NRG gets pissy at PSC

March 21st, 2007

Yesterday’s PSC meeting was a bit much — it lasted until 6:30 p.m., but the good news is that the non-utility intervenors, who had been lumped together in an inexplicable Order by the RFP hearing examiner (Order HERE — well, it will be when the inaccessible PSC site is back up and running) were finally granted intervention separately as full parties in the RFP docket. WHEW! A start.

But late the night before the hearing, NRG filed documents “under seal.” Apparently they threatened to sue the PSC — don’t they have any manners? If they want to sue, just do it!!! Then we can get to the “merits” which of course are non-existent. Release the info, DUH!

Until they get around to releasing their info, until the PSC orders it or, as Muller suggested, the PSC throws out the NRG proposal because of their (un)reasonable attitude, consider the emissions info from the Excelsior docket:

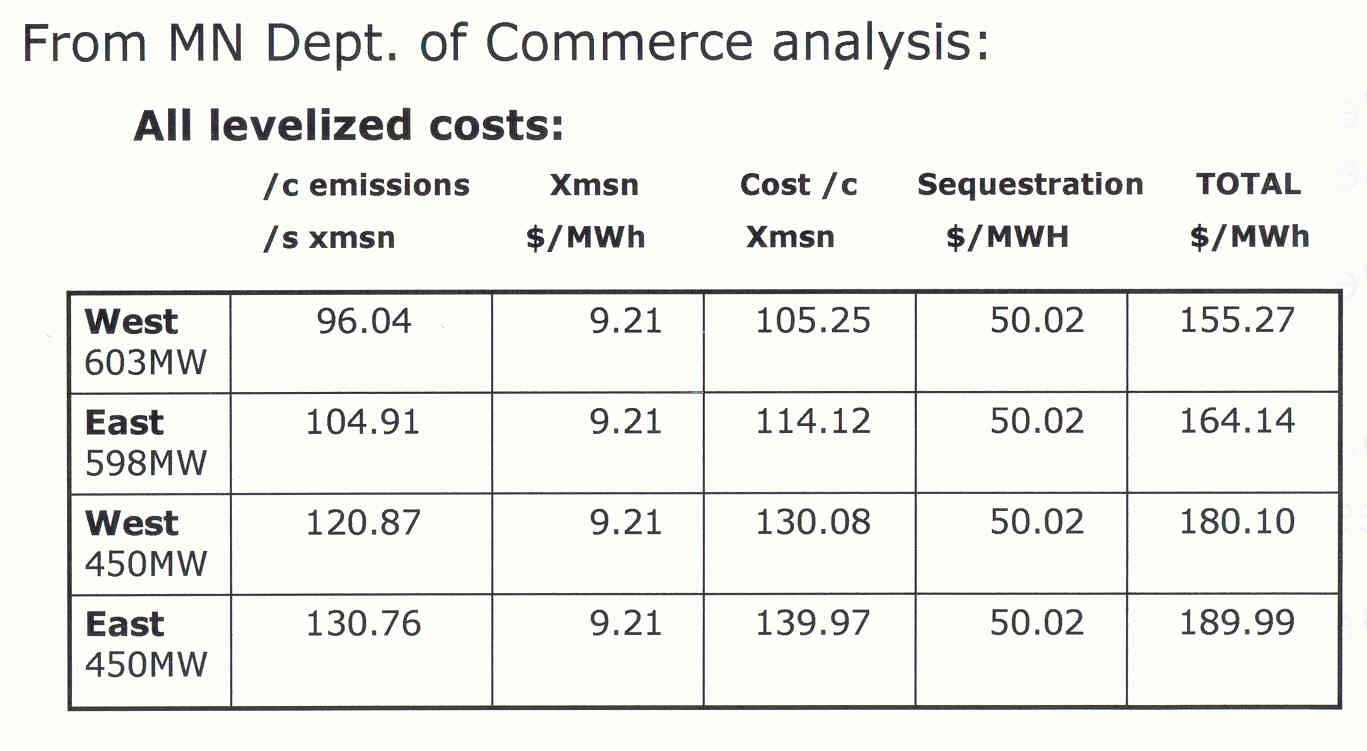

And then there’s that little matter of cost — here it is from the Excelsior docket, the Amit testimony — assume NRG is similar unless proven otherwise:

Get pissy all you want, NRG, but WE KNOW THE TRUTH ABOUT IGCC! We know the emissions profile sucks and we know the cost is outrageous, and we don’t want to pay for it!

NRG says it will sue to hide emissions data

By AARON NATHANS, The News Journal

Posted Wednesday, March 21, 2007

NRG Energy said it will sue to block the disclosure of emissions data and other information contained in its bid to the state to build a new power plant.

On Tuesday night, after a five-hour meeting, the Public Service Commission voted to release portions of NRG’s bid, including the emissions data, within five business days. NRG has vowed to try to find a court that will halt the disclosures.

“We will pursue an appeal on this matter,” said NRG attorney Michael Houghton. “We will act quickly.”

The commission agreed with a staff recommendation to keep financial details private.

At Tuesday’s meeting, NRG made a last-minute bid to keep additional portions of its bid secret, and succeeded in several areas. The commission agreed to keep secret detailed staffing plans for the proposed plant.

Alan Muller of Green Delaware argued at the meeting that the plans should be released because the company has used job creation as one of its selling points.

The commission also agreed to keep private a PowerPoint presentation from an NRG supplier and contract language between NRG and a supplier, which NRG argued were protected by a confidentiality agreement.

The commission agreed to keep private two sections of the bid relating to the price of its proposed product, despite commission staffer James Geddes’ description of them as “rather generic.”

Most commission members hadn’t read an NRG memo filed under seal Monday by the time the meeting started. They took a 45-minute recess to review the memo, then went into a rare closed session to confer with staffers. The News Journal raised an objection to the closed session, claiming it was not supported under the state’s open meetings law.

NRG is proposing a 600-megawatt coal plant for its Indian River facility. The plant would use technology that turns coal into synthesis gas, allowing for some toxins to be removed.

The proposal is one of three to supply energy to Delmarva Power to help meet the state’s long-term energy needs. The other bidders are Bluewater Wind, which wants to put up an offshore wind farm, and Conectiv, which wants to build a natural gas plant. Both have released their emissions data.

NRG officials say they should be exempt from releasing emissions data and other information because their technology is so new in the United States that releasing it would give competitors an unfair advantage. If the company revealed its suppliers, “we’re standing here with our pockets open, ready to be fleeced,” said Caroline Angoorly, the company’s regional senior vice president.

But Muller said more disclosure is better.

“NRG appears to be a company with a lot to hide,” Muller said. “If their bid could stand up to scrutiny, why do they seem so determined to conceal the main underlying facts?”

A state consultant has said Conectiv’s bid best meets the criteria the state set out for the bidders. Bluewater Wind came in second, and NRG last.

Delmarva says it would prefer not to contract with any of the bidders, believing it could keep prices stable with a combination of conservation and competitive buying on the open market.

The commission made its order Tuesday after receiving a Freedom of Information Act request from The News Journal and others. Its order covers all three companies; NRG had blacked out the most information.

Copyright ©2007, The News Journal

Secrets – IGCC cannot stand the light of day

March 18th, 2007

All over the U.S., they’re trying to keep the facts of IGCC from the public. Why? DUH, because if the facts were known, IGCC would be dead.

Well, surprise, surprise, it’s PUBLIC INFORMATION!!! Nearly all of the Minnesota information is public, and despite this very public collection of IGCC information, Delaware, Indiana and Florida are keeping essential facts from the public.

But wait… it gets worse… some thing the public has no interest in the information, that the public has no business in these proceedings, that the public is not a stakeholder.

Can you believe it??? From the Delaware Public Service Commission Staff:

… although the public is a beneficiary of the work performed by Commission Staff in its attempt to release as much information as possible, the public is not a stakeholder in the Commission’s, and other agencies’, determination as to whether such work should be adopted.

DAG Memo on Confidentiality 2-12-07

NRG on Confidentiality 2-16-07Staff Memo on Confidentiality 2-23-07

Hiding the facts in Indiana:

Hiding the facts in Minnesota:

Hiding the facts in Florida:

For all of you who want to know what’s what in coal gasification, go to www.mncoalgasplant.com and start digging. The Minnesota PUC filings are there, and are also available at www.puc.state.mn.us, go to “eDockets” and then to “Search Documents” and then search for 05-1993. This docket is the first one to come down the pike, and the costs are so high and the environmental performance so low that it will fall on its own. And this is the information that must get out — this information tanks any IGCC proposal.

If you have any concerns about what this all means, see:

Steve Jenkins has spent a career promoting IGCC, and he explains it all — he knows the problems and testifies about them at great lengths. But folks, it’s really not that complicated. Message: IGCC can’t stand the light of day.

Running scared – more BS on BSII

March 18th, 2007

DE’s final RFP public comment hearing

March 17th, 2007

Energy debate continues at series of public hearings

By Rachel Swick

Cape Gazette staffPublic hearings kicked off this week to discuss the future of power in Delaware, while at the same time evaluations of three proposals were released, instantly drawing criticism from two of the power bidders.

The evaluation by state agencies and an independent consultant looked at three proposals submitted to the state Public Service Commission (PSC) and Delmarva Power for a long-term contract for new power.

The proposals include a 200-megawatt natural gas plant from Conectiv, a 600-megawatt coal-gasification plant from NRG Energy and a 600-megawatt off-shore wind farm from Bluewater Wind.

The results ranked Conectiv first, with Bluewater Wind in second and NRG, third.

Jim Lanard, director of strategic planning and communications for Bluewater Wind, said the evaluations were inconsistent, giving such a great advantage to Conectiv for its lower price that the other proposals could not equal Conectiv – even though they may have outscored the natural-gas plant on aspects such as fuel diversity, innovative technology and environmental impact.

“It’s impossible to compare the three companies when Conectiv admits they will change their price in the future,†said Lanard, who questioned whether the price Conectiv quoted for costs associated with natural gas are realistic or just overly optimistic.

Lanard said the evaluation process was inconsistent because evaluators used one scale for price categories and an entirely different method when looking at emissions and environmental impact. He said the same scale should have been used for each factor; had the same scale been used, the overall results would have been different.

“Just with changes to those categories, Bluewater would be considerably ahead,†said Lanard.

Evaluation process flawed

While NRG officials did not agree that Bluewater would be ahead, they did agree that the evaluation did not come out with the best solution to Delaware’s energy problems.

“We absolutely stand behind our proposal, which would allow Delaware to meet its energy needs and environmental objectives affordably with IGCC and carbon capture and sequestration, now and into the future,†said Caroline Angoorly, NRG’s senior vice president for the Northeast Region.

“After reviewing the initial evaluation reports, however, I’m concerned that all of the taxpayer-funded work done to make this a competitive process, with an independent evaluation of the value being offered to the state, has been wasted.â€

NRG concluded that the consultants’ report is fundamentally flawed on many levels. Most notably, the report recommends state agencies do the exact opposite of what the request for proposals was intended to accomplish. The consultants, who ranked each proposal on a point system, gave the most points to a natural gas project – when the process was designed to move Delaware toward greater fuel diversity.

“More natural gas generation means Delaware ratepayers will be vulnerable to more volatile and high gas prices,†said Angoorly. “Moving to IGCC technology would provide increased fuel diversity and would allow us to use U.S. coal, which has much more stable pricing than natural gas and is in abundant supply. And we can use this technology to remove the substances that have traditionally made coal environmentally less desirable.â€

NRG also noted that while the proposed IGCC plant met all seven criteria listed in the request for proposals – including use of innovative baseload technology, existing fuel and transmission infrastructure and existing brownfield or industrial sites – the project ranked a distant third.

“The evaluation process concludes that IGCC – the very technology that leaders around the world are holding up as the next generation of power plants – is wrong for Delaware,†said Angoorly.

NRG submitted these comments to the PSC after reviewing the evaluation reports. NRG maintains that the evaluation was not objective because the consultants relied on models for evaluation that were constructed by Delmarva Power, an affiliate of Conectiv, which was one of the bidders. Angoorly said it would have been better for the consultants to construct their own models, so that the review would have been truly independent.

NRG was awarded no points for its proposal to shut down two of its oldest operating units at Indian River, which would cut down on carbon and other emissions.

“The evaluation process has failed to reflect the real cost to Delaware of a large, intermittent energy resource,†said Angoorly. “If Delmarva chooses offshore wind power, additional power will have to be purchased from another source to meet energy needs when the weather is warm, the wind is not blowing, air conditioners are on and electricity demand and costs are at their highest.â€

Risks merit emphasis

The first of three public hearings was held Tuesday, March 6, in Dover and drew many Sussex County residents and business owners interested in talking about wind.

It also drew many NRG employees, who were bused to the hearing by the company.

Kim Furtado, holistic health expert and Millsboro resident, said she was encouraged by how much average citizens cared and knew about the power question in Delaware. “After examination of the point system used by this RFP process and the consultants’ report, it is clear to me health factors are not included with enough foresight,†said Furtado.

“I urge you to place appropriate perspective on the health risks of each bid as you analyze the consultants’ reports, and honor your historical opportunity to do so.â€

The second hearing, to be held at Delaware Technical & Community College was postponed due to the winter weather on Wednesday, March 7.

It will be held at 7 p.m., Monday, March 12, at Del Tech in Georgetown. The public is welcome to attend.

Toxic Release Inventory 2005 numbers released

Statistics compiled in the Delaware Toxics Release Inventory 2005 indicate a decline in toxic emissions for most big polluters in the state, including the Indian River Power Plant in Millsboro.

“In Delaware, TRI reports for 2005 show that on-site releases reported under TRI were lower by 18 percent when compared to 2004, and they were lower by 29 percent compared to 1998,†said Delaware Department of Natural Resources and Environmental Control (DNREC) Secretary John Hughes upon the release of the data this week.

“One reason for the decrease in reported on-site release amounts is that the Indian River Power Plant had fewer impurities, including chlorine, in the coal it burned in 2005.â€

Indian River Power Plant, owned by NRG Energy, is the biggest polluter in Delaware, but efforts to clean up the plant in recent years are steadily reducing toxic emissions.

In 2004, Indian River reported releasing 241 pounds of mercury into the air and land. That number went down in 2005, when Indian River only released 205 pounds of mercury.

With new regulations from the state and new technology the plant owners plan to install, that number should drop dramatically in the coming years, said NRG officials.

In 2004, Indian River released 130,000 pounds of sulfuric acid into the air. In 2005, that number dropped to 110,000 pounds.

“While there is positive news within the TRI data, there is also some negative news within the program. Recently, the EPA (Environmental Protection Agency) weakened the TRI program by enacting a rule allowing more facilities to report on the TRI short Form A that does not report any amounts,†said Hughes. DNREC sent a letter to the EPA opposing the rule change.

“Fuel quality, as well as amount of energy production, can affect the environment,†said Hughes. “We encourage both industry and the public to do their share to help preserve the environment through greater energy efficiency and material selection.â€

For more information on TRI data, visit www.serc.delaware.gov/services/search/index.shtml

Contact Rachel Swick at: rswick@capegazette.com

Land use challenge – FPL Glades Power Park

March 17th, 2007

Did Lykes, FPL and Glades County come together to alter rules to allow an Everglades power plant?

By Craig Pittman, Times Staff Writer

Published March 15, 2007Tampa-based Lykes Brothers and Florida’s largest utility cut a deal with Glades County officials to illegally rezone 400,000 acres of Lykes land to allow the utility to build a power plant at the edge of the Everglades, an environmental group charged in a lawsuit filed late Tuesday.

The Lykes land, which covers 90 percent of Glades County, had been zoned for agriculture. The rezoning, quietly approved by Glades officials last year, inserted the letter “P” into line number 1,745 of a 2,100-line table in its land-use ordinance, the suit contends.

That small alteration changed the uses permitted in agricultural areas to include power plants.

“They just slipped it by everybody,” said David Guest of Earthjustice, which filed the suit on behalf of five Glades County landowners.

David Guest, Earthjustice

Glades officials weren’t trying to fool anyone, said Assistant County Administrator Larry Hilton. The change was supposed to help Lykes develop a 3,500-home community called Muse Village in another part of the county, he said, not hide Florida Power & Light’s plans for a new coal-fired plant near Lake Okeechobee.

Lykes vice president Mark Morton said his company asked for the change, but agreed with Hilton that this wasn’t about FPL’s new plant.

“We told the county that they needed to add language to allow utilities on agricultural land” to provide power for Muse Village, he said. “After that, the power company thing came up.”

An FPL spokeswoman declined to comment.

To keep pace with rising electricity demands, FPL has been trying for years to build a power plant somewhere in South Florida. Originally, the utility intended to build it in St. Lucie County, a plan that stirred tremendous controversy.

In November 2005, St. Lucie commissioners said no because of pollution concerns and possible violations of the county’s growth plan.

So, in February 2006, FPL officials began talking to Glades County officials about building a 1,960-megawatt plant there. Last September, the utility announced it would build the plant on about 5,000 acres of Lykes-owned farmland 5 miles northwest of Moore Haven.

That puts it within 70 miles of Everglades National Park and 40 miles north of Big Cypress National Preserve. Utility officials say the $5.7-billion plant will employ a technology called advanced supercritical pulverization, burning coal at extremely high temperatures and using extensive filters to make it far cleaner than a regular coal-fired plant.

But last week the Sierra Club, Florida Wildlife Federation and other environmental groups filed papers with the Public Service Commission to oppose the plant, citing concerns about the impact of pollution on the already imperiled Everglades.

Everglades National Park Superintendent Dan Kimball has also expressed concern about the plant’s smokestacks pumping mercury into the air and water. Mercury contamination is already such a big problem at the park that visitors are warned not to eat fish caught there.

The news that Glades commissioners had approved a land-use change that would clear the way for building a coal-fired power plant in their backyard caught local residents off-guard, said Lynn Kilcoyne, who has lived there 20 years.

“I’m amazed at how sneaky they’ve been in all this,” said Kilcoyne, lead plaintiff in the lawsuit.

Records obtained by Earthjustice show that Hilton and County Manager Wendell Taylor met on March 29, 2006, with four FPL executives as well as Morton and another executive from Lykes and Glades County Commission Chairman Butch Jones.

No records show what they discussed. But at that point the zoning code said land zoned for agriculture would not be suitable for commercial and industrial development.

On April 6, 2006, county officials sent out a public notice about a proposed land-use change that made no mention of power plants. After two public hearings at which no one mentioned power plants, the commission in May adopted the change by a unanimous vote.

After the vote, George Whidden of Florida Power & Light sent an e-mail to Glades officials thanking them for the “very substantial progress you have made on our endeavor” and stating “it is indeed a pleasure working with such straightforward folks.”

The suit seeks to stop Glades from being able to use the new zoning for the FPL plant. So far, no hearing dates have been scheduled.

Times staff research Caryn Baird contributed to this story.

Craig Pittman can be reached at craig@sptimes.com or at 727-893-8530.