Dairyland’s Q-1D South Environmental Assessment

June 19th, 2016

Dairyland Power Cooperative’s transmission through Onalaska and La Crosse is something to see…

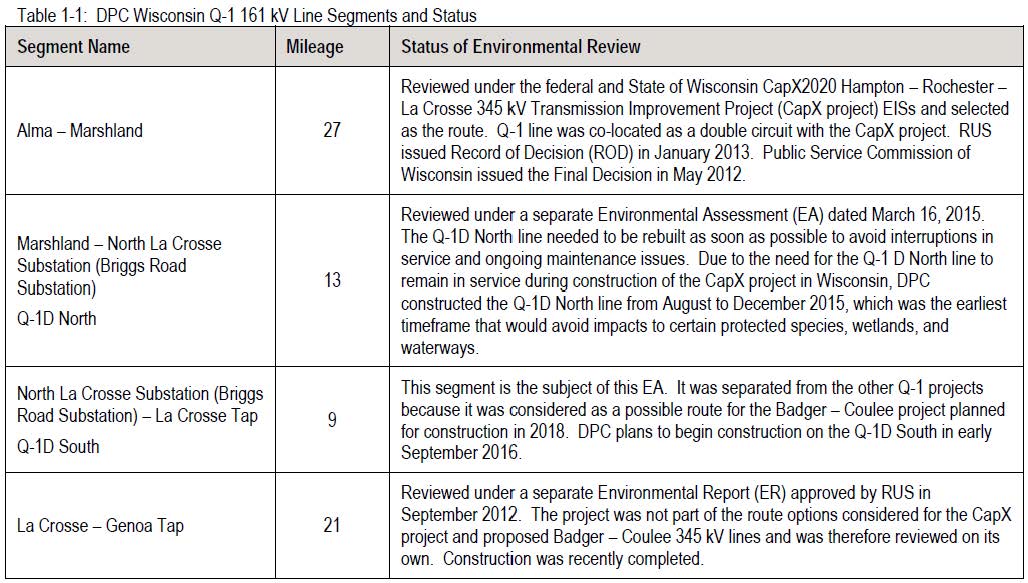

Dairyland Power Cooperative and USDA’s Rural Utilities Service has released the “Q-1D South” Environmental Assessment, open for Comment until July 1, 2016:

And from Dairyland’s site:

Briggs Road to La Crosse Tap (Q-1D South) – Environmental Assessment

Comments are due July 1, 2016 — send to:

USDA’s Dennis Rankin: dennis.rankin@wdc.usda.gov

(I’d also cc DPC’s Chuck Thompson: cat@dairynet.com)

By U.S. Mail:

Dennis Rankin

Environmental Protection Specialist

USDA Rural Utilities Service

1400 Independence Avenue S.W.

Mailstop 1571, Room 2242

Washington, DC 20250-1571

What’s to comment on? I see two issues that should be sufficient to stop this project in its tracks — the debt load of Dairyland Power Cooperative and the physical setting of the project which too near and right over people’s homes.

Debt load — Dairyland Power Cooperative’s debt is excessive and should prohibit taking on more debt:

Dairyland Power Cooperative’s Annual Meeting was last week. One purpose of an organization’s Annual Meeting is to discuss its financial status and approve plans going forward.

Dairyland depends on federal USDA/RUS loans to pay for its transmission expansion, such as the Q-1 transmission upgrades, including Marshland-Briggs Road and now the stretch from Briggs Road to North La Crosse south of I-90. Another USDA/RUS loan paid for Dairyland’s share of the CapX La Crosse line now blighting the bluffs. Dairyland will also be part owner of the MISO Hickory Creek to Cardinal line from Iowa to Madison. That’s a lot of transmission and loans.

Dairyland recognized this financial risk and lopsided debt/equity position, and in 2012 sought help from FERC_(DPC_Request4DeclaratoryOrder), requesting a hypothetical capital structure of 35 percent equity and 65 percent debt when its actual capital structure was 16.5 percent equity and 83.5 percent debt, and FERC did grant this relief in an Order for DPC for CapX 2020 (see FERC Docket, go HERE and plug in docket EL13-19-000). That Order, and the 83.5/16.5% debt/equity ratio was prior to the present Q-1 D South project and the MISO MVP Hickory Creek to Cardinal transmission line. Dairyland requested a “hypothetical” (bogus) debt/equity ratio to preserve its credit rating and enable low cost loans. The true debt level makes DPC a higher risk.

Are Dairyland members aware of the 83.5%/16.5 % debt/equity ratio and reliance on loans for major transmission projects? What’s the debt level where new projects are included? This new transmission enables increased power marketing and sales, a private purpose. Is this highly leveraged position for new transmission in the best interests of Cooperative members?

Physical setting of the project — it’s just too close!

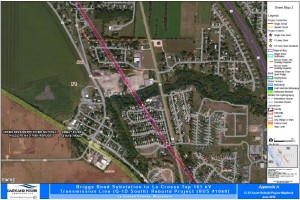

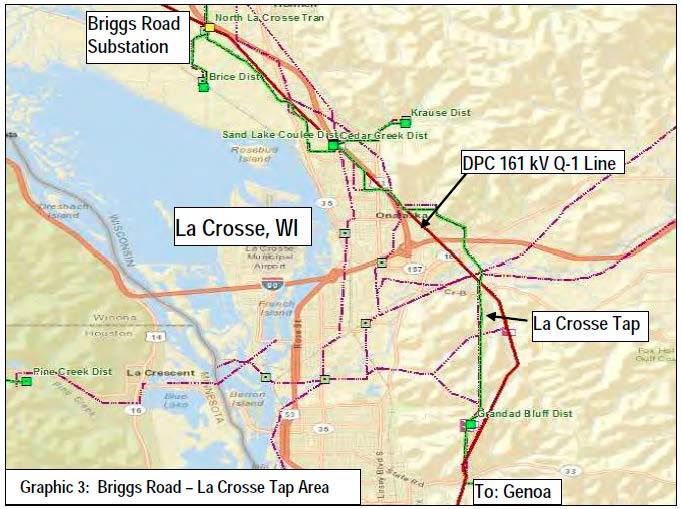

The map way above is what the transmission system in the area looks like theoretically, according to the Wisconsin Public Service Commission, but here’s what Dairyland’s Q-1 South line looks like on the ground:

Really… Here’s what it looks like from a satellite with the lines drawn in, on the far south:

Here’s what it looks like further north — look at all those homes:

And here’s what the Wisconsin PSC Code says about clearances in PSCW 114.234:

(2) Transmission lines over dwelling units. [Follows NESC 234C1b, p. 119] (Addition) Add the following paragraph c:c. Transmission lines over dwelling units.No utility may construct conductors of supply lines designed to operate at voltages in excess of 35 kV over any portion of a dwelling unit. This provision also applies to line conductors in their wind-displaced position as defined in Rule 234A2.Note: It is the intent under s. SPS 316.225(6) that the public not construct any portion of a dwelling unit under such lines.Note: The term “dwelling unit” has the meaning given in ch. SPS 316, which adopts by reference the definitions in NEC-2008.Note: See s. SPS 316.225(6) Clearance Over Buildings and Other Structures, which refers to ch. PSC 114 regarding clearance of conductors over 600 volts and the prohibition of dwellings under or near overhead lines.

USDA’s Dennis Rankin: dennis.rankin@wdc.usda.gov

(I’d also cc DPC’s Chuck Thompson: cat@dairynet.com)

By U.S. Mail:

Dennis Rankin

Environmental Protection Specialist

USDA Rural Utilities Service

1400 Independence Avenue S.W.

Mailstop 1571, Room 2242

Washington, DC 20250-1571

ATXI shot down by Missouri Appellate Court

August 11th, 2015

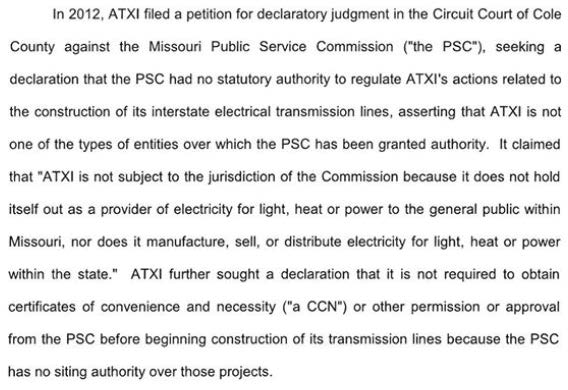

Check out this great slap down of Ameren Transmission Company of Illinois by the Missouri Court of Appeals when Ameren challenged the lower court’s dismissal of their attempt to circumvent state regulation (thanks to Paul Henry for passing this on):

As you know, Missouri is the state that had the wherewithall to declare that Grain Belt Express and its Clean Line was not a utility. In this case, Ameren went in and said, with it seems quite a bit of arrogance, Missouri, don’t touch me, we don’t have to play with you, you don’t regulate me:

WOW, whew, that sure didn’t work for Ameren. Love it when that happens.

WOW, whew, that sure didn’t work for Ameren. Love it when that happens.

Minn. Stat. 117.189 Legislative History

August 6th, 2009

This is one of those things that’s been bugging me for a long time, and I’m finally getting around to looking it up. There are a few twists and turns, and this is a long post, with a lot of links and a lot of audio listening for you to dig in if you’re interested. If you’re a landowner, you sure better be! If you’re a landowner affected by utility infrastructure, this is required reading and listening!

Here we go!

History of Minn. Stat. 117.189

Here’s the statute (the specific statutory cites below are linked):

117.189 PUBLIC SERVICE CORPORATION EXCEPTIONS.

Sections 117.031; 117.036; 117.055, subdivision 2, paragraph (b); 117.186; 117.187; 117.188; and 117.52, subdivisions 1a and 4, do not apply to public service corporations. For purposes of an award of appraisal fees under section 117.085, the fees awarded may not exceed $500 for all types of property.

History:

Short version – this bill was a bipartisan sell-out that exempted CapX 2020 and any other public service corporation project from eminent domain that every other entity must comply with. Why on earth would they do this… or rather, what innocent explaination is there for this 117.189 section of the bill?

So far that I’ve heard (only ~6 hours thus far), Sen. Scott Dibble is the only one asking “Why exempt public service corporations?”

The only Senators who voted against this were:

Anderson, Cohen, Dibble, Hottinger, Marko, Moua, Pappas, Ranum, Skoglund

The only Reps who voted against this were:

Davnie, Ellison, Goodwin, Hausman, Hornstein, Huntley, Johnson, S., Kahn, Lanning, Lenczewski, Mahoney, Mariani, Mullery, Paymar, Thao, Wagenius, Walker

Please take a few minutes and send them a thank you note! Here’s a link to their emails:

*****************************************************

First, some more history, going back to my all time favorite bill:

Remember, this was the bill that grew from the deal the enviros did in 2003, incorporating the material terms of that deal into the 2005 Omnibus bill.

And… why… look, there’s language in the 2005 Transmission Omnibus Bill from Hell mandating an “Eminent Domain Landowner Compensation — Landowner Payments Working Group!”

55.35 ARTICLE 1155.36 EMINENT DOMAIN LANDOWNER COMPENSATION56.1 Section. 1. [LANDOWNER PAYMENTS WORKING GROUP.]56.2 Subdivision 1. [MEMBERSHIP.] By June 15, 2005, the56.3 Legislative Electric Energy Task Force shall convene a landowner56.4 payments working group consisting of up to 12 members, including56.5 representatives from each of the following groups:56.6 transmission-owning investor-owned utilities, electric56.7 cooperatives, municipal power agencies, Farm Bureau, Farmers56.8 Union, county commissioners, real estate appraisers and others56.9 with an interest and expertise in landowner rights and the56.10 market value of rural property.56.11 Subd. 2. [APPOINTMENT.] The chairs of the Legislative56.12 Electric Energy Task Force and the chairs of the senate and56.13 house committees with primary jurisdiction over energy policy56.14 shall jointly appoint the working group members.56.15 Subd. 3. [CHARGE.] (a) The landowner payments working56.16 group shall research alternative methods of remunerating56.17 landowners on whose land high voltage transmission lines have56.18 been constructed.56.19 (b) In developing its recommendations, the working group56.20 shall:56.21 (1) examine different methods of landowner payments that56.22 operate in other states and countries;56.23 (2) consider innovative alternatives to lump-sum payments56.24 that extend payments over the life of the transmission line and56.25 that run with the land if the land is conveyed to another owner;56.26 (3) consider alternative ways of structuring payments that56.27 are equitable to landowners and utilities.56.28 Subd. 4. [EXPENSES.] Members of the working group shall be56.29 reimbursed for expenses as provided in Minnesota Statutes,56.30 section 15.059, subdivision 6. Expenses of the landowner56.31 payments working group shall not exceed $10,000 without the56.32 approval of the chairs of the Legislative Electric Energy Task56.33 Force.56.34 Subd. 5. [REPORT.] The landowner payments working group56.35 shall present its findings and recommendations, including56.36 legislative recommendations and model legislation, if any, in a57.1 report to the Legislative Electric Energy Task Force by January57.2 15, 2006.

Now, let’s take a look at who was on that Committee:

REPRESENTATIVE MEMBERS

1. Jim Musso (Xcel Energy) representing transmission owning investor-owned utilities

2. Bob Ambrose (Great River Energy) representing electric cooperatives

3. Mrg Simon (Missouri River Energy) representing municipal power agencies

4. Chris Radatz-representing the Minnesota Farm Bureau

5. Tim Henning (farmer) representing the Minnesota Farmers Union

6. Jack Keers (Pipestone County Commissioner) representing county commissioners

7. Robin Nesburg (Rural Appraisal Services) representing real estate appraisers

AT LARGE MEMBERS

8. Beth Soholt (Wind on the Wires)

9. John Nauerth III (farmer)

10. George Crocker (North American Water Office)

11. Bob Cupit (Public Utilities Commission)

12. Bill Blazar (Minnesota Chamber of Commerce)

Here’s the report of the Work Group:

LANDOWNERS’ PAYMENTS WORKING GROUP

REPORT TO THE LEGISLATIVE ELECTRIC ENERGY TASK FORCE (LEETF)

Laws 2005, chapter 97, article 11, required the Legislative Electric Energy Task Force (LEETF) to create a landowners’ payments working group to study alternative methods of remunerating landowners on whose land high-voltage transmission lines have been constructed.

The group was created, met twice, and this is a report of its findings and recommendations.

LANDOWNER PAYMENTS GROUP FINDINGS

1. Farm owners in southwestern Minnesota want compensation for high-voltage transmission line easements to be paid annually as a percentage of the current value of the land so that as land values rise or drop, the payments rise or drop accordingly.

2. Easement acquiring utilities are not in favor of the proposal described in item #1 and do not want to fundamentally change the current method of payment for easements, which consists of a onetime payment based on a percentage value of the land over which the easement is acquired.

3. The Legislature has the authority to mandate the payment system described in item #1.

4. There are no jurisdictions that have the payment system described in item #1.

5. The payment system described in item #1 would be more expensive than the current payment system, assuming the percentages proposed by the landowners with attendant upward pressure on rates.

6. There is a social value to having a harmonious, nonadversarial process to acquire high-voltage transmission line easements that has an economic value that is hard to quantify.

7. There is a sense that the process for negotiating an easement and/or contesting it by a landowner is too expensive and complicated and it may be helpful to search for legislative ways to ensure that all similarly situated landowners receive the same just compensation without being intimidated by the process or forced to great expense by the process.

8. While this group was formed due to farm landowner concerns, the scope of the charge extends to all landowners. Guidance from the task force is necessary as to the scope of the charge because the scale of the issue is altered if any easement over any land is the subject of the discussion.

9. While the direct parties in interest–the landowners and utilities–are stalemated, the current push to acquire easements for new lines makes the issue one that should have a firm handle kept on it.

RECOMMENDATIONS

1. If further work is to be done on this topic, the task force should provide the guidance described under finding #8.

2. If the task force wants to continue work on this topic and wants more public input, it should consider utilizing the same persons who are on the current study group.

3. The task force may wish to consider whether there are flaws in the current easement acquisition process related to its expense to landowners to contest and perceived intimidating qualities.

*****************************************************

Let’s look at the eminent domain bills the following session, Senate bill, SF 2750 and the House bill, HF 2846.

SF 2750

Senate Authors, none added after introduction: Bakk ; Kiscaden ; Bachmann ; Chaudhary ; Kubly

Bill as introduced, had the Public Service Corporation exemption AND the appraisal fee limitation:

On the Senate side, there are some interesting statements in the first Committee hearing, Judiciary, discussion about limiting who can speak at county meetings about eminent domain (!!!), limitations of attorneys’ fees… and there’s a discussion that I’m trying to transcribe … will post soon…

Senate Judiciary – March 9, 2006 – PART I

Senate Judiciary – March 9, 2006 – PART II

Senate State and Local Government Operations – March 13, 2006 – Part I

Senate State and Local Government Operations – March 13, 2006 – Part II

Here’s Sen. Dibble questioning, in State and Local Government Operations – March 13, 2006 Part I (linked):

Senate State and Local Operations Committee

Chair: We’ll ask Senator Bakk to address this question.

*****************************************************

HF 2846

As introduced it had the Public Service Corporation exemption:

*** The sentence about appraisals did not appear in it as introduced or in the 5 engrossments online.

Here’s the House Research explanation of that paragraph:

12 Public service corporation exception. Provides that the provisions for attorneys’ fees (section 4 ), compensation for loss of going concern (section 8 ), minimum compensation (section 10 ), and limitations (section 11 ), do not apply to public service corporations.

*****************************************************

Conference Committee

04/12/2006 Senate conferees Bakk, Murphy, Betzold, Higgins, Ortman

04/12/2006 House conferees Johnson, J.; Abrams; Davids; Anderson, B.; Thissen

*****************************************************

Here are the reports of House and Senate adoption of Conference Committee Report, including votes:

![Ulman_St[1]](https://legalectric.org/f/2016/06/Ulman_St1-224x300.jpg)