NRG gets pissy at PSC

March 21st, 2007

Yesterday’s PSC meeting was a bit much — it lasted until 6:30 p.m., but the good news is that the non-utility intervenors, who had been lumped together in an inexplicable Order by the RFP hearing examiner (Order HERE — well, it will be when the inaccessible PSC site is back up and running) were finally granted intervention separately as full parties in the RFP docket. WHEW! A start.

But late the night before the hearing, NRG filed documents “under seal.” Apparently they threatened to sue the PSC — don’t they have any manners? If they want to sue, just do it!!! Then we can get to the “merits” which of course are non-existent. Release the info, DUH!

Until they get around to releasing their info, until the PSC orders it or, as Muller suggested, the PSC throws out the NRG proposal because of their (un)reasonable attitude, consider the emissions info from the Excelsior docket:

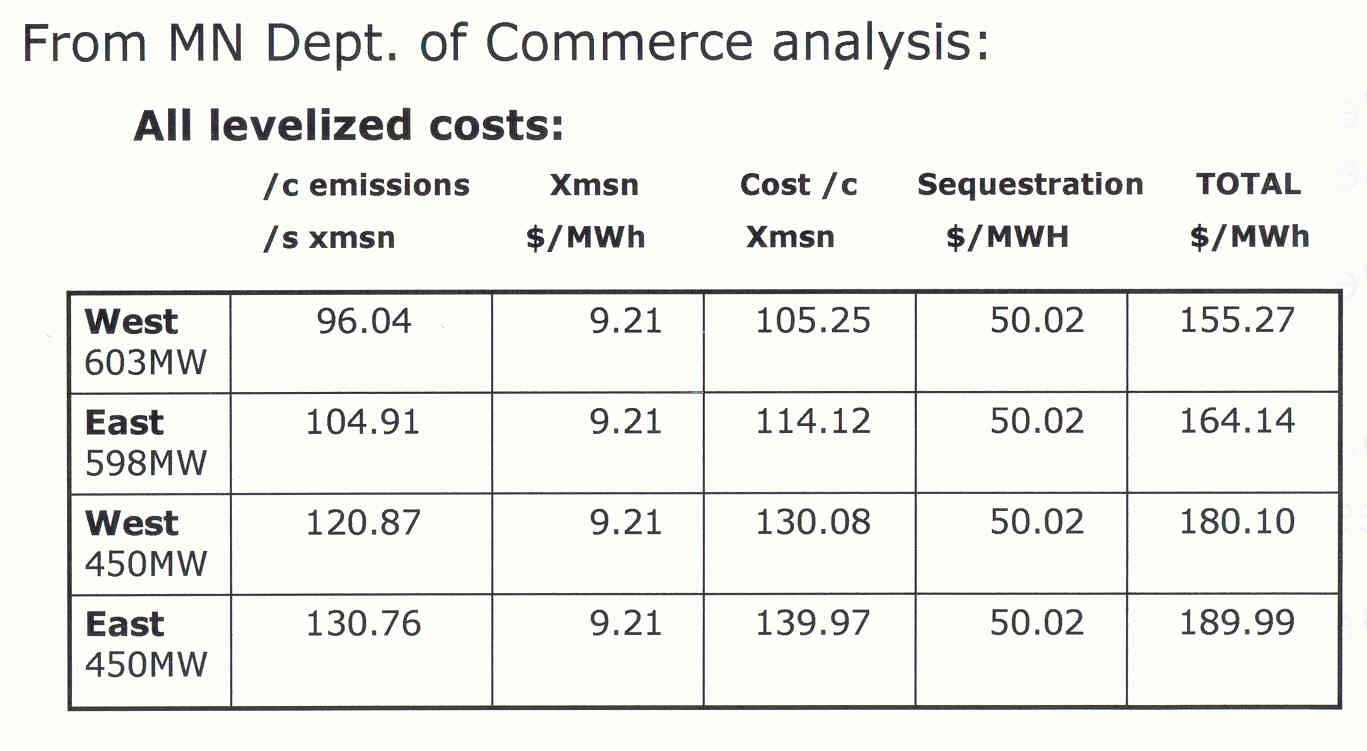

And then there’s that little matter of cost — here it is from the Excelsior docket, the Amit testimony — assume NRG is similar unless proven otherwise:

Get pissy all you want, NRG, but WE KNOW THE TRUTH ABOUT IGCC! We know the emissions profile sucks and we know the cost is outrageous, and we don’t want to pay for it!

NRG says it will sue to hide emissions data

By AARON NATHANS, The News Journal

Posted Wednesday, March 21, 2007

NRG Energy said it will sue to block the disclosure of emissions data and other information contained in its bid to the state to build a new power plant.

On Tuesday night, after a five-hour meeting, the Public Service Commission voted to release portions of NRG’s bid, including the emissions data, within five business days. NRG has vowed to try to find a court that will halt the disclosures.

“We will pursue an appeal on this matter,” said NRG attorney Michael Houghton. “We will act quickly.”

The commission agreed with a staff recommendation to keep financial details private.

At Tuesday’s meeting, NRG made a last-minute bid to keep additional portions of its bid secret, and succeeded in several areas. The commission agreed to keep secret detailed staffing plans for the proposed plant.

Alan Muller of Green Delaware argued at the meeting that the plans should be released because the company has used job creation as one of its selling points.

The commission also agreed to keep private a PowerPoint presentation from an NRG supplier and contract language between NRG and a supplier, which NRG argued were protected by a confidentiality agreement.

The commission agreed to keep private two sections of the bid relating to the price of its proposed product, despite commission staffer James Geddes’ description of them as “rather generic.”

Most commission members hadn’t read an NRG memo filed under seal Monday by the time the meeting started. They took a 45-minute recess to review the memo, then went into a rare closed session to confer with staffers. The News Journal raised an objection to the closed session, claiming it was not supported under the state’s open meetings law.

NRG is proposing a 600-megawatt coal plant for its Indian River facility. The plant would use technology that turns coal into synthesis gas, allowing for some toxins to be removed.

The proposal is one of three to supply energy to Delmarva Power to help meet the state’s long-term energy needs. The other bidders are Bluewater Wind, which wants to put up an offshore wind farm, and Conectiv, which wants to build a natural gas plant. Both have released their emissions data.

NRG officials say they should be exempt from releasing emissions data and other information because their technology is so new in the United States that releasing it would give competitors an unfair advantage. If the company revealed its suppliers, “we’re standing here with our pockets open, ready to be fleeced,” said Caroline Angoorly, the company’s regional senior vice president.

But Muller said more disclosure is better.

“NRG appears to be a company with a lot to hide,” Muller said. “If their bid could stand up to scrutiny, why do they seem so determined to conceal the main underlying facts?”

A state consultant has said Conectiv’s bid best meets the criteria the state set out for the bidders. Bluewater Wind came in second, and NRG last.

Delmarva says it would prefer not to contract with any of the bidders, believing it could keep prices stable with a combination of conservation and competitive buying on the open market.

The commission made its order Tuesday after receiving a Freedom of Information Act request from The News Journal and others. Its order covers all three companies; NRG had blacked out the most information.

Copyright ©2007, The News Journal

Of mad cows and pissy deer…

September 17th, 2005

From webs.wichita.edu/mschneegurt/biol103

In the “it’s about time” category…

Late last month, however, the USDA issued an important and welcome update on its mad cow surveillance program. Since June 2004 the government has tested more than 460,000 “high risk” beef cows — animals culled by veterinarians or renderers because they showed nerve disorders or other potential symptoms of mad cow disease, formally called bovine spongiform encephalopathy (BSE). The idea is not to test for food safety, since the animals had been pulled from the food chain anyway, but to estimate how far BSE had spread in the American herd. So far, only one of the tested cows has turned up positive. Now the department will expand its tests to 20,000 animals that show no symptoms but are old enough to have developed the disease. Europe includes such animals in its testing program and has found many cases of BSE, so this is a valuable addition to the nation’s surveillance protocol.

Should we worry about Creutzfeldt-Jakob Disease? Considering this is not something typically suspected, that we don’t test the cows, how would we know CJD? Did the man in Northfield who died of CJD a while back have CJD Variant? In the UK, you’re more likely to die of CJD than of HIV from a blood transfusion — considering all the prevantative measures with blood transfusions, YOU WOULD THINK THAT WE’D TAKE SIMILAR LEVELS OF PRECAUTIONS WITH MEAT … but as my ex-husband would say, “Goes ta show ya don’t think!”

I’m a veggie primarly because in 6th grade we toured the Swift plant in South St. Paul.

From the Minnesota Historical Society

It was either tour that plant or the Metro sewage treatment plant, and I wanted to see the collection they had of items flushed. Oh well, just my luck, I instead had to see meat packing in action, and what really did it was a couple of big barrels of eyes that were going into hot dogs. After the tour, they handed us each a cold hotdog. Urp…

This image was accompanied by a meat version of the “Beans, beans, the magical fruit” ditty…

Add to it the cumulative impacts of a couple years cooking at the Seward Cafe (some folks’ tour of da hood), plus I was a meat hauler in a past life, spending lots of time at IBP and John Morrell and Farmland (check this!), etc., waiting for animals to be killed, cut up, put in bins or boxes and stuck on my truck, where we spent the next 36-48 hours headed west to Farmer John’s, Cal-Hono, and cold storage and grocery warehouses all over California.

And then there’s the pissy deer in Wisconsin… Hmmmm… I’ve got a friend in the pissy deer area who’s displayed some obvious judgment problems… maybe that’s his problem!

How do these Chronically Wasted Deer get from South Dakota to Wisconsin? Think it doesn’t happen here? Here are some more info links.

Meat? When pigs sing and cows fly…

From: www.madcowsracing.org (Stephanie found this one a while back)

Juhl in the news

September 22nd, 2019

Remember the Juhl Energy permit fiasco in Rock County earlier this month?

Rock County CUP granted

Now another Juhl project in the news, featuring Dan Juhl, who says he’s retired. HA! Doesn’t look like it… [After I published this, found another in the STrib, “Minnesota wind-solar hybrid project could be new frontier for renewable energy,” yup, “retired” guy on a big PR push!]

FYI, yes, distributed generation is where it’s at, siting small projects near load means that no new transmission is required, but because the massive transmission build-outs of CapX 2020 and MISO’s 17 project MVP portfolio have been built, well, it’s a little late.

BTW, Dan Juhl was present at the September 8, 2001 meeting at the Dinkytown Loring, after the first of Xcel’s 345kV transmission lines was proposed (Search for PUC Docket 01-1958) where Beth Soholt and Matt Schuerger asked a bunch of likely intervenors, “What would it take for you to approve of this project?” They never answered my question of what they were getting to promote it, but Matt Schuerger sure did get pissy and flustered and threatened to stomp out of the meeting! I did find documentation the $4.5 million (2001) and $8.1 million (2003) grants for “Wind on the Wires,” at that time a program of the Izaak Walton League. Clearly they got at least that much, and from other sources they got more, who knows how much… And all those transmission projects went through…

Anyway, here’s the recent report on a new project, from MPR:

New power generation: Rural co-op makes bet on wind, solar hybrid

The electricity we use is often generated hundreds of miles away. Dan Juhl wants to keep it local.

To prove his theory, Juhl’s company — Juhl Energy — has built what he calls the first hybrid generating system in the country.

A smaller scale for energy resilience

A customer in co-ops

****************************************

New Power Generation? Just saw the reincarnation at the Sheldon last year…

Oh… nevermind…

Center of the American Experiment – Conflatulence!!

October 30th, 2017

These folks drive me crazy! Katherine Kersten has been on my list since the 80s when she wrote an editorial in the STrib about student loans, praising the Reagan cuts to student loans, and major decreases in income limits for “need based” student loans, just at the time I was winding up my BA and trying to get into law school. Who paid for her legal education? Anyway, yeah, obviously we don’t see eye to eye on anything, but this latest blather from them goes beyond a difference of opinion, to a too frequent spewing of conflatulence. And when I see this, yeah, I get on a rant too, it’s kind of disjointed, so I’ll be reworking soon. These claims are so insidious, because the facts do take some digging and some sifting. Add to that there is so much misinformation going on about transmission, about the Clean Power Plan… GRRRRRRRRRR…

Check this out:

Yeah, this CAE thing is going around, it’s arrived in my inbox via clients working on wind projects, it’s arrived via a transmission person from ND who put it on my facebook page via a WindAction post, which cut and pastes another “reporters” blog about the CAE “Report.” Playing “telephone” and we know how that goes… So let’s go straight to the horse’s … well, the other end.

This CAE “Report” is taking multiple things, trying to patch together an argument they want to make, but the patches aren’t holding. This comes on the heels of another report that found its way into my inbox with the claim that wind is very expensive, that it costs about 8 times the PPA cost because it’s intermittent, and because of that, they added in cost of power to cover when wind isn’t blowing (ummmm, you only pay for what you use, at the PPA price, DOH!).

Point by point in the “report” from CAE, they claim:

Minnesota has lost its advantage on electricity

That’s true! But sorry, CAE, it’s not because of wind. Rates have gone sky high in Minnesota for a couple of reasons. 1) Wholesale deregulation allowing sales from any Point A to any Point B, and 2) Transmission for coal and whatever else, from every Point A to every Point B. It is NOT 3) Wind is higher priced, because it is not.

Reason one that are rates are as high as Illinois rates? The economics of deregulation aren’t rocket science. When you have something to sell, you sell to the highest bidder. If someone else wants it, then they have to pay the going rate. A good resource on how we got to where we are is “The Economics of Regulation: Principles and Institutions,” by Alfred E. Kahn. It’s a major tome, but hey, just read Chapter 2, the chapter on electricity, “The Traditional Issues in the Pricing of Public Utility Services. Then, go back and read the introduction, where it gets into building more capacity than is needed, and the burden on ratepayers when utilities go overboard, particularly relevant when we get to the next point, that of overbuilding, and also consider the 105+ coal plants proposed but not built, including many coal gasification plants (i.e., Excelsior Energy’s Mesaba Project here in Minnesota and the NRG plant in Delaware, both of which I helped tank. The Mesaba Project provided much needed details about the technical problems and economics of coal gasification and the impossibility of carbon capture and storage that doomed any project from the get-go. IGCC – Pipedreams of Green & Clean), and the economic and technological disasters of the new Vogtle and V.C. Summer nuclear plants, and two coal gasification plants in Edwardsport , Indiana (coal gasification off more than on, often down completely) and Kemper IGCC in Mississippi (over $7 billion and now burning natural gas) that got off the drawing board but are economic disasters with ratepayers holding the bag.

Take a look at the cost of electricity, in real time:

FYI, here’s some wallpaper for ya, with the MISO Market LMP price in real time (keep in mind, this is spot market, so prices higher than PPA prices):

https://www.misoenergy.org/MarketsOperations/RealTimeMarketData/Pages/LMPContourMap.aspx

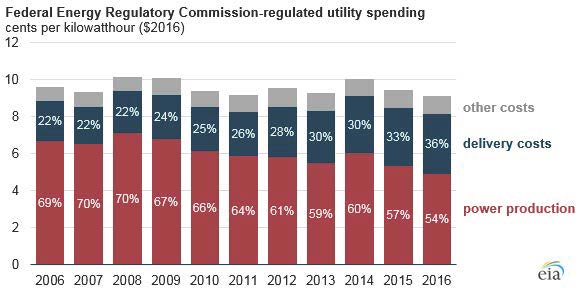

Check this slide from FERC info on EIA page:

What? Delivery costs? Oh, TRANSMISSION!! (full story from EIA HERE)

Note also, from the same EIA post, the shift away from Power Purchase Agreements that came with the decrease in demand electricity glut:

Now, let’s move on to 2) Transmission for coal and whatever else may happen to be there, from every Point A to every Point B.

When you’re thinking about this, and about all the whining about shutting down coal plants, remember that the older very high priced to operate coal plants are being shut down. What about other plants? If all, if the majority, of coal plants were shut down, what would that mean for the transmission system? This is important — if those plants were shut down, there would be lots of room on the transmission system. But they didn’t. Instead, they built this huge transmission overlay called CapX 2020, at a cost of over $2 BILLION, and are now building the MISO 17 project MVP Portfolio (see MVP Dashboard — now up to $6.6 BILLION). MISO is now talking about a Regional Transmission Overlay above those (click on the maps in the link, AAACK!). Check the 20170131 EPUG Preliminary Overlay Ideas List. Get your pocketbook ready to pay for this. And for your nightmares, piece by piece:

In the process of getting from any Point A to any Point B, we’ve overbuilt transmission to the point that Xcel Energy is whining that the grid is only 55% utilized.

(N) Identify and develop opportunities to reduce customer costs by improving overall grid efficiency. In Minnesota, the total electric system utilization is approximately 55 percent (average demand divided by peak demand), thus providing an opportunity to reduce system costs by better utilizing existing system assets (e.g., generation, wires, etc.). (e21_Initiative_Phase_I_Report, p. 11).

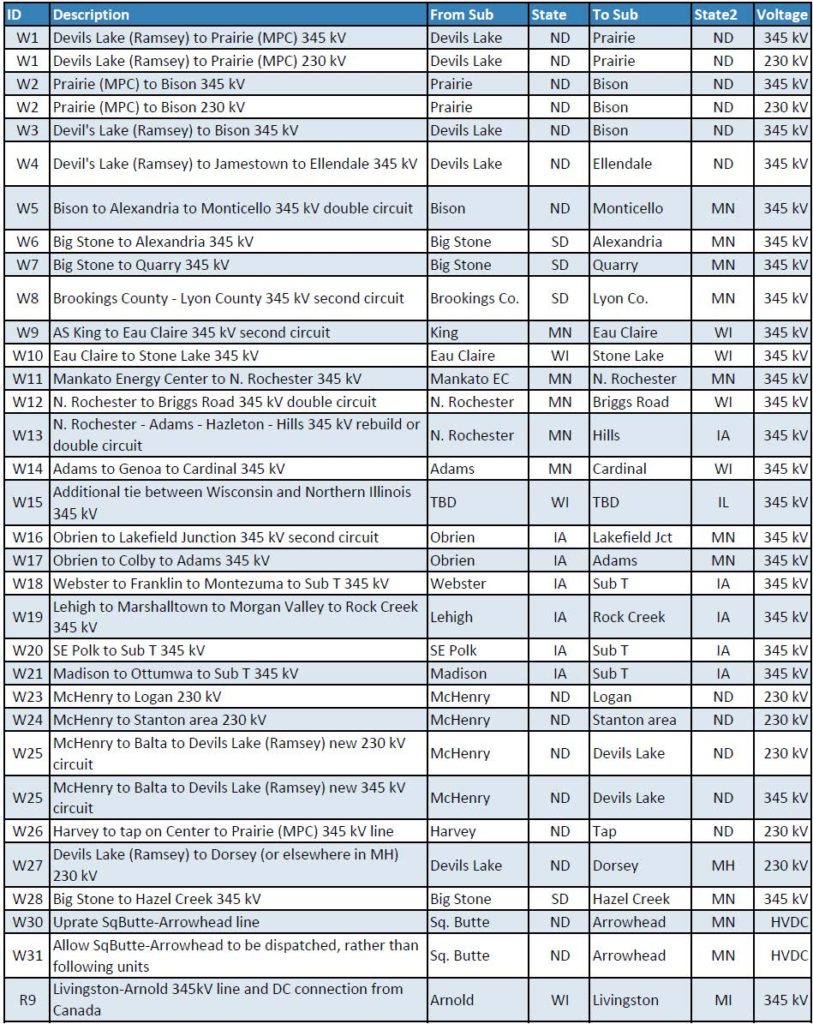

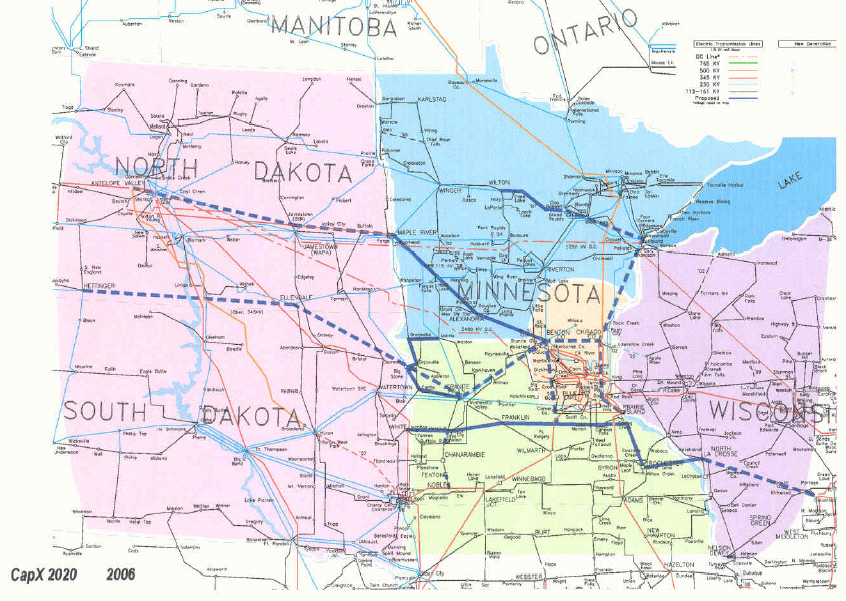

OK, let’s look at “any Point A to any Point B.” Where does this CapX 2020 that started the big transmission build-out start and where does it end (keeping in mind it began with WIREs and WRAO released in 1998, they’ve built almost all of those proposed then)?

Well, fancy that. It starts in the coal fields of the Dakotas, at the major coal plants fueled by the neighboring coal mines. Oh, and look, it goes east to the Madison ring and off to Illinois… huh… funny how that works… Now, think about what it means for “pass through” Minnesota!

How about the MISO 17 project MVP Portfolio, again, now priced at over $6.6 BILLION (it was $5.24 billion when approved by MISO):

And the addition of the capital costs of these projects to the rates has not been adequately considered. Xcel admits in its latest rate case initial filing (15-826), now water over the dam, that it’s transmission driven. In the CapX 2020 cases that No CapX 2020 intervened in, the Certificate of Need and multiple routing dockets, we were not able to raise rate issues, consistently and adamantly told that no, that can only be addressed in rate cases. Was Center of the American Experiment there? Nope. They were just agitating to get people to comment, but no substance. Maybe if they’d read the rate case dockets, they’d have some credibility, but nooooooo.

Look at PUC Rate Case Docket 15-826, and the one before it, 13-868. What is driving Minnesota’s price is not wind (it’s much lower PPA price than any other resource) but transmission. We’re now paying for CapX 2020 transmission and the MISO MVP 17 project portolio (an apportioned share). Transmission ROI is 12.38%, though it’s in a fight at FERC which will lower it to maybe 9+%, which is much more than they get on electricity because price is so low. We are also now paying for rebuilding the Sherco 3 coal plant which was down for two years after the turbine went wild and blew up, and that rehab was over budget (2 years that power wasn’t needed, but rebuilt it anyway and we’re paying!). And the Monticello nuclear plant rehab and uprate which cost twice as much as they thought (and so because of too high cost and lack of need, they started but then cancelled the same at Prairie Island here in Red Wing). (the electric market is so bad, prices so low, that Xcel is wrangling to have its “business plan” determine rates, not cost! And they want to focus on building things to get that ROI which is a lot higher.) Center of the American Experiment is not a credible source, they do this sort of thing all the time to advance their agenda, and don’t dig into the facts. WindAction latches on to this, without looking for details, facts. That comes out in the rate case.

I tried, both individually and on behalf of No CapX 2020 to intervene in the most recent rate case (15-826) because CapX and MISO MVP transmission is the driver, and got into quite a testy fight with the ALJ, Judge Oxley. He was so extreme in his resistance, worked so hard to exclude No CapX, beyond anything I’ve ever seen before. When I presented at the public hearing, he refused to allow cross examination of the witnesses, said he wouldn’t require their witnesses to be present at the hearing, and started yelling at me, all on the record, and it looked like he was about to start crying, eyes red and watery, shaking visibly. It was so bizarre. Details here – particularly the Denial #2_Overland-NoCapX Intervention where he declared NO, NO intervention in a very pissy way, and despite this being the rate case, and throughout the CapX 2020 dockets (all 5 of them over 8 years!) and ITC’s MISO MVP Line 3, where we were repeatedly prohibited from addressing rate impacts, nope, no intervention in the rate case:

Encourage public participation? Yeah, right…

February 10th, 2016

Public participation? Tough in Xcel rate case

July 14th, 2016

And here’s an interesting tidbit exposing Xcel’s failure to pay taxes, in essence a public subsidy of Xcel:

Xcel Energy Rate Case — taxes & xmsn rider

June 27th, 2016

From my NoCapX2020 site:

Xcel Rate Case in CapX territory

Well, look who’s intervened in the rate case!

Also, note how CAE goes into a spiel about wind “subsidies” but they don’t address that ALL forms of generation are subsidized, with nuclear getting the most expensive of all, coal second (and shall we get into subsidies for failed IGCC/coal gasification? OH MY DOG!). I have no time for these “subsidy” arguments when there’s no charge to remove ALL subsidies for energy across the board. They also talks about wind needing coal as “backstop.” Ummm, no, that’s natural gas. Coal can’t ramp up and shut down quickly. Natural gas can and does. Shame, they should know better… Coal as “backstop.” Good grief. And on top of that, they try to argue that the cost of backup power for intermittent should be considered as part of the cost of intermittent? Oh, right… tell that to the natural gas plant operators, tell that to those negotiating PPAs for intermittent power! What a hoot! FYI, no, it doesn’t work that way.

And here’s a simple way to clairfy — think about what it would mean if they shut down the coal plants, as we keep hearing about… would we need ANY new transmission? And think about what we’re paying in our utility bills to shuffle this power eastward. Which we’ll get back to further down, and now, on to the next point:

Minnesota’s energy policy primarily promotes wind power.

Yeah, that’s true, wind and solar. For years wind has been a “least cost” option, as declared by the Dept. of Commerce and the Public Utilities Commission, as they do the Integrated Resource Planning and review of Power Purchase Agreements. But don’t forget when talking about energy policy, the massive promotion and subsidization of coal gasification, which even with all the push, couldn’t make it. It was tossed out of the PUC based on the outrageous costs, despite the state subsidies from several sources, and federal bankrolling, grants, and subsidies (for more info, search here for “Mesaba” and “IRRB,” “Mesaba” and “DOE” and just “Mesaba” and scroll through. There’s a lot, that was a 5+ year fight.).

CAE states that there will be only “modest increases in solar,” and that’s way off, both for commercial and residential. Watch! FULL DISCLOSURE: My father designed the solar at the Minnesota Zoo (which was hot water, they didn’t know much about that in early-mid ’70s and produced way too much, was taken down, and the pieces parted out across Minnesota — Ralph Jacobson, IPS knows more about that.). Solar is best because it produces on peak, is storable, particularly at a residential level, and it’s right where load is. Why isn’t every big box in Minnesota covered with solar?

Minnesota has also policy-wise, or unwise, pushed biomass, which has been an economic disaster and Xcel Energy has cut the “biomass mandate,” and is trying to get out of the PPAs for biomass plants that they don’t own, and working to slash the price at the HERC garbage incinerator. Biomass, high priced as it is, however, is a very small percentage of total generation.

Minnesota energy policy also focuses on conservation and efficiency. Conservation is by far the cheapest, because if you don’t use it, it doesn’t cost a thing!

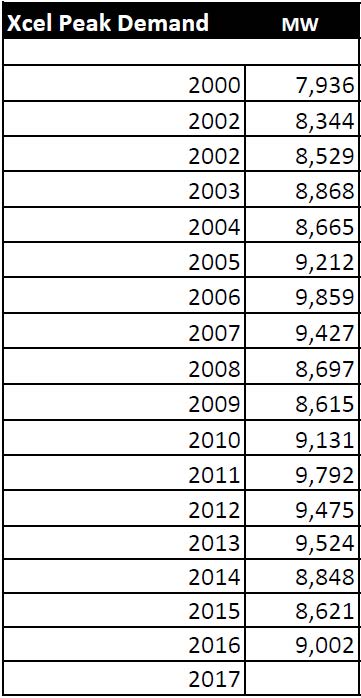

And look at Xcel Energy demand over the years:

It’s Xcel Energy’s, and the utility industry world’s, “new normal,” as Xcel’s CEO Ben Fowkes calls it. Here’s their 2017 3Q powerpoint that came out with their 3Q investors call: CLICK HERE! New capital investment of $1.5 billion and “Targeted ownership” = “Steel for Fuel” plan, making money off capital costs, and significant decrease in fuel costs. Base capital plan of $19 billion = ~5.5% rate base growth — that’s the point! Making money in a way that’s not dependent on selling electricity. And slide 10, Minnesota’s 0.5% DECREASE in sales, overall Xcel 0.2% growth. The “new normal.”

Minnesota’s energy policy is falling on its own terms, as it has not achieved a significant reduction in CO2 emissions.

True, but… This is an area of conflatulence. State policy promoting wind DOES NOT EQUAL reduction of CO2 — it only equals building wind. Building billions of MW of wind will not decrease CO2 emissions. Closing coal plants will. Stopping burning will. That’s the only way.

Minnesota has not closed all, or even most, its coal plant generation. We have only closed some of the older coal plants that are not economical to run. Look at Sherco 3, a plant that had a major turbine failure and fire and was off line for nearly two years and was rehabbed to the tune of over $200 million. With that plant off line, CO2 emissions would have been greatly reduced, were in fact greatly reduced, but the Clean Power added those emissions back in for their modeling! WHAT? Here’s the poop on that:

Look at how the “adjusted” Minnesota’s baseline levels due to Sherco 3 being out for nearly 2 years:

The EPA examined units nationwide with 2012 outages to determine where an individual unit-level outage might yield a significant difference in state goal computation. When applying this test to all of the units informing the computation of the BSER, emission performance rates, and statewide goals, the EPA determined that the only unit with a 2012 outage that 1) decreased its output relative to preceding and subsequent years by 75 percent or more (signifying an outage), and 2) could potentially impact the state’s goal as it constituted more than 10 percent of the state’s generation was the Sherburne County Unit 3 in Minnesota. The EPA therefore adjusted this state’s baseline coal steam generation upwards to reflect a more representative year for the state in which this 900 MW unit operates.

Clean Power Plan Final Rule (PDF p. 796 of 1560).

… sigh… much ado about nothing. But remember, it’s not binary. Wind isn’t “replacing” anything. Wind is added on top of the existing generation, of which we have a surplus before it’s even added. Once more with feeling, WIND ISN’T REPLACING ANYTHING! We could shut down those coal plants now and wouldn’t miss them, but then the utilities couldn’t sell the surplus generation, couldn’t make money providing transmission service from Point A to Point B, and couldn’t make money on capital costs of transmission with a much higher return for building transmission than for selling electricity.

Here’s more on that, from a study released when they were working to get the transmission scheme rolling. The purpose of MISO Midwest Market — where ever would I get the idea that the purpose of it is to displace natural gas with coal generation?

Well, look at pps. 14 and 83:

Again, the purpose, to sell from any Point A to any Point B. That’s what it’s all about! It has nothing to do with displacing coal with wind, and it has nothing to do with taking coal off line, shuttering plants, and it has nothing to do with reduction of CO2 through reduction of burning to generate electricity.

To satisfy Minnesota’s renewable energy standard, an estimated $10 billion dollars has been spent on building wind farms and billions more on transmission.

When talking about costs, True, lots has been spent on building wind farms. However, until very recently, utilities have not been spending those billions of dollars, the wind developers and wind companies have, and utilities are buying the energy via Power Purchase Agreement, and not spending the billions of capital costs, instead letting the independent power producers do it. There’s a big difference there between PPA and capital costs, and CAE does not acknowledge it, and does not acknowledge that we’re being billed for PPA costs and not capital costs in most instances.

Billions on transmission, yes, that’s true, as above, but that transmission is not for wind. It’s for wheeling their surplus power through Minnesota and out of the state, whatever power is there, and remember, those lines start at the coal plants! Again, check the ICF MISO Benefits Analysis Study to see why they want to build all this transmission.

$10 billion capital cost spent building wind farms? Compare with the $29 BILLION cost of building two nuclear reactors, 2,200 MW, at Vogtle, which will never run. Building generating plants of any sort costs money. The failed Mesaba Project coal gasification plant was expected to cost, at last estimate by DOE, over $2.1 billion, for 663 MW. Failed Kemper IGCC 582 MW for $7.1+ billion. As of year end, 2016, there was over 3,500 MW of installed wind capacity. $10 billion capital cost? Cost comparison anyone for construction of generation?

I want people to know that relying on pieces like this is not a good idea! Sending around these “reports,” i.e., the CAE “report” with its many misstatements about things where the authors they should know better, is not helpful because it’s a false spin, FAKE NEWS from the masters of misrepresentation. This rate issue and cost of generation, the decreasing demand and increasing conservation, and transmission for coal is something I’ve been enmeshed in for a long, long time, and I can’t let stuff like this slide.

tRump’s Memoranda & Executive Orders

January 24th, 2017

There’s been a flurry of activity, and finally they posted the actual documents so we can see what’s going on, or what won’t be going on. This was part of my “One a Day” plan to send off a missive to the White House every day, something of substance. When the Contact page was blank on Monday morning, I started calling, ALL DAY LONG, and got through around 7 p.m., when a human answered, and hung up. I called back, got that same human, who wouldn’t tell me who I should talk to about the Executive Orders (presumed that’s what they were as that’s what was said) and said the Comment office person was gone so I had to leave it online, and she got pissy when I said that the Comment page was blank, and hung up again. OK, whatever…

Civics Lesson from USA Today, Presidential memoranda vs. executive orders. What’s the difference?

Here are the Memoranda thus far from the White House page (these are not required to be published in the Federal Register, so ???, but they are now on the White House Memoranda page:

Presidential Memorandum on January 24, 2017Presidential Memorandum on January 24, 2017Presidential Memorandum on January 24, 2017Presidential Memorandum on January 24, 2017Presidential Memorandum on January 23, 2017Presidential Memorandum on January 23, 2017Presidential Memorandum on January 23, 2017Presidential Memorandum on January 20, 2017

And here are the Executive Orders, from the White House Executive Order page:

Executive Order on January 24, 2017Executive Order on January 20, 2017

Now maybe they’ll have the routine down and keep up with what they’re doing. Drives me crazy to be loating around in the dark — it’s hard enough to know or guess what these might mean in practice, but without an actual document to look at, it’s just blather. Well, it’s just blather anyway, but here it is. Read it and get busy!