IGCC in the news

December 5th, 2006

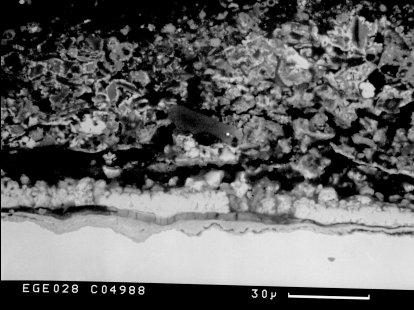

Coal Gasificaiton Corrosion, stolen from http://midas.npl.co.uk/midas/content/mn025.html

Lots of coal gasification in the news lately. We’re still working on those Exhibit Lists for the Mesaba coal gasification project Power Purchase Agreement proceeding at the PUC. I’m so tired of looking at pieces of paper, every horizontal surface is covered with paper, boxes, more boxes, plastic storage containers for the testimony, I’m going to have to run to that big box over the hill and get a bunch of hollowcore doors… all the IRs are in order and stuff just isn’t there, and I don’t have the Chamber’s stuff and oh, my…

WHERE IS THE STUDY ON FUEL FLEXIBILITY THROUGH GASIFICATION OF PUC FILINGS?

… sigh…

Anyhoo, the wire lit up with the STrib article, so in case you haven’t noticed that one yet, here it is – “about to become public” eh?

Power-plant producing hot debate

Xcel Energy electricity customers have billions of dollars at stake in a dispute overa proposed Iron Range power plant. The developers and Xcel Energy disagree on the cost of the plant’s power.

Mike Meyers, Star Tribune

Two Minnesota power companies have been expending much of their energy lately in a behind-the-scenes struggle that’s about to become public.The outcome might affect the quality of the air Minnesotans breathe and affect the state’s economy for generations to come. Much of the friction has centered on a single question: What’s the most cost-effective way to produce electricity in the first third of this century?

Excelsior Energy, a start-up company that wants to build a new-technology coal-gasification power plant on the Iron Range, says the electricity it will produce will cost no more — and perhaps billions of dollars less — than Minnesotans otherwise would pay.

Xcel Energy, which would be required to buy Excelsior’s power, says the imposed deal could result in $1.5 billion or more — in today’s dollars — in added costs to customers over 22 years. The 2003 Legislature, which created the requirement, aimed to foster cleaner use of a cheap, abundant fuel — coal — and create jobs on Minnesota’s Iron Range.

From 2011, when the Excelsior plant would begin operation, until 2033, the average Minnesota residential customer would pay an extra $5 to $7.50 a month for Excelsior’s power, while a typical commercial/industrial customer would pay $2,700 to $3,900 more per month, by Xcel’s estimate. Utilities plan well into the future because building new power plants takes many years.

Put another way, Xcel estimates that its Minnesota customers would pay 4.7 percent more for electricity from the Excelsior plant than they would for power supplied by Xcel or bought on the open market.

The state Public Utilities Commission (PUC) will decide which company prevails early next year. Public hearings are set for later this month. Excelsior needs PUC approval before it can begin building a power plant on 1,260 acres of undeveloped and unoccupied land in Iron Range Township, north of the city of Taconite.

Cleaner air, more jobs

To borrow the money needed to build the plant, Excelsior must show lenders that someone will buy the power it produces. That’s where Xcel comes in. While Excelsior presumably could sell electricity to other buyers on the nation’s power grid, building a plant on speculation would require a leap of faith from lenders that buyers would step up and pay a price for electricity high enough to repay Excelsior’s expenses.

The developers of the Excelsior project have been working on their idea for several years.

The husband-and-wife team, Thomas Micheletti and Julie Jorgensen, have years of experience in the power industry. Jorgensen, a lawyer who also holds a degree in finance, has put together power-plant deals across the United States and the world, from Australia and Latin America to the Czech Republic. Micheletti was for years a lawyer at Xcel’s Northern States Power.

In an era when many countries have imposed “carbon taxes” on utilities to reduce pollution, the couple conceived of turning to new coal-gasification technology — transforming coal into gas — for a cleaner alternative to coal-fired power plants. They also tapped into the Legislature’s interest in boosting the economy on the Iron Range. Their project promises to create more than 3,500 construction and ancillary jobs from 2008 to 2011. The plant would employ 107 full-time workers once it begins operation.

Over the next 30 years, the developers envision as many as six coal-gasification plants in northern Minnesota.

The initial plant would produce 600 megawatts of electricity — enough to power 600,000 homes. It also promises dramatic reduction of the pollution associated with burning coal, including particulates, sulphur and mercury. Burning gas made from coal still will produce carbon dioxide, a greenhouse gas, but Excelsior has unveiled plans to curb that pollution. Xcel officials note that the cost of keeping carbon dioxide out of the environment is not included in the projected $2 billion cost of the plant, though ultimately, state residents would pay the bill.

Excelsior officials say Xcel’s rate calculations are deliberately misleading.

A desire to kill?

Jorgensen, Excelsior’s co-president and chief executive, said Xcel wants to kill the proposed Iron Range plant in favor of building its own conventional coal-burning generating plants a few years from now.

She predicted that if the Iron Range plant isn’t built, Xcel will rely more and more on natural gas to fuel electrical generators, putting its customers at risk of soaring costs if gas prices spike.

In a 2004 “resource plan” filed with state regulators, Xcel estimated natural gas would be used to generate 10 to 15 percent of electrical energy in Minnesota by 2015. That’s two to three times the share produced by natural gas today. That’s good news for Xcel’s shareholders, Jorgensen said, because gas-fired electrical generators are relatively cheap to build, but it would be bad news for ratepayers because Xcel could pass on any increases in natural gas prices.

She characterized the Excelsior generator as an insurance policy against a rise in the cost of natural gas. The plant would turn pulverized coal into gas that would be burned to fuel electrical turbines.

Xcel officials note, however, that Excelsior will use natural gas as a backup fuel for its generators and that coal, the plant’s chief fuel, is subject to price swings, as well. The price swings in coal are small compared to past ups and downs in the price of natural gas, however.

Another unknown is the exact final cost of the Excelsior plant — a key factor in setting rates for the electricity produced there.

“Once they figure out how much it’s going to cost to build Excelsior, they’re willing to set a price,” said Elizabeth Engelking, Xcel manager of resource planning and bidding. “We would be signing an agreement without knowing what the actual cost is.”

However, once a price was set for electricity from the new plant, Engelking acknowledged, Excelsior would have to live with it. Excelsior shareholders, not Xcel customers, would pay for any construction cost overruns, she said.

Power demand rises

Excelsior has marshaled a number of experts to testify that a coal-gasification plant would meet the state’s fast-growing appetite for electricity. Xcel hasn’t built a major “base-load” generator, meant to produce power around the clock, since the 1980s.

Xcel says more base-load energy is needed, but not in the quantities to be produced by Excelsior, and not on Excelsior’s timetable.

To head off a shortage in electricity supply, Xcel plans to boost the output of its existing nuclear and coal-fired plants between 2009 and 2014, increasing capacity by 300 megawatts. It also recently set plans to buy 375 megawatts generated by wind and water to meet base-load needs after 2015.

The bottom line: Excelsior’s electricity won’t be needed when the plant goes into production in 2012, Xcel says. To be sure, Xcel’s links to the nation’s power grid would allow the utility to sell excess power to other companies, but not necessarily at the price Xcel paid for the electricity.

“Customers will be paying for excess capacity for three years,” Engelking said.

Engelking, an economist, said Excelsior’s argument about the potential for rising natural gas costs doesn’t mean its power plant is a low-cost alternative.

In testimony before state regulators, Engelking said Xcel ran computer simulations assuming sharply higher natural gas prices. The price of electricity in Minnesota remained unchanged in those scenarios whether the Iron Range plant was built or not, she said. The reason: Natural gas will not be used for generating electricity day-in, day-out, but only in periods of relatively high demand.

Excelsior officials are suspicious of Xcel’s forecasts, saying that Xcel ratcheted down its estimates of electricity needed in the next few decades only after the Legislature mandated that Xcel buy power from the Excelsior plant.

“We know the growth of the state and metro area has been solid, totally predictable,” said Micheletti, Excelsior co-president and chief executive. “All of a sudden, they’ve lowered the growth rate from historical averages.”

Xcel counters that its computer forecasts change twice a year in routine reviews.

“Of course it will change over time,” said Judy Poferl, Xcel director of regulatory administration. “To say that we somehow manipulated really does not give credit to the process we go through.”

Xcel’s numbers are reviewed by outside experts at the PUC and Department of Commerce.

“In 2004, the Department of Commerce said we were over-projecting our customers’ needs for power,” Poferl said.

Mike Meyers â?¢ 612-673-1746 â?¢ meyers@startribune.com

©2006 Star Tribune. All rights reserved.

Poor Mike, I think I blew up his computer with attachments of stuff he obviously needs to review, and for sure exceeded the STrib’s limit. Ja, he’s new to this, but there’s no time like the present to learn about coal gasification! For example… from the sound of it, it’s just a disagreement between Xcel and Excelsior, and none of the other parties are named, their positions are not addressed. Most of the other parties have been stepping up to the plate — where’s the Chamber of Commerce’s great arguments, where are their concerns? Where’s mncoalgasplant.com? My clients’ had to fight Excelsior’s challenge to their Intervention — whatever legitimate reason could they have to try to deny the local affected landowners participation in this docket? And there are statements like that of Jorgensen, who “said Xcel wants to kill the proposed Iron Range plant in favor of building its own conventional coal-burning gnerating plants a few years from now.” Say WHAT??? Ummmm, the PUC has approved Xcel’s Resource Plan, which says it can procure 375MW of baseload generation to begin in 2015, they’ve decided to go with hydro and wind, so will somebody tell Julie? She can’t get away with statements like that, does she think the public doesn’t know that there is an RFP coming down the pike on this, and everyone is wanting all this Resource Plan information entered into the docket. So DUH — but remember, “If we were a bunch of liars, we wouldn’t have got to where we are with this project.” Uh-huh… yup… Oh, and Jorgensen is not an attorney licensed in Minnesota, neither is Micheletti — both their licenses have been suspended for non-payment. Check the Supreme Court site HERE.

And then there’s coal. Excelsior doesn’t have a coal contract, and yet the article doesn’t even mention what happened to the price of coal a year ago, it TRIPLED! it’s gone down some, but that’s a major problem when coal is such a large part of the cost of running a plant.

The article also makes a claim about “the state’s fast-growing appetite for electricity,” but there’s NO “fast-growing apetite for electricity,” and you can verify that in the NERC 2005 Reliability Assessment where they say they’ve overbuilt and that the electric consumption in the MRO (MAPP) region grew by only 0,6% over the prior year. And then there’s the CapX2020 Technical Report where they note a 6,300MW “need” in the region, and that there’s 16,712MW in the MISO queue (that’s on p. 7). It’s demonstrated in Excelsior’s exemption from the Certificate of Need — they couldn’t prove need if they wanted to! How many more examples do they need?

Oh, and Excelsior claims that “fuel flexibility” is a big part of this and they aim to demonstrate that PRB coal can be used for coal gasificaiton. Well, hee hee he, the DOE just handed down some tax credits and PRB is NOT included. aaaaaaaaaaawwwwwwwwwww… As the article notes, PRB is already low in supfur and it’s logically tough for a PRB plant to meet the standards, but what I’m wondering is whether the Excelsior plant was counting on or wanting this tax break, if it was a factor in their fuel flexibility claim, or their unwillingness to declare specific fuel type and their lack of a coal contract.

Here’s an article about that tax break from the Billings Gazette:

Tax Breaks for Power Questioned

By The Associated Press

CASPER – A state lawmaker is questioning proposed tax breaks to encourage the construction of coal gasification power plants in Wyoming.

Rep. Debbie Hammons, D-Worland, said lawmakers should consider the long-term implications of such tax breaks.

“When is it an incentive and when is it a subsidy?” she asked.

The proposed tax breaks are being considered by the Joint Minerals, Business and Economic Development Interim Committee, which met Monday. The tax breaks would apply to power plants that convert coal into gas, then burn the gas much more cleanly than coal can be burned.

Steve Waddington, executive director of the Wyoming Infrastructure Authority, said eliminating the 5.5 percent state severance tax on coal for a 500-megawatt “integrated gasification combined cycle” plant would amount to an annual $2.2 million tax break.

“This would be a significant incentive for those considering an IGCC plant to build it in Wyoming,” he told the committee.

He said the cost of coal was not a “driving factor” in considering where to build coal gasification plants.

But he said a tax holiday might give Wyoming an edge amid competition for such a plant.

He also said that Wyoming’s thin air and high-moisture coal could affect profitability for whoever builds a coal gasification plant in Wyoming.

But Hammons pointed out that other states seeking coal gasification plants have taxes that Wyoming doesn’t have, including a personal income tax.

“What if we create a false sense of commercialization?” she asked.

Dan Neal, executive director of the Equality State Policy Center, also argued against a severance-tax holiday. He said the whole point of encouraging coal gasification plants would be to boost the state’s revenue from coal.

“If we don’t collect the taxes, then we squander our assets,” he said.

The Wyoming Infrastructure Authority recently sought partners for a coal gasification demonstration project. It expects to decide soon from a pool of about a dozen applicants.

Copyright © 2006 Associated Press.

December 6th, 2006 at 8:03 am

Carol,

You know very well that the reason that projects using WYO coal were not included in any of the tax credit awards was because it was too low in sulfur, not because it wouldn’t work.

Harry