Paused Social Security withholding? Remember!

October 21st, 2024

I’d forgotten about this, and it’s an important point that needs attention, given the election. We need to focus on bolstering Social Security.

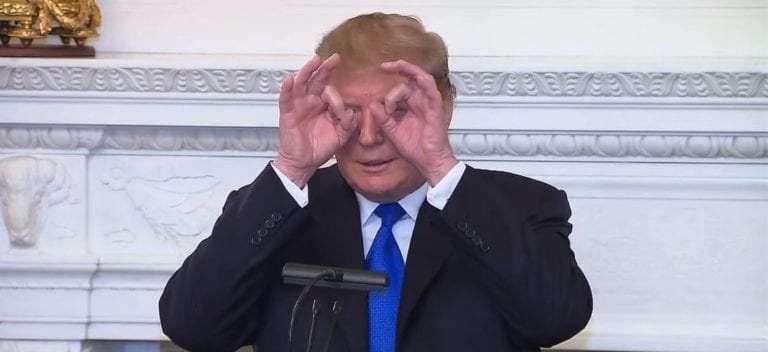

Social Security withholding… talk about short-sighted… do you remember when tRump ordered a pause in payroll withholding for Social Security? It was chump change for the workers who got a small boost in take home pay and later had to pony up for those missed contributions. But policy wise, it was a HUGE step, and keep in mind that it was done by a Presidential Memorandum:

Deferring Payroll Tax Obligations in Light of the Ongoing COVID-19 Disaster – Memorandum for the Secretary of the Treasury

Yes, he really did that, deferral of withholding from September 1, 2020, to December 31, 2020. Thankfully, after those few months, payroll deduction was resumed.

What would it mean if Social Security payroll withholding were discontinued long term?

Social Security would go broke. As of now, it is projected to run out of funds in 2035. From the Social Security Administration:

The Future Financial Status of the Social Security Program

We know that they’d love to end Social Security and Medicare, that’s a well documented talking point, one which they do not like to have raised publicly. Every worker has paid into this fund for their entire working life. How to dismantle it? They’d start out, bit by bit, raising the age to receive Social Security and Medicare, decreasing or eliminating withholding, lowering the benefit. Just NO!

Leave a Reply