LS Power withdraws Texas plant

September 18th, 2009

Remember LS Power, the ones who have the harebrained idea of building an 855MW gas plant next to the Chisago substation? They may think that calling it Sunrise River Energy makes it less odius! Well, LS Power is starting to see the light, and let’s hope this idea of withdrawing the project spreads northward!

Power plant pulls plug on project

And from LS Power, the LS Power spin:

Well, DUH!

LS Power won’t build Navarro County Power Plant

LS Power cancels plans to build power plant in Navarro County

LS Power’s Sunrise River mega gas plant

June 26th, 2009

LS Power is proposing to put a massive 800+ MW gas peaking plant in Chisago County, right by the Chisago County substation. This isn’t news for regular Legalectric readers, but the community is just starting to wake up.

This plant was the subject of a utility personal property tax exemption bill introduced by area legislators, Rep. Jeremy Kalin and Sen. Rick Olseen, and they introduced it without notifying local governments that they were pulling out a lot of much needed funding by exempting the plant from taxes (if local residents have to pay taxes, shouldn’t they? How is LS Power special?). THIS SAYS THE GOVERNOR VETOED IT.

When it came up at the county, and a Commissioner wanted to send a thank you to Kalin and Olseen, things got a little hot:

That’s encouraging, not everyone is toadying…

There have been meetings this week about the LS Power proposal, one on Monday for “stakeholders” it seems, and another on Tuesday for the public. The one on Monday, well, we need more information… like, who’s a “stakeholder,” and who decides?

As for Tuesday, here’s a link:

And will you look at who was there?!?!?!

And I hear they’ll be holding another next Monday, so you should go if you’re interested:

Where?

When?

I’m struck by how the statutory reference on the “Friends” site is only to Chapter 216E, the siting and routing process, and worse, it focuses on the the shortened “Ram it Through” alternate review... if they’ve got that up their sleeves, they’ll need a whack upside da head on that one. And if it’s shortened review, they have the option of “local review.” Is that the plan? FOR AN 855MW PLANT??? GUESS AGAIN, CUPCAKE!!!

And so, welcome to the Certificate of Need concept.

It seems to me that they had at least one similar meeting over a year ago, in April, 2008, looking at a snippet from Larry Baker’s page — who was regarded as a “stakeholder” then??

LS Power’s proposal is moving along in the MISO queue:

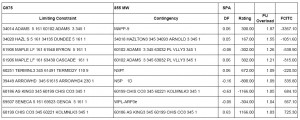

As you can see from the G975 chart in the study above, G975 has a few problems:

Here’s an earlier report from one of the three prior MISO queue’d projects for this location:

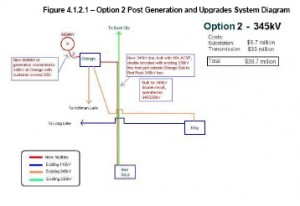

… and what’s interesting about is, first, they eliminated a reconductoring option because it was deemed too costly, not feasible, and here are the other options, starting with Option 2, p. 7 in the study above:

See that big honkin’ 345kV line that would have to be built?!?!

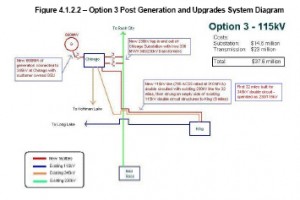

And for Option 3, p. 8:

More transmission lines to be built…

Either way you look at it, we’re talking lots of big transmission in Chisago land.

Whatever are they thinking?

Interesting day at PUC – Part 2

June 12th, 2009

Part 2 – Chisago Transmission Project

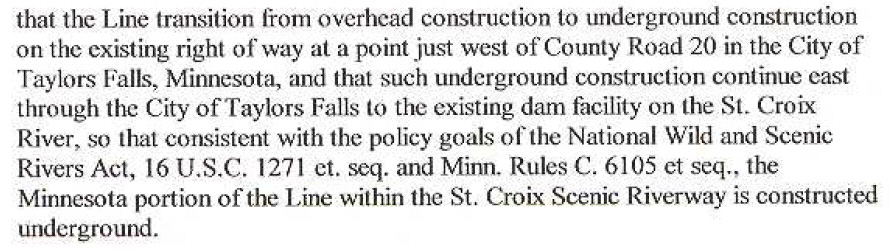

For the full PUC docket, go to www.puc.state.mn.us and click on “eDockets” blue button, and search for 04-1176 and/or 06-1667. The issue before the PUC was Taylors Falls’ Petition to Amend the Chisago Routing Permit because NSP was trying to route the line contrary to the specifics of the Agreement between the City and the utility.

It was a Petition from City of Taylors Falls, but the Order was off, and Pugh, acting as Chair (after Reha, who had been acting as Chair in Boyd’s absense, recused herself), had MOES’ David Birkholz start, and argue against the Petition. Hmmmmm… then after that, we did introductions and argued the Petition. It started with the City of Taylors Falls, Loren Canaday, past council member back when the Agreement was made, and Michael Buchite, current Mayor. Loren Canaday was in office and was an advocate for the Agreement, and he spoke about the history of the Agreement, and recommended “a small jog south of the utility corridor, which would permit undergrounding without harming the wetland.”

Bill Neuman brought in a letter dated May 29, 2007, from Commerce’s Birkholz, asking the National Park Service for a summary of its position, noting that the “opinion of NPS is critical.” and asking whether NPS DOES have significant objection if the transmission line is not undergrounded dto the river. NPS said that the routing should NOT reverse conditions agreed upon by Cities of Taylors Falls and St. Croix Falls and Xcel.

Jill Medland of NPS came in and spoke. She is in the Resource Management Division, in charge of Environmental Compliance and Permit Review. She gave some history of the St. Croix River Valley protections. She noted that Taylors Falls has done an exemplary job of protecting the river valley, using its authority and its will. She said that the way she reads the Agreement, they all advocated for the configuration in the Agreement, undergrounding down the high river bluff to the dam.

O’Brien asked whether NPS opposed blasting in the basalt, and Medland responded, “We have no reason to oppose that.”

Through out this discussion, I was wondering how they thought Xcel would bury the line down the bluff if not by blasting… EARTH TO MARS! IT’S A BLUFF! IT’S ROCK!

It was a tortured discussion, with Commissioner Wergin noting that she was not there for the decision, and the Agreement was in the record (implying, HEY YOU, WHERE WERE YOU ON THIS!). Pugh and O’Brien were pretty sheepish about not having addressed the agreement in the Order. I got it in the record, Exhibit 218, but it wasn’t my job to advocate for Taylors Falls interests, that’s their job, and where were they? But neither the ALJ nor the PUC took any note of the material terms in the Agreement and addressed consistency of the plan with the Agreement.

Bottom line – Motion to require company to make compliance reports, and to suspend the Petition to Amend, and that parties are urged to revisit the Agreement and if necessary, to invoke the Arbitration clause.

Passed unanimously, only Pugh, O’Brien and Wergin, as Reha was recused and Boyd was absent.

Rep. Kalin and Sen. Olseen push LS Power tax exemption

April 28th, 2009

Well, Jeremy Kalin is not happy with me, but I don’t see that amendments to the Tax Omnibus bill does it. He says that all the local governments are covered in a Tax Omnibus amendment (Tax Omnibus is HF 2323, HERE) and that they must have a Host Fee Agreement. But what I see is one amendment that is GOOD language I’ve been passing out since 2005, except for one serious problem — where I had “Host Fee Agreement” it says “site agreement.” Color me a lawyer, but that’s not the same thing. Here’s that amendment, 272.0275 below. If it said “Host Fee Agreement” or “Agreement for payment in lieu of taxes” I’d be over the moon with joy, but this could mean anything and does not address payment of taxes. What do you think?

103.6 Sec. 6. [272.0275] PERSONAL PROPERTY USED TO GENERATE

103.7 ELECTRICITY; EXEMPTION.

103.8 Subdivision 1. New plant construction after January 1, 2010. For a new

103.9 generating plant built and placed in service after January 1, 2010, its personal property

103.10 used to generate electric power is exempt if an exemption of generation personal property

103.11 form, with an attached siting agreement, is filed with the Department of Revenue. The

103.12 form must be signed by the utility, and the county and the city or town where the facility is

103.13 proposed to be located.

103.14 Subd. 2. Definition; applicability. For purposes of this section, “personal property”

103.15 means tools, implements, and machinery of the generating plant. The exemption under this

103.16 section does not apply to transformers, transmission lines, distribution lines, or any other

103.17 tools, implements, and machinery that are part of an electric substation, wherever located.

103.18 EFFECTIVE DATE.This section is effective the day following final enactment.

The language they put in that’s LS Power specific does offer protections, but given there are three lines into the Chisago sub, and a new one just announced going east into Wisconsin, I don’t see that any limitation of transmission routing would be effective.

Here’s the LS Power specific language, one sentence is now two (para.5 & 6), and there’s an added paragraph that it must be in a county with an essential services and transmission services ordinance (geeee, I wonder who helped write that?). A signed “development agreement” does not address personal property taxes. So I’m not satisfied (I know, always the bitch, but there it is, this isn’t enough, doesn’t have the right language).

1.29 Sec. 5. Minnesota Statutes 2008, section 272.02, is amended by adding a subdivision

101.30to read:

101.31 Subd. 92. Electric generation facility; personal property. (a) Notwithstanding

101.32subdivision 9, clause (a), attached machinery and other personal property that is part of

102.1an electric generation facility that exceeds 150 megawatts of installed capacity, does

102.2not exceed 780 megawatts of summer capacity, and that meets the requirements of this

102.3subdivision, is exempt. At the start of construction, the facility must:

102.4(1) be designed to utilize natural gas as a primary fuel;

102.5(2) be owned by an entity other than a public utility as defined in section 216B.02,

102.6subdivision 4;

102.7(3) be located within five miles of two or more interstate natural gas pipelines;

102.8(4) be located within one mile of an existing electrical transmission substation with

102.9operating alternating current voltages of 115 kV, 345 kV, and 500 kV;

102.10(5) be designed to provide electrical capacity, energy, and ancillary services;

102.11(6) have satisfied all of the requirements under section 216B.243;

102.12(7) have executed an interconnection agreement with the Midwest Independent

102.13System Operator that does not require the acquisition of more than one mile of new

102.14electric transmission right-of-way within the county where the facility is located, and does

102.15not provide for any other new routes or corridors for future electric transmission lines in

102.16the county where the facility is located;

102.17(8) be located in a county with an essential services and transmission services

102.18ordinance;

102.19(9) have signed a development agreement with the county board in the county in

102.20which the facility is located. The development agreement must be adopted by a two-thirds

102.21vote of the county board, and must contain provisions ensuring that:

102.22(i) the facility is designed to use effluent from a wastewater treatment facility as its

102.23preferred water source and will not seek an exemption from legislative approval under

102.24section 103G.265, subdivision 3, paragraph (b);

102.25(ii) all processed wastewater discharge will be colocated with the outfall of a

102.26wastewater treatment facility; and

102.27(iii) penalties will be paid to the county for harm to any aquifer or surface water as a

102.28result of construction or operation and maintenance of the facility; and

102.29(10) have signed a development agreement with the township board in the township

102.30in which the facility is located containing provisions ensuring that noise and visual

102.31impacts of the facility are fully mitigated. The development agreement must be adopted

102.32by a two-thirds vote of the township board.

102.33(b) Construction of the facility must begin after March 1, 2010, and before March 1,

102.342014. Property eligible for this exemption does not include electric transmission lines and

102.35interconnections or gas pipelines and interconnections appurtenant to the facility.

103.1(c) The exemption granted under this subdivision is void if the Public Utilities

103.2Commission issues a route permit for an electric transmission line connected to the

103.3electric substation nearest the exempt facility on a route where no electric transmission

103.4line currently exists.

103.5EFFECTIVE DATE.This section is effective the day following final enactment.

===================================

Why do elected officials do things like this? Who are they representing? Why would they give away a source of much needed local revenue for local governments? Why would they do that without any kicker for the affected local governments making the sacrifice of hosting a HUGE electric generating facility? Why would they put a for-profit independent power producer above their constituents? Why would they let a corporation off the hook, at the same time that millions of taxpayers are lined up at the mailbox? What makes this corporation special?

LOCAL GOVERNMENT APPROVAL???

H-O-S-T F-E-E A-G-R-E-E-M-E-N-T ???

Is it that difficult?

Did they bother to look at Minn. Stat. 272.02 to see how exemptions are done?

Yes, there’s a new power plant planned for Chisago County, and

Rep. Jeremy Kalin and Sen. Rick Olseen, joined by Rep. Rob Eastlund and Rep. Bob Dettmer, have introduced a bill to exempt LS Power’s 855MW gas plant from utility personal property taxes. And by this bill, they’re screwing their constituents. How? There’s no requirement in the bill that the local governments (Chisago County, Lent Township and the school district) approve this exemption AND there’s no requirement in the bill that there be a Host Fee Agreement.

Here’s the bill, SF 1671 and HF 2317:

1.1 A bill for an act1.2 relating to taxation; providing a personal property exemption for an electric

1.3 generation facility;amending Minnesota Statutes 2008, section 272.02, by

1.4 adding a subdivision.

1.5 BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF MINNESOTA:

1.6 Section 1. Minnesota Statutes 2008, section 272.02, is amended by adding a

1.7 subdivision to read:

1.8 Subd. 90. Electric generation facility; personal property. Notwithstanding

1.9 subdivision 9, clause (a), attached machinery and other personal property which is part

1.10 of an electric generation facility that exceeds 150 megawatts of installed capacity, does

1.11 not exceed 780 megawatts of summer capacity, and that meets the requirements of this

1.12 subdivision is exempt. At the time of construction, the facility must:

1.13 (1) be designed to utilize natural gas as a primary fuel;

1.14 (2) not be owned by a public utility as defined in section 216B.02, subdivision 4;

1.15 (3) be located within five miles of at least two interstate natural gas pipelines;

1.16 (4) be located within one mile of an existing electrical transmission substation with

1.17 operating alternating current voltages including each of 115 kV, 345kV, and 500 kV;

1.18 (5) be designed to provide electrical capacity, energy, and ancillary services and have

1.19 satisfied all of the requirements under section 216B.243; and

1.20 (6) have executed an interconnection agreement with the Midwest Independent

1.21 System Operator that does not require the acquisition of more than one mile of new

1.22 electric transmission right-of-way within the county where the property is located.

1.23 Construction of the facility must be commenced after March 1, 2010, and before

1.24 March 1, 2014. Property eligible for this exemption does not include electric transmission

2.1 lines and interconnections or gas pipelines and interconnections appurtenant to the

2.2 property or the facility.

2.3 EFFECTIVE DATE.This section is effective for assessment year 2009 and

2.4 thereafter, for taxes payable in 2010 and thereafter.

As someone said today, “They’re telling us that all the plants get exemptions.” To which I said, “Yes, and are they telling you that most also require that local governments approve it, and that they get a Host Fee Agreement?” And of course, the answer was: NO! Local governments need to know that there is an option that they’re not being told about, and an option that would provide serious financial benefits at a time when local governments are really hurting.

Where to go for guidance? Look no further than language found in other exemptions, in Minn. Stat. 272.02:

Jeremy, Rick, add this language, quick before you take away revenue that they sorely need:

To qualify for an exemption under this subdivision, the owner of the electric generation facility must have an agreement with the host county, township or city, and school district, for payment in lieu of personal property taxes to the host county, township or city, and school district.

Or from the Cannon Falls Invenergy gas plant:

To qualify under this subdivision, an agreement must be negotiated between the municipal power agency and the host city, for a payment in lieu of property taxes to the host city.

This is something we learned in Goodhue County, dealing with the Prairie Island nuclear generating plant, these are for-profit independent power producers, and they have to pay their fair share. If they’re exempted, there must be a requirement that they pay their fair share to the county, township and school district to compensate them for hosting the plant.

Here’s a memo from Goodhue County’s former Auditor, Brad Johnson, who is now the head financial honch at the School District, still hot on the trail of that utility personal property tax:

Brad Johnson letter – Invenergy Peaking Plant, Goodhue County

Here’s a Resolution from Scott County showing how to do it, how to stand up on your hinders when faced with a corporation with its slimy hand out, or rather, its slimy hand in your pants pocket (hand in your pants, perhaps?):

OK, Chisago County, Lent Township, and the school district, it’s YOUR turn. Rep. Kalin and Sen. Olseen, it’s YOUR turn. Step up to the plate, stand up for your constituents!

Meanwhile, I’ll keep looking for those Goodhue County and Scott County Host Fee Agreements.

Xcel – Undergrounding in Taylors Falls

April 4th, 2009

Shame, shame, shame, Xcel…

Remember way back when, Chisago II, when then Northern States Power did a deal with the City of Taylors Falls and the City of St. Croix Falls? I won’t forget the cities’ joint siging meeting, because the then Mayor of St. Croix Falls, now a felon, ordered me arrested when I inquired during public comment period about the “Project Mitigation Fund and Committee.” Guess he didn’t want that discussed, didn’t want it questioned… thanks to all the hollering from the audience I didn’t end up with three hots and a cot!

This was a three way deal. Well, Xcel has just unilaterally, without permission of Taylors Falls and St. Croix Falls, altered provisions of the construction specifics that were material terms of the agreement.

From the agreement:

See??? Undergrounding “to the existing dam facility on the St. Croix River…”

Simple enough… but here’s what it says in the PUC Order of February 20, 2008:

… and..

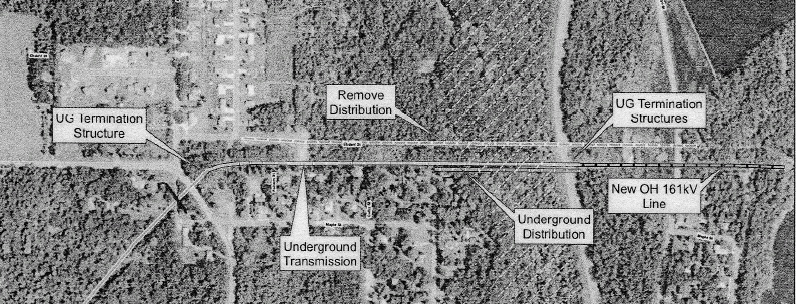

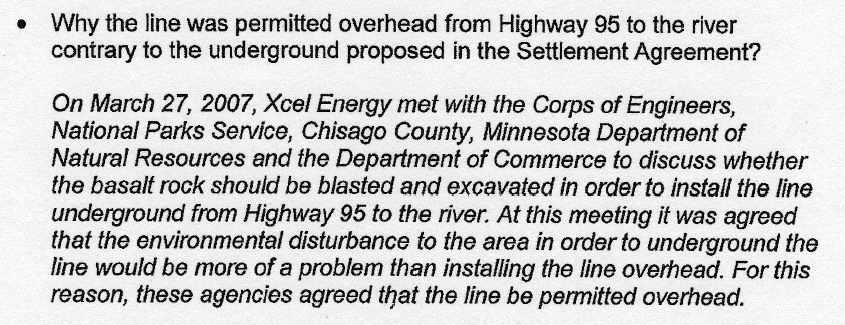

So in the agreement, it is undergrounded all the way to the river, and in the PUC Order, it’s above ground from Hwy. 95 to the river on H-frame structures. EH? Well, what does that look like? Here’s the map:

Off to the right, the wider road where there’s a box pointing downward at the wider road where it says “UG Termination Structures” and the line representing transmission changes to sort of a weird dashed line just after the road, that’s Hwy 95 where just east of the highway, it changes from underground to overhead. If you follow it from Hwy. 95 to the right, east, you’ll see it go over County Road 16, Wild Mountain Road and then over to the St. Croix River.

What does Taylors Falls think about it? They’re unhappy enough to have rattled Xcel’s cage, and got this response from Xcel:

Xcel’s explanation why transmission line was overhead when it was supposed to be underground is… well… read it for yourself:

Oh, right, Xcel, because you got everyone together EXCEPT those who are party to the agreement and they agreed, yeah, seems like it’s OK… uh-huh…

I think a better response: “THAT’S DIFFERENT!”

Should the settlement agreement be amended? Xcel has this to say:

Xcel says there’s no need to amend the settlement agreement and that they’ve “complied with all of the provisions relative to Taylors Falls.” Oh… uh-huh…

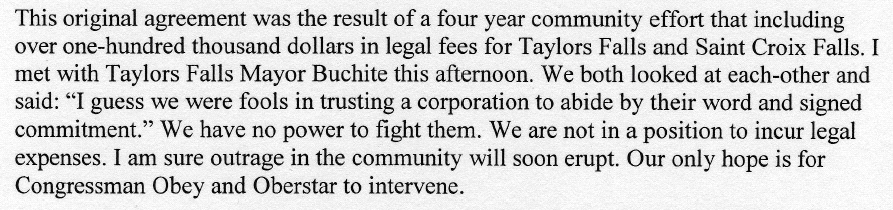

St. Croix Falls, the other party to the agreement, is outraged! They took it to Congressman Obey:

Can you hear their eyeballs rolling, hands thrown up in disgust?

And what’s this about the school in St. Croix Falls?????

Xcel is getting a little too big for its britches!