Utility Personal Property Taxes – Itasca County

December 4th, 2005

Economic Development (with capital letters) is more than just “jobs, jobs, jobs.” That’s what infuriates me about this JOBZ zone crap, because it usually just shifts companies around to whatever locality is chump enough to give them free ride on property taxes and income taxes, meanwhile driving up infrastructure costs that are not supported by the entity that causes it, GRRRRRRRRRRRRRRRRRRRR, if I ruled the world, the corporations would pay their own freight. JOBZ, TIF, tax “abatement,” everywhere we turn, it’s corporate welfare at our expense.

Then you’ve got this Mesaba coal gasification project, getting every “incentive” from the government trough that you can think of, and some that only Tom Micheletti could have thought of — I’ve got to hand it to him, he’s VERY creative, but there’s no excuse. They’ve gotten money from the state’s Renewable Development Fund ($10 million over 5 years), the IRRRB or IRRA or whatever it’s called now has paid in millions too, and the DOE with $36 million plus the $800+ million in federally guaranteed loans, we’re paying for that. To top that off, they went to the Counties, Itasca and St. Louis, so they’re covered wherever it goes, and got another $50 million for infrastructure from each. Say WHAT? How can these counties afford that?

They can’t. They’ve figured that out. This money has to come from somewhere.

An article in the Grand Rapids Herald-Review shows that Itasca County is listening. They’re under fire from citizens who’ve just received their tax bills, constituents who are staggering under the increase and are outraged. The county has taken an objective look at the income and outgo and they know who is paying their fair share — they know that utilties tax rates have been cut. Is that fair? Here’s a part of the article:

Frustration vented at county Truth-in-Taxation

That situation has become a reality in Itasca County, said McLynn, when utility companies, such as Minnesota Power, which operates Clay Boswell in Cohasset were given property tax relief a few years ago. Those missing revenues are now being covered by homeowners.

Information distributed by the county auditor indicated that over the past three years, utility taxes have dropped significantly.

Public utilities accounted for 21 percent of the county property tax base in 2002 while in 2005, that percentage is projected to be 13.7 percent. During the same period of time, homestead property taxes have risen from 30 percent of the property tax base in 2002 to a projected 35 percent in 2005.

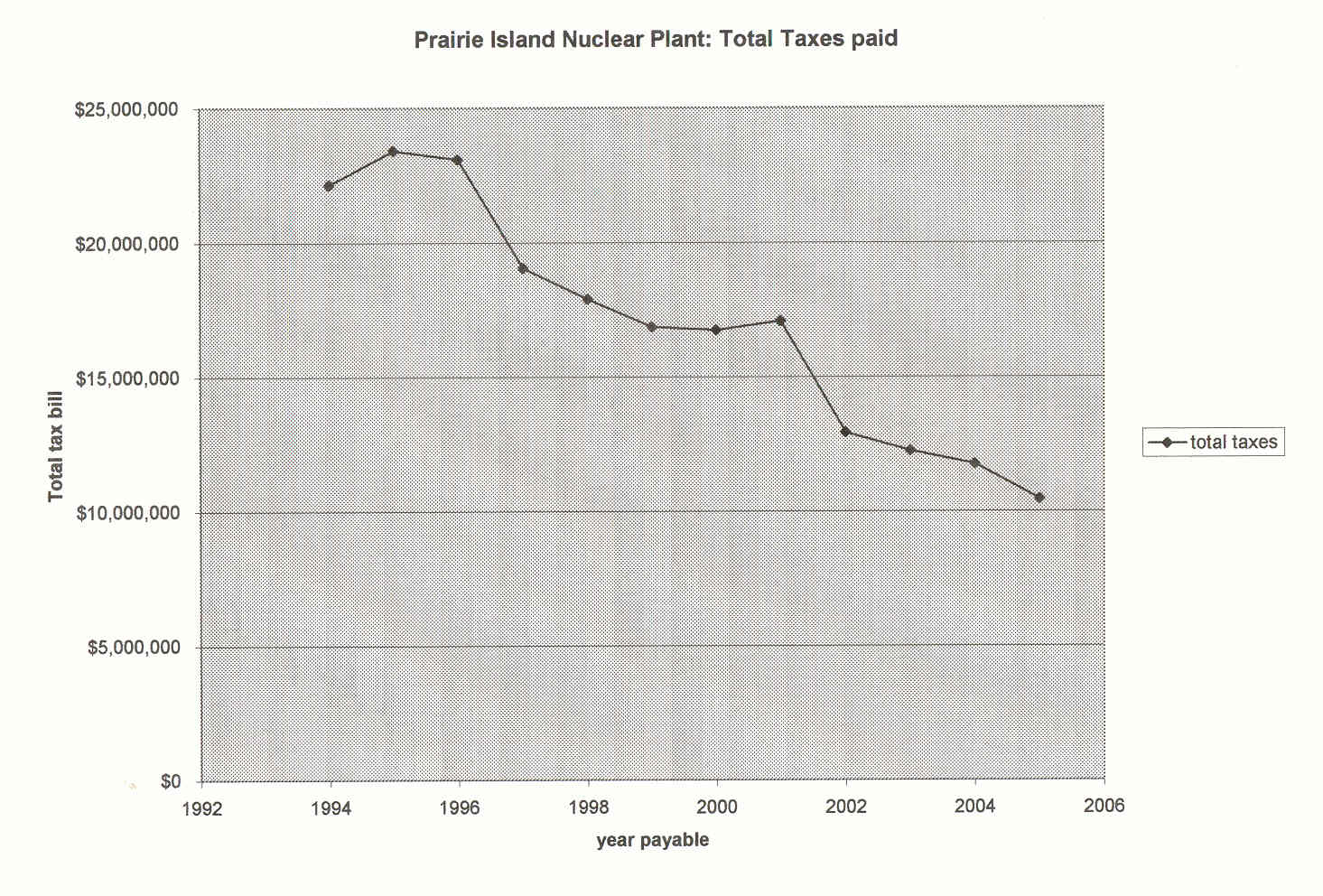

A county that’s already hurting financially cannot afford that kind of hit. In Goodhue County, our utility personal property tax revenues from the Prairie Island plant were cut by more than half, from $23 million to $10 million. Download file THAT HURTS!

Itasca County knows that the bill will fall due, that all these perks of corporate welfare aren’t free, they are paid for by the county taxpayers. Can they afford to support projects like this? Can they afford to support projects like this without getting their fair share from the power plant? Let’s ask them!

Utility Personal Property Tax #1

November 2nd, 2005

WHAT IS PERSONAL PROPERTY TAX?

We’ve all heard local governments squealing and skwaking because they’re hurting for revenue, it’s real and painful, but I’ve never heard anyone talk about utility personal property tax as a source of revenue to look at — why? I can’t even get Joel Kramer to show a flicker of interest — yet this is the tax source that is the single highest source of revenue in Red Wing, and Goodhue County and the school district.

Why is utility personal property tax so important here, and to all local governments, even if they don’t know it? Because every community hosts utility infrastructure, on which personal property tax is based. Here in Red Wing, we host the biggest power plant in the state (until Mesaba), all 1060MW of Prairie Island Nuclear Generating Plant, and Xcel pays personal property tax to the local governments — lots of it!

Here’s the state chart that tells the story of utility infrastructure growth and growth of tax, and of the sharp decline over the last decade. Table 9, Estimated Distribution of Gross Tax by Property Type, 1974-2004. More charts, to be discussed later, can be found at the State’s Tax Info Central: General Reports & Data!

Here’s the House Research “Nutshell” on Wayback Utility Personal Property Tax

Here’s Mike Bull’s (House Research) Primer on Utility Personal Property Tax 2003 and a later update Primer on Utility Personal Property Tax (see, he earns his pay!)

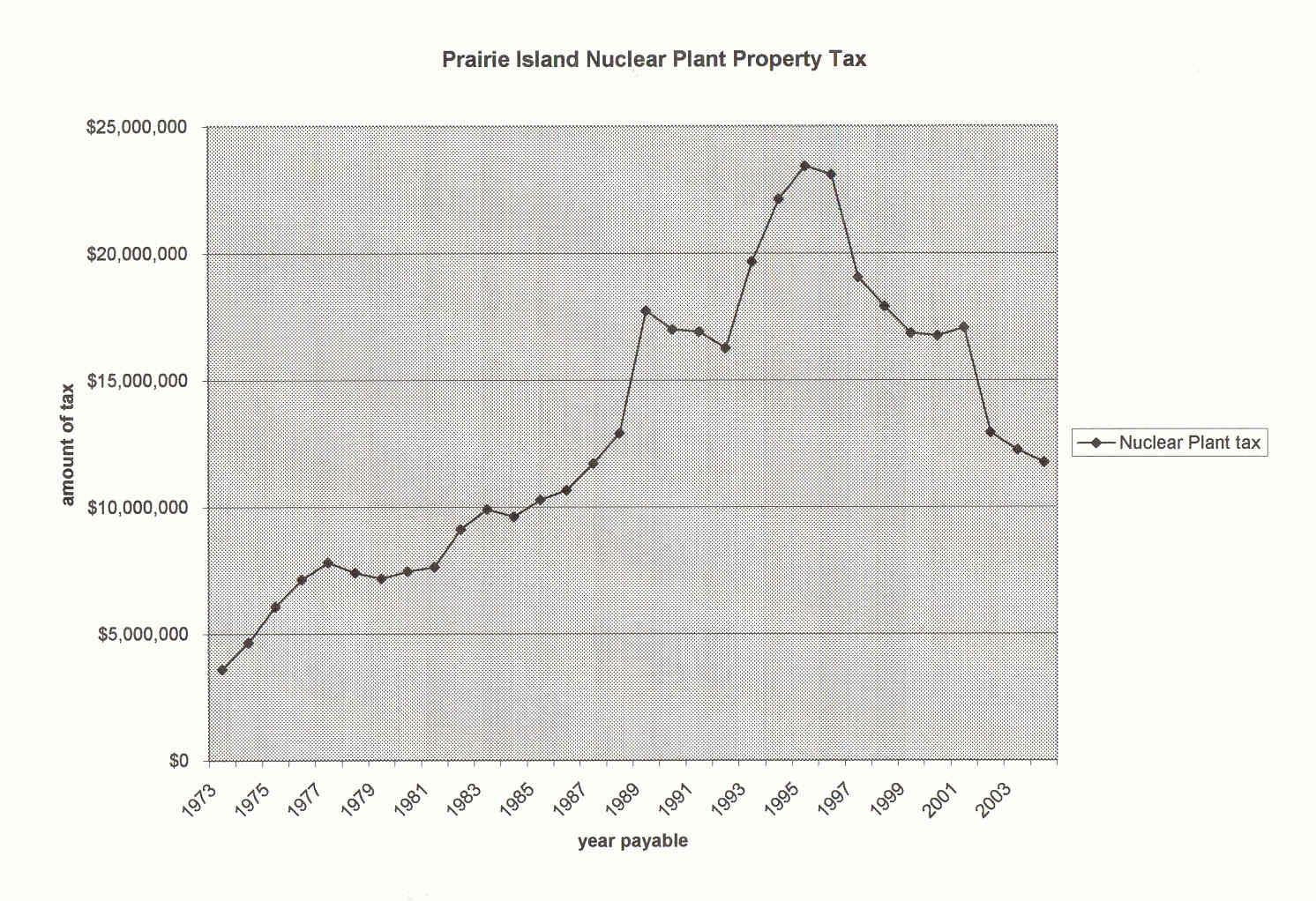

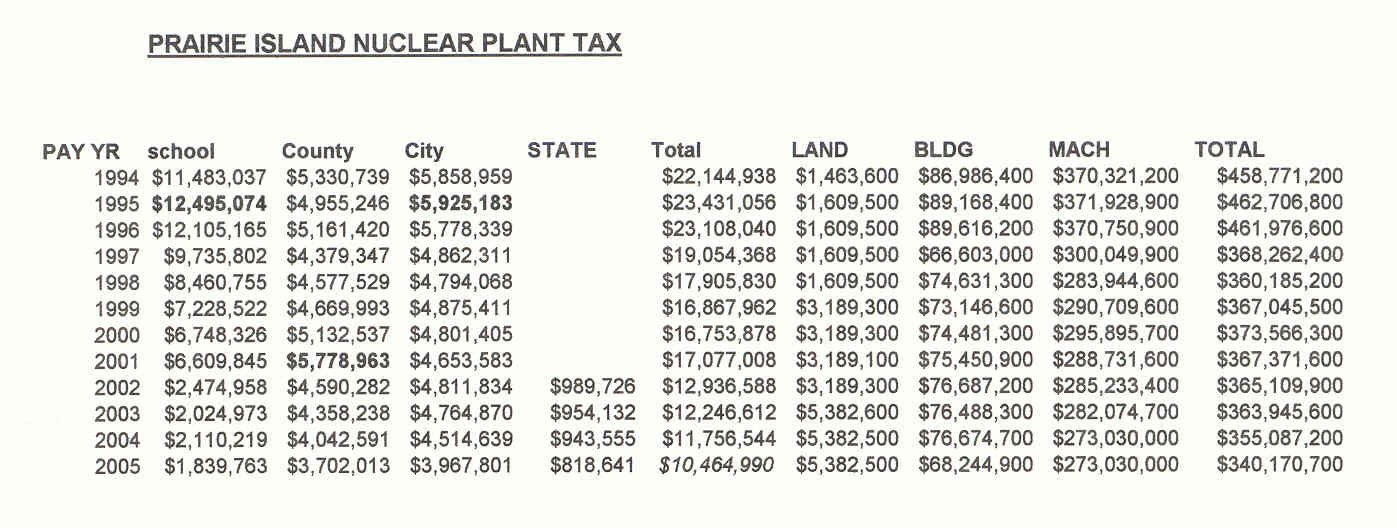

Here’s how much personal property tax is generated by Prairie Island, from the opening of the plant through 2004:

Utility personal property tax is essentially a deal struck to encourage communities to host large noxious facilities and/or to compensate them for the costs, even the amorphous externalized costs like “living immediately downwind and downriver from a nuclear plant.” The tax has been in existence for a long time, but the rate has been cut significantly over the last decade, from 4.6% to 2%!

When the plant was built, the community “agreed” to host it and knew that it would receive some benefits, including the utility personal property tax. Things went south fast after 1994. In the 1994 legislative session, there was a strong and large movement in the county and city to “save the tax base.” I’d just moved into the county and was living in Kenyon, and they held meetings all across the county to get the citizens whipped up — if the plant would close — WE’D LOSE OUR TAX BASE! People from Red Wing and Goodhue County went up to the capitol by the bus load, and it was a session that went down as one of the most contentious in history, leaving many scarred.

The deal struck between NSP and “environmental” groups included provisions for an 825MW wind mandate, a per cask payment into the Renewable Development Fund; NSP got its dry cask storage and extended plant life, and they both stuck it to Goodhue County — if the people of Goodhue County wanted dry cask storage so bad, they could have it, and that became the “alternate site mandate,” that nuclear waste had to be sited off of Prairie Island and “in Goodhue County.”

ARTICLE 6

ALTERNATIVE SITE

Section 1. [116C.80] [HIGH-LEVEL RADIOACTIVE WASTE; SPENT

NUCLEAR FUEL STORAGE; ALTERNATIVE SITE.]Subdivision 1. [DEFINITION; DRY CASK STORAGE

FACILITY.] For the purposes of this section, “dry cask storage

facility” or “facility” means a high-level radioactive waste

facility that is located in Goodhue county but not on Prairie

Island for storage of spent nuclear fuel produced by a nuclear

reactor at the Prairie Island nuclear power generating plant.Subd. 2. [CERTIFICATE OF SITE COMPARABILITY.] Prior to

construction of a dry cask storage facility, the public utility

that operates the nuclear power generating power plant at

Prairie Island shall obtain a certificate from the environmental

quality board that the site for the facility is comparable to

the independent spent fuel storage facility site located on

Prairie Island for which the public utilities commission granted

a certificate of need in docket number E002/CN-91-91.Subd. 3. [REVIEW BY THE BOARD.] The board shall review the

siting procedures and considerations for siting large energy

electric generating plants under sections 116C.51 to 116C.69 and

rules adopted under those sections and shall adopt, by

resolution, after a public comment period, those procedures,

considerations, and rules it determines are necessary to

designate a site for a dry cask storage facility and to issue a

certificate of site comparability. The siting procedures and

considerations must provide for an opportunity for all

interested persons to participate.

NSP MOVES IN FOR THE KILL

The Governor’s signature wasn’t even dry and NSP was already trying to cut the utility personal property tax. Not just cut, NSP wanted to eliminate it. It went on for years, and their arguments were an example of disgusting self-interest from which ratepayers would see no benefit. Tom Micheletti, then NSP’s VP of Public and Government Affairs, argued:

Minnesota levy makes electricity more costly for consumers than in other states.

What a load of unadulterated crap. We’re the lowest-priced-electricity state in the region, and he’s making an argument like that, what does he take us for? And yet, they weren’t laughing in the aisles. I let loose in the Red Wing paper about this in March, 1997 — it drove me crazy that the people who NSP recruited to work for them in 1994 were having their taxes pulled out from under them. My editorial: Download file I moved here to Redwing from Northfield a couple years later.

Here’s Micheletti’s “Commentary” (have you ever seen one so long?) in the STrib also in March 1997, the one with the inane “costly” argument: Download file

That was the legislative session where Rep. Dennis Ozment slammed his fist down and said (a near quote) “The electric industry is still regulated, it’s not appropriate to consider this now… I don’t recall electing NSP to the legislature!” That was back in the days when he represented the public interest. But the chart below tells the tale — NSP got its wish:

And here are the actual numbers:

NSP, now Xcel, got only part of its wish. The tax rate was cut from 4.6% to 2%, a dramatic cut for counties such as Wright and Goodhue, and for cities like Red Wing and Monticello, which are dependent on the revenues from their deal to host a large noxious power plant. BUT DON’T FORGET THAT THOSE TAX REVENUES ARE STILL THERE! Hosting a power plant still provides significant revenues to local government, and any local government faced with the prospect of hosting a plant, such as the Simon Industries plant in Waseca, or the Invenergy plant in Cannon Falls, or the Mesaba plant in Taconite, must make sure they get their fair share, particularly if the developer wants to have the plant legislatively exempted from personal property tax. With the Mesaba plant, you know Micheletti wants an exemption from Personal Property Tax and doesn’t want to pay out in a Host Fee Agreement…

Coming up next — Exemptions from Personal Property Tax and Host Fee Agreements.

Special thanks to Brad Johnson, Goodhue County Auditor/Treasurer for providing the charts on utility personal property tax — he coughed these up when I was working on the Simon Industries tax exemption where Waseca County and Blooming Grove Township stood up and demanded a Host Fee Agreement… but that’s for the next installment. I’m still trying to get these same type of charts for Wright County, and for some reason, after how many tries, still nothing…