but close enough for electricity), keeping in mind that these are PROJECTIONS, and that they’re adding a “Coincident Peak adjustment” which should be included in the “peak” calculations):

Notice the only slight reduction in coal capacity, just 19 MW, nuclear stays the same, a 320 MW decrease in gas, a 128 MW reduction in Wind, Hydro, Biomass, which I hope includes garbage burners and the Benson turkey shit plant , slight increase in solar of 18 MW, and Load Management also a slight increase of only 80 MW. This is Xcel Energy with its business as usual plan, which has to go. We can do it different, and now is the time.

Will someone explain why we paid so much to uprate Monticello, and paid to rebuild Sherco 3?

From the archives:

500+ give LS Power a piece of their mind

October 20th, 2009

2012 NERC Long Term Reliability Assessment

May 7th, 2013

PJM Demand is DOWN!

November 15th, 2012

Transmission? It’s NOT needed!!!

October 18th, 2012

Xcel shelves projects, admitting demand is down

December 3rd, 2011

PJM Demand is DOWN!

November 15th, 2012

But we knew that…

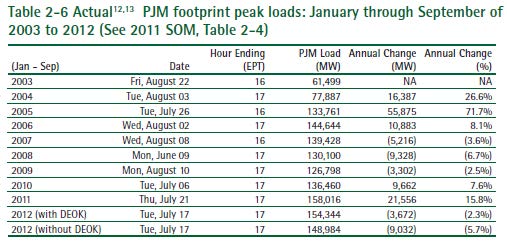

Here’s the part I’m most interested, demand is DOWN, from the intro, summarizing p. 23 of the report linked above:

The PJM system peak load for the first nine months of 2012 was 154,344

MW, which was 3,672 MW, or 2.3 percent, lower than the PJM peak

load for the first nine months of 2011. The DEOK Transmission Zone

accounted for 5,360 MW in the peak hour of the first nine months of

2012. The peak load in 2012 excluding the DEOK Transmission Zone was

148,984 MW, a decrease of 9,032 MW, or 5.7 percent, from the peak load

for the first nine months 2011. (See page 23)

2.3%, 5.7%, DUH! Demand is DOWN! Here’s the specifics:

Xcel’s in a bit of a bind…

February 18th, 2012

Of note for Minnesota, which needs all the property tax revenue it can get:

Yes, it’s $28 million and it’s both electric and gas. So even though it came out of the electric case, it’s for both businesses.

Demand is down down down and Xcel says they won’t need any more new generation until at least 2018. Well DUH! They filed an amendment to their IRP given that the situation is sooooooo bad.

Something I found interesting, aside from their projections of load growth that are down the toilet:

The most important information is fundamental data regarding the status of the economy and projections of economic growth.

And lack thereof:

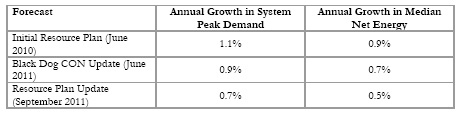

We now expect 0.7% annual demand growth and 0.5% annual energy growth over the Resource Plan horizon, down from 1.1% and 0.9%, respectively, included in our initial filing. The magnitude of the reduced forecast is such that it prompts us to reconsider some components of our Five Year Action Plan.

Which means:

We do not expect additional generation will be needed on our system until 2018.

Well DUH! And that’s a full year after Mikey Bull had estimated at that big LS Power meeting in Chisago! So I’d guess that if they’ll admit that, it’s really 2020 or further out. And remember CapX 2020 is based on a 2.49% annual increase? Right…

They had issued an RFP for wind, but they don’t need or want it now:

Currently we have significant installed generation and a bank of renewable energy credits that we can use to satisfy our renewable energy requirements. To the extent the PTC expires and wind prices increase as expected, we will be able to rely on our installed generation and banked RECs rather than adding uneconomic wind generation.

DUH!

They also note that they’ve lost some wholesale customers, which is also noted in this week’s FERC filing, a Complaint against Xcel, where p. 11 of the complaint they state they lost 9 wholesale customers in Wisconsin and Michigan. For more on that, go to NoCapX 2020:

CATFIGHT! Xcel and ATC go at it at FERC

Demand is down… How many more ways can we say it?

September 8th, 2011

Demand is down, ja, we know that, you betcha… and it seems word is finally getting out!

And we know those utilities and how badly they want to “prove” need, but hey, bullshit by any other name smells as sweet!

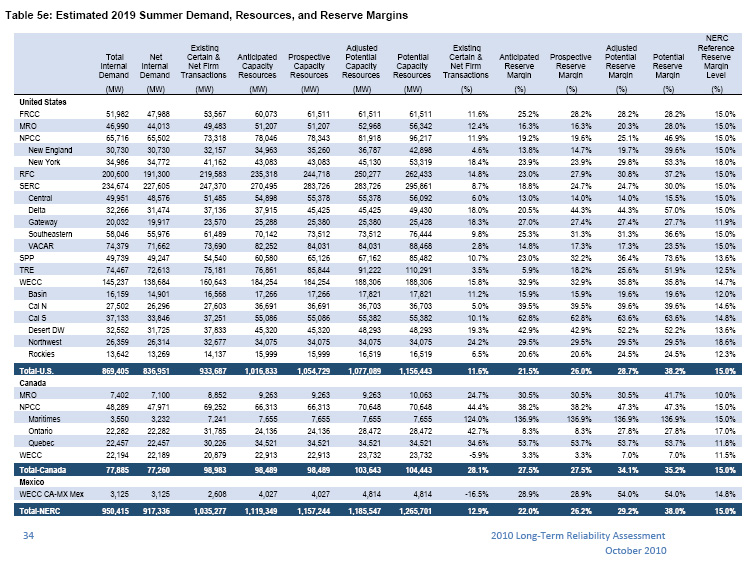

Reserve margins are at an all time high and projected to get higher, from the 2010 NERC Long Term Reliability Assessment:

And then there’s the MISO State of the Market Report agreeing:

And then there’s the MISO State of the Market Report agreeing:

Including all demand response capability, we estimate a planning reserve margin in the range of 28 percent to 37 percent depending on the summer capability of the resources that are assumed. These margins substantially exceed MISO’s planning reserve requirements that have recently increased from 15 percent to 17 percent.

p. iii, Ex. Summary, 2010 MISO State of the Market Report. Increased required reserve margins? Hmmmmm, part of their hype on transmission build-out was that it would DECREASE reserve margins… but hey, they said “competition would decrease prices” didn’t they… and they ARE, but not for US, cost of electricity is only lower for those elsewhere, and not for those of us in a “low cost” state. Consider Xcel’s request to raise electric rates 37.5% over the next 5 years…

And here is Associated Press saying what we already know…

Shocker: Power demand from US homes is falling