Xcel Energy admits “growth” is down

July 30th, 2015

Xcel Energy’s 2nd quarter call was this morning.

Xcel Energy (XEL) Benjamin G. S. Fowke on Q2 2015 Results – Earnings Call Transcript

From the Seeking Alpha transcript, a cute tidbut:

Got that?

0.5%

That’s a ways away from the 2.49% upon which the CapX 2020 transmission build-out was based. DOH!

And about multi-year plans and why they “underperformed,” there was this snippet on the Seeking Alpha transcript:

And from our friends at Xcel:

And more:

• Xcel Energy Second Quarter 2015 Earnings Report

• Xcel Energy Second Quarter 2015 Earnings Presentation

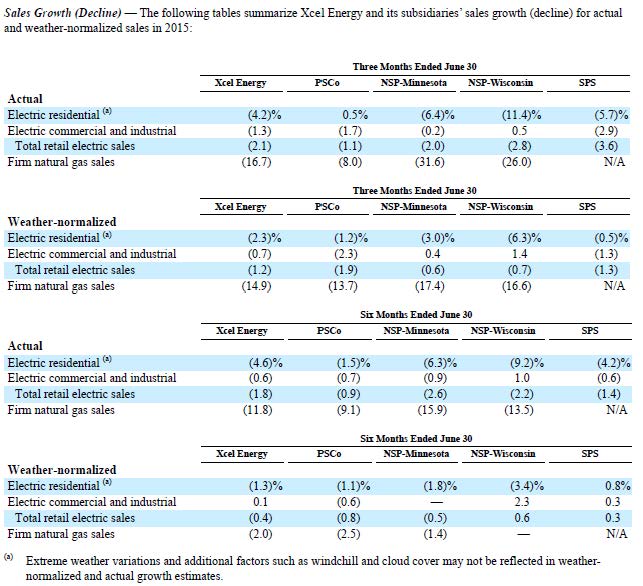

And for those of you into charts and graphs (from the 2Q 2015 Report_1001200774):