ILSR’s Farrell on Fed Transmission Scam

June 29th, 2011

ILSR’s John Farrell is halfway there – he recognizes the federal part of the transmission equation, but the state part is missing, for example, Minnesota’s special eminent domain exemptions for “Public Service Corporations” (particularly where the transmission is for private profit, NOT public service), rate recovery for “Construction Work in Progress” and state regulators refusal to examine the interstate nature of transmission proposals. And the third part of that unholy trinity — in the Midwest, bulk power transmission would not be being built but for the Settlement Agreement – ME3(Fresh Energy), Izaak Walton League (and Walton’s program Wind on the Wires), Minnesota Center for Environmental Advocacy, and North American Water Office. This glut of transmission is their legacy. It takes all three to build transmission.

From Grist, today:

Feds running a high-voltage gravy train for power transmission

by John Farrell

28 Jun 2011 6:00 AM

Even as distributed generation shows economical and political advantages over centralized renewable energy, the Federal Energy Regulatory Commission (FERC) is running a high voltage gravy train in support of expanded transmission. FERC’s lavish program is expanding large transmission infrastructure at the expense of ratepayers instead of looking at more economical alternatives.Since 2007, FERC has had 45 requests for bonus incentives for transmission development — authorized under the 2005 Energy Policy Act — and has provided all or most of the requested incentives in more than 80 percent of the cases. With the bonuses, the average return on equity for utilities for their new transmission investments is nearly 13 percent. This high rate of return is a full 2.5 percentage points higher than the median utility return on equity [PDF], a value considered just and reasonable by state public service commissions in ordinary times. However, these rewards came during a time when unemployment doubled, the stock market tumbled, and most corporations were lucky to have any profit.The ratepayer impact of these bonuses is significant. In a November 2010 criticism of FERC transmission awards, Commissioner John Norris noted that the 2 percent bonus FERC provided to the PATH high-voltage project on the Eastern seaboard would “cost [Maryland] ratepayers in PJM at least $18 million per year.” The bonus payments were also given in concert with other incentives that reduced risk, including rate recovery during construction and guarantee of payment if the facilities were abandoned for reasons outside utility control.

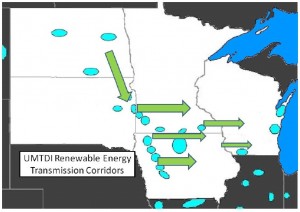

UMTDI Transmission coming soon?!?!?!

September 30th, 2010

But wait… it’s already here!

Just in from Bob Cupit, from the Upper Midwest Transmission Development Initiative:

Here’s the initial idea:

The RGOS first-mover subset located within the UMTDI states’ footprint is:

• Big Stone, SD to Brookings, SD 345kV – estimated cost of $150 million.

• Brookings, SD to Twin Cities, MN 345kV – estimated cost of $700 million.

• Lakefield Junction, MN to Mitchell County, IA operated at 345kV but constructed at 765kV specifications to allow full upgrading and operation at 765kV in the future – estimated cost of $600 million.

• North La Crosse, WI to North Madison, WI and Dubuque, IA to Spring Green, WI to Cardinal, WI 345kV – estimated cost of $811 million.

• Sheldon, IA to Webster, IA to Hazleton, IA 345kV – estimated cost of $458 million.

In addition to the proposed transmission projects above, the Midwest ISO’s Midwest Transmission Expansion Plan (MTEP) for 2011 identifies the following transmission project as an initial candidate for regional cost sharing because of its regional benefits.

• Ellendale, ND to Big Stone, SD 345 kV – estimated cost of $275 million.

OK, folks, do any of these lines look familiar? Why is the CapX 2020 Brookings SD to Twin Cities MN 345kV line on this list? Why is the CapX/ATC North LaCrosse, WI to North Madison, WI on this list? Hmmmmmmmmmm…yet they say this:

Although UMTDI actively engaged in the identification of possible renewable resource areas and potential transmission corridors, this should not be taken as expression of support for particular routes, particular projects, particular voltages, or appropriate levels of spending in any state proceeding. Those decisions remain for a future day, when specific projects might be proposed. However, the Executive Committee sees great value in affirming its support for coordinated state efforts on these multi-state projects, and its general support for these corridors, which appear to have value in all identified reasonable futures.

Um… hello, they’re listing specific proposed projects.

Of course it’s all connected, how stupid do they think we are? Well, pretty damn stupid, look what they’re recommending, cost-sharing to shift the cost across MISO:

A key, unresolved issue for construction of projects of this magnitude is cost sharing. The criteria in the Midwest ISO’s recent tariff filing at FERC, as well as other activities ongoing at the Midwest ISO, indicate that these first-mover projects would likely all qualify for cost allocation treatment. This designation would mean that all energy users in the Midwest ISO’s footprint would share the costs of these “no regrets” lines. FERC has not approved this rate treatment, however, and it is likely that FERC will receive a number of comments and objections to the Midwest ISO’s tariff proposal. While the UMTDI Executive Committee has not taken a position on the Midwest ISO’s cost allocation filing, it is safe to say that the absence of cost sharing would make construction of EHV transmission lines in these corridors very difficult.

And PJM too:

The total cost for these first-mover lines is approximately $5.8 billion with $1.4 billion being funded by customers in PJM, the Midwest ISO’s neighboring independent system operator to the east.

And because they know this isn’t needed or wanted, they’re frantically trying to find a way to circumvent state authority — how about a multi-state regulatory body to site transmission… or direction to the states from FERC to act:

States Together

Interstate Compacts At the highest levels, all five states have the power to create a compact, with the consent of Congress, to establish a common agreement on how to develop the UMTDI Project. Minnesota and Wisconsin provide specific powers to their respective governors to enter compacts involving transmission lines. Congress has specifically contemplated the compact mechanism by authorizing three or more states to form a compact, subject to Congressional approval to “facilitate siting of future electric energy transmission facilities.” Sec. 216(i) of the Federal Power Act (FPA), 16 U.S.C. § 824p. Another FPA provision, little used § 209, authorizes the FERC to delegate any subject matter in its jurisdiction to a group of states, offering another potential avenue of federal approval for joint state action on transmission siting and cost allocation.

…”little used § 209″… how perverted can we get? Perhaps there’s a reason why a state PUC would be reluctant to permit projects like this?!?!?!?

Xcel’s “forward sale agreement”

August 5th, 2010

Xcel is trading a bunch of paper for a bunch of money, 21,850,000 pieces of paper to be precise. How much money is that? Seems to be $469,775,000, or $408,500,000, gross, or $396,245,000 net to Xcel, depending on what numbers you look at, or what they sell at!

What will they do with it? According to the prospectus, and an article written about it:

“Xcel Energy intends to use any net proceeds that it receives upon settlement of the forward sale agreement described above, or from the sale of any shares to the underwriters to cover over-allotments, to repay outstanding commercial paper and make capital contributions to its operating subsidiaries.”

Here’s an article from Marketwatch:

Doesn’t this have the feel that they’re desperate for cash flow? We know they can’t get their construction capital to build the Brookings transmission line, and they’re hot to trot both about PUC ordained rate recovery, which they did not get and their Motion for Reconsideration (PUC Docket 09-1048) went nowhere.

Here’s Seeking Alpha’s Xcel 2Q Earnings Call Transcript!

Seeking Alpha Xcel 2Q Earnings Call Question & Answer

And a choice answer snippet from the Q&A:

Time to change channels…

June 3rd, 2010

It’s all been happening over at NoCapX 2020 — there’s exciting news to publish here on other things, but no time until after tomorrow at 4:30!!

Big Stone II transmission is DEAD

March 5th, 2010

This was in the mail — what a day this has been. I’ve been buried in other things and lost track of this one.

Big Stone II transmission connected into CapX.

The transmission study shows that BSII transmission needs CapX:

And the question remains — how much does CapX 2020 need BSII?

Thanks to a little birdie for bringing this PUC Order to my attention!!!