2019 PJM State of Market

March 12th, 2020

PJM’s annual State of the Market Report has been released by Marketing Analytics:

What I’m looking for first is demand info, so I’m searching. Here ya go:

It looks like peak demand/load, at 148,228MW is above what it was in 2006. From FERC – Electric Power Markets PJM:

All time peak demand: 144,644 MW (set August 2, 2006), and down to 139,438 in 2007.

Peak demand growth (2006-2007): Peak demand declined 3.6%. See PJM State of the Market 2008, below.

| 2006 | ||

|---|---|---|

| Summer Peak Demand (MW) | 144,644 | 139,438 |

| (Source: PJM) |

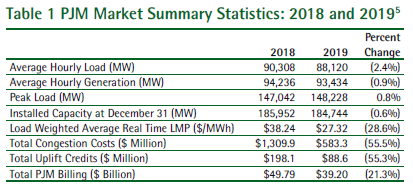

And about wholesale cost, from the 2019 State of the Market report:

One of the benefits of competitive power markets is that changes in input prices and changes in the balance of supply and demand are reflected immediately in energy prices. PJM real-time energy market prices decreased significantly in 2019 compared to 2018. The load weighted,average real-time LMP was 28.6 percent lower in 2019 than in 2018, $27.32 per MWh versus $38.24per MWh. Of the $10.92 per MWh decrease, 41.5 percent was a result of lower fuel costs. Other contributors to the decrease were the dispatch of lower cost units, decreased load and lower markups (2019 SoM,Intro, p 3).

Once more with feeling –wholesale energy costs and prices are DOWN, DOWN, DOWN, yet rates are going UP, UP, UP. DOH! It’s because, like Xcel, utilities are changing their business plan. They’re not making the money anymore on selling electricity, and can make a LOT more by building infrastructure that we don’t need and charging us ratepayers for it. Transmission costing billions; the rebuild and start up of Sherco 3 after 22 months off-line, and then announcing shut down of 1 & 2; the rebuild of Monticello costing twice the estimate; request to PUC to sell surplus Sherco and King plant generation on MISO market (just how is running it for sale elsewhere consistent with cutting CO2?!?!?)…

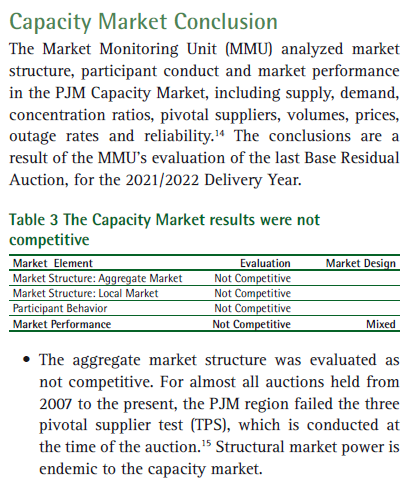

Another thing I do see is that the Capacity Market is deemed “Not Competitive,” and this has been a documented problem since 2007. DOH! Yet it continues.

If it’s not competitive, why hasn’t the market structure been changed? After all, it’s all about “let the free market decide,” and where it’s not competitive, that isn’t happening, eh? As Marketing Analytics states, “Structural market power is endemic to the capacity market.” From a wiki definition of endemic, “In epidemiology, an infection is said to be endemic in a population when that infection is constantly maintained at a baseline level…” Houston, methinks we have a market problem…

More to follow, but wanted to get these tidbits out there.

Demand is down… How many more ways can we say it?

September 8th, 2011

Demand is down, ja, we know that, you betcha… and it seems word is finally getting out!

And we know those utilities and how badly they want to “prove” need, but hey, bullshit by any other name smells as sweet!

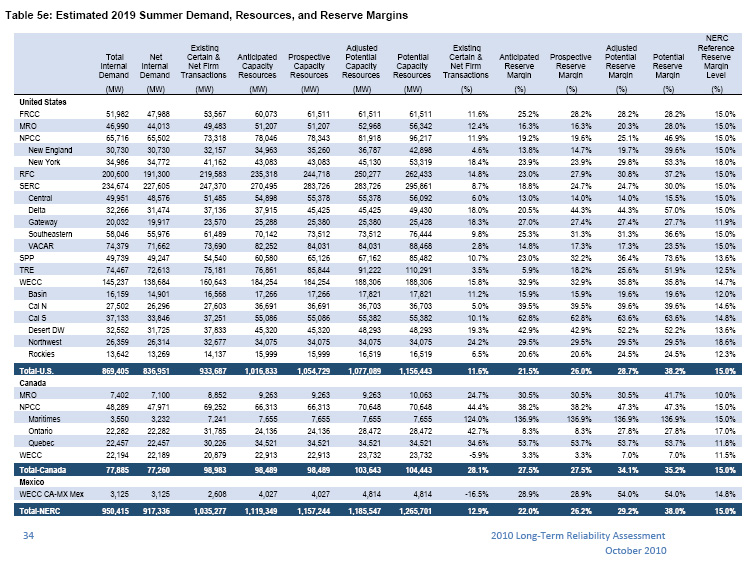

Reserve margins are at an all time high and projected to get higher, from the 2010 NERC Long Term Reliability Assessment:

And then there’s the MISO State of the Market Report agreeing:

And then there’s the MISO State of the Market Report agreeing:

Including all demand response capability, we estimate a planning reserve margin in the range of 28 percent to 37 percent depending on the summer capability of the resources that are assumed. These margins substantially exceed MISO’s planning reserve requirements that have recently increased from 15 percent to 17 percent.

p. iii, Ex. Summary, 2010 MISO State of the Market Report. Increased required reserve margins? Hmmmmm, part of their hype on transmission build-out was that it would DECREASE reserve margins… but hey, they said “competition would decrease prices” didn’t they… and they ARE, but not for US, cost of electricity is only lower for those elsewhere, and not for those of us in a “low cost” state. Consider Xcel’s request to raise electric rates 37.5% over the next 5 years…

And here is Associated Press saying what we already know…

Shocker: Power demand from US homes is falling

Delmarva Power IRP Tomorrow Night!

July 13th, 2009

That’s Idiocy Returning on Parade…

Tomorrow night in Dover, the Public Service Commission is opening the doors and it’s your turn to let them know what you think about Delmarva Power’s energy policy, how they’re getting their electricity, what sort of generation it’s coming from, what they’re doing (not) about conservation and efficiency, and what sort of generation you want them to use, i.e., get wind on line NOW! And tell them we don’t need no stinkin’ transmission!

This is your opportunity. They won’t let parties testify, so it’s your turn to step up to the plate.

Now for some background. All the PSC blurbs call this the 3rd Delmarva Power IRP, but it’s not, it’s their third attempt to get it right, and the last one was so bad that they spent years trying and last November submitted a redo as asked by PSC, then a month later, they send a lame cover letter saying that they want to count that November redo attempt as the one due December 1, 2008.

So the PSC grabs that November 2008 attempt and accepts it. EH???

Right… whatever.

You might remember Delmarva Power’s Todd Goodman’s outrageous behavior at the last IRP meeting in December, 2008. AWARD FOR TODD GOODMAN, DELMARVA POWER.

Well, the Delmarva Power IRP saga continues, and the Workshop, Public Comment session…. whatever it is, it’s tomorrow night.

Tell the PSC that it’s time Delmarva Power get serious about conservation, that we want coal plants shut down, that it’s time to get wind on line, and that we do NOT want the Mid-Atlantic Power Pathway transmission line (you know, that line that runs from coal plants SW of Delaware, up through Indian River and to Salem. PJM admits that the Indian River to Salem part of it is not needed, and it’s time to get the WHOLE truth out, that the entire line is not needed. See Mid-Atlantic MAPP line cut short).

COME TO THE PSC’S DELMARVA POWER IRP WORKSHOP… PUBLIC COMMENT SESSION… JUST COME AND TELL THEM WHAT YOU THINK?

ruth.price@state.de.us

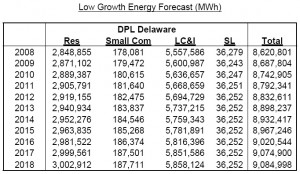

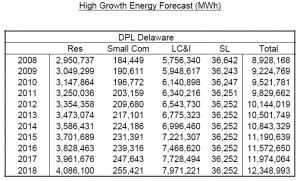

Delmarva Power’s IRP is based on an annual increase in demand of 1.9%. Uh-huh… right…

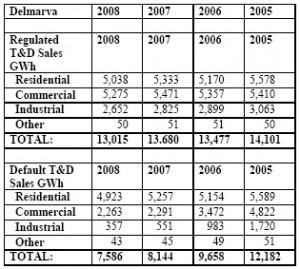

Look what has been happening to electrical use:

Hmmmmmmmmmm, do you see what I seeeeeeeeeeeeee…

Regulated T&D Sales have gone down.

Default T&D Sales have taken a significant dive.

Despite that, what do they project in the IRP? From their IRP Appendix A:

Energy use, measured in MWh, has been dropping significantly for years… but we knew that…

Now what about peak? The Delmarva peak isn’t in their 10-Ks, but here’s PJM:

2008 Peak 136,310MW

Projected Peak 134,430MW

DOWN 1,880MW

DOWN 1.4%

And with 165,200MW of generation and a reserve margin of 28.6% (15% necessary) which even PJM describes as “well in excess,” suffice it to say PJM doesn’t need new power anytime soon.

Read it all here:

And here’s some history – PJM’s revenue decreased 8% in 2008 (p. 9 of 44):

And remember, PEPCO, Delmarva Power’s parent, says that it may not sell shares to finance the MAPP line — so how would they finance it… or would they just admit that it’s not needed and not build it?

Pepco CFO May Postpone Investment to Avoid Share Sale

Pepco fell 3 cents to $13.39 in composite trading on the New York Stock Exchange.