Plantings in Red Wing

August 9th, 2015

Thanks to Sheila in Frontenac who gave us TWO van loads of day lilies. They’re in, looking kinda bent up and tired, they’ve had quite a journey, but they’re perking up and next year they’ll look like something, and the year after, even better. The grass wasn’t coming in on the boulevard after the West Avenue redo, it looks like crap, so let’s see how the day lilies do. To be covered with chips soon, we have lots of the left over from the West Avenue construction. And on the other side, in the yard, in addition to the day lilies, I’ve added a bee balm and a few cone flowers. Soon, the Little Free Library on the metal post, and I found the perfect browsing chair to chain to the post. Before winter?

Thanks to Sheila in Frontenac who gave us TWO van loads of day lilies. They’re in, looking kinda bent up and tired, they’ve had quite a journey, but they’re perking up and next year they’ll look like something, and the year after, even better. The grass wasn’t coming in on the boulevard after the West Avenue redo, it looks like crap, so let’s see how the day lilies do. To be covered with chips soon, we have lots of the left over from the West Avenue construction. And on the other side, in the yard, in addition to the day lilies, I’ve added a bee balm and a few cone flowers. Soon, the Little Free Library on the metal post, and I found the perfect browsing chair to chain to the post. Before winter?

And speaking of plantings, we often have a picnic up on Memorial Bluff at the lower quarry, the beautiful newly refurbished area with huge stone benches overlooking the garbage burner. They’d reopened it last year, but this year, it was clear most of the newly planted trees had died. Tonight I saw there were new ones… GREAT! But look, really, 6 of them are planted under the transmission line. It’s bad enough that they put two big stone picnic benches under the transmission line, but TREES? How long will it be before our friends at Xcel Energy mow them down?

Property tax relief for transmission lines

August 5th, 2015

My clients have a tendency to hang around like bad habits — once awake to utility schemes, they take a bite and won’t let go. I’ve been blessed with an active bunch, and today I woke up to another example. Nancy “BOOM!” Prehn is one of my faves, she lives on top of the only natural gas underground storage dome in Minnesota, under about 10 square miles north of Waseca. She singlehandedly got an EAW on how the gas company was handling water. At the time, they were releasing water from wells onto their fields, and it wasn’t helping the corn and beans any. Turns out it wasn’t seriously polluted, and the gas company had to build a water treatment facility and storage tanks at each well to contain the water, and then suck it out, bring it over to HQ and run it through the treatment system before releasing it.

Nancy has a way of being ahead of the curve, and when she starts digging, look out. Now she’s working on tax credits for those with utility infrastructure on their land, like a natural gas dome! It’s needed for gas and oil pipelines too!

Here’s what she found today, from the 1979 legislative session, check Article 2, Section 20, a tax credit for landowners living under transmission lines — how did I not know this?

| Chapter 303 | HF1495 |

And it’s still law today:

How much is this tax credit? Well, it’s complicated… and there’s a ceiling, see the statute for specifics:

It was enacted during the last transmission build-out, circa 1979, and has been changed many times over the years:

History:

(2012-3) 1925 c 306 s 3; 1949 c 554 s 3; 1978 c 658 s 4; 1979 c 303 art 2 s 20; 1980 c 607 art 10 s 3; 1Sp1981 c 1 art 2 s 15; 1982 c 523 art 16 s 1; 1Sp1985 c 14 art 4 s 70; 1Sp1986 c 1 art 4 s 24; 1987 c 268 art 6 s 35; 1Sp1989 c 1 art 2 s 11; 1990 c 604 art 3 s 22; 1Sp2001 c 5 art 3 s 44; 2003 c 127 art 5 s 21; 2014 c 275 art 1 s 90

Note this one that changed it from any “high voltage transmission line” as defined by then PPSA 116C.52, Subd. 3, to a high voltage transmission line “with a capacity of 200 kilovolts or more”

which also happened in the Buy the Farm statute:

Bottom line — it’s good people affected by transmission get a tax credit for their burden, but it’s bad that it’s not assessed to the ones that took that easement. It should be assessed to utilities/energy companies, the ones causing it and benefiting from it, not the rest of us taxpayers who have to make up the difference for local governments who need the tax revenues.

TO DO: We need to make this tax credit applicable to all energy infrastructure (Note I said “energy” and not “utility” because there’s a lot of infrastructure being built that is NOT utility. but oil companies, and those “transmission only” private purpose companies.) and to assess the entity that burdened the property for the amount of that tax credit.

One transmission line easement settled!

October 14th, 2014

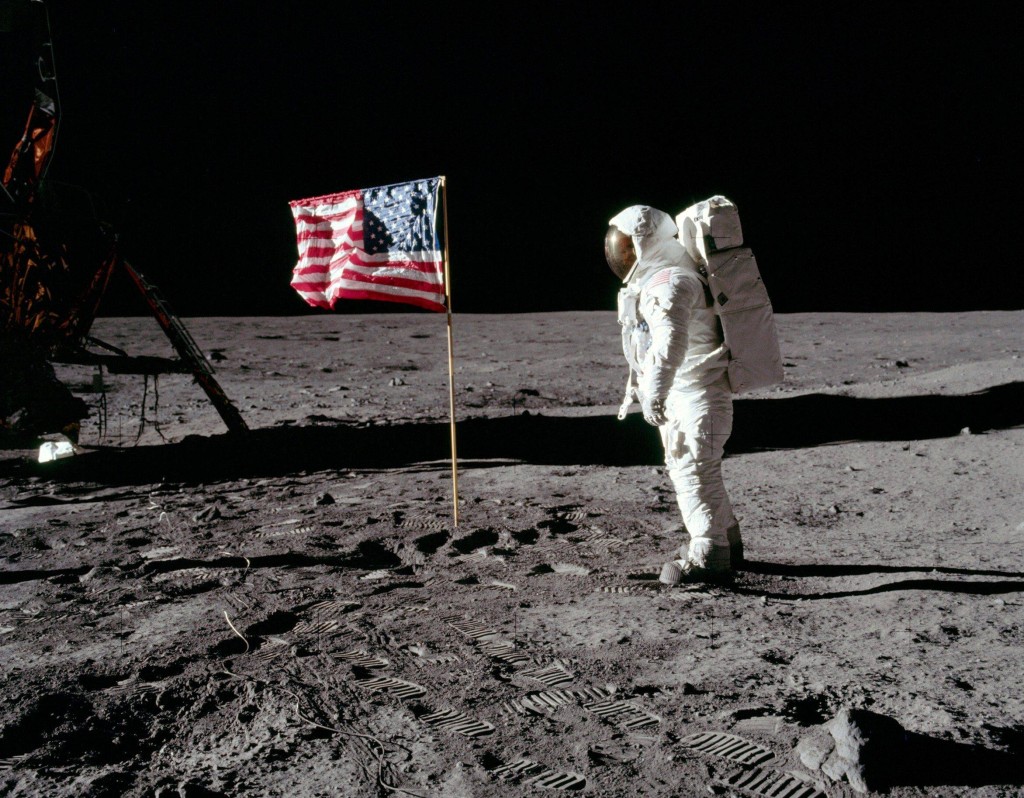

One small step… and a giant leap! A transmission easement settled, and at more than twice the original offer. Yeah, we can live with that.

The troubling thing is that the appraisal didn’t really make sense, and they way they came to the appraisal amount didn’t add up. But despite that, the bottom line was good, so we’re not going to quibble.

Onward, heading up north for transmission hearings for the Not-so-Great Northern Transmission Line.