PJM Market and U.S. electricity glut

November 10th, 2017

Electricity glut? It’s all over the U.S. It’s not just in MISO’s Midwest that there’s an energy glut, it’s also PJM, which is the market that Midwest electricity producers have their eyes on. PJM is TRANSMISSON and ELECTRIC MARKETING. And North American Electric Reliability Corporation, NERC, verifies it’s EVERYWHERE!

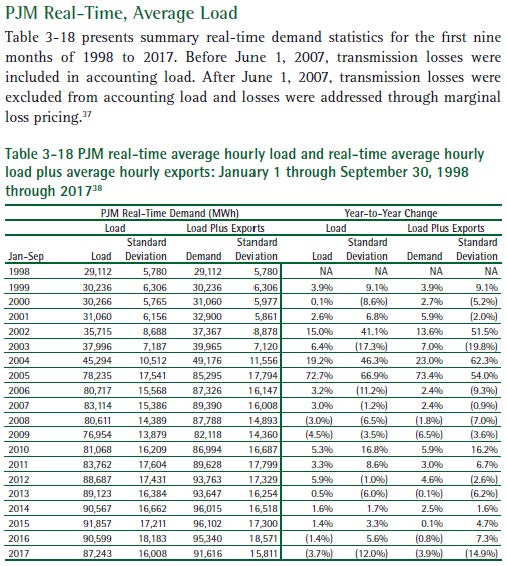

Just in, Monitoring Analytic’s 3rd Quarter report that includes the summer peak:

Here’s the bottom line, found on p. 120:

The PJM system real-time peak load in the first nine months of 2017 was

145,635.9 MW in the HE 1800 on July 19, 2017, which was 6,541 MW, or 4.3

percent, lower than the peak load in the first nine months of 2016, which was

152,176.9 MW in the HE 1600 on August 11 ,2016.

And just a few pages later, p. 123 (note losses are now treated differently, after they got onto the transmission build-out for export, shipping from any Point A to any Point B)(note also how MW exports incorporated into “Load plus Exports” has increased):

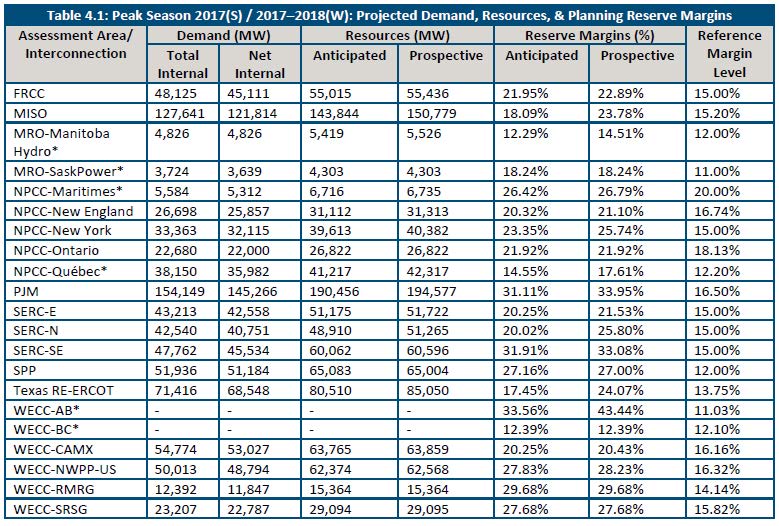

So while you’re mulling that over, consider the 2016 NERC Reliability Assessment:

This is the chart I’ve been trotting out for what, 19 years now? Reserve margins, showing that there’s plenty of electricity to go around (p. 44 of NERC Report above) (click for larger version):

Not only is MISO far ahead of what’s needed, even for reserve margins, but look at PJM here, more than twice what’s needed to cover reserve margins.

We can easily reduce coal generation NOW. What’s the hold up? Oh, right, marketing dreams… marketing dreams that we’re paying for, that transmission build-out that no one needs and no one wants, and their plans for even more! Planning meetings open only to a select few!

Leave a Reply