IGCC – speaking of ED… and NRDC

March 17th, 2007

Steve Jenkins, former IGCC promoter toady extraordinaire, has come clean about coal!

IGCC just can’t get it up, it’s not a happenin’ thang… it’s unreliable… this should be common knowledge, but for some reason, some persist in denial. Why would NRDC and ED say “IGCC is good with capture and sequestration” when it’s NOT good, and “capture and storage” is NOT happening?

Wabash River was utter disaster. Pinon Pines never worked. Carbon capture and sequestration isn’t happening. So at what point do they admit that IGCC is a stupid fork to take, a diversion from the real work of generating and using electricity that we can live with? That works FOR us, rather than poison us. From NRDC’s Coal in a Changing Climate:

There is no such thing as “clean coal.†However, as far as the air pollution and global warming effects of coal are concerned, technologies ready for widespread commercial application can dramatically reduce emissions of carbon dioxide, mercury, sulfur, and nitrogen oxides from coal conversion. Although the other challenges remain, we must employ these technologies now to prevent evenreater damage from coal use. The race for a better energy future is on.

And here’s ED on IGCC:

What’s wrong with this picture? DUH!!! NRDC’s and ED‘s claims are against evidence!!! Obviously they aren’t reading the record of Excelsior Energy’s Mesaba Project.

One of the more public flops was the Pinon Pine project, which for some reason didn’t turn up in my prior searches. Here’s the link:

And of course there’s the:

And based on a career of IGCC promotion and toadism, Steve Jenkins has filed the most amazing testimony in the Florida “Glades Power Park” docket:

So what’s going on in Florida? It’s dreadful — first off, they want to build a 1,900MW pulverized coal plant, the “Glades Power Park.” Pricetag? $5.7 billion! Holy shit!

OK, so if that isn’t enough, dig the testimony of Richard “The Vermin” Furman:

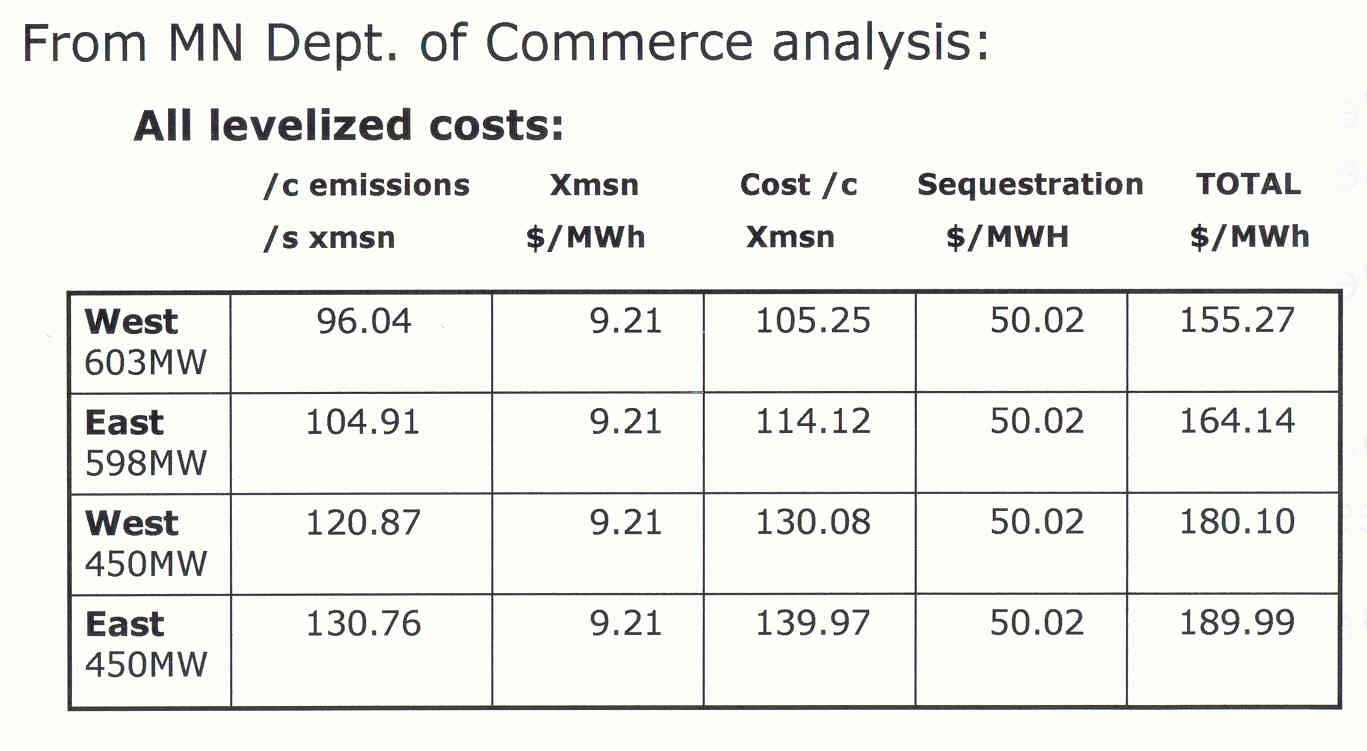

This guy testifies that IGCC in the midwest costs 5.26 cents per kilowatt hour! Well, not quite, he testifies that a DOE report says that’s the cost. HELLO!! DUH!!! Double it and you’re close!

From Dr. Elion Amit’s Rebuttal Testimony in the Minnesota Excelsior case:

Solar/gas combo announced for Arizona

March 16th, 2007

Thanks to Harry for sending this article from Power Engineering that shows yet another utterly sensible option for dispatchable power!!!!! In addition to my fave, the wind/gas combo, now a solar/gas combo has been announced for Arizona:

LS Power to develop solar plant next to gas-fired facility in Arizona

7 March 2007 — LS Power Group has initiated the development of a stand-alone solar power plant near its natural gas-fueled Arlington Valley Energy Facility, a 570 MW combined-cycle plant in Maricopa County, Arizona.

“We have begun serious evaluation of a major thermal solar project on the 3,500-acre parcel we own surrounding the Arlington Valley plant,” said Jason Hochberg, president of LS Power. “This large, flat, very sunny location has tremendous potential to produce clean, renewable energy.”

In addition to the stand-alone project, LS Power is studying the feasibility of building a solar integration project at the same location. Thermal solar units would generate steam for use in the combined-cycle plant, possibly reducing fuel consumption and cutting emissions, including greenhouse gases. The integration project would be among the first ever built for commercial use.

The development project is being undertaken by LSP Polaria, an LS Power subsidiary. When the pending business combination between LS Power and Dynegy closes, the project will be jointly owned by the two companies under the terms of a joint venture arrangement.

Copyright © 2007: PennWell Corporation.

Where can we do CSP and gas?

Titillating info from SDEIA Energy Study

March 13th, 2007

WIND/GAS COMBO IS LEAST COST

This month’s art history post, with guidance from Legalectric’s own art historian, leads off with underdrawings a la Giorgione, to highlight the exciting stuff in the South Dakota Energy Infrastructure Authority’s Energy Study. It seems they’ve figured out a few things: High cost of new infrastructure, massive transmission upgrades if they want to do coal for export, AND most importantly, that if they want to do all this spending (of our money!?!) they’d damn well better find a market for this electricity because they don’t have one!

In the midst of it, on p. 56, dig this:

As shown on Figure 5.1, when the wind alternative is combined with NGCC units to achieve a baseload-eequivalent reliability level, the resulting wind/gas combinations show significantly higher busbar costs than the puliverized coal options for such baseload applications. The NGCC and IGCC options showed higher costs as well.

OK, but that’s according to those figures for coal above. Take a look at the Mesaba Project numbers — when reality of IGCC is compared to the wind/gas combo what happens? CLICK HERE for Amit Rebuttal Testimony:

The Schulte report for SDEIA was dated January, 2007, so he had access to all the info on cost of BSII and cost of Excelsior from the Minnesota PUC dockets — Oh, forgot to mention, Schulte is former VP of Excelsior Energy — seems he had the sense to get out.

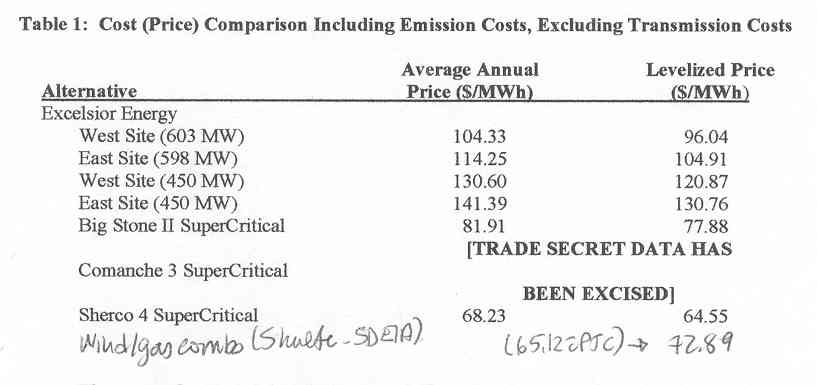

OK, let’s make that point a little more graphically. Here’s the Amit Table 1, that shows comparative costs:

I’ve scribbled in SDEIA/Schulte’s January wind/gas combo numbers. Schulte’s coal numbers are way too low.

The wind/gas combo has the lowest levelized price.

Can someone explain to me why we’d do anything other than add wind around gas plants for back up (if and only if necessary)?

And y’all remember the capital cost of Excelsior Energy’s Mesaba Project:

DOE Financial Assistance Cover Sheet

600MW of IGCC for $2,155,680,783, or $3,593/kW

Once more with feeling:

just my ecoimagination… runnin’ away with meeeee

March 10th, 2007

Hey, Fred, see that cliff? Let’s make a run for it… one… two…

Midwest Has ‘Coal Rush,’ Seeing No Alternative

Energy Demand Causes Boom in Plant Construction(and MSNBC too)

By Steven Mufson

Washington Post Staff WriterSaturday, March 10, 2007; A01

COUNCIL BLUFFS, Iowa — From the top of a new coal-fired power plant with its 550-foot exhaust stack poking up from the flat western Iowa landscape, MidAmerican Energy Holdings chief executive David L. Sokol peered down at a train looping around a sizable mound of coal.

At this bend in the Missouri River, with Omaha visible in the distance, the new MidAmerican plant is the leading edge of what many people are calling the “coal rush.” Due to start up this spring, it will probably be the next coal-fired generating station to come online in the United States. A dozen more are under construction, and about 40 others are likely to start up within five years — the biggest wave of coal plant construction since the 1970s.

The coal rush in America’s heartland is on a collision course with Congress. While lawmakers are drawing up ways to cap and reduce emissions of greenhouse gases, the Energy Department says as many as 150 new coal-fired plants could be built by 2030, adding volumes to the nation’s emissions of carbon dioxide, the most prevalent of half a dozen greenhouse gases scientists blame for global warming.

Even after a pledge last month by a consortium of private equity firms to shelve eight of 11 planned coal plants as part of their proposed $45 billion buyout of TXU, the largest utility in Texas, many daunting projects remain on drawing boards. Any one of the three biggest projects could churn out more carbon dioxide than the savings that a group of Northeast states hope to achieve by 2018.

Utility executives say that the coal expansion is needed to meet rising electricity demand as the U.S. population and economy grow. Coal-fired plants provide half the electricity supply in the country.

“A lot of congressmen ask me, ‘Dave, why are you building that coal plant?’ ” says MidAmerican’s Sokol. “And I say, ‘What are my options?’ “

Sokol says he wants to help customers improve efficiency by 10 percent. His holding company, which is more than 80 percent owned by Berkshire Hathaway, includes the utility PacifiCorp in the Northwest and Rocky Mountains as well as MidAmerican; together they generate 16.7 percent of their power from renewable resources. The Iowa subsidiary alone gets 10 percent from renewables. Between 2000 and 2005, the company cut the amount of carbon emitted for every unit of energy generated by 9 percent.

But half of that reduction in the rate of emissions was offset by higher overall output. Electricity demand in Iowa is growing at a rate of 1.25 percent a year, and Sokol says that until new technologies become commercial or nuclear power becomes more accepted, coal is the way to meet that demand.

It remains unclear how Congress will cope with this problem. Although climate-change experts hope that new technology will deliver a way to capture and store carbon dioxide produced by coal plants, that technology remains in the pilot stage; it could take another decade before it is proven.

Companies say the new coal plants are better than old ones, though both use the same approach: pulverizing coal, then burning it in huge boilers to power giant turbines. The new $1.1 billion MidAmerican facility will be one of the nation’s biggest, with 790 megawatts of capacity. Its boilers and pulverizers will devour 400 tons of coal every hour, 3.5 million tons a year, Sokol says. Combined with an existing plant next door, it will require a fresh train of coal every 16 to 17 hours; each train will be nearly 1.5 miles long and lug 135 cars about 650 miles from Wyoming’s Powder River Basin.

While newly constructed plants cough up a tiny fraction of the pollutants environmental regulators have focused on in the past — sulfur dioxide, mercury and nitrogen oxides — they emit only 15 percent less carbon dioxide. They do that simply by being more efficient. Scrubbers like those used to extract other pollutants from a plant’s exhaust don’t exist for carbon dioxide.

Environmentalists worry that the new pulverized-coal plants, built to last 40 to 50 years, will saddle the country with high greenhouse-gas emissions for decades. Peabody Energy, for instance, has proposed two giant 1,500 megawatt plants, one for western Kentucky and one for southern Illinois.

“Each of these coal plants is making bad global-warming policy, project by project,” says Bruce Nilles, a Madison, Wis.-based Sierra Club lawyer who is fighting the Midwest plants. “It’s a high priority to convert these investments in coal plants into something cleaner and smarter.”

If coal plants must be built, environmentalists prefer integrated gasification combined cycle (IGCC) plants that they say will make it easier later to capture carbon dioxide and store it underground. Only a handful of those are being planned.

“We’re making investment decisions today that will make it impossible in 2020 to get the next increment of [greenhouse gas] reduction,” Nilles says.

But the IGCC plants can add as much as $200 million to construction costs; only two are operating today. Companies that make the plants, such as Siemens and General Electric, aren’t willing to guarantee certain levels of performance, utility executives say. Referring to GE’s chief executive Jeffrey R. Immelt and GE’s “ecomagination” ad campaign, one utility executive who spoke on condition of anonymity because his company might still do business with GE said, “I think Immelt’s ecomagination got away from him.”

State regulators, who give thumbs up or down to coal plant proposals, worry mostly about reliability and costs to consumers. In the 1990s, many utilities built natural-gas-fired plants, but in the past two years gas prices have soared. Now, coal backers say that coal is cheaper than other fuels such as natural gas.

One wrinkle: The cost of building coal plants is climbing as demand for engineers and equipment rises. In December, Westar Energy, the largest electric utility in Kansas, shelved its plan to add a 600- to 800-megawatt coal-fired plant. Greg A. Greenwood, vice president of generation construction at Westar, said that in the previous 18 months the estimated construction cost had soared $400 million.

Environmentalists and many economists argue that the price of coal plants is higher when environmental costs are included.

One of the Sierra Club’s targets has been a $2.2 billion project belonging to We Energies, part of Wisconsin Energy. In the town of Oak Creek, just south of Milwaukee, the company has carved 6 million cubic yards of earth from a bluff along Lake Michigan to create a bowl for two 615-megawatt coal-fired power plants, the first due to open in 2009. Trucks and workers are crawling over the site; five enormous boilers stand side by side, waiting for duty. Cranes lean in over the steel scaffolding, and a completed exhaust stack points into the winter sky.

The plan for the plants was hatched after a hot 1997 summer, when the utility came close to ordering rolling blackouts to deal with heavy electricity demand. The state had not built a new power plant since 1984, and the crisis helped ensure a unanimous vote by the Wisconsin Public Service Commission for more coal plants.

But the Oak Creek project sparked a range of protests that landed it before the state Supreme Court, which ruled 4 to 3 in favor of the plant. Construction began the next day.

We Energies chief executive Gale E. Klappa says the trimming of greenhouse gas emissions is a worldwide problem and asks why We Energies should voluntarily shoulder the burden. “You could black out the state of Wisconsin . . . and it would not make a difference in the CO2 levels of the world,” he says.

Klappa says new coal plants have benefits. He spreads a piece of paper on his conference table. It shows the amount of carbon dioxide emitted for each megawatt-hour of energy dropping by 12.5 percent from 1990 through 2011 after the new coal plants come online. Another sheet of paper, however, shows that with higher electricity output, We Energies’ total emissions of carbon dioxide will grow 76.6 percent.

“With significant investment and technology, we can bend the line down, but getting the level down to 1990 levels is a huge challenge not only for us, but for society as a whole,” Klappa says.

Nilles says that We Energies has made only a feeble attempt to slow the 2 percent a year growth in energy demand. Klappa says that he aims to reduce demand by 55 megawatts, just 1 percent.

Nilles says that the model for electricity expansion is the municipal utility in Springfield, Ill., which negotiated a plan with the Sierra Club after the group had stopped three coal plants in the state. Under the plan, the utility will increase the money spent on energy efficiency tenfold, shut down two old coal plants, improve pollution controls at three others, buy enough wind-powered energy to meet 20 percent of its needs, and build a new cleaner coal plant. However, its capacity — and thus its carbon dioxide emissions — will increase.

While some of the Sierra Club members in Springfield weren’t satisfied, Nilles says “for a state capital in the middle of coal country, the symbolism [of the agreement] is huge. How do you quantify that?”

IGCC doesn’t cut it in Delaware

March 10th, 2007

BEWARE — THE POST YOU ARE ABOUT TO VIEW IS QUITE GRAPHIC!

Coal gasification, wind, and natural gas, OH MY!!! And nobody’s touting IGCC, well, except for the obvious toadies…

LOTS going on in Delaware this last week, they’ve got their Integrated Resource Plan dragging behind an ill-advised but mandated RFP for electricity they don’t need! I’ll start out with the IRP/RFP articles and then the coverage of public comment meetings that were held this week. Dig this, the meetings were to be on Tuesday, Wednesday and Thursday, and the Wednesday one was cancelled because of “weather.” 1/2 inch of snow… really, 1/2 inch. What would happen if they got hit with the 24″ we got here in the two storms the week before last.

The first is about the continuing saga of redacted information. There are three proposals in response to the RFP, and all three are redacted beyond comprehension. Redaction and secrecy about information in applications isn’t anything new. Companies even hide under the cover of third party confidentiality contracts to keep necessary information from the public. It happened here in Minnesota, where we had to fight to get information made public, and even Xcel Energy, with all their power (why do you think they call them power companies?) couldn’t free up the basic cost of the plant! Maybe that info will become public, but it’s going to take more public pressure.

They’ve finally posted the Comments on the request of PSC — it’s odd, the PSC is asking “How should we do this” and THERE ARE NO RULES!! Hello! They need a rulemaking. The PSC’s Bob Howatt told an Regulatory Assistance Project interviewer that there were to be rules coming out in the spring of 2007. SEE RAP INTERVIEW HERE. So why are they doing an IRP without rules, before the rules come out. Is this a way to force a result, or shut out the public? It may be both! SOMEBODY PETITION FOR A RULEMAKING!! SOMEBODY GET A LEGISLATIVE MANDATE FOR A RULEMAKING!!! (…sigh… that’s the lawyer talking…)

NRG made some pretty absurd statements about efficiency (yes, it is filed under “NRG stupid statements” — NRG’s Steve Corneli knows better than this!!!):

NRG clearly hasn’t a clue. Check out RAP’s Efficiency Policy Toolkit for some basics that work and examples from around the country.

And about that redacted Information: This is what the site plan in the NRG proposal looks like, really, it’s this cheezy!

And this is their coal pricing. Coal price inherently stable? Hmmmm… in December 2005 the price of coal tripled… could their short-term memory loss be attributable to mercury…

The Daily Times/News Journal reported on efforts to wrench the proposal open to the public — and it looks like details may be made public week after next — IT’S ABOUT TIME. Leave a comment below their article so they know how you feel about the secrecy:

Details of power plant may see light

By Jeff Montgomery

The News JournalPublic Service Commission staffers are expected to call for the release of a substantial amount of information being withheld by companies vying to build a new power plant, a top commission official said.

The information — including how the projects would be financed, costs of electricity they would generate and the amount of pollution they would emit — has been blacked-out from documents because the companies claim releasing it would put them at a competitive disadvantage.

But several individuals and organizations have called for the release of details because the state’s formula for choosing the winning bidder is based solely on financial and pollution information.

Those calls were rebuffed until Bruce Burcat, the executive director of the Public Service Commission, said the agency was reviewing the documents with an eye toward recommending release of details at its March 20 meeting.

“There will be a number of documents and line items that have been redacted that will be recommended to be released to the public,” Burcat said.

The documents were generated by Bluewater Wind LLC, Conectiv Power and NRG Energy, companies that have filed separate, dramatically different plans for supplying Delmarva Power with energy. Lawmakers ordered the process after electricity rates increased 59 percent last year for residential customers.

Critics of the process say that the public has been wrongly shielded from crucial bid information on rates, reliability and the environmental impact.

“It needs to be opened up more. Absolutely,” said Letitia L. Diswood, co-president of the League of Women Voters of Delaware. “I think it’s a very technical, complicated issue. It’s very hard to make simple for the public, but it’s extremely important.”

The PSC already began the process of accepting public comment on the proposals without releasing crucial details. More public hearings are scheduled for next week and next month.

It even made WMDT TV — KEEP THE PRESSURE ON:

PSC wants more details from companies proposing power plants

And now, on to coverage of the well-attended public meetings:

Del. energy bids debated; Public weighs in on choices for power

By Kate House-Layton, Delaware State News

DOVER — Tuesday was the first of three public comment sessions the state Public Service Commission has scheduled in connection with bids three energy companies have submitted to Delmarva Power and the state for new electric generation in Delaware.

Most of the comments Tuesday at Legislative Hall in Dover supported Blue Water Wind’s offshore Atlantic wind farm generation proposal or NRG’s proposal to expand the Indian River power plant in Millsboro to include coal gasification generators.

Conectiv, a sister company to Delmarva Power, has proposed a natural gas-fired generator in New Castle County.

Conectiv’s bid last month won the most points from Delmarva Power and the state’s independent consultant reports.

Delmarva Power said it opposed all three bids. The state’s report gave no recommendation.

NRG supporters, mostly NRG employees or retirees, touted the reliability a coal-generated power plant provides.

“Wind is a pretty hip, sexy energy option,†Delaware resident and NRG employee Doug Netting.

Wind, however, is intermittent, he said.

On low wind days, electric companies would have to pluck energy off the grid using whatever is available that day. Most of the time electricity from coal-fired plants would be on tap.

Jim Sadowski, NRG’s environmental manager for the Indian River power plant, said it would take gale-force winds to create three megawatts of electricity.

Julie Rigby of Seaford said the wind farm proposal concerned her for potential dangers to birds that migrate along the coast.

Several environmentalists, however, strongly supported wind power.

The state’s independent consultant report said Blue Water Wind could provide price stability, but was more expensive.

Federal emission taxes, medical bills and public health outweigh a price on an electric bill, some said.

“The economic evaluation of price benefit is shortsighted,†said Kim Furtado, a Millsboro resident and doctor of natural medicine. “It does not access the benefits we will gain by acknowledging the health costs with generating power.â€

Connie Peterson of Lewes and others pointed to the volatility of fossil fuel costs.

“They cannot guarantee stability,†she said.

Jim Black, director of Community Outreach for the Delaware Clean Air Council, said gas prices continue to fluctuate and fossil fuel costs likely will rise.

“The wind will still blow for free,†he said.

If there was any consensus, it was that something had to be done about electricity in Delaware.

Delmarva Power representatives last month said that instead of new generation, it favored conservation strategies, continuation of a new east-west transmission line and increasing its portfolio to more renewable energy sources from the existing power grid.

Residents disagreed.

“Inaction is not the answer,†said Wilmington resident Harry Gravell, who represented Delaware builders.

“It would be a big mistake to do nothing, we have to change,†Vincent Ascione of Sussex County said.

Delmarva Power spokesman Tim Brown afterward said that the utility stands by its recommendation. The company previously said it did not find that any of the bids would economically benefit its customers.

PSC panelist Jeffrey Clark and PSC executive director Bruce H. Burcat said they were impressed with the public comments and said the panel would give them strong consideration when it comes time to make a recommendation.

Two more hearings are scheduled.

Tonight’’ meeting will be at the Delaware Technical & Community College’s theater at the Owens campus in Georgetown.

Thursday’s hearing will be in the auditorium of the Carvel State Office Building at 820 French St., Wilmington.

Both meetings start at 7 p.m.

Here’s another, this one from News Journal, and be sure to add your comments here too:

By AARON NATHANS, The News Journal

Posted Friday, March 9, 2007Wind-power advocates packed a public hearing Thursday night on whether to build a new power plant to meet Delaware’s long-term energy needs.

The event, held at the Carvel State Office Building in Wilmington, attracted a full room of about 160 people. They were commenting on a state consultant’s report that said Conectiv’s proposed 180-megawatt natural gas plant was the best among three options.

But most of the speakers early in the evening focused on the environmental harm that could be caused by a new plant that burns fossil fuels such as natural gas or coal. NRG is proposing a coal gasification plant.

Most of the speakers instead said they liked a proposed wind farm that would feature 200 turbines in the Atlantic Ocean off Rehoboth Beach or Bethany Beach.

“The conventional wisdom is that the public’s environmental interest is in conflict with the public’s economic interest,” said Tom Noyes, of Wilmington. “But my review of the record leads me to believe that the conventional wisdom has been turned on its head in this case. Burning more fossil fuels doesn’t make economic or environmental sense for Delaware.”

And Ellen Lebowitz of Newark said global climate change could wreak havoc on the state’s coastline.

“Wind is here. It’s free from nature. We can harvest it now,” she said.

Several people spoke up for the NRG proposal. Robert Carl, business manager of Local 42 of the Heat & Frost Insulators & Asbestos Workers, praised the potential of “clean coal” to produce a “ripple effect” in the economy by creating good paying jobs.

“NRG’s commitment to clean fuel seems to be on the right path,” he said.

The event was sponsored by the Public Service Commission. The commission, along with three other state agencies, is expected to recommend within the next several months whether to proceed with one of the proposed power plants. The hearing was the last of three public hearings this week.

The commission is expected to hold more public hearings later in the process.

Some speakers criticized the commission and the three companies for redacting information from their bids so the public could not see it. NRG, for instance, redacted information about exactly how much pollution its proposed plant would send into the air.

Lisa Pertzoff of the League of Women Voters said the bids were lacking “key environmental and cost data.” The consultant reports had so much jargon, even the most informed members of the public could not understand them, she said. Such problems potentially undermined public confidence in the result, she said.

Delmarva Power is recommending against all the proposals, saying they would not be cost-effective. The company can meet its needs by a combination of conservation, buying on the wholesale market, and improving the region’s power infrastructure, it says.

Contact Aaron Nathans at 324-2786 or anathans@delawareonline.com.