Wind Rulemaking — Petition for Reconsideration

October 16th, 2018

Remember when AWA Goodhue and Pickens were pushing that wind project in Goodhue County and accused the local folks of “promiscuous ice fishing” and baiting eagles? Well, above is what Goodhue Wind Truth’s Marie McNamara had to say about that… and we’re still at it.

A couple months ago, we filed yet another rulemaking petition, this one was the 2nd for wind rulemaking in Minnesota, to address the big holes in Minn. R. Ch. 7854, the wind siting rules.

The Commission wasn’t thrilled, and denied the petition:

DENY THE PETITION? WHEN THERE ARE NO WIND SITING RULES? Yeah, right… so here’s what we filed today:

Petitions for Reconsideration of Line 3 PUC decision

September 26th, 2018

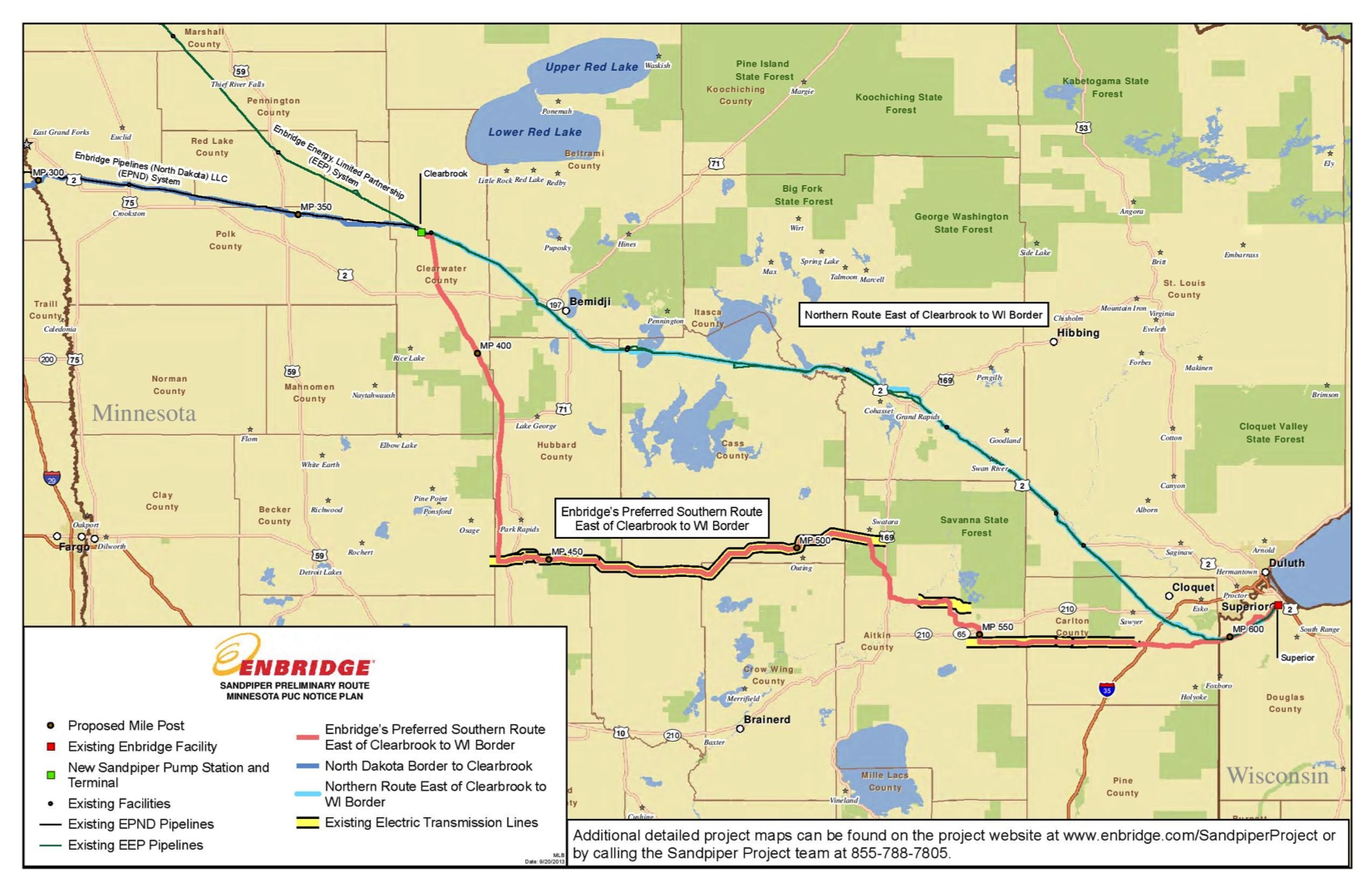

Today the Motions for Reconsideration for Enbridge’s Line 3 pipeline were due, and here they are:

Friends of the Headwaters_20189-146618-01

Whew, that’s a lot to read, but it’s instructive!!

Video of Thursday’s PUC meeting!

September 23rd, 2018

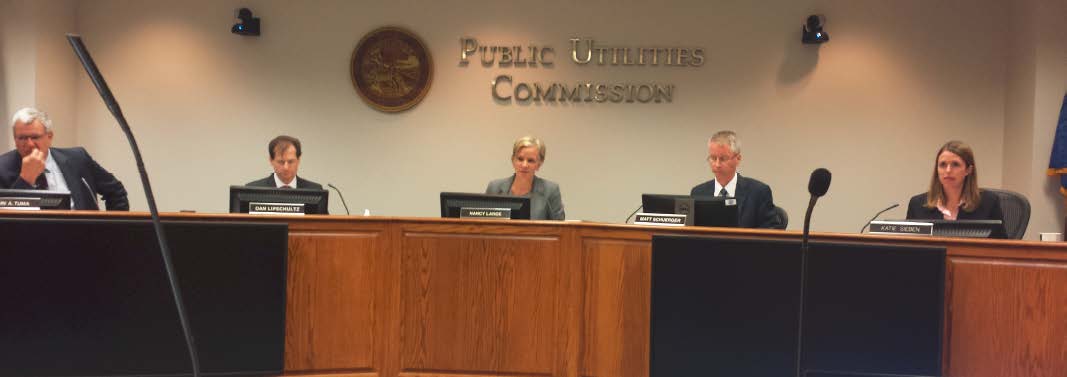

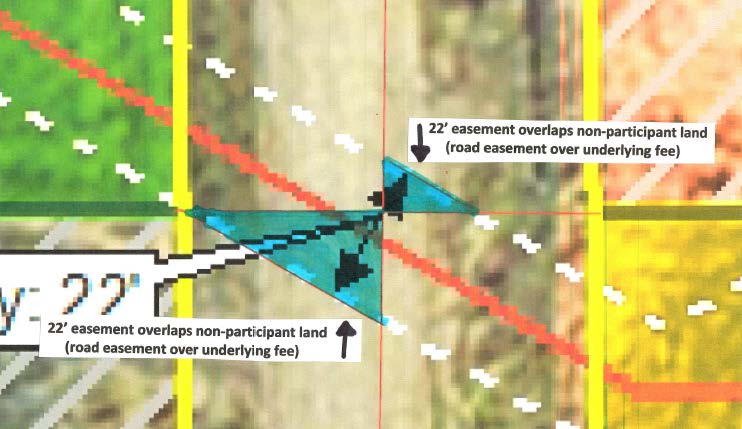

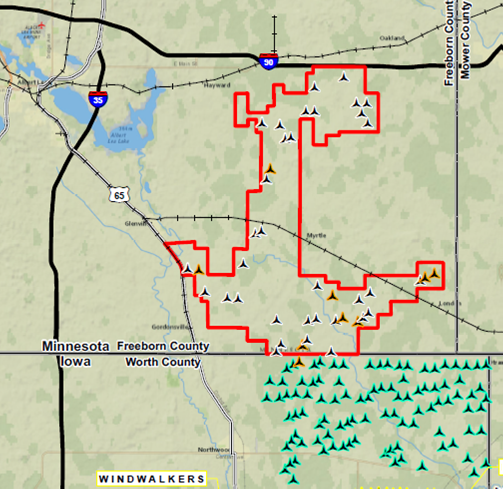

Here’s the audio and video of the Public Utilities Commission meeting of September 20, 2018, where the Commission decided to deny the Goodhue Wind Truth rulemaking petition and to approve the Freeborn Wind siting permit Recommendation of the Administrative Law Judge that the permit be denied, AND to approve the transmission line, for which Freeborn Wind does not have all necessary land rights — note the blue triangles — that represents the underlying fee interest of non-participants.

So, Thursday’s meeting? Goodhue Wind Truth rulemaking petition and Freeborn Wind siting and transmission permit? Here ya go!

Video (can’t figure out how to download video)

Audio Download

Below the video screen is a list of agenda items. Click #2 for their rejection of the Goodhue Wind Truth Petition for Rulemaking. Click on #3 for their approval of the Freeborn Wind Site permit, and #4 for their approval of transmission for Freeborn Wind. Liberally dose yourself with anti-emetic before watching!

Freeborn? PUC upends ALJ’s Freeborn Wind Recommendation

September 21st, 2018

It was a full house yesterday at the PUC but the result was a bust. The PUC tossed the Freeborn Wind ALJ Recommendation right out the window, did a 180 from the ALJ’s Recommendation and granted a siting permit and transmission permit for Freeborn Wind. There was a last minute “compromise” presented by Freeborn Wind and Commerce, last minute, meaning the DAY BEFORE, and the PUC Staff Briefing papers had 23 pages of an inexplicable chart of proposed adoption and rejection of Exceptions.

20189-146406-01_PUC_StaffBriefingPapers

Through what gyrations will they get their “order” to align with the record? Out with it — let’s see!!

In the STrib:

Minnesota utility regulators approve Freeborn County wind farm opposed by neighbors

In the Albert Lea Tribune:

Commission unanimously approves Freeborn Wind Farm permits

From the article:

Commissioner Katie Sieben said she also supported the project, noting she received a letter in July 2017 from a constituent saying the issue was “tearing neighbors apart.”

“I would hope that as the applicant has modified, has moved wind turbines, has lessened that division,” she said.

Sieben says Freeborn “has moved wind turbines?” WHERE EVER WOULD SHE GET THAT IDEA? The application wasn’t modified, wind turbines haven’t been moved. This just proves she hasn’t read the record. How many times did Dan Litchfield testify that they couldn’t move any turbines?

And on KIMT TV:

Freeborn Wind Farm approved by the Minnesota Public Utilities Commission

Another Freeborn last minute filing! And AFCL response

September 19th, 2018

Freeborn Wind at the PUC tomorrow.

Watch on line HERE: Live Webcast

ANOTHER LATE FILING!!! This last minute flurry is indicative of their desperation! So I guess it’s a good thing, but hey, I’ve got to get ready for the Wind Rulemaking docket that I’ve been trying to get before the Commission for how many years? Oh well… one thing at a time…

Freeborn Wind’s “Late Filed — Proposed Special Conditions Related to Noise _20189-146486-01

And our response just filed:

Oh yeah, we’re going to have fun at the PUC tomorrow. Watch on line HERE: Live Webcast

And background, yesterday and day before:

AFCL reply to Freeborn Wind’s Motion to Exclude

Freeborn Wind files Motion to Exclude!!