Minn. Stat. 117.189 Legislative History

August 6th, 2009

This is one of those things that’s been bugging me for a long time, and I’m finally getting around to looking it up. There are a few twists and turns, and this is a long post, with a lot of links and a lot of audio listening for you to dig in if you’re interested. If you’re a landowner, you sure better be! If you’re a landowner affected by utility infrastructure, this is required reading and listening!

Here we go!

History of Minn. Stat. 117.189

Here’s the statute (the specific statutory cites below are linked):

117.189 PUBLIC SERVICE CORPORATION EXCEPTIONS.

Sections 117.031; 117.036; 117.055, subdivision 2, paragraph (b); 117.186; 117.187; 117.188; and 117.52, subdivisions 1a and 4, do not apply to public service corporations. For purposes of an award of appraisal fees under section 117.085, the fees awarded may not exceed $500 for all types of property.

History:

Short version – this bill was a bipartisan sell-out that exempted CapX 2020 and any other public service corporation project from eminent domain that every other entity must comply with. Why on earth would they do this… or rather, what innocent explaination is there for this 117.189 section of the bill?

So far that I’ve heard (only ~6 hours thus far), Sen. Scott Dibble is the only one asking “Why exempt public service corporations?”

The only Senators who voted against this were:

Anderson, Cohen, Dibble, Hottinger, Marko, Moua, Pappas, Ranum, Skoglund

The only Reps who voted against this were:

Davnie, Ellison, Goodwin, Hausman, Hornstein, Huntley, Johnson, S., Kahn, Lanning, Lenczewski, Mahoney, Mariani, Mullery, Paymar, Thao, Wagenius, Walker

Please take a few minutes and send them a thank you note! Here’s a link to their emails:

*****************************************************

First, some more history, going back to my all time favorite bill:

Remember, this was the bill that grew from the deal the enviros did in 2003, incorporating the material terms of that deal into the 2005 Omnibus bill.

And… why… look, there’s language in the 2005 Transmission Omnibus Bill from Hell mandating an “Eminent Domain Landowner Compensation — Landowner Payments Working Group!”

55.35 ARTICLE 1155.36 EMINENT DOMAIN LANDOWNER COMPENSATION56.1 Section. 1. [LANDOWNER PAYMENTS WORKING GROUP.]56.2 Subdivision 1. [MEMBERSHIP.] By June 15, 2005, the56.3 Legislative Electric Energy Task Force shall convene a landowner56.4 payments working group consisting of up to 12 members, including56.5 representatives from each of the following groups:56.6 transmission-owning investor-owned utilities, electric56.7 cooperatives, municipal power agencies, Farm Bureau, Farmers56.8 Union, county commissioners, real estate appraisers and others56.9 with an interest and expertise in landowner rights and the56.10 market value of rural property.56.11 Subd. 2. [APPOINTMENT.] The chairs of the Legislative56.12 Electric Energy Task Force and the chairs of the senate and56.13 house committees with primary jurisdiction over energy policy56.14 shall jointly appoint the working group members.56.15 Subd. 3. [CHARGE.] (a) The landowner payments working56.16 group shall research alternative methods of remunerating56.17 landowners on whose land high voltage transmission lines have56.18 been constructed.56.19 (b) In developing its recommendations, the working group56.20 shall:56.21 (1) examine different methods of landowner payments that56.22 operate in other states and countries;56.23 (2) consider innovative alternatives to lump-sum payments56.24 that extend payments over the life of the transmission line and56.25 that run with the land if the land is conveyed to another owner;56.26 (3) consider alternative ways of structuring payments that56.27 are equitable to landowners and utilities.56.28 Subd. 4. [EXPENSES.] Members of the working group shall be56.29 reimbursed for expenses as provided in Minnesota Statutes,56.30 section 15.059, subdivision 6. Expenses of the landowner56.31 payments working group shall not exceed $10,000 without the56.32 approval of the chairs of the Legislative Electric Energy Task56.33 Force.56.34 Subd. 5. [REPORT.] The landowner payments working group56.35 shall present its findings and recommendations, including56.36 legislative recommendations and model legislation, if any, in a57.1 report to the Legislative Electric Energy Task Force by January57.2 15, 2006.

Now, let’s take a look at who was on that Committee:

REPRESENTATIVE MEMBERS

1. Jim Musso (Xcel Energy) representing transmission owning investor-owned utilities

2. Bob Ambrose (Great River Energy) representing electric cooperatives

3. Mrg Simon (Missouri River Energy) representing municipal power agencies

4. Chris Radatz-representing the Minnesota Farm Bureau

5. Tim Henning (farmer) representing the Minnesota Farmers Union

6. Jack Keers (Pipestone County Commissioner) representing county commissioners

7. Robin Nesburg (Rural Appraisal Services) representing real estate appraisers

AT LARGE MEMBERS

8. Beth Soholt (Wind on the Wires)

9. John Nauerth III (farmer)

10. George Crocker (North American Water Office)

11. Bob Cupit (Public Utilities Commission)

12. Bill Blazar (Minnesota Chamber of Commerce)

Here’s the report of the Work Group:

LANDOWNERS’ PAYMENTS WORKING GROUP

REPORT TO THE LEGISLATIVE ELECTRIC ENERGY TASK FORCE (LEETF)

Laws 2005, chapter 97, article 11, required the Legislative Electric Energy Task Force (LEETF) to create a landowners’ payments working group to study alternative methods of remunerating landowners on whose land high-voltage transmission lines have been constructed.

The group was created, met twice, and this is a report of its findings and recommendations.

LANDOWNER PAYMENTS GROUP FINDINGS

1. Farm owners in southwestern Minnesota want compensation for high-voltage transmission line easements to be paid annually as a percentage of the current value of the land so that as land values rise or drop, the payments rise or drop accordingly.

2. Easement acquiring utilities are not in favor of the proposal described in item #1 and do not want to fundamentally change the current method of payment for easements, which consists of a onetime payment based on a percentage value of the land over which the easement is acquired.

3. The Legislature has the authority to mandate the payment system described in item #1.

4. There are no jurisdictions that have the payment system described in item #1.

5. The payment system described in item #1 would be more expensive than the current payment system, assuming the percentages proposed by the landowners with attendant upward pressure on rates.

6. There is a social value to having a harmonious, nonadversarial process to acquire high-voltage transmission line easements that has an economic value that is hard to quantify.

7. There is a sense that the process for negotiating an easement and/or contesting it by a landowner is too expensive and complicated and it may be helpful to search for legislative ways to ensure that all similarly situated landowners receive the same just compensation without being intimidated by the process or forced to great expense by the process.

8. While this group was formed due to farm landowner concerns, the scope of the charge extends to all landowners. Guidance from the task force is necessary as to the scope of the charge because the scale of the issue is altered if any easement over any land is the subject of the discussion.

9. While the direct parties in interest–the landowners and utilities–are stalemated, the current push to acquire easements for new lines makes the issue one that should have a firm handle kept on it.

RECOMMENDATIONS

1. If further work is to be done on this topic, the task force should provide the guidance described under finding #8.

2. If the task force wants to continue work on this topic and wants more public input, it should consider utilizing the same persons who are on the current study group.

3. The task force may wish to consider whether there are flaws in the current easement acquisition process related to its expense to landowners to contest and perceived intimidating qualities.

*****************************************************

Let’s look at the eminent domain bills the following session, Senate bill, SF 2750 and the House bill, HF 2846.

SF 2750

Senate Authors, none added after introduction: Bakk ; Kiscaden ; Bachmann ; Chaudhary ; Kubly

Bill as introduced, had the Public Service Corporation exemption AND the appraisal fee limitation:

On the Senate side, there are some interesting statements in the first Committee hearing, Judiciary, discussion about limiting who can speak at county meetings about eminent domain (!!!), limitations of attorneys’ fees… and there’s a discussion that I’m trying to transcribe … will post soon…

Senate Judiciary – March 9, 2006 – PART I

Senate Judiciary – March 9, 2006 – PART II

Senate State and Local Government Operations – March 13, 2006 – Part I

Senate State and Local Government Operations – March 13, 2006 – Part II

Here’s Sen. Dibble questioning, in State and Local Government Operations – March 13, 2006 Part I (linked):

Senate State and Local Operations Committee

Chair: We’ll ask Senator Bakk to address this question.

*****************************************************

HF 2846

As introduced it had the Public Service Corporation exemption:

*** The sentence about appraisals did not appear in it as introduced or in the 5 engrossments online.

Here’s the House Research explanation of that paragraph:

12 Public service corporation exception. Provides that the provisions for attorneys’ fees (section 4 ), compensation for loss of going concern (section 8 ), minimum compensation (section 10 ), and limitations (section 11 ), do not apply to public service corporations.

*****************************************************

Conference Committee

04/12/2006 Senate conferees Bakk, Murphy, Betzold, Higgins, Ortman

04/12/2006 House conferees Johnson, J.; Abrams; Davids; Anderson, B.; Thissen

*****************************************************

Here are the reports of House and Senate adoption of Conference Committee Report, including votes:

PUC’s wind turbine noise docket in the news

August 4th, 2009

It’s out today, Dan Gunderson at MPR has done an extensive piece on the Minnesota Public Utilities Commission “investigation” of wind turbine noise and health impacts, looking at, per the PUC:

The Commission is gathering information to determine if current permit conditions on setbacks remain appropriate and reasonable.

PUC – Notice WITH SERVICE LIST

Here’s the audio — full text is way below:

What concerns me is that, again, they only gave notice of this docket to the wind industry, and not the people intervening or commenting in PUC wind dockets who raised this issue in the first place, and my comment on that to the PUC, urging them t expand the Notice:

Overland Comments – Request for Broader Distribution of Notice

To see the PUC’s wind turbine setback docket, go to www.puc.state.mn.us, click “eDockets” on lower right, and search for docket 09-845.

And here’s the MPR piece in writing:

Wind turbine noise concerns prompt investigation

by Dan Gunderson, Minnesota Public RadioIn Minnesota, those complaints prompted the Public Utilities Commission to investigate.

Soon after they moved in, dozens of wind turbines sprouted in a neighbor’s nearby field.

In Minnesota, a handful of groups have organized to demand tougher regulation. They want the state to require more distance between wind turbines and homes. A report by the Minnesota Department of Health concluded there are potential health concerns.

Read the rest of this entry »

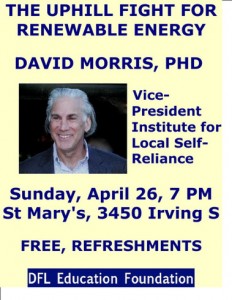

David Morris on PUC process and Capx 2020 decision

April 24th, 2009

Once more, it’s David Morris, Institute for Local Self Reliance, telling it like it is. The PUC process is long over do a complete revamping. It is based on laws and rules that grew out of the 1970s-1980s transmission fights, and gave people a useful and meaningful way to participate in these proceedings. But that’s gone, gone with the 2001 changes, gone with the 2005 Transmission Omnibus Bill from Hell, and we’re left with just about nothing. In other states, there’s Intervenor Compensation which allows Intervenors the ability to pay for expert witnesses, there are free transcripts as a matter of course, and there’s encouragement and support of Intervenors, not a drive to push them out of the process that we see here, that we saw in this CapX proceeding, when the ALJ tried to boot out U-CAN; that we saw in the Excelsior Energy docket (scroll down to “Fourth Prehearing Order”).

David Morris: If it’s citizens vs. utilities, utilities win

The PUC has an approval process that stacks the deck against the public.

By DAVID MORRIS

Last update: April 23, 2009 – 6:50 PM

A few days ago, the Minnesota Public Utilities Commission (PUC) approved a massive high-voltage transmission project known as CapX that will cost Minnesotans an amount equal to the projected biennial state budget deficit and four times the total bill to taxpayers for the Twins and Gophers stadiums.

With respect to the stadiums, Minnesotans were able to actively participate in the decisions, both directly and indirectly through elected representatives. Both those in favor and those opposed to using tax dollars to pay for the stadiums engaged in a spirited public debate. The Legislature is currently just as vigorously debating ways it can eliminate the budget deficit.

The PUC process, on the other hand, is much more hostile to citizen participation and influence. Indeed, the deck is stacked against the average citizen. Utilities have a virtually unlimited budget to argue their positions — a budget they raise from their ratepayers. Citizens, on the other hand, must raise their own money, and lots of it, to participate effectively.

The rules under which the PUC operates are established by the Legislature. Utility lobbyists are powerful there. But they’re not all-powerful. Thus, over the years, Minnesotans have been able to enact rules to help level the playing field for citizens. For example, the law requires the PUC to reject an application to build a large power plant or a high-voltage transmission line unless the utility proves it is needed to improve reliability or meet increased demand or achieve renewable-energy goals. As part of the application, the utility is expected to thoroughly and completely explore alternatives to its proposal, including no-build options. The burden of proof on whether a project is needed rests with the utilities.

The PUC, regrettably, has interpreted this rule so as to turn it on its head. At the PUC, the burden of proof rests with those opposed to a new power plant or high-voltage transmission line. It is up to the people whose homes and farms may be seized by utilities if a project is approved to make the case for alternatives. Doing so requires an extremely high level of technical expertise. A serious technical and economic examination of alternatives can cost $100,000 to $200,000 or more.

Even if citizens are able to raise that kind of money, they face other hurdles. To analyze alternatives, they must access data that only utilities possess. In many cases, the utilities call that data proprietary and argue that to make the information public is to give a possible advantage to a competitor. One would think that this would be a hard argument to make. After all, Minnesota utilities have a monopoly on the sale of electricity. Apparently, however, it is not a hard argument to make at the PUC.

A formal proceeding, such as a judicial proceeding, involves the cross-examination of witnesses. In many proceedings, utilities again tax their customers by using ratepayer money to acquire a transcript. One would think that since the transcript is in electronic form, the PUC would post it and make it freely available to the public. Astonishingly, the PUC rules state that court reporters own the transcript! Citizens and other intervenors must pay for their own copies of transcripts, which, for controversial projects, could mean $5,000 to $10,000 per copy.

In the recent CapX transmission case, the PUC went one step further in denying citizens. The need for the transmission lines was based in large part on a projection of significantly increasing demand. That projection was largely made in forecasts completed in 2004. It has already proven to be vastly overstated. Moreover, the current economic collapse is translating into shrinking, not growing, electricity demand. Hundreds of citizens asked the PUC to take this new information into account and keep the proceeding open. The PUC decided the current economic free fall doesn’t make a difference.

Utilities are gearing up to ask the PUC to spend billions more for even higher-voltage transmission lines. These will be built to send electricity from the Dakotas to Chicago and New York while running right through Minnesota. If these lines are approved, Minnesotans will probably pay most of the costs, while receiving little if any benefit.

Imagine if legislators proposed taxing us to build a sports stadium in Chicago. The proposal would be dead on arrival. Citizens have influence and even power in the Legislature. The process and rules at the PUC must be redesigned to allow them similar access and influence over energy decisions.

David Morris is vice president of the Institute for Local Self-Reliance, based in Minneapolis and Washington, D.C.

It’s the economy, stupid!

April 6th, 2009

We’ve heard that before and we abdicated… and where are we?

Thanks to Jonathan Larson, who never fails to delight with his finds, for this insightful and inciteful piece:

“This article is dedicated to the protestor on Wall Street on 25 September, 2008, who said what everyone was thinking.”

Patti Fritz, whatever are you thinking?

February 2nd, 2008

News over the wire today, Rep. Patti Fritz has authored and introduced HF 2601, a stealth interim introduction, hmmmm…

H.F. No. 2601, as introduced – 85th Legislative Session (2007-2008)

Posted on Jan 22, 2008

1.1 A bill for an act

1.2 relating to natural resources; removing certain land in the Cannon River area

1.3 from the wild and scenic rivers program.

1.4 BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF MINNESOTA:

1.5 Section 1. CANNON RIVER WILD AND SCENIC RIVERS DESIGNATION.

1.6 The commissioner of natural resources shall remove the following land within

1.7 the Cannon River wild and scenic river area from the Minnesota wild and scenic rivers

1.8 program under Minnesota Statutes, sections 103F.301 to 103F.345: all property west of

1.9 Faribault Boulevard, north of 164th Street, and south of 158th Street. The commissioner

1.10 shall amend Minnesota Rules, chapter 6105, and the management plan for the area to

1.11 reflect this change.

1.12 EFFECTIVE DATE.This section is effective the day following final enactment.

Whatever is she thinking? This bill would remove a chunk of the Cannon River from Wild & Scenic designation. Why? I can’t imagine any other reason than that the Wild & Scenic designation gets in the way of something some developer wants to do. What gives?

Here’s a google map: 158th & Hwy. 3

Here’s the street view (cool option, eh?), and isn’t this right by the park:

(Now, if I can just learn how to embed this stuff)