MN PUC – How To eDockets

February 1st, 2024

Who cares about the Minnesota Public Utilities Commission’s eDockets system? We all should care! It’s the best way to keep up with what’s going on in the docket, what others are filing, what issues are being raised, what’s the status, and to track all NOTICES, which will tell you of hearings, comment windows, orders, and pay particular attention to those from PUC, OAH (Office of Administrative Hearings), and EERA and DER (Commerce). Also look for comments from individuals and note their concerns.

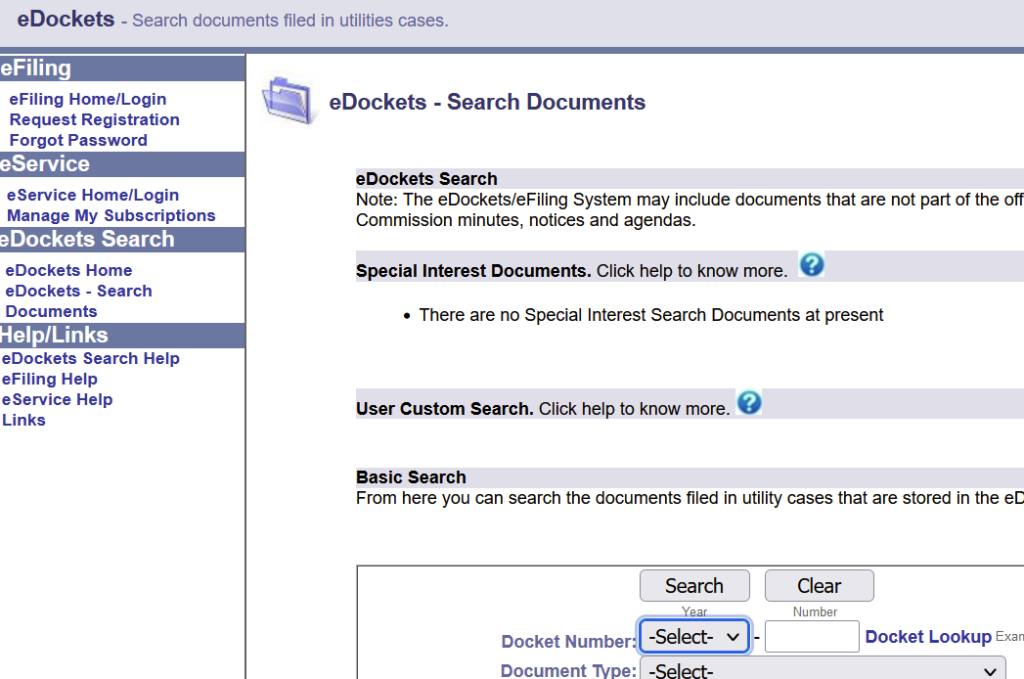

How to get to eDockets? First go to the PUC’s Main Page (see above) at https://mn.gov/puc then click “eDockets” and you get this and click “eDockets” again:

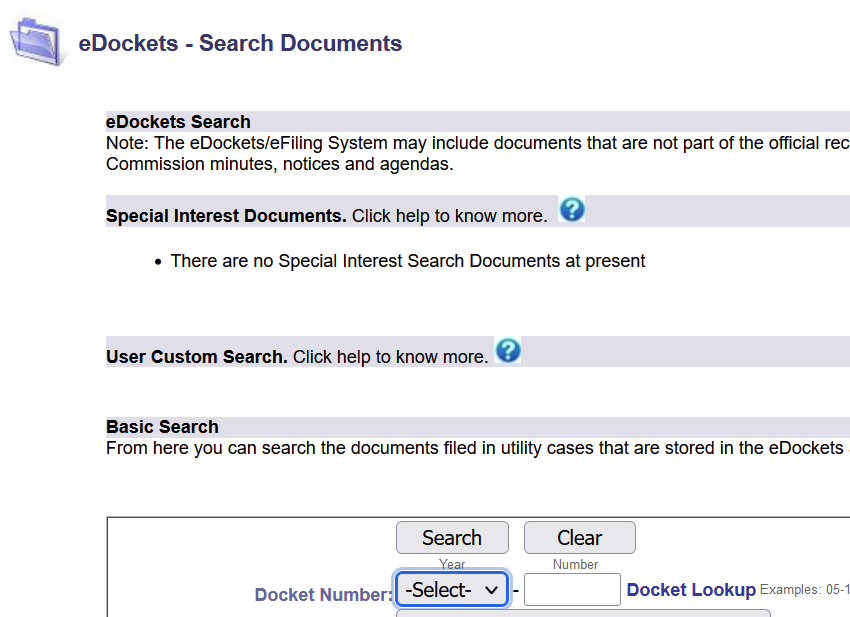

Then you’ll get to this screen:

At “Docket number -Select” scroll to “22” (the year) and at “Number” enter “131” for Certificate of Need, or “132” for Route docket (and for other dockets, same routine, enter the year and docket number, and there you are!). And for sure look at both. Then click “Search.” (when there are multiple dockets, as with the MN Energy CON, be sure to check both dockets, one at a time). This works for any docket, like the 800MW RFP docket, E002/CN-23-212, plug in year “23” and Number “212” and there you go! Spend some time playing with it to get acquainted, it’ll become second nature soon.

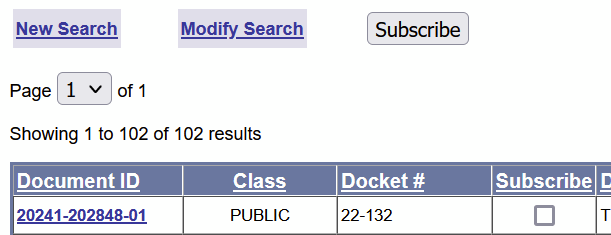

When you get to the docket, as below, click on the far left link in a row to get that filing in that row. Do it a few times, and it’ll be quick and easy! If in active for a while, it will boot you out and you get to start over.

Also, “subscribing” is important to keep up to date on what’s being filed. When there are multiple dockets, be sure to subscribe to both!

To subscribe, when you get to the docket, note the column for Subscription and boxes, as in lower right here:

Click one of the boxes in that subscribe column, any one (above on lower left), and then click the link above “Subscribe” and you’ll go to this screen:

Enter your email address, and for “Type of Subscription” enter “docket” and then you’ll have to enter the docket(s), and then “Add to List.” You’ll get a confirmation email, click and confirm, and there you are!!

When you get emails about the docket, it will have the docket number, and as they come in, pay particular attention to Notices, as there will be dates that are important, meeting/hearing dates, deadlines for comment, etc.

Now, get to it. LOTS of reading, and as you go, you’ll get familiar with it and the process. IT WILL GET EASIER!!

Now for the fun part — FILING IN eDOCKETS! Why file in eDockets? When you file in eDockets, you know what you’ve submitted has been received and is part of the record, and so others can know what your concerns are — it’s SO important to know you’re not alone in this!

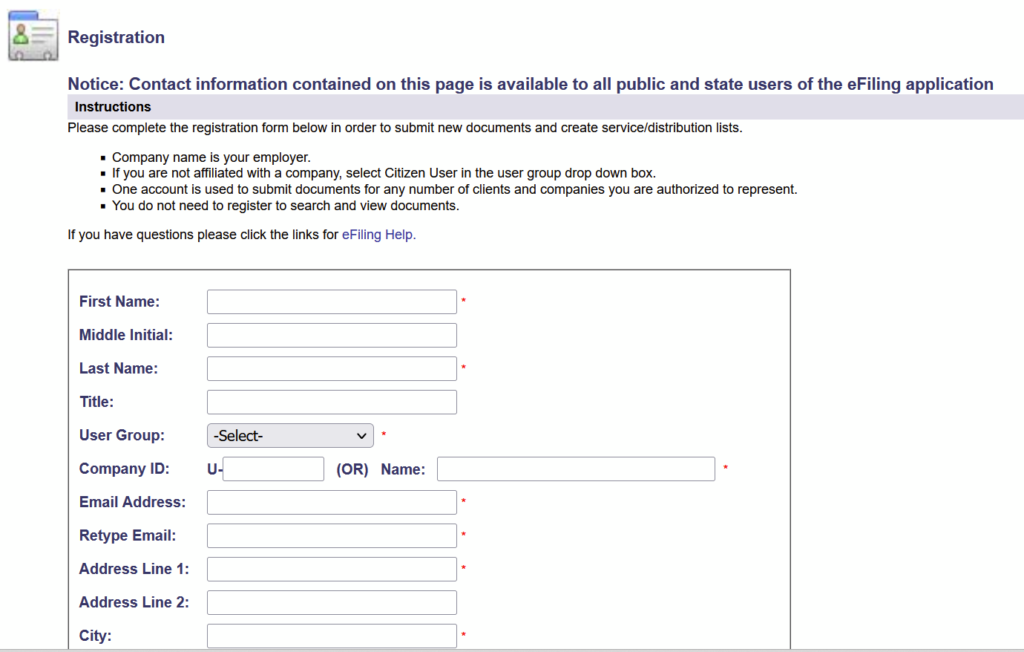

To file, first you have to register. In that first eDockets screen go to upper left corner:

Where it says “eFiling”, register by clicking on “Request Registration.” You’ll get this screen:

Fill it all out, click for electronic service — Do not get into paper in these dockets, it is a royal pain, and sending out paper copies to everyone is EXPENSIVE. Click “Submit” and you’ll get confirmation email, confirm, and you’re all set.

To eFile after you’ve registered, click “eFiling Home/Log In” and follow the directions.

WHEN THERE ARE MULTIPLE DOCKETS, BE SURE TO FILE IN BOTH! For the MN ENergy Connection, be sure to write “route” comments with those on-the-ground issues you know best because you’re right there, and also be sure to write comments on “need” because that’s the overarching issue — if the Commission determines it is not needed, it won’t be built — and if it IS deemed needed, it’s a matter of where, and routing is an ugly mess and can devolve into a “STICK IT THERE” struggle. Always address the (lack of) need issues, as that’s the only real way to stop a project.

If you need help on eFiling, contact the Commission’s Public Advisor Charley Bruce — charley.bruce@state.mn.us

Once you take the time to sign up, and get familiar with it, you’ll see how easy it is to keep up with what’s going on, and how easy it is to eFile — and last minute!! So easy, I’d be lost but for eDockets and eFiling, you have no idea how awful it was to make paper copies of all filings, and mail them to everyone, whew, it was beyond difficult, and so expensive. Now, it’s a “work from home” easy-peasy process, the best ever change in PUC process, and pretty much everywhere across the country, in administrative proceedings like this, and in most every court system too. Participating, practice, was so much harder before.

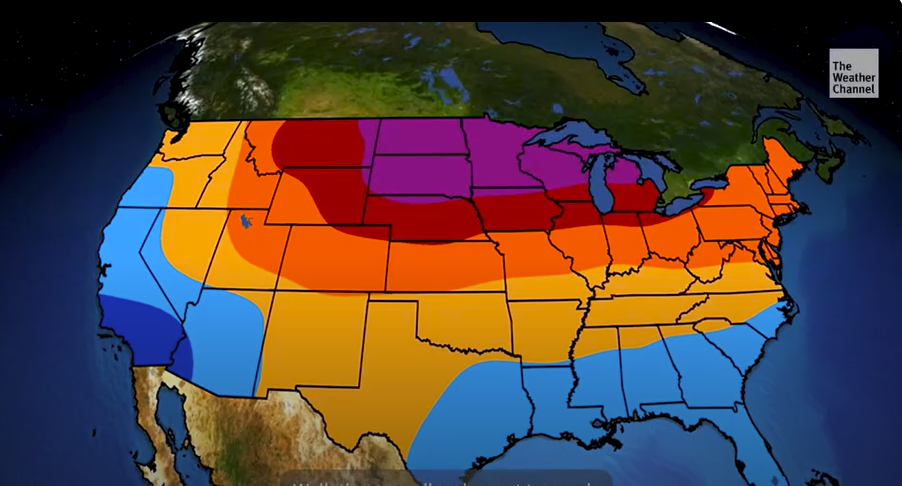

Yes, climate change is real…

February 1st, 2024

If you want to learn how to navigate the PUC’s eDockets system:

MN PUC – How To eDockets

I’m working on an overview of “need” for the “MN Energy CONnection” transmission project, Xcel’s latest effort of shifting costs of preserving “valuable interconnection rights” at the Sherco coal plants’ substation. They’ve come up with a plan to run a radial line, yes, RADIAL, from Lyon County up to Sherco, 160-180 miles, AT A COST OF $1.14 BILLION! It’s a brilliant idea, gotta admit… Xcel is the GOAT at planning, BUT it’s such a scam. I do hope we can change the trajectory, get the focus on Xcel, and not be dumping this on the backs of ratepayers and landowners.

Ahhhhh… Xcel’s MN Energy CONnection… In the midst of extreme weather events, I spent time over the last two weeks, seven meetings over four days, for scoping of the Environmental Impact Statement for this project. Here’s the Notice:

Yesterday in Monticello, MN, it was up to 54 degrees! At each of the seven meetings, at least two people waxed histrionically that climate change was not real. How can this be? Granted, 54 degrees and El Nino is “weather” but we all know of the weather extremes, drought, intense storms, that are obvious signs of climate change. Even insurance companies, due to weather extremes, our home insurance doubled (!), and the company said they were doing that for all Minnesota customers (Minnesota focused because we’re in Minnesota!). In Florida, insurance companies are refusing to offer coverage, California too. That article has this pie chart from insurance industry:

Granted, it’s focused on perception of when your “home” will be affected, and not LIFE, but according to the insurance industry, so many say “no effect” and I’ve heard enough denial of climate change lately to think that the pie chart is credible. Insurance companies make money on their gambles, and if you’re insuring anything, you’re betting against the house.

Sherco 3 IS closing. Xcel wants to build this transmission below, and have ratepayers and landowners pay for it. The purpose of this is to preserve Xcel’s “valuable transmission interconnection rights” at Sherco.

I don’t think so…

Transmission road show continues…

January 31st, 2024

FYI: MN PUC – How To eDockets

The last two weeks have been scoping meetings for the Environmental Impact Statement for the “MN Energy CONnection.” Per Xcel’s site, “You can read the Certificate of Need filing here and the Route Permit application here.” I don’t see the word “REVISED” on this…

Here’s the REVISED Certificate of Need application:

And here’s the Route Application:

Route-Application App C are the maps — TOO LARGE — see eDockets

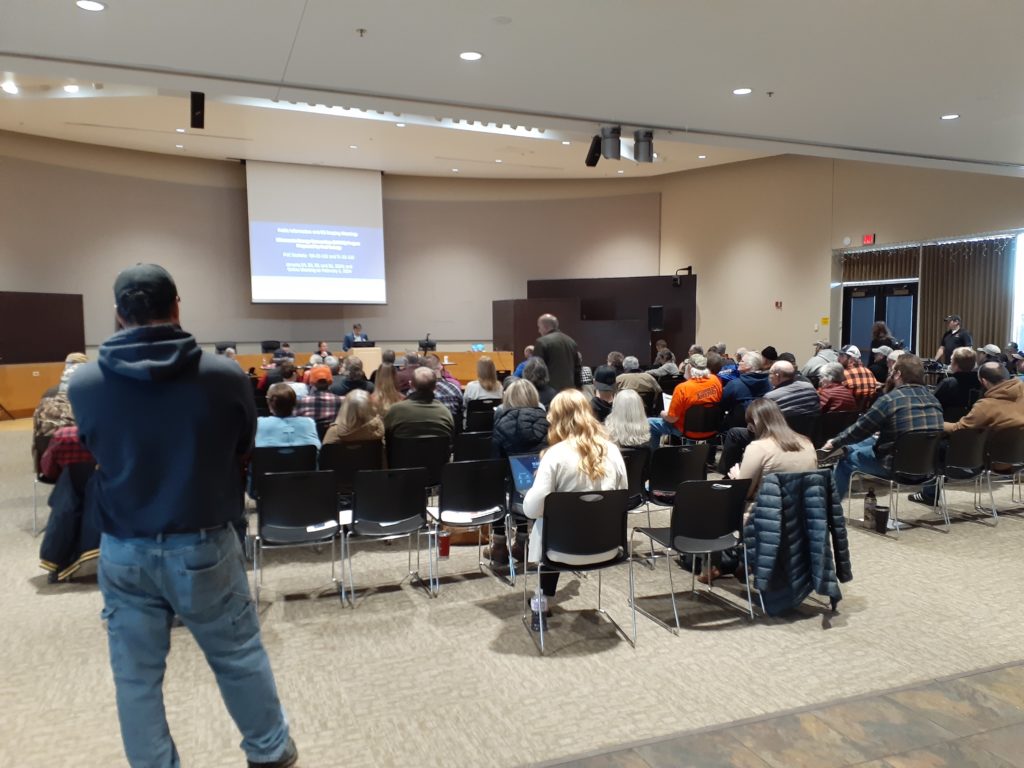

So many people getting notice of the “MN Energy CONnection” transmission line have CapX 2020 in their yard, and they are PISSED! It was standing room only last night in Litchfield, 100 of my flyers gone and folks were still filing in. Again this morning in Monticello, over 100 again:

Several this morning brought up EMF and the magnetic fields. The magnetic fields from the “REVISED” application are cause for concern — look at their modeling levels shown for the edge of the Right of Way:

Anyway, there’s a lot tocomment about, things that should be included in the EIS. But now’s not the time to write. More later.

Motion for Certification of W.O.L.F. Intervention

January 27th, 2024

Here we go for another round — a Motion for Certification to the Public Utilities Commission:

https://www.revisor.mn.gov/rules/1400.7600/… Any party may request that a pending motion or a motion decided adversely to that party by the judge before or during the course of the hearing, other than rulings on the admissibility of evidence or interpretations of parts 1400.5100 to 1400.8400, be certified by the judge to the agency…

https://www.revisor.mn.gov/rules/1400.7600/

We’re asking that the Public Utilities Commission take up the matter of World Organization for Landowner Freedom’s Intervention:

Included after the Motion, but here separately:

It’s just so offensive. This matter matters (!), and W.O.L.F. is the only one in there objecting and requesting Intervention. Why this Motion? Why ask for Certification to the Public Utilities Commission to consider and decide? Well, in a nutshell:

Why?? Because of the ALJ’s denial of W.O.L.F.’s intervention based on a false statement regarding W.O.L.F.’s “only” contribution, and conflation of two different conditions in the original Arrowhead-Weston Transmission Line Exemption Order, that of the noise condition and the necessity of noise reduction measures to comply with Minnesota’s noise standard (Minn. R. 7030.0040) with an 800 MVA transformer limitation of capacity to assure the line isn’t for bulk power transfer! I have an urge to do a Data Practices Act Request and have the EQB’s Arrowhead Transmission Project record sent to his office!

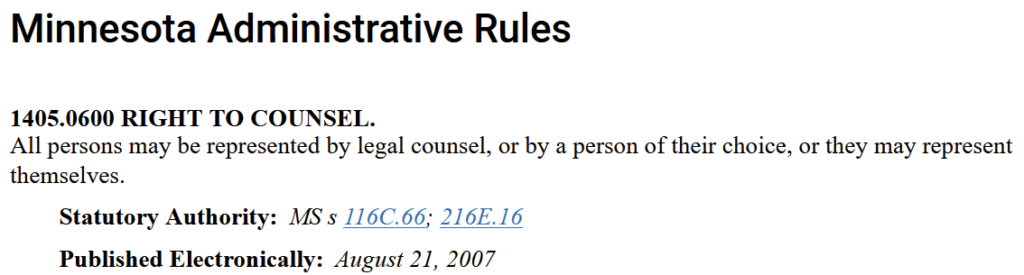

This same Administrative Law Judge threatened the “Union Intervenors” with unauthorized practice of law… veiled threat? No, it’s overt. He had to take the action of looking beyond the OAH Rules to find Minn. Stat. § 481.02 and Minn. Stat. § 481.02, subd. 3(5) (2022), and to say:

In short, while the Judge does not intend to manage the practice of law in this matter, parties should be aware that potential issues could arise for non-lawyers who are not statutorily exempted from the general prohibition of non-lawyer practice of law in Minn. Stat. § 481.02. The Lawyers Professional Responsibility Board may be a resource for more information on this topic.

Really, that’s a quote — and no, it’s not a “helpful cautionary warning” — check this footnote:

OH. MY. DOG! That’s just too bizarre.

- Looking up a name on MARS attorney registration site takes a matter of seconds — “does not know” when it’s that easy to find out? Give me a break…

- But that’s not an issue. Runke and Kolodzieski have not held themselves out as attorneys, to my knowledge.

- But more importantly, non-attorneys are welcome to practice in hearings before Office of Administrative Hearings (OAH). See the Power Plant Siting Act rules, Minn. R. 1405.0600, and also Minn. R. 1400.5800. This is something a Judge at the Office of Administrative Hearings frequently presiding over utility dockets should know. There’s no excuse for threats like that, bandying about “unauthorized practice law.” This is not “court” and the OAH rules expressly provide for non-attorney representation.

I’ve run short of printable words, though I did quick hammer out this objection, and copied the Chief Judge:

This is all so contrary to the Public Utilities Commission’s charge to encourage public participation:

216E.08 PUBLIC PARTICIPATION.

Subd. 2. Other public participation.

The commission shall adopt broad spectrum citizen participation as a principal of operation. The form of public participation shall not be limited to public hearings and advisory task forces and shall be consistent with the commission’s rules and guidelines as provided for in section 216E.16.

What? We’d pay for Xcel’s gain?

January 25th, 2024

FYI: MN PUC – How To eDockets

Last night in Marshall, 175-200 people showed up at the “MN Energy Connection” scoping meeting for an Environmental Impact Statement for both Certificate of Need and Routing. This is a meeting very early in the process, and the level of interest, and the distress, is very high. That’s more people than showed up for even the later hearings on CapX 2020, except maybe the last hearing held in Cannon Falls after a new route segment was produced with inadequate notice to landowners, when the large high school auditorium filled to the brim.

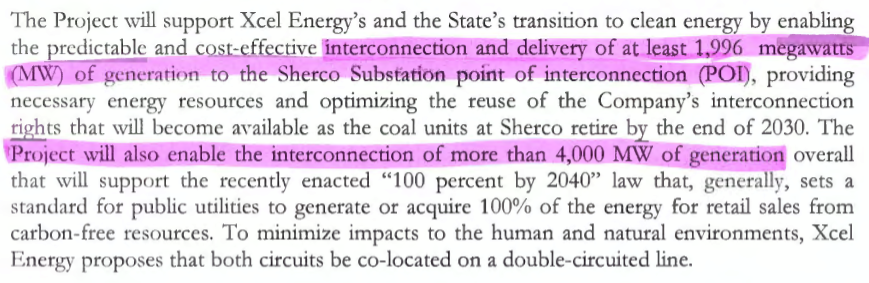

The “MN Energy Connection” is a scam, emphasize the CON in CONnection. The purpose, stated clearly in different ways, is to preserve Xcel’s 1,996MW of “valuable transmission interconnection rights.” That number is oft repeated, but there’s another number on the first page of its application:

So now we’re enabling “interconnection of more than 4,000 MW of generation… How so? Do explain, but it’s no surprise given that there’s always more going on than what’s immediately apparent.

To do this, Xcel wants to build a 160-180 mile long apparently radial transmission line from Lyon County in SW Minnesota to its Sherco plant, where it’s shutting down the coal plants, and it’s framing this as a “Gen-Tie” line. A “Gen Tie” line is typically a few miles long connecting generation to a substation, hence the grid. This one? Oh, that’s a stretch.

A few points that call this scheme into question (but no doubt about it, it’s brilliant):

Xcel is putting in 710 MW of solar generation in the area:

710 MW is a big chunk of 1,996 MW. How are they getting away with saying they “need” this line to interconnect 1,996 MW at Sherco?

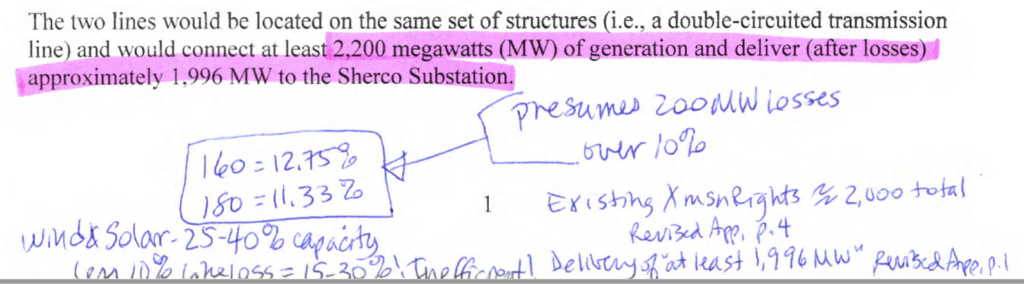

Another factoid — line loss is disclosed, for a change, and it’s over 10%. That’s enshrined in the Public Utilities Commission Order of August 10, 2023. I filed the STrib article and this Commission order, with my bar napkin jottings, with the PUC early yesterday:

Here’s the important admission, that 2,200 MW is put into the lines, and over 160-180 miles, only 1,996 MW arrives! That’s 11.33-12.75% line loss.

That means that the new “big” 250 MW solar project is only 45 MW over what’s lost going from Lyon County to Sherco! Does this make any sense?

Now consider the generation capacity factor of wind and solar. Wind is actually 40% though the MISO number is just over 15%. Solar is about the same. If there’s 11.33-12.75% line loss in transmitting a 15-40% generating source, what’s the sense in that?

This project is now estimated to cost $1.114 BILLION. This is to be spent to preserve Xcel’s “valuable transmission interconnection rights,” and logically, enable continued revenue from transmission service. Xcel is expecting to get Commission approval to claw this out of ratepayers pockets, and to get the land through eminent domain — that this project should be built on the backs of ratepayers and landowners.

What’s the “value” of these “valuable transmission rights?” Shouldn’t that value that value be deducted from the amount to be shifted to the ratepayers? Shouldn’t that be covered by Xcel stockholders? And what of the value of continued provision of transmission service, shouldn’t that also be removed, perhaps as charged?

Another thought. I’ve seen so many interconnection studies where MISO estimates the cost of interconnection, the upgrades to the system needed to put that generation online, and the generator pays those costs. So does that mean the generators will pay the costs of this line, and then ratepayers pay for it too? Hmmmm, color me confused.

Something else bothers me about this. They say this conductor is 636 Grosbeak ACSR, two twisted together, “bundled.” The photos used show what’s probably a CapX line, bundled in that there are two conductors held together in each position, giving twice the capacity. So my question is, are the twisted conductors (bundled) also bundled together in pairs? And then let’s consider that it’s a double circuited project.

Xcel says the amperage is 3,000. The MVA is ??? I’m a math idiot, 46th percentile, but I want to know the conductor configuration. For the magnetic field charts, they’re using 1,100 and 660 MVA. Now I know that 3,000 amps per ? per what?? Their engineer admitted the capacity was more than that 1,100 or 660 MVA, so what exactly is it, and though they claim it’s limited by the Sherco substation’s 1,996 MW interconnection limit, I can’t imagine that’s forever engraved in stone.

Another thought… the need for “voltage support.” That’s because of the line loss and instability over the long distance (not only is transmission inefficient, but it’s inherently unstable). That will cost a lot. $253 million, plus synchronous condensors at the Lyon County sub. Are we ratepayers gong to be charged for all this as well? But of course!

Here are selected pages of the Xcel Revised Application that I filed in eDockets, because I’m referencing them in this round of meetings (p. 8 of this pdf is Ex. 35 from the SW MN 345kV transmission proceeding, docket 01-1958):

On that happy note, time to get ready for day two!

Here’s last night’s meeting in the news:

Swedzinski: Xcel lines should not be built

People attending Marshall meeting ask for energy company, PUC to reconsider proposal to install 345-kilovolt line in region

Jan 25, 2024

Deb Gau – dgau@marshallindependent.com

Photo by Deb Gau Representatives of Xcel Energy, including Matt Langan, right, answers questions from the public before the start of a meeting in Marshall on Wednesday night. A public comment period at the meeting was part of the review process for Xcel’s permit application on a proposed 345-kilovolt transmission line running from Becker to Garvin.

MARSHALL — A proposed electric transmission line running from Sherburne County to Lyon County is raising concerns for many area residents. A packed crowd at a public meeting Wednesday night urged representatives of the Minnesota Public Utilities Commission and Xcel Energy to consider how the project would affect their farms and families.

“The process of making these decision where we’re running these lines is very critical to all of us, especially in what we do here in the land,” Brian Hicks said. “I’m just really encouraging you to take this serious, because it impacts us greatly.”

A few different speakers at the meeting — including state Rep. Chris Swedzinski — said the lines should not be built at all.

“I think Xcel is making a mistake shutting down the coal-fired plants,” Swedzinski said at the public comment session. “Give us more than just two choices. Give us a third, to just say no.”

Xcel Energy has applied for state permits to build a proposed 345-kilovolt electric transmission line running from Becker to a new substation near Garvin. Xcel spokespeople said the project would make it possible to connect with sources of wind energy in southwest Minnesota, to replace the coal-fired Sherco power plant in Becker.

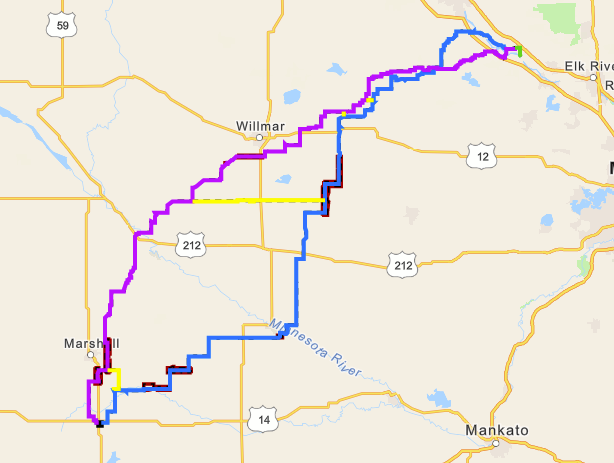

Two possible routes have been proposed for the transmission lines. One route roughly follows the path of Minnesota Highway 23 between Willmar and Marshall, before turning south toward Garvin. The other proposed route approaches Lyon County from the east, through Redwood County.

“At this early point in the process, there is no preferred route between the two,” said Matt Langan of Xcel Energy

Part of the review process for Xcel’s permit applications includes public meetings, written comment periods, preparation of an Environmental Impact Statement (EIS), and hearings conducted by an administrative law judge, said Scott Ek of the Minnesota Public Utilities Commission. The purpose of Wednesday’s meeting was to help determine the scope of the EIS.

Members of the public at the meeting could comment on the human and environmental impacts of the transmission line that should be studied, said Andrew Levi, environmental review manager with the Minnesota Commerce Department. Commenters were also encouraged to suggest alternatives that would help address those impacts.

Several members of the public said they were concerned about the effects of soil compaction from construction of the power lines, and the possibility of stray voltage affecting their homes or cattle. Lyon County resident Dan Wambeke said he and others living near the CapX 2020 power lines in the area have already experienced those problems.

“We are united in the feeling that it would be an unjust and unreasonable burden to ask us to support another high-voltage power line in our vicinity,” Wambeke said. He presented a petition asking the PUC to remove part of one of the proposed routes, between Highway 23 north of Marshall and Highway 19 east of Marshall, from consideration. “This is the section of the power line, or of the route, that interacts with CapX.”

Other commenters, like Hicks, shared concerns on how the proposed lines would affect the environment and the land in their neighborhoods.

“We’ve got native prairie ground, we’ve got environmental easements, and drainage systems that all have to be taken into account. And without the drainage, it really hinders our ability to be profitable,” Hicks said.

Mike Truwe, of rural Tracy, said one proposed route for a connector line ran very close to his property.

“The line, the right of way, would basically remove a whole front row of trees in front of my property,” he said. “If it were to be moved a half mile down the road, to 310th Avenue — no one lives on that run, and it’d be working with the same landowners, so there’s no change there.”

Lisa Dallenbach said one of the proposed routes ran close to her home north of Walnut Grove.

“Same as everybody else, I’m worried about the stray current. Because I’ve heard of fellow farming rock pickers being subjected to stray currents when they pick rock,” Dallenbach said. “I do a lot of rock picking, probably three or four weeks as soon as we get the crop put in, and I’m not super excited because we farm the piece where the line is going to be.”

Dallenbach also shared Hicks’ concerns about how the lines could affect the environment near the Cottonwood River. The area gets wildlife like trumpeter swans, bald eagles and migratory birds that could be affected by the power lines, she said.

Dallenbach said she wanted the PUC to address the fact that Xcel could potentially take property for the transmission lines through eminent domain.

“Because it is a public utility, and it’s trying to do what’s best for the public, I have no say. You guys can come within 50 feet of my house. Nothing I can do about it. And that should frustrate all of us landowners, that we don’t have a choice,” Dallenbach said. “We don’t want our land stolen from us. We’ve worked hard for it.”

“If a public utility such as Xcel Energy gets a route permit from the Commission, they can use the provisions in eminent domain,” Ek said. However, before that could happen the Commission would first need to determine there was a need for the project, and go through the route permit process. That was why it was important for the public to give feedback and suggest alternatives.

“During the comment period, we really want to see alternate routes,” he said.

Swedzinski told the Independent he had heard concerns from constituents about the proposed transmission line. It was one reason why he was attending the meeting.

“People are largely not wanting it,” Swedzinski said. The transmission line proposal was seen as the first step toward a more power lines crossing the state in the name of green energy, he said. “The people that are against coal, they don’t have to see any of this,” Swedzinski said.

EIS scoping meetings will continue to be held in the project region this week and next week. On Thursday, meetings will be held at Max’s Grill in Olivia and the Redwood Area Community Center in Redwood Falls. The Olivia meeting starts at 11 a.m., with doors opening at 10 a.m. The Redwood Falls meeting starts at 6 p.m., with doors opening at 5 p.m.

Written comments on the project’s environmental impact are also being accepted. Written comments must be submitted by Feb. 21.