Biennial Transmission Plan Reply Comments filed

March 15th, 2023

I must admit, I get so tired of over and over and over and over harping on the basic bottom line, that we DON’T NEED MORE TRANSMISSION. But oh well… here we go again. Just filed Reply Comments on the Biennial Transmission Report:

Once more with feeling:

2021 Biennial Transmission Report

MISO bars access to planning meetings

May 24th, 2017

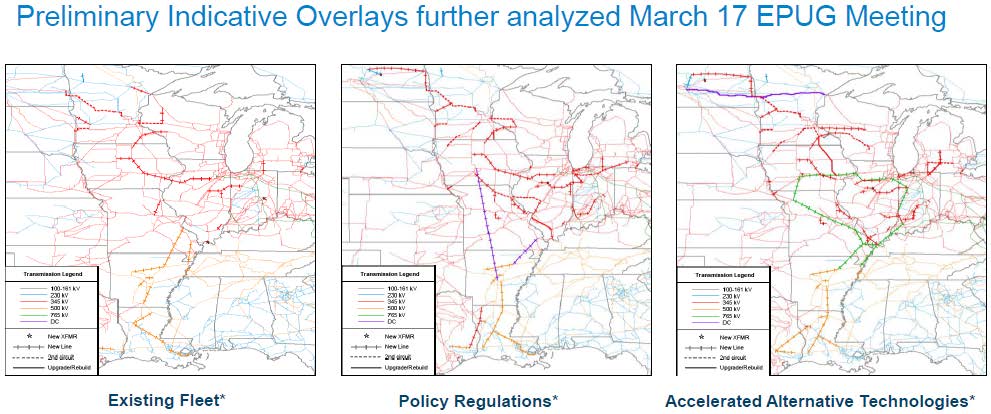

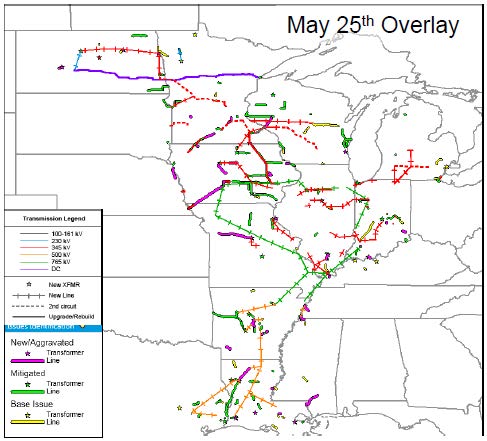

From the public meeting materials, here’s what they’re looking at, above. These are significant additions to the transmission grid in Minnesota and Wisconsin.

MISO’s Economic Planning Users Group is planning a “Regional Transmission Overlay Study” and they’re having another meeting tomorrow, May 25, 2017 down in Metatairie, Louisiana.

Here’s the call in info:

WebEx Information

Event Number: 966 575 350

WebEx Password: Ts824634Participant Dial-In Number: 1-800-689-9374

Participant Code: 823713

Meeting Materials from the MISO site:

- 20170525 EPUG Item 01 Agenda 5/23/2017 05:24 PM

- 20170525 EPUG Item 02 Regional Transmission Overlay Study Overview 5/22/2017 05:47 PM

- 20170525 EPUG Item 03 Preliminary Overlay Indicative Concepts 5/23/2017 05:29 PM

- 20170527 EPUG Item 04 Explore New Benefit Metrics RECB Survey 5/22/2017 04:42 PM

- 20170525 EPUG Item 05 Michigan Exploratory Transmission Study Transmission_Ideas 5/22/2017 04:44 PM

- 20170525 EPUG Item 05 Michigan Exploratory Transmission Study Update 5/22/2017 04:44 PM

- 20170525 EPUG Item 06a Indicative Overlay Design Work Session West 5/24/2017 02:20 PM

- 20170525 EPUG Item 06b Indicative Overlay Design Work Session Central 5/24/2017 02:21 PM

- 20170525 EPUG Item 06c Indicative Overlay Design Session Sub-regional Connections 5/24/2017 02:22 PM

- 20170525 EPUG Item 06d Indicative Overlay Design Work Session South public 5/24/2017 02:23 PM

- 20170525 EPUG RTOS Issues List 5/23/2017 05:45 PM

- 20170525 EPUG RTOS Ideas Tracking Sheet 5/23/2017 05:44 PM

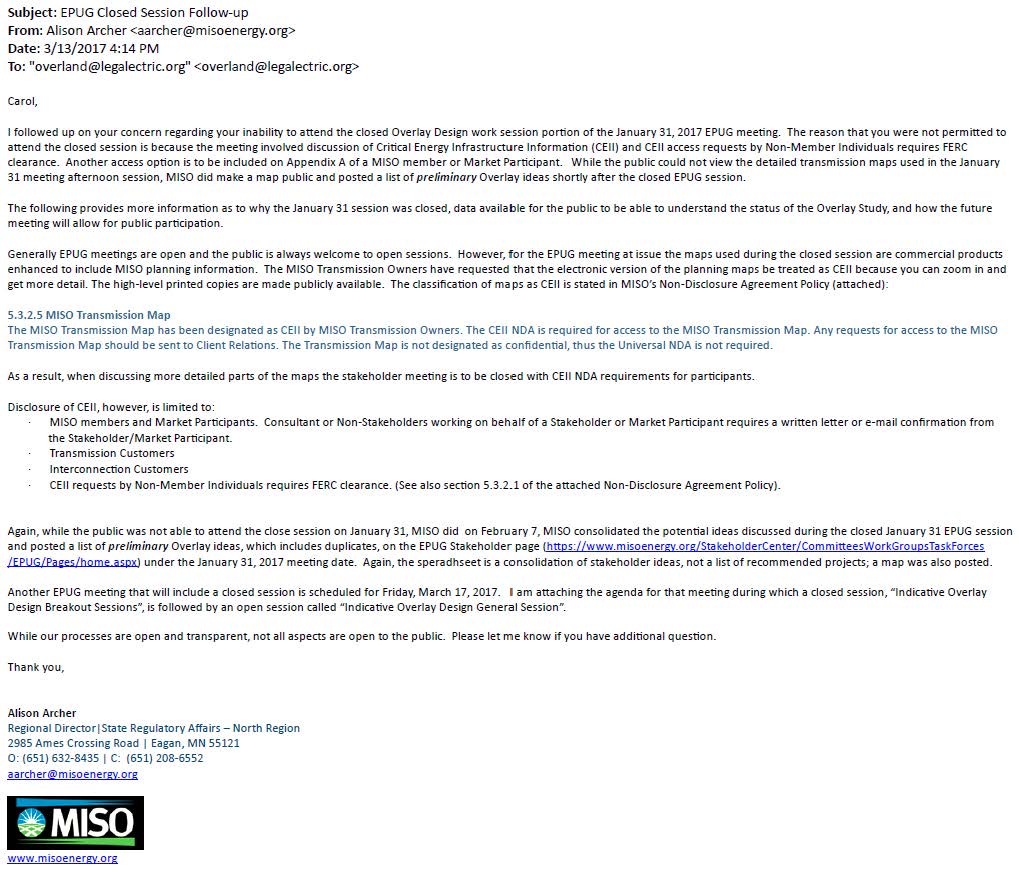

Here’s the problem — they close the meeting, and people like me aren’t allowed to attend. First I was told, back in January when I tried to register:

Thank you for registering for the Economic Planning Users Group (EPUG) on Jan 31. The afternoon portion of this meeting will be held in CLOSED session and reserved from MISO Members or Market Participants only. Please feel free to attend the morning session from 11:00 am to 12:45 pm ET / 10:00 am to 11:45 CT.

I filled out their “CEII – Non-Disclosure Agreement” form and fired it off. But noooooo…

So next I went to the PUC’s Quarterly MISO update, where I was assured that we could make arrangements so that I could attend. I resent the “CEII – Non-Disclosure Agreement” and went back and forth and it came to this (click for larger version). Note this “explanation” of options to be able to attend:

The reason that you were not permitted to attend the closed session is because the meeting involved discussion of Critical Energy Infrastructure Information (CEII) and CEII access requests by Non-Member Individuals requires FERC clearance. Another access option is to be included on Appendix A of a MISO member or Market Participant.

So that says there are two ways to gain access, 1) get “FERC clearance” or 2) “Another access option is to be included on Appendix A of a MISO member or Market Participant.” One or the other. Emphasis added. Here’s the email (click for larger version) laying out those two options:

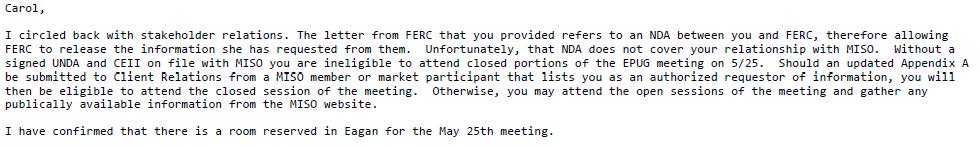

Oh, I says to myself, off to FERC. I sent in the requisite paperwork to FERC, and got “FERC clearance” and they shipped me the CEII information, including but not limited to the map. I let MISO know I’d obtained “FERC clearance,” and here’s the response (click for larger version):

ARRRRGH, they have my CEII NDA on file, have had it since January 23, 2017. I resent it to the writer of these emails on March 4, 2017, and I sent it again today, and objected to yet another change in their “rules” (click for larger version):

So the plot thickens — from MISO (click or larger version):

And from moi (click for larger version):

Transmission in NYT today

February 7th, 2009

Matthew Wald has a good piece in the NYT today, good in that it raises some of the issues, but these issues raised need some more digging, can you dig it?

Check this paragraph from the article:

In fact, energy experts say that simply building a better grid is not enough, because that would make the cheap electricity that comes from burning coal available in more parts of the country. That could squeeze out generators that are more expensive but cleaner, like those running on natural gas. The solution is to put a price on emissions from dirtier fuels and incorporate that into the price of electricity, or find some other way to limit power generation from coal, these experts say.

Not “could,” but WOULD “squeeze out generators that are more expensive but cleaner” and adding externalities to coal generation cost would only stop that, would only be a “solution” if it tacked on HUGE costs, far greater than those anticipated by those advocating either Cap & Trade or Tax.

But those of us in transmission are glad to see the driver for new construction exposed, as it was in the MISO Benefits Study by our good friends at ICF:

RTO operational benefits are largely associated with the improved ability to displace generation with coal generation, more efficient use of coal generation, and better use of import potential.

Here’s that MISO study, the above quote comes from the conclusions, p. 83, and is also stated in the intro — THIS IS THE REASON FOR TRANSMISSION, THIS IS THE REASON FOR THE MIDWEST MISO MARKET. Read the study:

ICF’s Independent Assessment of Midwest ISO Operational Benefits

For example, Jose Delgado whining about hwo long it took to get the permit for Arrowhead, what does he expect for a project that was an absurdly obvious ploy for a superhighway for bulk power portrayed as a “local load” need for WUMS? They put together many options in the WRAO report, and selected one, Arrowhead, “3j,” as the be-all and end-all of transmission. That was declared the ONE line that would fix Wisconsin. Then, next thing you know, they still want to do “5” more commonly known as the Chisago project, they want to do “9” in SW Minnesota claiming “it’s for wind” when there’s only 213-302MVA coming off of Buffalo Ridge into the Nobles substation, they do them all because that’s what they want, they can ship bulk power. It’s been so dishonest… Utilities have been so dishonest…

And let’s look at the financing of these lines. CapX 2020 testimony and a powerpoint demonstrate that they don’t have the financing lined up for that $2 billion dollar project. They were working through Lehman Bros. so what does that say? The “Cap” of CapX 2020 is “Capital” and they don’t have it. But because they want it, they’ll make us pay for it. Is something wrong with this picture?

———————————————–

Hurdles (Not Financial Ones) Await Electric Grid Update

“We burn up three years on a line that will take two months to build,” he said.

Transmission – Mid-Atlantic Power Pathway

February 2nd, 2009

Delmarva Power has been hosting meetings about its proposed Mid-Atlantic Power Pathway. The next meeting is:

Wednesday, February 4 @ 6 p.m.

Millsboro Civic Center

322 Wilson Highway

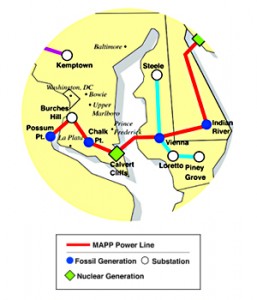

This is an electrical superhighway through Delaware, the map makes that much clear.

What’s interesting is that Rep. Tom Carper seems to be taking an enlightened and informed position on this:

Today, there’s a long piece in the News Journal about it, with the above quote from Carper:

Power-line plan stirs environment fears

Bluewater Wind hails pathway for clean energy

Delmarva Power to hold transmission line meetings

January 22nd, 2009

MID-ATLANTIC POWER PATHWAY?

JUST SAY NO TO TRANSMISSION FOR COAL AND NUCLEAR.

Delmarva Power will be hosting three meetings in Sussex County on the MAPP transmission line, no not MAPP of “MAPP map” fame, but Mid-Atlantic Power Pathway, a big line designed to bring coal generated electricity through Delaware, and take Delaware’s Indian River coal generation north east into New Jersey.

Times, dates and locations for community meetings:

Tuesday, January 27

Delmar Fire Hall

Bi-State Blvd. & Grove St.

Delmar, Del.

6 p.m. to 8 p.m.Thursday, January 29

Gumboro Fire Hall

37030 Millsboro Highway

Gumboro, Del.

6 p.m. to 8 p.m.Wednesday, February 4

Millsboro Civic Center

322 Wilson Highway

Millsboro, Del.

6 p.m. to 8 p.m.

Delaware is way behind in transmission regulation. Unlike most states, Delaware does NOTHING at all to regulate transmission — there’s no Certificate of Need or Certificate of Public Convenience and Necessity required, they do NOT have to demonstrate that the line is needed. And there’s no PSC routing proceeding either. In most states, they DO have to demonstrate need or the line cannot be built, and the line must be for a public purpose. For the MAPP line, which is bulk power transfer, MARKET TRANSACTIONS, there’s no public purpose here, just private purpose, corporate profit. There’s nothing in it for Delaware. Well, it does enable NRG to move its coal generation around more easily.

You may hear claims “it’s for wind” and that is a crock. You may have heard Jeremy Firestone say that this line is designed for coal and nuclear, but could be designed to help wind development in Delaware — Jeremy Firestone may be the wind guru, but Firestone’s outside his area of expertise and his failure to say “SHUT DOWN INDIAN RIVER” comes through loud and clear. Here’s Firestone and Kempton’s comments about MAPP from Bluewater Term Sheet comments:

NO NO NO, that only enables coal and nuclear. Whatever are you thinking?

Delaware Electric Cooperative has said that it wants to build a NEW North Anna nuclear plant — is that still DEC’s plan? If so, the MAPP line would get that nuclear power there, and all DEC customers would be participating in nuclear expansion. Is that what you want? This is an issue for Sussex county to weigh in on now!

Shutting down NRG’s Indian River Generating Plant is the logical step to help wind development in Delaware, both in market development and transmission access. And of course it’s the logical step to reduce toxic emissions in Delaware — the Indian River Generating Plant is the largest point-source polluter in Delaware. To quote Muller: DELAWARE NEEDS TO STOP BURNING COAL.

How would shutting down the Indian River plant enable wind? Indian River’s two smallest plants will be shut down in 2009, and removal of that generation leaves enough transmission infrastructure generation and reservations for the Bluewater Wind project. If Indian River was completely shut down, there’s room for a lot more off-shore-wind generated electricity than Bluewater plans — several times the MW of the Bluewater Project. Let’s get to it — shut down Indian River now — and if NRG’s bid for gas generation to back up wind is approved, that would be sited there — just the right place back up wind and provide reactive power for the system.

And a little sidebar — though many Renewable Energy Standards passed, ALL have a fatal flaw — not a single one is linked to any shut down of fossil fuel generation. So for a 25% RES, we’re looking at adding that above current generation, not cutting generation, so the numbers look like this: 100% demand + 25% RES = 125% rather than 100% demand -25% fossil fuel + 25% RES = 100%. That may seem simple… so why are all RES’s missing this important connection?

What this MAPP line does is enable coal generation from the other end of the line and coal generation at Indian River to continue, and to be sold on the market, so that even if Delaware does not use the generation, they can sell it elsewhere. Even if CO2 externalities add to the cost, on the spot market they can sell it anywhere and still make a lot of money. Yeah, good idea.

Once more with feeling — Two points here:

1) SHUT DOWN ALL OF NRG’S INDIAN RIVER COAL GENERATING PLANT AND MAKE ROOM FOR WIND!

2) JUST SAY NO TO TRANSMISSION FOR COAL!

Here’s Delmarva’s blurb published nearly verbatim in the Sussex Countian:

Here’s the Delmarva from a PR service:

Mid-Atlantic Power Pathway Meetings Scheduled for Sussex County, Del.

Times, dates and locations for community meetings:

Tuesday, January 27

Delmar Fire Hall

Bi-State Blvd. & Grove St.

Delmar, Del.

6 p.m. to 8 p.m.Thursday, January 29

Gumboro Fire Hall

37030 Millsboro Highway

Gumboro, Del.

6 p.m. to 8 p.m.Wednesday, February 4

Millsboro Civic Center

322 Wilson Highway

Millsboro, Del.

6 p.m. to 8 p.m.