Mesaba Project at the PUC on August 14th

August 5th, 2012

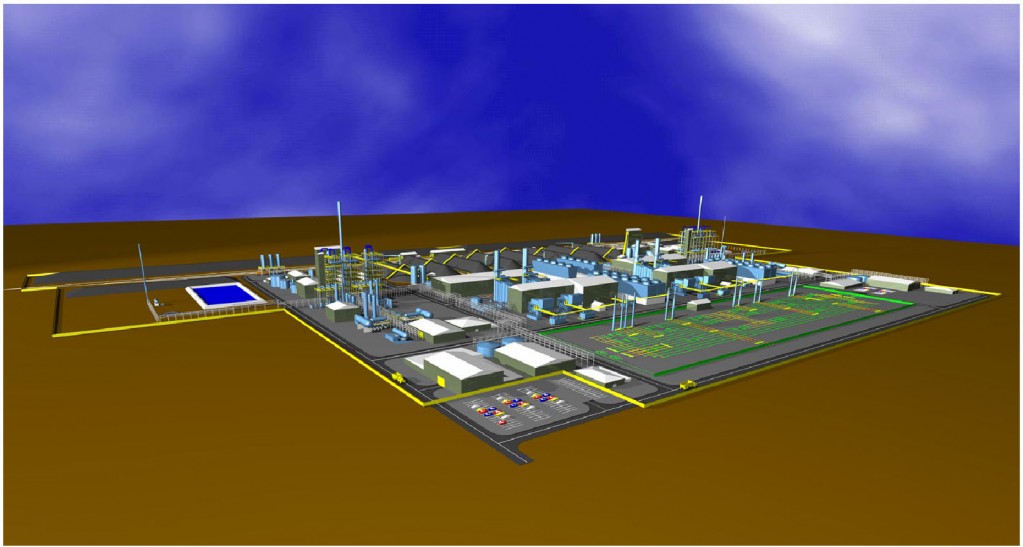

Excelsior Energy’s Mesaba Project, the coal gasification plant that will not die, is returning to the Minnesota Public Utilities Commission on August 14, 2012.

At that time, they’ll address whether the original project’s permits apply to this project, and whether this one, under Minn. Stat. 216B. 1694, requires additional environmental review:

**6. E6472/GS-06-668 Excelsior Energy, Inc.

In the Matter of the Joint LEPGP Site Permit, HVTL Route Permit and Pipeline (Partial

Exemption) Route Permit Application for the Mesaba Energy Project in Itasca County.

Should the Commission find, pursuant to Minnesota Statutes 216B. 1694 subdivision 3, that the

site and route permits issued on March 12, 2010 for the Mesaba Energy Project are deemed valid

for a natural gas fired plant located at the same site and that no additional environmental review

is required under applicable state rules?

This docket has been one of the longest strangest trips ever, a coal gasification plant that wasn’t needed yet fed by state and federal money, using CO2 capture and storage that does not, can not, and will not exist. Here’s some history:

Health Benefits of Coal (ya gotta read this one, HILARIOUS!)

Mesaba – Extend the Hearing! (the hearing was a farce)

And why are we here on the 14th? The PUC granted a Site Permit to the project f/k/a Mesaba Project, the coal gasification plant:

Then it starts getting complicated, Excelsior sends PUC letter saying it wants confirmation that the permits issued for the Mesaba Project coal gasification plant are valid for a natural gas plant, and that it would require no further environmental review:

And then Excelsior chimes again disclosing not much of anything about their “plan” for this gas plant:

And then the Comment period is extended and we get another bite:

And now we’re off to the races…

In the Duluth News Tribune:

Mesaba is baaaaaack!

June 11th, 2012

Excelsior Energy’s Mesaba Project has raised its ugly head again. There were rumors for a long time that Micheletti wanted to change it to a natural gas plant. Then they went to the legislature and got the “incentives” for their boondoggle “clean coal” plant, the “innovative technology” that doesn’t work… they went to the MPCA and their air permit was AGAIN rejected as incomplete, and now they’ve gone to the PUC, requesting confirmation that the permits they have are valid. Oh, PUH-LEEZE!

Here we go again…

mncoalgasplant.com will be filing comments, no doubt about it!

Would the PUC doesn’t transfer projects like this without amending the permit application, without verification of what indeed it is they want to do? If you take the original ALJ Decision, the Permit Order and the Permit itself, redact everything related to coal gasification, what’s left? Not much! We need to know what they’re planning (if anything, this remains the vaporware project from hell).

This is the letter filed by Excelsior Energy — I don’t recall having received it, but will dig through the piles here, they DO have my correct address (though I note that they sent to Excelsior’s Evans, Greenman and Harrington at their OLD address!):

Here is the PUC’s Notice of Comment Period, first round due June 29, 2012:

And what’s most disturbing is the legislative change in 2011, supported, DEMANDED, by Gov. Dayton:

Subd. 3. Staging and permitting.

(a) A natural gas-fired plant that is located on one site designated as an innovative energy project site under subdivision 1, clause (3), is accorded the regulatory incentives granted to an innovative energy project under subdivision 2, clauses (1) to (3), and may exercise the authorities therein.

(b) Following issuance of a final state or federal environmental impact statement for an innovative energy project that was a subject of contested case proceedings before an administrative law judge:

(1) site and route permits and water appropriation approvals for an innovative energy project must also be deemed valid for a plant meeting the requirements of paragraph (a) and shall remain valid until the earlier of (i) four years from the date the final required state or federal preconstruction permit is issued or (ii) June 30, 2019; and

(2) no air, water, or other permit issued by a state agency that is necessary for constructing an innovative energy project may be the subject of contested case hearings, notwithstanding Minnesota Rules, parts 7000.1750 to 7000.2200.

Here’s the link to the full Minn. Stat. 216B.1694.

Excelsior Energy Air Permit Incomplete

January 5th, 2012

It appears Tom Micheletti, Excelsior Energy, is having another bad day. The Air Permit for the Mesaba Energy Project was rejected by the MPCA as incomplete, modeling not approved, the list goes on and on… Yes, that’s “our” Mesaba, the coal gasification power plant that can’t get a Power Purchase Agreement if its life depended on it, and yes, its life does depend on it.

MPCA Letter – Mesaba App Incomplete – Dec 30 2011

Thank you, Air Quality at the MPCA, for making my day!

IGCC, and Excelsior Energy’s Mesaba Project

September 6th, 2010

A couple of days ago, a little birdie sent me an uplifting article, and what I like most about it is the use of the term “boondoggle,” which is the definition of Minnesota’s “own” Mesaba Project:

If IEEE’s Spectrum is using that term, the rest of the world can’t be far behind!

We’ve been having quite a few go-rounds about Mesaba lately, since Iron Range Resources unilaterally decided to significantly and substantively alter the “contract” for the $9.5 million in funding. I’d started a post on that and can’t find it for the life of me, so here we go… Now remember, this is not including the state’s Renewable Development Fund money or the DOE’s money thrown at this project, this is “only” the state IRR’s money, $9.5 million, and the interest on that “loan” is 20%:

MCGP Exhibit 5023 – IRR & Excelsior Convertible Debenture Agreement

You’ll find that interest rate on p. 12, 20% simple interest per annum on the outstanding principal. Since they’ve paid nothing on it except the $40k that they were found to have spent improperly (with many other issues not addressed because the IRR had “destroyed” documentation… yeah, right…), 20% simple interest per annum on a “loan” from 2004 means that there’s another $8,000,000 due now. And this does NOT take into account the initial $1.5 million from IRR, it’s just the agreement above.

And as noted above, a couple of weeks ago, it seems the IRR unilaterally decided to significantly and substantively alter the “contract” … based on exactly what???

Here’s how Commissioner Sandy Layman characterized the predicament:

The principal balance owed by Excelsior Energy, Inc. to Iron Range Resources under the

existing loan documents is $9,454,962.

No mention is made of the more than $10 million in interest. Nada…

Here are two of Aaron Brown’s posts:

Excelsior Energy to seek huge break from Iron Range Resources

… and …

This Iron Range blogger is done apologizing for Iron Range cronyism

Here’s Charlotte Neigh’s editorial, published in the Grand Rapids Herald-Review and on the Citizens Against the Mesaba Project site:

IRR WRITES OFF $ MILLIONS OWED BY EXCELSIOR ENERGY

Excelsior Energy stalling payment to IRR… AGAIN

August 18th, 2010

.

As inevitable as the tide, the Minnesota winter snows, mosquitos, death and taxes… This is way too predictable! Charlotte Neigh, of Citizens Against the Mesaba Project, is dead on again with her trajectory of Excelsior Energy’s weaseling out of their financial responsibilities in this Mesaba Project boondoggle. A deadline is approaching where Excelsior Energy has to make a payment on its financing from the Iron Range Resources Board:

MCGP Exhibit 5023 – IRR & Excelsior Convertible Debenture Agreement

A little birdie just sent this, literally hours after Charlotte had mentioned that the next payment was coming due and wondering what they were going to pull this time to get out of it (it’s ALWAYS something):

Excelsior asks for more time to repay Iron Range loans