TXU says NRG, AEP back away from IGCC

January 12th, 2007

Or are they? And who cares? And why is anyone concerned? Apparently the realities of IGCC, the fantasy of coal gasification, the claims with out any factual basis whatsoever, well, it seems things are getting hot, cooling down, it’s all over the map and everyone’s in a snit. What’s … Dog, I need another word for “hilarious” … anyway, it’s funny, it seems NRG is getting pissy about their reputation! They’re worried as being perceived as backing AWAY from IGCC, but from here, in the middle of a coal gasification cost docket, it seems that getting as far away as possible is the best way to preserve credibility — in Minnesota, coal gasification and Excelsior’s Mesaba Project is political leprosy. Remember the Policy Statement of Ed Garvey ???? Backing away from IGCC is a good and credible thing to do!

Here’s the PRESS RELEASE that NRG sent out, copied by Power Engineering.

According to Power Engineering, here’s the TXU email comments that NRG was responding to:

Reality Check: Proposed IGCC Power Plants Face Cancellation, Cost Recovery Opposition and Delay

AEP: Billion-Dollar Plant’s Costs Are Escalating

“The company said earlier this year the plant would probably cost about $1 billion. It promised to provide a more detailed cost estimate by the end of this year. But in a letter hand- delivered on the day after Christmas to its regulator, the state Public Service Commission, the company’s lawyers said it wouldn’t be able to provide the estimate at this time.

“…What we’ve found out is, part of the higher cost is from the construction market — concrete, steel, labor — the regular things you have in construction,” Matheney said. “It’s also the first time a plant of this type has been built to commercial scale.”

…The company has repeatedly said it will only build such plants in states where regulators allow it to recover its costs. That means ratepayers would have to pay increased rates.”

…Morris [AEP Chairman and CEO Mike Morris] said the process of getting the regulatory and legal authority to build the integrated gasification plants “is taking longer than we’d like — at least longer than I’d like. And arguably longer than our customers can really afford and longer than the instate regulators can afford.”

– Charleston Daily Mail, 12/27/06

NRG: Company Shelves Plan For “Clean Coal” Power Plant

“…NRG officials said they decided to drop the coal technology (IGCC) because the company couldn’t build the planned 630-megawatt plant in time to receive state incentives….Environmental groups were already fighting the plant, saying the new coal technology still produces carbon dioxide, which, unless captured, contributes to global warming. The technology to capture the gas is still being developed.”

– Associated Press, 11/28/06

AEP: CEO Says Issues Could Delay Clean Coal Build

“…The company had been hoping to build an integrated gasification combined cycle (IGCC) power plant in Ohio by 2010, “but it’s probably more like 2011 or 2012,” AEP CEO Michael Morris said….The process in Ohio has been slowed because of a lawsuit that alleges that the state public utility commission would overstep its authority by approving cost recovery for the coal plant. Morris said he expects a decision from the state’s Supreme Court early in 2007….”

– Reuters, 11/06/06The Bottom Line: IGCC is still a developing technology that is not yet available at the scale, efficiencies and availabilities needed to meet Texas’ near-term power needs.

Cost Recovery Is Not an Option in Texas: Electric utilities developing IGCC plants in other states depend on limiting their technology and operational risk with regulatory cost recovery — that’s not an option in Texas.

IGCC Technology Not Guaranteed for Texas Fuels. No IGCC technology suppliers are currently providing guarantees for IGCC plants using the coals available in Texas.

AEP’s billion dollar plant’s costs escalating? Well, DUH! Remember this? Excelsior’s DOE Financial Assistance Agreement

Does that seem like anything to get pissy about? So will someone explain to me how TXU’s “bottom line” assessment is off? AEP is hopefully going back to the drawing board, reassessing their costs for their project, which are likely something like Excelsior’s $2,155,680,783 for 600MW, or $3,593/kW. NOT INCLUDING CARBON CAPTURE OR SEQUESTRATION — another DUH! Obviously a hundred or so coal plants in Texas is not a good idea, and if you want to be appalled, check out their PLANS. But IGCC is not the answer, not here, not there…

The situation here in Minnesota with Excelsior Energy is anything but normal, what with deals for nuclear waste, deals for wind, I think my clients and moi are the only ones not part of a deal on this, and with that backdrop of wheeling and dealing, then we toss on top all the known problems of coal gasification, all the bait and switch of this particular proposal, all the risk shifting and cost shifting, and there’s no way that anyone with a modicum of consciousness could think that Excelsior’s Mesaba Project is a good idea and that it’s even remotely regarded as likely to be least cost. There is no way that anyone who has read even part of the testimony could support it. For example, the Department of Commerce brief is pretty direct – check it out HERE.

For those of you not acquainted with NRG, where Excelsior Energy’s Tom Micheletti and Julie Jorgensen are from, and also everyone else on their team, if you don’t know what NRG’s about, here s a must read docket. CLICK HERE – Go to the PUC’s SEARCH screen and search for docket: 02-1346. Read all about it! NRG is the company that went down and almost took Xcel out, Meyer Shark’s been on Xcel for decades and is the only one really paying attention to this. Slowly, NRG is turning around, but not without casualties.

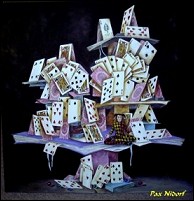

NRG – this looks like a good time to reassess your lust for IGCC. Take a good look at the Excelsior record to gain some perspective on how you may fare in a regulatory proceeding. IGCC is a house of cards — and it’s not in the public interest. But more on point, it’s not in NRG’s interest. IGCC is not in AEP’s interest. IGCC is not in TXU’s interest. And afterall, your corporate interest — that’s literally your bottom line. IGCC ain’t a happen’ thang…

Ethanol – Advanced BioEnergy’s SEC filings

January 12th, 2007

(Note that an ethanol plant doesn’t look all that different from a coal gasification plant? It’s like a refinery in a corn field…)

There’s lots of talk around town about the Advanced BioEnergy ethanol plant that’s been proposed for the south side of County Road 8 by Dundas, between Hwy. 3 and Interstate 35. Bridgewater Township has instituted a moratorium and is doing local planning, and I sure hope doing some looking into what Advanced BioEnergy is about. There’s info out there on the internet — what would we do without it! The internet sure is the Great Equalizer, and the Great Organizer too!

A coal cohort did a little digging and found some GOOD STUFF!

See link for full document — as of Nov 2006 looks like Advanced BioEnergy (ABE) is in the works to sell out to a South Dakota connection (with the understanding that the â??Marketing Agreementâ?? holds) and note the NO PUBLIC ANNOUNCEMENT, and hey, I’m not a party to the agreement!

Section 6.2 No Public Announcement.

None of the parties to this Agreement shall make any public announcement concerning this Agreement, without each other partyâ??s prior written consent (which shall not be unreasonably withheld); provided, however, that any of the parties, but only after reasonable consultation with each other party, may make disclosure if required under applicable law or the rules and regulations of the SEC or any listing agreement with a national securities exchange; and provided further, however, that following execution of this Agreement or consummation of the Closing, ABE may, in its sole discretion, make a public announcement regarding the transactions contemplated by this Agreement and the integration of the HGFâ??s business into that of ABE.

And another very interesting tidbit! ABE, in its filings with SEC, HERE’S LINK,reported that:

â??We will depend on others for sales of our products, which may place us at a competitive disadvantage and reduce profitabilityâ?¦â?We expect to hire a third-party marketing firmâ?¦â?

Excerpt from link above:

Section 6.1 Consent; Waiver.

â?¦..(b) By execution and delivery of this Agreement, (i) HGF and Aventine agree that, notwithstanding Section 1.A. of the Ethanol Marketing Agreement by and between HGF and Williams Ethanol Services, Inc. d/b/a Williams Bio-Energy, dated November 30, 2000, including an Amendment effective April 2, 2003 (the â??Marketing Agreementâ?), the Marketing Agreement shall not terminate as a result of the transactions contemplated by this Agreement, but shall remain in full force and effect on and after the Closing Date according to its existing terms and conditions (except for Section 1.A.) until amended or terminated by HGF and/or Aventine, and (ii) Aventine waives any and all rights and claims under Section 1.B. of the Marketing Agreement that may arise from the transactions contemplated by this Agreement.

Section 6.2 No Public Announcement. None of the parties to this Agreement shall make any public announcement concerning this Agreement, without each other partyâ??s prior written consent (which shall not be unreasonably withheld); provided, however, that any of the parties, but only after reasonable consultation with each other party, may make disclosure if required under applicable law or the rules and regulations of the SEC or any listing agreement with a national securities exchange; and provided further, however, that following execution of this Agreement or consummation of the Closing, ABE may, in its sole discretion, make a public announcement regarding the transactions contemplated by this Agreement and the integration of the HGFâ??s business into that of ABE.

Click HERE for a link for document filed by South Dakota Wheat Growers Ass.

which says:

Filed by South Dakota Wheat Growers Association

pursuant to Rule 425 under the

Securities Act of 1933, as amendedSubject Company: Advanced BioEnergy, LLC

Commission File No.: 333-125335November 7, 2006

Dear SDWG Member:

Your South Dakota Wheat Growers Board of Directors, together with the Board of Managers of Heartland Producers, LLC, has approved an agreement with Advanced BioEnergy, LLC (ABE) to exchange the partnership interests in Heartland Grain Fuels, LP (HGF) held by South Dakota Wheat Growers and Heartland Producers for cash and equity of ABE.

Under the terms of the transaction, the partners of HGF will receive approximately $16.8 million in cash and approximately 2,631,000 newly issued units of ABE. In addition, HGF intends to make a special distribution to its partners of approximately $8.65 million of earnings prior to the initial closing of the transaction with ABE. Wheat Growers currently owns approximately 48% of HGF and will receive its pro rata share of the consideration from the transaction. In addition, Wheat Growers will continue supplying corn to the HGF facilities.

ABE is a development-stage company specializing in ethanol production. It currently is building a 100-million gallons per year dry mill corn-processing ethanol plant near Fairmont, Nebraska and has letters of intent to build similar plants in Indiana and Minnesota.

Wheat Growers Board believes this business relationship with ABE will provide the following benefits to the HGF investors and the agricultural producers in this area:

a. Heartland Grain Fuels investors will become part of a company with plans to become a larger ethanol producer: By being part of a larger ethanol production company, HGF can achieve additional economies of scale that are difficult to achieve with just two plants in North-Central South Dakota.

b. Heartland Grain Fuels investors will achieve greater geographic diversity: By being part of ABE which is building plants in other Midwest states, risks associated with drought and marketing should be mitigated.

c. The transaction will allow Heartland Grain Fuels investors to obtain cash from present operations: Ethanol prices have been at historical highs and this transaction allows HGF to return cash to its investors based on its recent performance.

d. This transaction will allow Heartland Grain Fuels investors to maintain an investment in an ethanol production company: Heartland Grain Fuels investors will retain their investment in an ethanol production company through the ABE Units they will receive in the transaction.

e. The transaction will allow Heartland Grain Fuels to maintain business relationships: The planned Aberdeen plant expansion will be completed, and current supply and marketing relationsips will be continued.

Prior to Heartland Producersâ?? closing on this business relationship, the transaction must be approved by Heartland Producersâ?? membership. Wheat Growersâ?? membership is not required to vote on the business relationship due to Wheat Growersâ?? cooperative structure and will complete its portion of the transaction prior to the vote by the Heartland Producers members. The Board of Managers of Heartland Producers has passed a resolution requesting Wheat Growers to close on this business relationship prior to the vote of Heartland Producersâ?? membership.

With the rapid changes occuring in the ethanol industry, the Wheat Growersâ?? Board believes this cash and equity exchange will allow the investment of HGF owners to grow beyond just the Huron and Aberdeen facilities, while continuing the local connection of your corn production to ethanol. If you have any questions, please donâ??t hestitate to contact Dale at 605-225-5500, extension 101 or dlocken@sdwg.com.

Sincerely,

Hal Clemensen, SDWG Board President Dale Locken, SDWG Chief Executive Officer

In connection with the transaction, ABE will file a registration statement that contains an information statement/prospectus with the U.S. Securities and Exchange Commission and relevant state securities regulatory agencies. HEARTLAND PRODUCERSâ?? MEMBERS AND OTHER INVESTORS AND SECURITY HOLDERS IN ABE AND HGF ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT, WHICH WILL CONTAIN INFORMATION ABOUT THE TRANSACTION AND THE MEETING OF THE HEARTLAND PRODUCERSâ?? MEMBERS THAT WILL BE CALLED TO VOTE ON THIS TRANSACTION, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THIS TRANSACTION. You will also be able to obtain the documents free of charge at the SECâ??s web site, www.sec.gov, and from ABE on its web site at www.advancedbioenergy.com or by contacting Bill Paulsen, at (605) 225-0520.

And thereâ??s more on ABE, and specifically ABE LLC Northfield. This explains the monumental RISKS with this company and this project! Bridgewater Township is on the right grack in initiating the 1-year moratorium. The township supervisors then have a chance to do the â??due diligenceâ?? to protect the township.

Click here and check out this 10KSB Fiscal Year End Sept 30th 2006 â??tell allâ?? REPORT.

The first page or two gives you plenty, then you can use FIND on the tool bar to get to Minnesota information.

Lots of conflict of interest, no experience, little to NO guarantees either from ABE OR the designers, builders AND hints of expenses to come if environmental investigation and/or changes in rules and regulationss occur. That’s an opening for future compliance problems and â??decommissioningâ? issues if plant is abandoned or goes belly up. Seems similar to the operating plants in Aberdeen and Huron, where waste disposal is an issue, not to mention Aberdeen after the expansion will use 500,000 gal daily, Huron 300,000 gallons dailyâ?¦ and many of these plants are tied to city water!

Q: WOULD ABE EXPECT TO BE CONNECTED TO DUNDAS CITY WATER SYSTEM? THAT WOULD NOT BE ALLOWED UNDER THE AGREEMENET WITH NORTHFIELD.

There’s enough here to give the Township supervisors something to think about…

Pipedreams of green and clean…

January 11th, 2007

So why isn’t this premise, “the only way we’ll be able to use all those coal reserves is if we can burn coal without emitting the CO2” regarded as a problem? How can they get away with this?

By THOMAS L. FRIEDMAN

Colstrip, Montana

All environmentalists have their favorite â??greenâ? energy source that they think will break our addiction to oil and slow down climate change. Iâ??ve come out to Montana to see mine. Itâ??s called coal.

Yes, yes, I know, you thought I was going to say corn ethanol or switch grass or soybean diesel. Well, one day they all might reach a scale that can get us off oil. But the cheap, available fuel that China, India and America all have in abundance today â?? and are all going to burn for the next decade â?? is coal. So unless we can burn coal in a cleaner way, you can kiss the climate goodbye â?? weâ??ll all be wearing bikinis and shorts in Manhattan in January.

When it comes to what it will take to â??greenâ? coal, thereâ??s no more informed or intrepid tour guide than Montanaâ??s Democratic governor, Brian Schweitzer. The governor, a bulldozer of a man, met me in Billings in his little prop plane, we flew into a winter gale that tossed us around like salad pieces, and then we set down on a makeshift runway in Colstrip, on the edge of a coal strip mine. On the way back, after flying through another howling storm that caused me to dig my nails so deeply into the armrests I left my fingerprints in the leather, I thanked the pilots profusely. The governor simply bellowed, â??Iâ??m glad we had our best interns flying today!â?

When it comes to cleaning up coal, though, Governor Schweitzer is dead serious.

â??Here in Montana we make our living outside,â? said the governor, an agronomist who got his start building farms in Saudi Arabia, â??and when you do that, you know the climate is changing. We donâ??t get as much snow in the high country as we used to … and the runoff starts sooner in the spring. … The river Iâ??ve been fishing over the last 50 years is now warmer in July by five degrees than 50 years ago, and it is hard on our trout population. … So when Exxon Mobil hires someone who calls himself a â??scientistâ?? to claim this is not true, you donâ??t have to get The New York Times to know the guy is blowing smoke.â?

But hereâ??s what the governor also knows: Montana has one-third of all the coal deposits in America â?? 8 percent of all the coal in the world. Montanaâ??s coal is roughly equivalent to 240 billion barrels of oil. â??Thatâ??s enough to replace all our imported oil for 60 years,â? he noted.

Thatâ??s the good news. The bad news is that because of global warming â?? fueled in part by carbon dioxide emissions from coal-burning electricity plants â?? the only way weâ??ll be able to use all those coal reserves is if we can burn coal without emitting the CO2. Otherwise weâ??re cooked, literally.

So Governor Schweitzerâ??s crusade is to get the coal-burning industries to take the lead on this, in partnership with government. The governor recalled a recent conference of coal-dependent industries, held in Phoenix, at which he held up a lump of coal and warned: â??You are the people who represent the companies who will decide whether Iâ??m holding up the future of energy or the past. Take a look at all the other people sitting at your table. You know who you see? You see the last remaining people on the planet who donâ??t believe CO2 is a problem. … The only way you will make this the energy of the future is to recognize C02 as a problem and that you have to be part of the solution.â? And by the way, he added, â??there is a lot of money in it for you guys. You can sell this technology all over the world.â?

Governor Schweitzer has a plan for Washington: 1) Set a floor price for crude oil in the U.S. at $40 a barrel forever. That will tell Wall Street that if it invests in new, clean coal technologies â?? which can be run profitably at the equivalent of $40 a barrel â?? OPEC will never undercut them. 2) Set up a European-style cap and trade system rewarding companies that buy clean coal technologies and punishing those that donâ??t. 3) Have Washington co-invest in a dozen pilot gasification and liquefaction technologies â?? which already exist â?? for cleaning coal and sequestering the carbon dioxide. Then weâ??ll identify the best technologies quicker and move down the innovation curve. 4) Write the regulations now for how we will manage carbon dioxide that is removed from coal and stored underground.

As we talked, four smokestacks from the coal-fired electricity plant in Colstrip, which helps power Portland and Seattle, were belching CO2.

â??For the last 100 years we built plants like this one,â? the governor said. â??It takes crushed coal, ignites it to heat water that produces steam, and that turns a turbine and produces electricity. … You build that smoke stack real high so that nasty stuff goes to someone elseâ??s backyard. Well, weâ??ve run out of backyards.â?

Ray weighs in, and Silberbauer, Pat would like to recall…

January 10th, 2007

.

UPDATE: Pat Silberbauer says he hit “reply all” but was referring to an internal message. Oh, OK… whatever.

And in case you missed it, here’s Garvey’s letter:

If that doesn’t leave you scratching your head…

================================

From the continuing Excelsior Mesaba Project saga — Hot off the inbasket:

Silberbauer, Pat would like to recall the message, “Digital document”.

The only thing sent recently by Pat Silberbauer was “The Garvey Letter” at 3:43 p.m. on Monday. Does this mean “Recall the Garvey Letter?” But there’s no letter attached withdrawing the paper copy. I’m soooo confused… so I sent the following missive to all:

I’m confused — please clarify!

I swear to Dog, the missive arrived just as I was trying to describe to someone how this case is “perversely hilarious.” Then this comes in… almost bust a gut laughing. What are we supposed to do? Somebody please explain! Do we recall all the articles written about the Garvey Letter, bring in copies of the paper and get our $0.50 back? Does this apply to the copy I scanned in and sent around, distinct from the ditigal copy emailed Monday at 3:43 p.m.? Does this apply to comments made over the digital phone line?

===================

And on another vein, moments before, someone else commented:

There is a (possibly) similar situation in Delaware. There is an RFP for generation and an IGCC proposal (from NRG) is competing with a wind proposal and maybe others. The coal burner people are saying in effect that they don’t want the cost of capture and sequestration included in their bid–which would then be uncompetitive–but they want to be able to pass those costs directly through to the public in the future should they arise….

It does sound similar, the pleadings have similar themes, no doubt about it. Wanting to sell more than is needed, talk of “stability of price,” Imputed Debt Offset issues, it seems their consultant in that case has identified some common issues.

=========================

And here’s what Ray Cox, former 25B Representative says, and yes, he is indeed saying that Garvey said that it’s all a matter of GRAMMAR! I’ve urged him to read the testimony and briefs of the parties. Sent links. Remember, Ray was a coauthor of the Mesaba bill, which did a LOT more than “offer some grants.” It EXEMPTED the plant from Certificate of Need review, not just for the plant but for as many plants as they want and all the transmission they want. They gave it the power of eminent domain — a PRIVATE company got the power of eminent domain. Selective memory, unfortunately, does not change the leiglsaiton. It’s too late for the “we have to see” line, when the farm was given away in 2003 — now we’re fighting to assure this boondoggle isn’t built:

Please, Ray, do your homework. Commerce’s and the MPCA’s review shows it’s not significantlly cleaner, air emissions wise, than a SCPC plant. You gave them approval without knowing about the particulars of this plant and then later would not do anything to amend that legislation. Now we’re dealing with this mess that you gave us. And don’t worry, I know that Sen. Steve Murphy amended your bill into the Prairie Island bill, and he’s accountable for this too. It’s going down in flames, but it never should have gotten this far. As a coauthor of that bill, you’ve got a responsibility to Minnesotans.

Please, go to www.mncoalgasplant.com and read the Commerce brief. Read MCGP’s and Xcel’s brief.

Read the MPCA emissions profile.

MPCA Testimony of Jackson

MPCA Emissions Profile

Reread the Prairie Island/Mesaba Bill here.

Once you’ve reviewed the reality that is Mesaba, can you even offer qualified support?

Annual Power Plant Siting Act Hearing

January 10th, 2007

ANNUAL HEARING – POWER PLANT SITING ACT

2:00 p.m.

Tuesday, January 23, 2007

PUC – Small Hearing Room

121 – 7th Place E.

St. Paul

I’ll bring my coffee pot and coffee.

Bring healthful treats to share, e.g., high carb, butter, unrefined sugar!

It’s not 116C anymore, it’s 216E… and that’s just the start of the changes to the Power Plant Siting Act, and here’s your opportunity to tell them what you think (for those of you wallflowers who don’t do it daily) for the record!

The commission shall hold an annual public hearing at a time and place prescribed by rule in order to afford interested persons an opportunity to be heard regarding any matters relating to the siting of large electric generating power plants and routing of high-voltage transmission lines. At the meeting, the commission shall advise the public of the permits issued by the ommission in the past year. The commission shall provide at least ten days but no more than 45 days’ notice of the annual meeting by mailing notice to those persons who have requested notice and by publication in the EQB Monitor and the commission’s weekly calendar.

This is for the Siting side of large electrical facilities.

The site for that part of things is the “Facility Permitting” site on the PUC’s site, go figure… I have asked so many times for a schematic of how it all fits together and everyone just laughs.

Here’s the link for the Project Docket site for the Annual Hearing. You’ll note 2005 dropped off the map… sigh…

Usually there’s a record – it’s taped, and then there are summarized comments which are usually pretty good, but in 2005 it looks like they’re all sleeping at the switch. That’s the first meeting after the switch from EQB to “the agency formerly known as the EQB” and no, I don’t know what to call it because, hey, it’s supposed to be “Commerce” but it’s at the PUC site, the Hearing docket and all the stuff that area is working on, so you tell me… makes no sense…

Remember when there was a “Department of PUBLIC SERVICE?” What a concept.

ANNUAL HEARING – POWER PLANT SITING ACT

2:00 p.m.

Tuesday, January 23, 2007

PUC – Small Hearing Room

121 – 7th Place E.

St. Paul