Pawlenty, Bill Glahn, MMPA and Excelsior

January 11th, 2009

Julie Jorgensen says the focus of Excelsior Energy’s sales pitch will now be Municipal Utilities… MMUA is sponsoring Mesaba dog & pony shows to Municipal Utilities… torturously long dog & pony shows about Mesaba… selling Mesaba… pushing Mesaba… arm twisting about Mesaba? WTF??? Well, we all know how much Pawlenty loves the Mesaba Project.

OK folks, let’s connect the dots between Gov. Tim Pawlenty, Bill Glahn, Minnesota Municipal Power Agency, Excelsior Energy’s Mesaba Project… and how does Minnesota Municipal Utilities Association fit in (could Kadermas be back there? Naaaaaaah…)???

We all know about Gov. Tim Pawlenty, the Green Chameleon:

Governor Pawlenty announces Bill Glahn as Director of Minnesota Office of Energy Security.

… nevermind, that’s a different “Bill Glahn” (ain’t google fun?)

We know the Minnesota Office of Energy Security, MOES, the part of Commerce that’s now charged with doing Power Plant (and xmsn) siting (Press Release – Gov. Pawlenty Announces Energy Initiatives, Jan. 17, 2008):

Prior to MOES, Bill Glahn was, according to the press release above, at Minnesota Municipal Power Agency.

And that means he was also Dahlen Berg: CLICK HERE FOR BILL GLAHN CV

From Dahlen, Berg’s site, here’s their explanation of their relation to MMPA:

Toadies all. It’s like Minnesota Rural Electric Association’s connection with CapX 2020 and GRE…

So Minnesota Municipal Utilities Association is doing dog & pony shows trying to sell Mesaba. HOW STUPID DO THEY THINK MUNICIPAL UTILITIES ARE? They can read the Mesaba Project ALJ’s decision, they can understand the meaning of TOO RISKY, they can understand the meaning of COSTS WAY TOO MUCH, they can understand the meaning of NOT IN THE PUBLIC INTEREST. The Mesaba Project is a real DUH! IT’S TOO ABSURD TO EVEN CONSIDER!

And knowing that Green Chameleon Tim Pawlenty is a toadie for Excelsior Energy and Excelsior’s Mesaba Project, knowing the extent to which he’ll promote this stupider than words can convey project, does anyone know why? What’s in it for him? What do they have on him? Why would he risk credibility and reputation supporting this utter bullshit project? What’s the rest of the story here?

NARUC’s and PUC’s odd affair with coal gasification & CCS

December 22nd, 2008

Every now and then, something still surprises me, and here’s today’s surprise… a eagle-eye cohort (with a snow day by the computer? If so, snow therefore can be a good thing) found these links which make me wonder if our Commissioners at the PUC are paying attention to the record of the Mesaba case, if they’re sleeping through they’re NARUC meetings, or both! It’s the PUC, it’s NARUC, whatever are they thinking?

NARUC (National Association of Regulatory Utility Commissioners) has a subcommittee called… are you ready… “Clean Coal and Carbon Sequestration.”

CLICK HERE FOR LIST OF MEMBERS

And look who’s there from Minnesota, Commissioners and Staff:

Phyllis Reha

Minnesota Public Utilities Commission

phyllis.reha@state.mn.usDavid C. Boyd

Minnesota Public Utilities Commission

david.c.boyd@state.mn.us

Bob Cupit

Minnesota Public Utilities Commission

Bob.Cupit@state.mn.us

Here’s NARUC’s Coal Generation Technology Primer, which you have to read to believe…

Minnesota’s Excelsior Energy Mesaba Project was THE first in this IGCC wave to be vetted with cost information somewhat available to the public. So USE IT! But no… Despite all these folks from our Public Utilities Commission who know intimately what a disaster coal gasification is, a la Excelsior Energy’s Mesaba Project, and who are on this Coal Gasification Committee, this NARUC organization that they belong to is putting out information as a “resource” that is way off base. It’s bad enough that they’re on this committee at all because it lends credibility to a losing and not-feasible technology, but this committee’s cost information so far off that it makes me gasp.

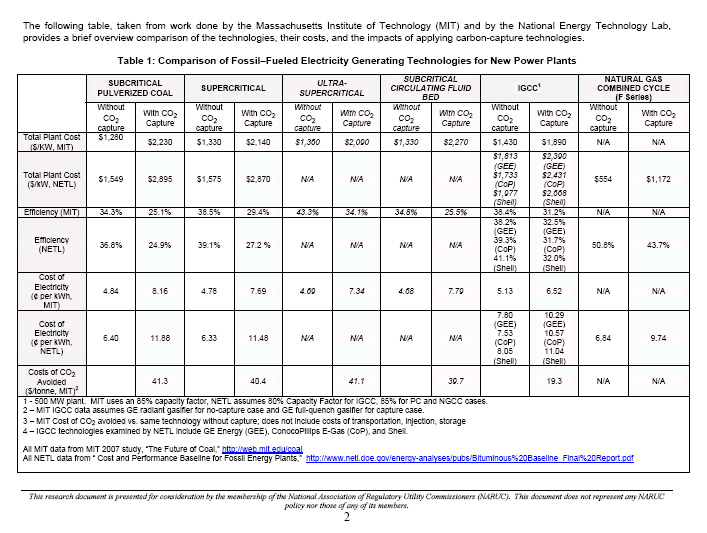

Here’s the NARUC chart from that “Primer” for various coal costs both per kW and kWhr, and see for yourself:

Again, the full report (this chart is on p. 2):

So, will someone please explain to me why they are saying that the cost of IGCC is $1,430-1,977/kW, and worse and more specifically, why the Conoco Phillips cost is $1,733/kW when we all know that the Mesaba Project, in 2005 dollars, was estimated at $3,593/kW? Why aren’t David Boyd, Phyllis Reha and Bob Cupit correcting NARUC staff about this claring error, a cost estimate that’s got to increase 100% to get close in 2005 dollars, and it’s gone higher since? Aren’t these NARUC people checking the projects that their members are regulating?

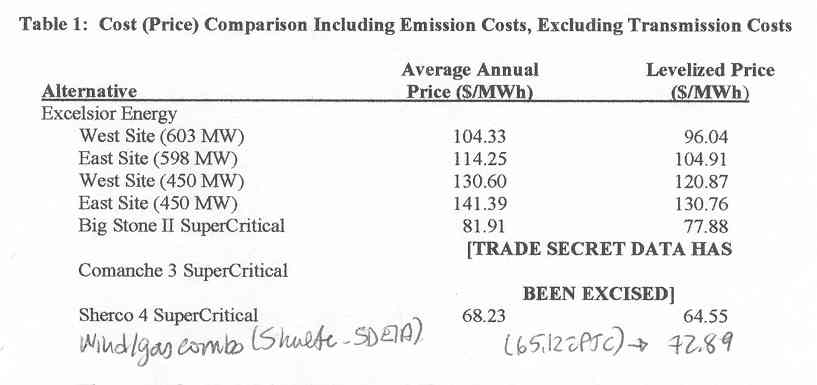

And then there’s the kWhr cost, also outrageous. They’re saying that kWhr cost of IGCC is 5.13-8.05 cents/kWhr. Once more with feeling, here’s the cost chart from Dr. Amit’s testimony:

CLICK HERE for Dr. Amit’s Rebuttal Testimony, p. 24, from whence this chart came.

CLICK HERE for wind/gas combo info from Shulte’s SDEIA report.

…and then there’s this continuing crap about Carbon Capture and Storage, and the NARUC chart has a column for CCS, claiming that IGCC with CO2 capture is $1,890-2,668/kW capital cost, and 10.29-11.04/kWhr. First problem is that they’re acting as if it were happening, and this is something even the DOE admits is not here and now and is not going to be available for a long, long time, so how can they presume? Second, the column is labeld as “with CO2 capture” and doesn’t address storage but there’s no clarification that in industry modeling, they only address capture and transport to the gate, and NOT storage, implicitly acknowledging that storage is not even contemplated. I’m not going to waste more time on this one, grrrrrrrrrrrr…

And it gets worse — CO2 capture for Supercritical Pulverized Coal, Supercritical, Ultra-Supercritical, Subcritical Circulating Fluid Bed…. oh, PUH-LEEEEZE… to presume CO2 capture for pulverized coal is … how else to say it… NUTS! How do they propose this be done?

It’s irresponsible to promote these delusions. Coal Generation Technologies was written by NARUC Staff Miles Keogh and Julia Friedman of the Grants & Research Department got $$$ from the U.S. EPA. PLEASE start digging, even just scratching the surfact, and you’ll see! Get IGCC cost information from each of those Commissions with IGCC proceedings before it and you’ll see, and I would think that info is readily available to you.

Chair Boyd, Commissioner Reha, and the legendary Mr. Bob Cupit… will you please straighten out NARUC as to the facts of coal gasification, specifically cost and CO2 CCS?

Another coal gasification plant canceled

November 26th, 2008

Yes, the only good coal gasification plant is a dead coal gasification plant. Coal gasification just doesn’t make any sense, and even project proposers are figuring that out!

Here it is in the Chicago Tribune:

Congrats to John Blair and Valley Watch for exposing the realities of this project.

But potential Rockport, Ind., facility still may have life

By Bryan Corbin

Wednesday, November 26, 2008“In a word, ‘thrilled,'” Blair said of his reaction to the decision.

Mesaba Project’s “procedural reconsideration”

November 25th, 2008

So what the hell is a “procedural reconsideration?” Today the PUC had the never-ending (until May 1, 2009) saga of Excelsior Energy’s Mesaba Project. The issue? Yet another Motion to Reconsider from Excelsior Energy, they don’t want to take NO for an answer.

The PUC staff recommended reaching the hand toward the life-support plug, but not yanking it with a final decision:

Staff acknowledges the comments of Minnesota Power requesting the clarification of whether the Commission’s approval or denial of Excelsior’s petition for reconsideration at this time constitutes a final decision for purposes of appellate review. In the alternative, the Commission will not enter a final decision until May 1, 2009, the deadline for negotiations. As such, Staff believes that the most judicially efficient course would be for the Commission to grant the petition for reconsideration for procedural reasons and hold further consideration in abeyance until after May 1, 2009.

Briefing papers, p. 13. And so they voted unanimously for alternative 1:

Grant the petition for reconsideration and rehearing for procedural reasons and hold further consideration in abeyance until after May 1, 2009.

For the whole Excelsior Energy saga, GO HERE and search for Docket 05-1993. And if that’s not enough, search also for 06-668!

So we’re still holding… zzzzzzzzzzzzzzzz

NRG’s New York IGCC plant is dead

July 20th, 2008

Another coal gasification bites the dust — yes, it took a coon’s age to get this posted, what can I say, the CapX hearings are taking up a lot of time… This was the best news in ages, continuing the theme that IGCC is a bad idea, too risky, too costly. This plant was one that seemed to have a lot of backing, which to me means that IGCC is done. When I’d posted about it, it garnered some wild NRG employee comments on this blog, ones that I hope that those employees’ bosses are aware of! I know NRG is watching, but I think some of their employees need to have their typing fingers taped together and/or not operate a computer while soused!

Here are a few articles with some choice comments:

From the Buffalo News:

Power Authority stops $1.6 billion plans for advanced coal plant at Tonawanda’s Huntley Station

From newsday.com:

NYPA halts plans for clean-coal plant in Tonawanda

And from the Post Journal:

NYPA withdraws support for North Tonawanda clean coal project

… and…

… and…

”Simply, at this time, the price gap is too large to overcome” said Pritchard of NYPA.

Tell us something we didn’t already know!!!