More on MISO cost/benefit study

February 18th, 2007

The other day I posted on a new MISO cost/benefit study that showed the impact of market transactions. Here’s that post. In their press release, there was a number, so I called it to get a copy of the study. Turns out it’s not going to be released until the end of the month, but here’s what I got today:

Hold on to your hats until the end of the month!

GRHR Letters to Editor

February 17th, 2007

Here are the latest LTE’s in the Grand Rapids Herald Review.

Project will be scenic blunder

Herald-Review

Friday, February 16th, 2007 05:01:56 PMEditor:

Having read many of the previous letters regarding the proposed Mesaba Energy project, I will attempt to avoid re-hashing all the reasons that this project should never happen and there are many.

The schmoozing and back-scratching between company management and local and state politicians trying to get the Mesaba Energy project to become a reality has been both blatant and shameful. Does this lack of conscience just qualify as business as usual?

Pollution on the local level will be extremely harmful to our lakes and our lungs. The BWCA and Voyageurs National Park are national treasures that should not be compromised by air pollution and mercury contamination.

Hopefully this boondoggle of a project will collapse under its own weight. If not, the road leading to it will need to be renamed. How about the Un-Scenic Highway, the Not-So-Scenic Highway or my personal favorite, The Scenic Blunder in the Sky-Way.

Bob Erickson

Balsam

========================

The next is from Ron Dicklich, who in my book lost any semblence of credibility at the Hoyt Lake DOE Hearing, when he misrepresented Utility Personal Property Tax as having been repealed, DUH, it’s not been repealed, he set up Rukavina with bad information, and as lobbyist for Great River Energy he should know better. At that same meeting, he had no clue the origins of the Mesaba bill and couldn’t even remember when the Mesaba bill was passed, much less what was in it! But this is the guy who is supposed to be watching legislation for the County and didn’t bother to let them know that a bill had been introduced in March 2006 exempting Mesaba from Utility Personal Property Tax that would cost the county millions in tax revenues annually. According to Plants Sites & Parks, October/November 1999, Ron Dicklich was Minnesota Iron and Steel’s Director of Public and Governmental Affiars – I guess that’s something he would know something about! And it’s a matter of public record that there is a contract with the County where he’s been hired as a “project coordinator” for $5,000/mo., he even gets to office at the County! At what point is he an interested person who should not be paid for or be involved in any part of this? I think that line was crossed a long time back…

And about cost — Dicklich has obviously not read the record about the cost of electricity produced by Mesaba. Hey Ron, you can find that at www.mncoalgasplant.com/ppa.html Check out the Dept. of Commerce’s Elion Amit’s testimony.

Dr. Elion Amit Direct Testimony

Time for you to do some homework… and about all of those searches from Pengilly for “Ron Dicklich” on my site this last week.. 13 was it?

CLICK HERE for Charlotte Neigh’s letter that he’s whining about.

Herald-Review

Monday, February 12th, 2007 08:18:21 AMEditor:

In my opinion, Charlotte Neigh’s letter of Jan. 31, 2007 was full of misleading information. I am compelled to set the record straight.

It is not true that I am paid $5,000 per month by Itasca County. RAMS has a contract with Itasca County to pay them up to $3,000 per month for project coordination services, and up to $2,000 per month for support services. I am compensated by RAMS as executive director and do not receive extra compensation for the services I provide. Rams has been eligible for up to $5,000 per month reimbursement since Aug. 28, 2006. To date, they have billed for just over $4,900 total.

Ms. Neigh’s suggestion about Commissioner Eichorn’s need for more accuracy is laughable as she left out major pieces of information concerning the Taconite hearing.

As a part of the hearing, Xcel Energy representatives testified they should not have to purchase the Mesaba Energy load was because there was no need in the market for additional electrical generation. The point I made in testifying was a letter I read from Xcel Energy to Howard Hilshorst. The letter stated Xcel was not able to make a proposal to MN Steel because they did not have enough resources. That means they did not have electricity to sell. Apparently they were not being honest about the supply issue.

The rule of supply and demand controls electricity just as it does other products and commodities. If you support MN Steel, you should be concerned about the largest electric company in the Midwest not having sufficient power to make a proposal to sell power for MN Steel. Electric companies say with Mesaba coming on line, costs of electricity will go up. I say that if it doesn’t come on line, our costs will go up. My point is that based on supply and demand MN Steel may need Mesaba to come on line just to keep electric costs competitive so that they can keep their costs down and compete in a steel market that will be competitive into the future.

It was also stated that the cost of building transmission would increase the cost of electricity. It could, but, it would make more sense to build eight miles of transmission than 200 miles.

What Commissioner Eichorn was saying, and that I testified to, was that MN Steel’s need for lower energy costs could depend on the future of Mesaba Energy. MN Steel will find electricity, but at what cost? MN Steel is our future. I am not willing to take any chances of it not being able to happen because of a lack of electricity or electricity that is too high cost. Xcel and others want to make sure that the supply levels assure them the profit their shareholders want. That is really what this is all about. I chaired the Minnesota Senate Committee on Energy and Public Utilities for four years and have a background on these issues.

Ron Dicklich

Executive Director

RAMS

And this one… good DOG, he thinks that the Beulah, ND, plant is doing “just fine” environmentally? Not only did it go bankrupt in the 1980s, it’s a hazardous waste site and has contaiminated the water! Here’s the Report to Congress on Special Wastes from Processing, Chapter 5 – check out p. 9 about Uranium-238 and Thallium! Yup, just fine…

Herald-Review

Wednesday, February 14th, 2007 10:35:21 AMEditor:

I believe we need the Excelsior Energy plant here. I think our county needs to look toward the future as well as look at the environmental impact. Itasca County needs this plant. It’s time we boost our economy and get good viable jobs to Itasca County. If this plant is so bad then why does the state of North Dakota have a coal gasification plant in Beulah N.D.? My brothers-in-law and father-in-law work there. According to them the plant is a success. The community thought the same as we did what about the environment’s impact. So far its doing just fine.

A bunch of panic talk always seems to destroy a good prospect of a big company looking to our area for building sites. I am a hunter and fisherman and believe in environment protection. If this is such unproven technology, why are we so afraid of it. The state of Minnesota would not grant permits to this company nor would the EPA on the federal level, if this was so bad. It’s time Itasca County residents look to the future.

Our tourism is not what it was years ago. I came here in 1979 with my family. I have seen a lot of development. A lot of people say we need different industry besides timber and iron. Now we have one and we are scared to death of it.

I think the fear of the unknown in this county is what suppresses it. We can no longer afford to worry about tourism or people not wanting to retire here if Excelsior builds this projected plant. MP&L has a great pollution control system at the Boswell Power station. Many times when I worked out there as a security guard the MP&L Company news letter would say how the Minnesota EPA awarded them or commended them on a job well done by using the system they have in place to keep our environment safe. There is air pollution any where in this world and many are taking action to safe guard against any permanent serious damage to the ecology. I believe Itasca County needs too look forward to the future to keep generations of children here giving them something besides box stores or driving 60 miles to a mine. Years of hearing, “We need more viable jobs” are coming back to haunt us. We have a great opportunity. Let’s not blow it this time.

Many studies have been conducted and panic talk is going to get us nowhere. However I don’t condemn anyone playing it safe either and watching out for the environment. That too is a great cause in itself. The mere mention of nuclear plants is outrageous. They are a lot more dangerous than a coal plant. Three Mile Island out East shouldn’t be forgotten. I believe this company has done and will do everything to keep our biggest resource and investment safe, the environment.

Dave Gunderson

Grand Rapids

Electric – 70s deja voodoo all over again

February 17th, 2007

As I work on this energy mess we’re in, I’m struck by the force of an industry push to construct despite no need, to build billions of dollars of generation and transmission that we don’t need to facilitate their unregulated wholesale market transactions, and of course that transmission will also facilitate all those new coal plants:

As if that wasn’t enough, there are all these folks promoting coal gasification when they haven’t a clue what it’s about, saying it has superior environmental performance, and pretending as if carbon capture and storage is feasible! What are they thinking?

And then I remember this meeting at Commerce, October 2000, I believe, back in the days when the enviros were ready and willing to acquiesce to “restructuring” or deregulation, which was a position utterly without gonads. This was in the … sigh… Ventura days, and although the “Department of Public Service” had been disappeared and Commerce took over, it was a time when people could easily meet with staff, a time when Commissioner Bernstein held the monthly breakfasts, when service lists were honored because the public mattered, where energy planning was a happenin’ thang and where the state’s preferences for distributed and renewable generation meant something. Anyway, recently I was jolted back by Charles Komanoff’s review and characterization of the overbuilding of the 70s, and remembered that back in October 2000, I’d copied parts of Kahn’s “The Economics of Regulation” to show the parallels, where we were going, and then Komanoff reminded me that we’re there, doing the same damn stupid human tricks all over again.

Kahn noted that utility regulation that levies current ratepayers provides, in the form of” increased cash flow to finance capacity additions,” incentive to build more generation than what’s needed. He also raised an interesting thought — that the way it’s foisted on current ratepayers, there’s inherent generational inequity. Hmmmm… Anyway, as the 70s “progressed” and so many nuclear plants were built, costs escalated astronomically, some were never completed, and those that were often left those utilities with grossly excessive and unneeded capacity. Ratepayers got hit hard. From there, go to my previously blogged description by Komanoff, in Power Plant Cost Escalation, of construction of nuclear plants that required extensive design and engineering for each plant, incorporating lessons learned and addressing problems that became apparent during design and construction, which lead to the high costs, both in construction and through abandonment of projects that weren’t economically and/or operationally feasible to build.

Coal gasification (IGCC) is our 70s nuclear. Too many yahoos are advocating construction of coal gasification plants without knowledge of the state of IGCC technology, the serious technological problems (such as gasifier problems so severe that they don’t solve it, they instead design in a “spare gasifier.” Oh, great…), and the massive cost increases — in the case of Mesaba, increasing from $500-600/kW when first proposed to legislature in January, 2002, to $3,593/kW, or $2,155,680,783 in May, 2006, and bound to go up further.

The rate structure would allow immediate inclusion in the rates, both for these IGCC plants and for the billions of dollars in unneeded transmission infrastructure of CapX2020 (Check the “Transmission cost adjustment” that lets them get it more quickly).

OK, once more with feeling. In Minnesota, our biggest utility doesn’t “need” new baseload power until 2015, and at that time, it’s only 375MW, which they’re fulfilling with wind and hydro. The Dept. of Commerce, in the Big Stone II plant in SD’s transmission docket here in MN, says that the many utilities that banded together to build BSII did not prove up need. There was no need for Mesaba so it was legislatively exempted from Certificate of Need. And Renewable Electricity Standard now before the MN legislature is a mandate, again, because there is no need (if we needed it, we wouldn’t require mandates). Yahoos claim “we’re going to freeze in the dark” NEED, growth of 2-2.49% annually but the Long Term Reliability Reports of the industry’s North American ElectriclReliability Council say otherwise — look at the lower rates of increase for demand and energy, high reserve margins, and high levels of new construction. The Wind Integration Study demonstrates that we can integrate 5,000-6,000MW into the Minnesota grid with only nominal transmission additions — we “need” 375MW and can integrate in thousands of MW! It’s really that simple!

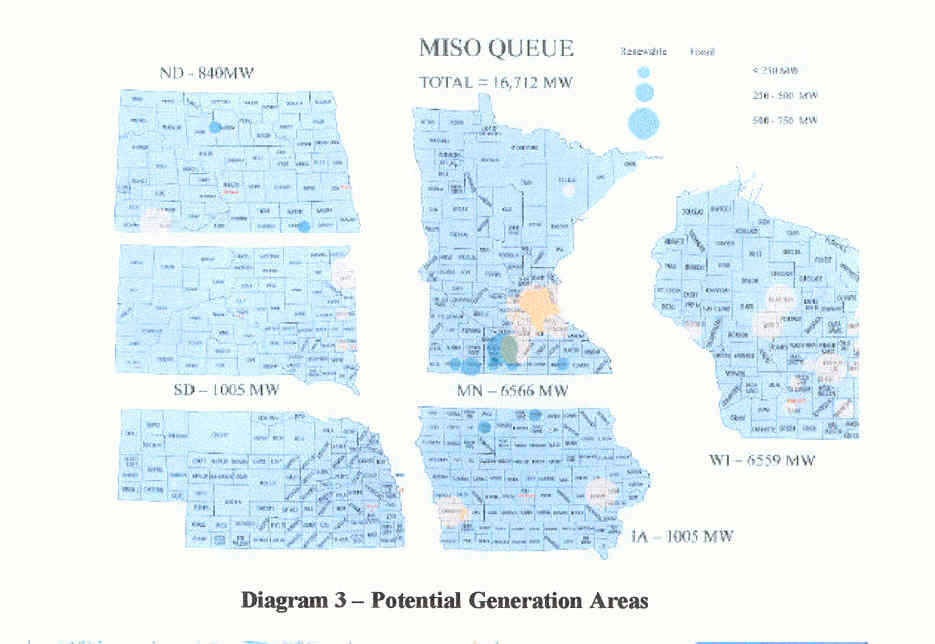

And as we know, CapX2020 (aka Xcel, et al) is driving the construction and of course they don’t look at their own map on p. 7, nor, it seems, is anyone else:

Why are legislators and policy wonks who have access to all this information buying this crap? Why would anyone think we need coal, much less that we can’t do without it? Why would anyone think we need over a billion dollars of transmission? It’s against evidence and we’ve been there, done that and we don’t need to do it again. Is it that we’re experiencing the limitations of our educational system and its inability to produce critical thinkers? Are we experiencing the impacts of mercury? Are we experiencing the impacts of the power of $$$$$$$?  Why do you thihnk they call them “power companies?”

Presentations at IEDC

February 16th, 2007

Here’s the lineup from the IEDC “Electricity 2020” forum in Grand Rapids on Wednesday — see for yourself.

Mike Bull – The Next Generation Energy Initiative

Bill Grant, Izaak Walton League – Energy Efficiency and Climate-Friendly Power Supply

CapX2020 – why not build?

February 16th, 2007

What’s the point of CapX 2020 and all the transmission expansion? Why, look at the map — they want to move electricity from the coal fields of the Dakots to Wisconsin (dig those dotted lines east and west). Why? Duh, well duh, to make money in the bulk power market, making bulk power transactions. So why are they trying to say they need it, that WE need it if we’re going to institute a Renewable Energy Standard? Because then we’ll pay for it. And they’re worried maybe we won’t.

Do you know that they’ve asked the PUC for an exemption to the meat of the “need” rules.

Why exempt it from filing requirements? Because they think we’re chumps enough to pay for it. But “need†is different than “we want it for bulk market transactions†and “we want it for profit.†And if it’s for their profit, and we’re not getting benefit, explain why we should pay for it? If they’re not exempt, they have to justify the lines, and if they’re exempt, they don’t have to answer those difficult questions!

They rush to build because there’s money in them thar lines! Here’s the poop from MISO:

Results Show Midwest ISO Energy Markets Bring Tangible Benefits to Nation’s Largest Power Grid ; Midwest ISO also advances two initiatives — a transmission expansion plan and an ancillary services market — to support markets in the future.

Feb 15, 2007 – PR NewswireCARMEL, Ind., Feb. 15 /PRNewswire/ — Results of a cost/benefit analysis show that two components of the Midwest ISO’s energy market brought $58 million in financial benefits – or an annualized figure of almost $70 million – to market participants during a 10-month study period. Summary results of the study, conducted by Virginia-based ICF International, were released to stakeholders today.

“These results show that we’re accomplishing one of our goals: bringing financial benefits to the region. This is in addition to our goals of improving reliability and promoting infrastructure growth, despite the challenges of creating the nation’s largest geographic ISO,” said T. Graham Edwards, President and CEO of the Midwest ISO. “The Midwest ISO is still a young organization and benefits will continue to grow as we mature and add services.”

The ICF study highlights the differences between realized and potential benefits, focusing on a subset of operational benefits: regional unit commitment and utilization of transmission assets. If Midwest ISO’s proposed Ancillary Services Market had been operational, the total potential benefits would increase by $189 million to a total of $460 million over the 10-month period, the study said. The Midwest ISO hopes to launch its Ancillary Services Market in the spring of 2008.

The study analyzed market information from more than 100 Midwest Market participants for the period of June 2005 through March 2006. Midwest ISO has asked ICF International to analyze an additional five months (April through August 2006) to provide more data on the cost/benefit of Midwest ISO’s impact and to analyze a second summer season.

ICF International is expected to release the study’s methodologies and assumptions at the end of February 2007.

Financial Benefits Will Grow As Midwest ISO Adds Services

Also today, the Midwest ISO Board of Directors approved the Midwest ISO Transmission Expansion Plan 2006 (MTEP 06), a far-reaching, long- term transmission expansion plan that recommends $3.6 billion in additional transmission infrastructure and improvements in the Midwest. This initiative is expected to reduce congestion costs by $2 billion annually.

MTEP 06 provides a comprehensive, top-down reliability evaluation of the expected performance of the region’s transmission system through 2011. Highlights include:

* $2.1 billion in committed projects by participating Transmission Owners

through the year 2011 and forecast of an additional $1.5 billion for

the same period;* Elimination of 22 of the top 30 constraints to market operations;

* Five recommended expansion plans specifically addressing constraints in

the newly identified Narrowly Constrained Area in Eastern Iowa and

Minnesota;* Facilitation of new generation entry by providing expansions to

accommodate 14,400 MW of new generation supply, including 2,810 MW of

renewable resources; and* Provision for footprint-wide expansions at all transmission voltage

levels including commitments for four new 345 kV and two 230 kV lines

for service by 2011.The $3.6 billion in expansion plans are in addition to the $13 billion in existing transmission investment within the Midwest ISO, and represent a $700 million increase in identified investment since the prior plan was issued in June 2005.

Since the Midwest ISO began regional planning, nearly $1 billion in new infrastructure and infrastructure improvements have been brought on- line within the Midwest ISO’s footprint. These include more than 460 miles of new transmission lines, nearly 2,400 miles of upgraded transmission lines, and numerous improvements to substations and other transmission facilities.

Finally, the Midwest ISO is filing with the Federal Energy Regulatory Commission (FERC) for the establishment of its Ancillary Services Market by close of business today, February 15. This filing represents a significant step in the evolution of the Midwest ISO markets as the Midwest ISO continues to enhance the efficiency of the markets while maintaining the same high degree of reliability with which the Midwest ISO has operated since its formation. The Midwest ISO believes that these proposed tariff changes, which are the result of over two years of analysis and evaluation and also encompass the best design elements of other ISO/RTO markets, will:

* Increase the efficiency of the existing Midwest ISO Day-Ahead and Real- Time Markets while minimizing total costs;

* Incorporate changes to accommodate the transfer of certain Balancing Authority functions to the Midwest ISO;

* Provide for efficient acquisition of the pricing of Operating Reserves;

* Present the mechanism for increased competition through additional available resources (including Demand Response Resources); and

* Complement the short-term markets price signals by encouraging resources to provide additional flexibility.

About the Midwest ISO

The Midwest ISO ensures reliable operation of, and equal access to, 93,600 miles of interconnected, high-voltage power lines in 15 U.S. states and the Canadian province of Manitoba. The Midwest ISO manages one of the world’s largest energy markets, clearing more than $2 billion in energy transactions monthly. The Midwest ISO was approved as the nation’s first regional transmission organization (RTO) in 2001. The non-profit 501(C)(4) organization is governed by an independent Board of Directors, and is headquartered in Carmel, Indiana with operations centers in Carmel and St. Paul, Minnesota. Membership in the organization is voluntary.

For more information, visit www.midwestmarket.org.