A storm of biblical proportions…

February 5th, 2010

SNORT!

CLICK HERE FOR THE NEWS JOURNAL SLIDE SHOW

If you’re from the Midwest, you’ll see why I don’t believe the hype.

There’s really no snow to speak of… But what do they do in Delaware?

ECONOMIC STIMULATION, they scream SNOW and everyone runs to the store, literally, shelves were empty, lines going way back, cashiers frantically calling for every employee in the store to open a register.

THE GOVERNOR SHUT DOWN THE STATE, nobody’s supposed to travel after 10 p.m.

and not just Delaware:

Washington, D.C., is supposed to get 24-30″ which begs the question — is hell freezing over?

Maybe they’re planning for us to freeze in the dark in an incubator without a job. Tomorrow morning will tell…

Minnesota Resource Assessment Survey

October 21st, 2009

From the Minnesota Office of Energy Security:

… the Minnesota Resource Assessment … sigh…

Get out your waders… from the solicited Comments at the end, from “stakeholders,” (did I miss some notice and comment period here??? Did any of YOU get notice???) the problems raised are nearly universally complaints.

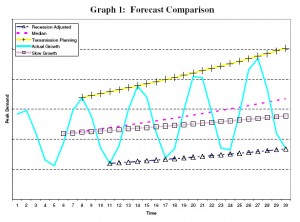

OK, now open it up and look … and in it on page 6 is that MOE’S napkin calulation that they finagled into the CapX 2020 record after we got extracted some damning testimony about decreased demand, this is such utter bullshit, look at this and see for yourself:

And you may ask, what that in the X axis? Good question, there’s no identification. And the Y? Same.

WTF?

This is the report we’ve been waiting so long for?

This is the report that, at the Legislative Energy Commission I testified at, Chair Solon-Prettner was asking for, demanding, because it was way late?

This report was presented in all seriousness to the Legislative Energy Commission? I would hope that I could hear them laughing all the way down here in Red Wing…

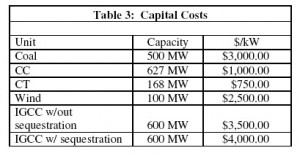

Here’s “Capital Costs” from page 19:

And further back, the Preliminary Capital Costs:

Oh, please… Commerce was part of the Mesaba Project, and Elion Amit did the economic analysis. From that 2005 data, this is way way off, THERE IS NO EXCUSE FOR THIS WHATSOEVER.

IGCC in 2005 dollars was $3,595/kW and now it’s more.

IGCC w/ sequestration is, first, NOT POSSIBLE, and second, price would double just for capture, and the storage can’t be done.

Coal is more expensive that that and you know it.

Wake me up when you can deliver some meaningful numbers.

Look at “Generation by fuel source under selected scenarios” starting on p. 87. In only one scenario does coal go down at all, and that’s for a “National RES” scenario, and it only goes down a teeny teeny bit. Give me a break…

DOH!

If you have questions or comments on this Minnesota Resource Assessment contact:

Marya White, Reliability Administrator

Minnesota Department of Commerce

85 7th Place East. Suite 500

St. Paul, MN 55101

651-297-1773

marya.white [at] state.mn.us

If you want to tell Steve Rakow what you think of his “Forecast Comparison” and analysis:

Steve Rakow

Minnesota Department of Commerce

85 7th Place East. Suite 500

St. Paul, MN 55101

steve.rakow [at] state.mn.us

Once more with feeling…

DOH!

7th Circuit tosses out FERC & PJM cost apportionment

August 13th, 2009

I was a big Posner fan in law school, mostly because he was so much fun to pick on, I so hate the “Chicago school.” But here’s another Posner, doing good! It’s a hilarious opinion, all the better because it so clearly tells FERC and PJM what to do with their rate shifting cost apportionment. GO POSNER!

Here’s the decision:

Two issues in this case:

1) PJM/FERC pricing based on marginal cost v. pricing including sunk costs. That one went for PJM/FERC, and American Electric and others lost in just a few paragraphs.

2) Where the action is — Ohio and Illinois Commissions objected to the 500+kV cost allocation on a pro rata basis, that “their rats should be raised by a uniform amount sufficient to defray the facilities’ costs.”

What’s particularly interesting to me is that this is all about “Project Mountaineer,” which PJM doesn’t even want to acknowledge exists! the Susquehanna-Roseland line that I’m working against is the NE part of line 1, and the MAPP line through now “just” a part of Delaware is the NE part of the southern line, line 4. Here’s the magnitude of Project Mountaineer – the Susquehanna-Roseland line is QUAD 500kV plus double circuiting the existing 230kV line, that’s one big project:

FYI, in the Cudahy dissent, he did some digging, and there is a Project Mountaineer tootnote quoting PJM stating that Project Mountaineer “would bring about substantial congestion relief and reliability improvements increasing Midwest-to-east transfers by 5,000 MW.” See Ventyx, Major Transmission Constraints in PJM (2007).

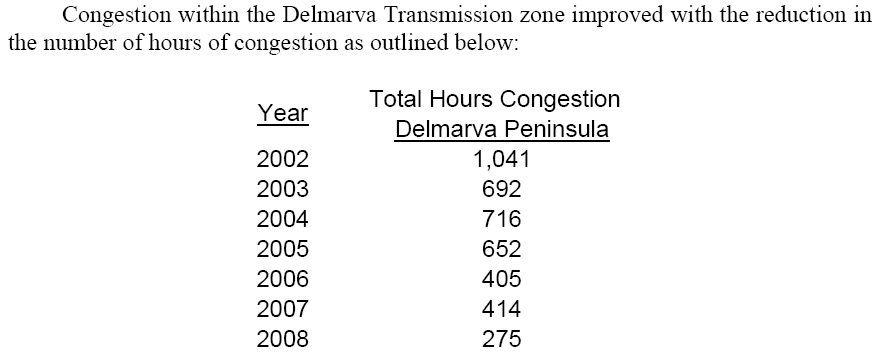

A quick sidebar… FYI, from Delaware Electric Cooperative 2009 Energy Plan – “CONFIDENTIAL”, arguing for the MAPP transmission project…

… and they report that transmission congestion is down 75% to 275 hours ANNUALLY! Really… so for that 275 hours we should build the $1.2 MAPP project? HOW STUPID DO YOU THINK WE ARE?

OK, back to Posners 7th Circuit decision. It was PJM’s idea, approved by FERC, to hit up all the utilities, and Illinois, a BIG example of the problem, would have had to pay out some $480 million while not receiving one dime of benefit. PJM used the theory that, well, PJM used to do it this way all the time before in massive infrastructure buildouts, but as Posner reminded them, that was then and this is now, PJM is a lot different now, Illinois wasn’t even part of the picture.

Posner was pissed off that there was no data at all to support their desired allocation, no data, no specifics about difficulties in assessing benefits, no lawsuits about inequities, no particulars, “[n]ot even the roughest estimate of likely benefits to the objecting utilities… oh yes, he let them have it… for page after page… and notes that FERC “brief devotes only five pages to the 500kV pricing issue.” FERC seems to presume a similar brainwashing in the courts that they and utilities presume of Commissions and legislatures, one that I see to often, that frantic claim of URGENT need, ‘WE’RE GOING TO FREEZE IN THE DARK IN AN INCUBATOR WITHOUT A JOB” theory, presented despite documented long term decrease in demand across the country. Once more with feeling, HOW STUPID DO YOU THINK WE ARE?

Oh, these guys irritate me. Anyway, check out this decision and consider the impact on all the 500kV and above projects applied for or waiting in the wings.

Mesaba spinnin’ it against gravity

April 2nd, 2009

THE MESABA PROJECT IS DEAD, DEAD, DEAD! Coal gasification is not happening. IGCC ist zu ende! How many silver stakes through its slimy heart will it take?

Once more with feeling:

This is from Charlotte Neigh, Co-Chair of Citizens Against the Mesaba Project, who, having reviewed the recent spin-doctoring of Excelsior Energy, and their tentacle-reach toward Minnesota Municipal Utilities — they’re trying to make it look like they’ve got something they haven’t got:

It is not correct to say that the federal government would back 73 percent of the total cost, or that the federal government has “pledged” $800 million in loan guarantees, or that municipal utilities would have to raise only 27 percent of the project costs to secure ownership of Unit 1 of the Mesaba Project.

Excelsior Energy has not yet been awarded any loan guarantees. It is one of eleven final applicants to share in a pool of $4 billion. Excelsior admits that its negotiations with DOE will continue throughout 2009. DOE stated in October 2007 that projects relying upon a smaller guarantee percentage will be given greater weight. Despite this statement, Excelsior repeatedly misled the media and even the PUC about the status of the loan guarantees, suggesting that they would cover 80 percent of the project costs.

Apparently Excelsior is now seeking 73 percent but this is a long way from becoming reality. A key requirement for qualifying is to have an assurance of revenues to be generated from sale of the product. This means a long-term commitment from a customer to purchase the energy. This is why the failure to achieve a PPA with Xcel Energy is critical. Other obstacles are DOE requirements for: credit assessment without a loan guarantee; approval of environmental and other permits; reduced greenhouse gases; and relative amount of cash contributed by the principals.

Now Excelsior is trying to entice municipal utilities into purchasing ownership interests by suggesting that 100 percent ownership can be obtained by raising 27 percent of the costs. Municipal utilities should carefully assess the likelihood that this amount or any loan guarantees at all will be awarded for the Mesaba Project before issuing bonds to finance such a purchase.

More information and analysis about the federal loan guarantees can be found by scrolling down to the October 8, 2007 entry on the CAMP website: www.camp-site.info/

Charlotte Neigh, Co-Chair

Citizens Against the Mesaba Project

Here’s an example of the bogus spin, from Business North — note she can’t even get the announcement time-frame right… Excelsior announced Mesaba in December, 2001, that’s EIGHT years ago:

No customer for controversial energy project

Excelsior Energy targets municipal PUCs in search for a buyer as key May 1 deadline looms.

4/1/2009

by Beth BilyAbout six years ago in the wake of the permanent closing of LTV Steel Mining in Hoyt Lakes, momentum began to develop behind a project concept, one since celebrated and renounced.

That proposed Mesaba Energy project with a price estimated at $2 billion has moved through various phases of public review to a potentially new location further west. Along the way it has become one of the most vigorously debated economic development initiatives proposed for Minnesota’s Iron Range.

Meanwhile, an important deadline looms that could make or break the project. The Minnesota Public Utilities Commission had ordered talks between Mesaba’s parent, Excelsior Energy, and power giant, Twin Cities-based Xcel Energy. The two sides were directed to negotiate a Power Purchase Agreement (PPA) for the approximate 600 megawatts of electricity Mesaba’s proposed Unit One would produce. That ordered negotiation period ends on May 1 and there is no evidence an agreement will be reached.

JCSP & UMTDI in the news

February 16th, 2009

More transmission – again in the Wall Street Journal.

Hard to tell which of the alphabet soups this article is about, and I’d say both, it’s about the Joint Coordinated System Plan and the Upper Midwest Transmission Development Initiative — UMDTI! But we know it’s all one and the same.

The article doesn’t really specifically name either “group” and it leaves us wondering just who or what is behind it. This is a good thing — yes, it really is as amorphous as it sounds! What disturbs me, of course, is the “It’s for wind,” because we know better!

At least the WSJ noticed the NYISO and ISO-NE’s objections — here it is again, it’s one of those letters I just can’t get enough of:

The UMDTI is insidious, a cheerleading effort to push transmission through. The way the thing is structured, is, as I said in my comments at the February 11, 2009, meeting, is ABSOLUTELY ASS-BACKWARDS. It’s market driven backwards engineering a transmission solution to support nonexistent need.

Upper Midwest Transmission Development Initiative – HOME PAGE

UMTDI Stakeholder Letter 10-28-08

Stakeholder Responses – LINK – look who the stakeholders are – DUH!

Wind on the Wires Comments … sigh…

UMDTI Stakeholder Letter 12-31-08 (Ed Garvey – MISO)

Dec 30 Draft – Cost Allocation Work Group (Marya White – Commerce)

December 30 Draft – Transmission Planning Work Group (Randy Pilo – PSC-WI)

Wind on the Wires cites many studies:

MISO’s Regional Generation Outlet Study (RGOS)

Transmission planning initiatives by” CapX 2020, ATC, Mid-American and others”

Minnesota RES transmission study

MISO’s MTEP-08 and MTEP-09

Joint Coordinated System Planning Stuey

Eastern Wind Integration Transmission Study

None of these studies are linked — and they’re not on the UMTDI site — let’s see how long it takes to find them.

Now for the more difficult ones… one moment please…