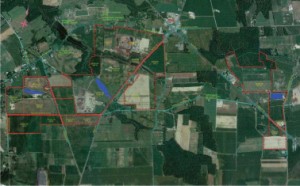

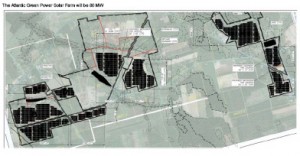

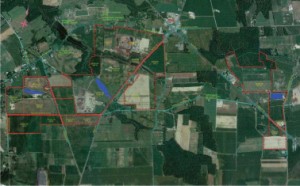

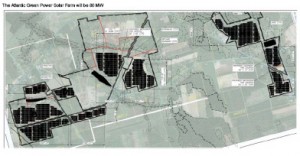

This is a map of the footprint of the 78MW Stella Solar and Atlantic Green Power project proposed for Upper Pittsgrove, New Jersey. I’ve ehard there are others planned nearby, but that this is the biggest.

Project description from Atlantic Green Power Holding Company 3Q 10-Q filing:

Pittsgrove Solar Farm

There are two meetings coming up about this project:

Informational Meeting

Elmer Grange Hall

Tuesday, March 16, 2010 from 6 to 8:30 p.m.

and the Land Use meeting where the town will approve or deny the application:

Upper Pittsgrove Town Hall

Thursday, March 18, 2010 at 7:30 p.m.

Now you all know how I love solar, from the solar hot water my father designed for the Minnesota Zoo to those simple little heaters you can make or buy:

Build a Simple Solar Heater

Northern Tool sells simple solar air heaters

Every house needs these simple solar heaters.

Solar PV should also be on the roof of every big box there is, and on every home. But to be clear, I don’t think it belongs covering prime ag fields a long way from load. That isn’t “highest and best use,” and just doesn’t make sense when you consider the capacity factor of solar and the line loss over transmission. So, this project seems odd…

Why do it? Well, look who is involved and the incentives — means, motive and opportunity — and given that, I hope the town will take a close look before jumping, at the very least, require these conditions (off the top of my head):

- No ag land be removed from production; and

- No ag land be removed from ag preservation designation; and

- Commercial solar be limited to commercial and industrial areas; and

- Commercial solar be limited to roofs in rural areas.

WHO IS GOING TO BUY THIS POWER?

LET’S SEE THE POWER PURCHASE AGREEMENT!

The article way below, from Today’s Sunbeam, says it is to be built on land that “is currently owned by Ed Stella and will be leased to Atlantic Green Power…” but the Atlantic Green Power site says that Edward Stella, Jr., is the “Vice President of Project Development.” From what I can see, this is their FIRST project. Edward Stella as VP? Really, it’s right here, so we’re not exactly talking about an arms length transaction:

Edward Stella, Jr.

Vice President of Project Development, Director

Edward Stella, Jr. was appointed as the Vice President of Project Development and as a Director of Atlantic Green Power Holding Company on February 3, 2010. He also was a founder of Atlantic Green Power Corporation, the wholly-owned subsidiary of Atlantic Green Power Holding Company, and has served as a Director thereof since its inception on September 17, 2009. He has over 30 years of experience in land development, land clearing and mulching operations. He is the President of Stella Contracting, Inc., one of the largest land-clearing companies operating on the East Coast, and the President of South Jersey Agricultural Products (SJAP), a company engaged in the sale of top soil and mulch to such customers as Scott’s, Coastal Supply, Home Depot and Lowes. Mr. Stella has had the honor of being nominated by Ernst & Young LLP for Entrepreneur of the Year in 2000 in the greater Philadelphia area.

If he’s connected to “such customers as Scott’s, Coastal Supply, Home Depot and Lowes” why aren’t they putting solar on the roofs of those big boxes, where it can be used, and not on prime ag land far away from big boxes?

Atlantic Green Power Holding Company has been in existence since September 17, 2009, and Edward Stella, Jr., has been “Vice President of Project Development” and a “Director” for all of a month.

A press released based blurb provides two sources for more information:

Robert Demos, Jr., President & CEO of Atlantic Green Power Holding Company

and

Howard Greene, Greene Inc., and CLICK HERE FOR GREENEINCPR.COM — HA!!

So now, let’s look at Lodestar Mining… from their site, their ONLY press release listed posts these links for Atlantic Green Power and Lodestar. CLICK ON THESE LINKS THAT THEY PROVIDED:

AGPH per yahoo

So keep digging – here are their SEC filings

LGST – their own link says “There are no All Market results”

Hmmmmmmmmmmm…

CLICK HERE for Lodestar’s 10-Q for the year ending June 30, 2008, with this statement:

CLICK HERE FOR LATE FILED 2008 10-K.

From their 10-K regarding their one option contract:

And this snippet:

We issued 3,000,000 shares of common stock pursuant to the exemption from registration set forth in section 4(2) of the Securities Act of 1933. On November 15, 2006, the corporation issued 3,000,000 shares of restricted common stock to Ian McKinnon, Chief Executive Officer of Lodestar Mining, Incorporated, that Rule 144 of the Securities Act of 1933 defines as restricted securities. The shares were issued in consideration for payment of $30,000 US from Ian McKinnon. These shares will be restricted by the resale limitations of Rule 144 under the Securities Act of 1933.

And again, a statement of its tenuous existence as a going concern:

CLICK HERE for latest SEC filings as Atlantic Green Power Holding Company — SUDDENLY IT’S ATLANTIC GREEN POWER HOLDING COMPANY, NEW PEOPLE, NEW PUROSE

And again, the solar project particulars:

Something that caught my eye on their site — which is repeated in the SEC 3Q 10-Q filing — a press release that talks about the ARRA incentive, a 30% cash payment in lieu of federal investment tax credit, and federally guaranteed loans and a 30% investment tax credit. Seems ALL of those would apply here, so let’s say Mr. Stella is “motivated.”

In the U.S., the American Recovery and Reinvestment Act stimulus bill of 2009 (ARRA) contains several provisions designed to alleviate renewable energy project financing constraints resulting from the economic downturn.

The ARRA establishes a temporary grant program that will allow commercial solar customers to receive a cash payment to cover 30% of the cost of installing solar equipment in lieu of the federal investment tax credit. The ARRA also appropriated $6 billion for a new loan guarantee program which the government estimates could support up to $60 billion of loans specifically for renewable energy and transmission projects. In addition, ARRA includes up to $2.3 billion for a new 30% investment tax credit for U.S. based renewable energy product production facilities.

Here’s the article from Today’s Sunbeam:

UPPER PITTSGROVE TWP. — Cropland here may see a new use in the near future after plans were submitted to the Upper Pittsgrove Township Planning Board to construct a 512-acre solar farm here.

The plans call for the solar farm to be spilt into two separate sections— an east site and west site. The land is currently owned by Ed Stella and will be leased to Atlantic Green Power based of Egg Harbor Township, officials say.

“We are talking about a total 72 Megawatts that will be generated,” said Richard M. Hluchan, Stella’s lawyer. “That is enough electricity to service 7,000 homes.”

The east site in total is comprised of 177 acres of farmland located near the intersection of Route 40 and Burlington Road. Ninety acres of that property will be used for solar panels, said Hluchan.

The west site will be located along Route 77 and its intersections with Newkirk Station Road, Colson Road, Bridgeton Road and Jefferson Road. Of that 681-acre property, 422 acres will be used for solar panels, said Hluchan.

“The panels will not be set up in one large mass section,” said Hluchan. “The east site will be split into three sections and the west will be split into 10.”

Extensive landscaping will surround the facility minimizing the eyesore of the panels with trees. Fencing will also be put up for security.

Read the rest of this entry »