“Wind on the Wires” and AWEA are whining and crying in the press about unfair treatment to wind generators. They do a deal with the devil to promote transmission and now are getting screwed — sorry, I won’t be hosting a pity party here!

AWEA PRESS RELEASE HERE.

AWEA and WOW’s FERC filing to protest MISO cost allocation proposal

To look at the full FERC docket, GO HERE TO FERC SEARCH PAGE, and search for docket ER09-1431.

“Wind on the Wires” is a subset of the Izaak Walton League – Midwest, not a separate organization. Some background here:

Years ago, the Midwest Izaak Walton League, together with MCEA, ME3 (Fresh Energy) and North American Water Office, did a deal with Xcel, and a massive “Wind on the Wires” grant was announced a couple of days later. The deal was to support a massive transmission buildout, specifically, to work to change state and federal law; to support transmission projects; to usher them through the legislature, state and federal administrative venues, to support at industry transmission planning groups; to support changes in rate recovery; to support changes in transmission need and siting criteria; and to allow transmission-only companies, all the things that Xcel wanted to roll out CapX 2020, JCSP, and whatever else is in their dreams.

Really… it’s all here:

Settlement Agreement – ME3, Waltons, MCEA, NAWO

$8.1 Million Wind on Wires grant from McKnight/Energy Foundation

Waltons 2007 Form 990, shows Beth Soholt, WOW Director & Matt Schuerger, Energy Systems Consulting, p. 19

This 2003 Settlement Agreement was in the Minnesota PUC’s TRANSLink docket, where Xcel wanted a transmission only company, not yet allowed in Minnesota. For the docket, go to www.puc.state.mn.us and then click on “eDockets” and search for docket 02-2152. F”or the resulting legislation, some of it, see 2005 Transmission Omnibus Bill from Hell.

So they jump through all those hoops and where are they? What happens?

Back to Cost Allocation of Transmission.

Let’s see… there was one cost allocation scheme, 50-50 split between owner utilities and generators connecting. Otter Tail Power objected and so the utilities changed it to a 90-10 split, and now “Wind on the Wires” and AWEA are screaming, whining and crying saying it has to go back. This has to do with how the utilities characterize the purpose of the line, be it for “Reliability” or “Generation Interconnection” and how costs are apportioned are different. In the CapX proceeding, the “Brookings line” was not declared, and the Fargo and LaCrosse lines were deemed “Reliability” but that’s absurd…

CapX’s Grover – Direct Testimony

CapX Application- Appendix D-5 – Cost Allocation

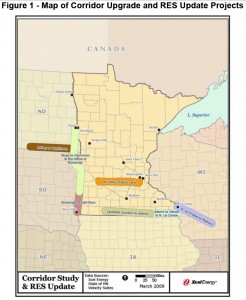

For “Baseline Reliability” projects here’s the cost allocation scheme:

For “Generation Interconnection” here’s the cost allocation scheme:

Ummmmm… a little more background here now that we’re talking about interconnection… does anyone remember the name of that coal plant that Otter Tail Power just got permitted to build? Oh, yeah, right, it’s BIG STONE II. And what was the name of that big honkin’ coal plant that “suddenly decided” to produce electricity rather than syngas? South Heart, yeah, that’s it. See “South Heart coal gasification — Coal on the Wires.” Both plants strategically placed to use CapX 2020 transmission. So what is the impact of this shift to Otter Tail Power and their Big Stone II project?

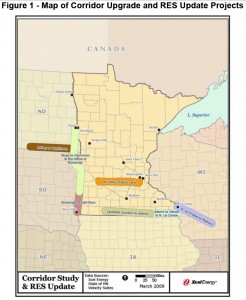

Here’s the Big Stone electrical link to CapX — it’s all connected:

Here’s new connector ND transmission announced April 3 — it’s all connected:

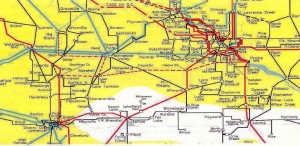

And of course, the big picture of CapX 2020 – click on it for a bigger picture to really appreciate those lines starting in the Dakotas:

Here’s an article from last week about their objections:

By Leslie Brooks Suzukamo

lsuzukamo@pioneerpress.com

Updated: 08/14/2009 12:01:26 PM CDT

The emerging wind industry in Minnesota and the Upper Midwest could be shut down by the cost of connecting to high-voltage transmission lines if a proposal by the organization that controls the Midwest’s power grid goes through, wind advocates say.

The grid operator and some utilities say the wind industry is overstating the effect, but the long-simmering dispute over who should pay for new transmission lines boiled over Thursday.

If the matter can’t be resolved, the wind industry insists, Minnesota’s renewable energy goals would be at risk.

The Midwest Independent Transmission System Operator, which covers 13 states and Manitoba, Canada, last month proposed changing the way costs are shared for new transmission lines. It wants to put 90 percent of the cost on energy generators, including the wind farms springing up across the Dakotas and southwestern Minnesota.

Previously, the cost has been split 50-50 between energy generators and transmission-line owners, typically utilities.

However, Otter Tail Power of Fergus Falls told the grid operator, known as MISO, recently that unless the sharing agreement is changed, Otter Tail would pull out of the system.

Wind farms in the Dakotas representing a total of 10,000 megawatts of electricity — a significant chunk of the power waiting to be added to the grid — wanted to connect to Otter Tail’s grid to reach Minnesota and the rest of the transmission system operator’s territory, said JoAnn Thompson,

Otter Tail’s manager of federal regulatory compliance and policy. Otter Tail consumers were going to have to pay half the cost of the new transmission, even though they would use almost none of that power, as it would be transmitted onward, she said.

“We support developing renewable energy but not at a substantially disproportionate impact to consumers,” she said.

The new cost-sharing proposal, which was submitted to the Federal Energy Regulatory Commission for approval, would increase the cost of developing wind energy projects so much they would no longer be economical, wind energy advocates said Thursday.

The American Wind Energy Association in Washington, D.C., and Wind on the Wires, a St. Paul-based industry association, filed a protest Thursday with the energy regulatory commission opposing the proposal.

“If (the transmission system operator) loads up the cost (of new transmission) on the generators, we won’t get new transmission built,” said Beth Soholt, executive director of Wind on the Wires.

“So unless we get the cost of new transmission spread out more evenly in the MISO footprint, wind-energy development is going to come to a screeching halt.”

The changes also could throttle efforts to export wind energy from the Upper Midwest to the rest of the country, the American Wind Energy Association added.

The Upper Midwest has been dubbed “the Saudi Arabia of wind” because of the region’s gusty conditions, but unless big and expensive transmission lines are built, there is no way to get that power from the scores of wind-energy projects proposed for the isolated prairie to energy-hungry metro areas like the Twin Cities, Chicago and points east, American Wind Energy Association analyst Michael Groggin said.

But Xcel Energy, which must generate 30 percent of its electricity from renewable energy by 2025, says the impact will be temporary. Xcel on Thursday asked the Federal Energy Regulatory Commission to require MISO to propose an alternative plan by April 1 next year, to be effective July 1, said Kent Larson, Xcel’s vice president of transmission.

MISO said it requested the shift in cost sharing to keep Otter Tail from bolting from the organization, which is voluntary. If Otter Tail pulled out, the wind farms in the Dakotas would have to pay higher rates to use Otter Tail’s lines as a bridge to the big cities anyway, said Clair Moeller, MISO vice president of transmission asset management.

A proposal by American Wind Energy Association and Wind on the Wires to spread the cost of new transmission to all MISO members would have caused utilities in the eastern part of the territory with no renewable-energy requirements to leave, Moeller added.

If members left MISO, the system of using the organization as a market to buy the cheapest electricity on the system would fall apart and rates would go up, Moeller said.

“So we were on the horns of a dilemma,” he said.

So if “Wind on the Wires” and AWEA object to “generator pays” transmission, where it’s the generator causing the need, then they’re now in essence advocating for a different scheme for Big Stone II and South Heart coal plants too. Oh, good idea…

Here’s another one that turned up — WOW and AWEA sent out a raft of press releasees…

by Stacy Feldman – Aug 17th, 2009

The burgeoning wind industry in America’s Upper Midwest could be at risk of shutting down if a new transmission policy by a local grid operator goes through, according to a pair of wind advocacy groups.

Even worse — the plan could put the nation’s renewable energy goals in jeopardy.

The American Wind Energy Association (AWEA) and Wind on the Wires (WOW) have filed a protest with the Federal Energy Regulatory Commission (FERC) to stop a proposal by the Midwest Independent Transmission System Operator (MISO) — one that would dramatically change the way costs are distributed for new transmission lines.

Specifically, the plan would force energy generators to bear a 90 percent share of new transmission costs in the region, wind farm developers included.

Currently, generators and utilities split the price paid, 50-50.

For the wind industry, that would be seen as a shame. Current plans for regional wind are grand. Developers want to build a wave of utility-scale wind farms, and get the ones that have already sprouted plugged in. In fact, a decent chunk of the power waiting to be added to the grid in the Midwest is wind.

But if FERC approves the proposal by MISO, which covers 13 states, those megawatts may have to keep on waiting. Here’s why:

“The proposed change would nearly double the cost for a wind plant to connect to the power system in the Upper Midwest, potentially forcing many wind plant developers to pull the plug on tens of billions of dollars of investment they have planned for the region,” said AWEA in a statement.

Simply put, wind would no longer be economical under the MISO scheme, and some projects that are waiting in the wings would be killed.

Without the planned turbines, states in the Upper Midwest, which include Minnesota, Wisconsin, Illinois, Indiana, and the Dakotas, may struggle to meet their renewable energy goals and mandates, the AWEA says. America as a whole would be hard-pressed to reach the White House ambition of doubling the nation’s supply of renewable energy in the next three years sans the Upper Midwest, known as the “Saudi Arabia of wind.”

As AWEA and WOW see it, the MISO policy is “unworkable” for the wind sector because of this fact. It assigns nearly all of the costs of upgrading the grid to the next wind plant waiting in line to connect to it. It’s akin to

“requiring the next car entering a congested highway to pay the full cost of adding a new lane,” said WOW Director Beth Soholt.

The Upper Midwest isn’t alone on this issue. Transmission has become the major tripwire to America’s green-powered future.

One of the biggest hang-ups is over a cross-country transmission superhighway that would zap electricity from America’s midsection to the urban areas that need it. The plan carries a massive, multi-billion dollar price tag. Those in favor say it would move the nation toward a clean renewable energy future. Those against see it as a total waste of cash, a covert attempt to serve some of the dirtiest coal plants, giving them access to new markets through transmission.

And then there’s the big issue of cost: Who would pay for it?

The MISO proposal is a local version of that long-simmering cost dispute.

What’s clear is that loading up the costs on generators could price many wind farm plans out of existence. There’s also the issue of costs to electricity consumers. The price hike to generators that a shift to MISO’s cost sharing would bring would be passed onto certain Midwestern consumers. They’ll end up paying more for the transmission of wind, and may not even benefit, if it gets sent to neighboring states. That could stymie public support for new wind energy.

AWEA and WOW have an alternative vision — to more broadly distribute transmission-line investments “in a way that matches the broadly distributed benefits of building a stronger grid, such as improved reliability and reduced power prices.”

But MISO’s rationale for its policy suggests something else entirely — that wind shouldn’t be the only game in town in the Upper Midwest.

“We continue to focus on addressing the challenges of integrating large quantities of wind through ongoing work with our stakeholders and state officials. This work includes developing long-term transmission plans, cost allocation strategies and other market solutions that preserve and enhance the ability of all resources, including wind, to integrate and operate efficiently.”

FERC has not indicated whether it favors MISO’s proposal or would recommend changes.

In a ruling in June on the Southwest Power Pool (SPP), the agency sided with the wind industry, deciding to more broadly and fairly spread the cost of building new transmission to all users of the SPP electric grid.

SPP serves Kansas, and parts of New Mexico, Texas, Oklahoma, Arkansas, and Louisiana, Missouri and Nebraska. In response to the decision, AWEA was hopeful for future transmission rulings:

“We hope other regions and the federal government will follow their lead and institute similar reforms so that we can begin to put the world-class wind resources that are currently stranded in rural parts of this country to use.”