GRE & Xcel are hustling for $$$$$

October 20th, 2010

Apparently Great River Energy and Xcel Energy are outlooking for money. Gee, I wonder why? I remember the snorts and hoots that broke out in the room way back during the CapX Certificate of Need hearing when they admitted to presenting their CapX 2020 financing dog & pony show to Lehman Brothers.

As for GRE, from Monday’s article in Finance & Commerce:

Xcel just made an SEC filing that shows some creative efforts:

“Secondary purpose of the Plan…” (click the quote for the full filing) “Secondary purpose…”

Yup, uh-huh… …WHAT… EVER!

Here’s the full article from Finance & Commerce about GRE’s capital raising efforts:

Great River Energy to sell $450M in mortgage bonds

Posted: 4:35 pm Mon, October 18, 2010

Faced with declining power-usage revenues and rising utility-plant costs, Maple Grove-based Great River Energy (GRE) on Monday issued $450 million in taxable first mortgage bonds to meet costs and pay down debt.

The mortgage bonds are intended to fund capital spending for the utility’s power generation and transmission as well as paying off $325 million of GRE’s $2.4 billion outstanding debt, said Susan Brooks, GRE treasury director.

“It’s part of our long-range plan to meet member costs in the most cost-effective manner,” said Brooks, who expects bond pricing to be set today.

The mortgage bond sale is the second such transaction in 2010 by GRE, which in April announced it would sell $106 million in tax-exempt first mortgage bonds issued by McLean County, N.D.

It’s not unusual for utilities to sell mortgage bonds to help make ends meet at a low cost. Such financing makes sense because GRE is making additions to its system and paying for generation and transmission improvements in the wake of the recession.

For example, GRE’s 2009 revenues fell $42.1 million to $787.8 million at the same time the utility was paying to develop a coal-fired plant in North Dakota and helping develop the CapX2020 system of transmission lines with 10 other state utilities.

Fitch Ratings assigned an A- credit rating to the $450 million mortgage bond sale. Fitch noted that, “while GRE’s debt level remains a concern, (it) has been effective in managing the higher debt loads, even in what has been a difficult operating environment.”

Background information on GRE’s mortgage bond offering from Fitch stated that GRE is working to lessen its debt-load by paring its five-year capital spending plan by $350 million.

GRE serves more than 645,000 residential and small-commercial customers through 28 member cooperatives. The utility maintains 3,647 megawatts of generation capacity, of which 2,751 megawatts is owned by GRE.

Additional capacity is expected to come online in 2012 when Spiritwood Station, a coal-fired plant near Jamestown, N.D., begins operation.

The start-up of Spiritwood, which has a peaking capacity of 99 megawatts, was delayed until early 2012 earlier this year because plans for an ethanol plant to use steam from the nearby coal plant failed to materialize.

Therese LaCanne, GRE spokeswoman, said Spiritwood also will provide steam for a Cargill Malt plant in the industrial park.

Of GRE’s 2009 power generation, 78 percent was coal-fired, with the remaining 22 percent coming from 7 percent renewable energy, 1 percent natural gas and 14 percent other energy sources.

Combined with the planned firing up of Spiritwood and wind energy contracts, GRE projects it will have adequate capacity to meet its member needs beyond 2020.

The utility projects compounded average annual peak load growth of 1.4 percent from 2010 to 2020, according to Brooks.

NPS: No Stillwater Bridge

October 18th, 2010

Friday the National Park Service said NO to the Stillwater Bridge across the Wild & Scenic St. Croix River.

This is the same NPS, but a different region, that has the Susquehanna-Roseland transmission line crossing of the Wild & Scenic Delaware Water Gap under review.

This Stillwater Bridge mess has been a decades long struggle.

When I heard about this on Friday, I started looking for the primary documentation, and couldn’t even find a press release. Then this a.m., a little birdie sent the press release…

… but alas, he had no primary documentation either! And so onward with the search, and still nothing, then, lo, another birdie dropped these into my inbox:

National Park Service – Transmittal Letter

National Park Service – Stillwater Bridge – Section 7a Review Final

Is there a trend? We can only hope…

Comments on MPCA’s Metro Solid Waste Policy Plan?

October 18th, 2010

Get ready to fire off some Comments!

Last Thursday evening was a meeting at the MPCA about the Metro Solid Waste Policy Plan. It was a meeting, sparsely attended as you can see. And it was not a hearing, there is no record and… well… the plan? It’s lame to say the least, no plan at all!

Here’s what jumps out at me:

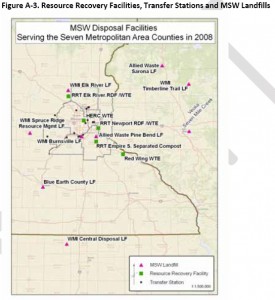

First, as a Red Wing resident, I note that the Xcel garbage burner is NOT on the map, only the City’s burner. Second, I note that Xcel’s Mankato burner is not on the map. EH? If they don’t know about or acknowledge these burners, what does that do for the credibility of this “report?”

More importantly, look at the skewed map. This is about METRO waste, but look where it’s going. It’s going out of the metro area. Greater Minnesota needs to institute a garbage tax, errrrr… fee, to force the Metro area to deal with its own waste and to institute serious recycling and Zero Waste programs. And they don’t separate out which is a “Resource Recovery Facility” and what is a burner in the legend. Maybe a big orange ire to denote burner?

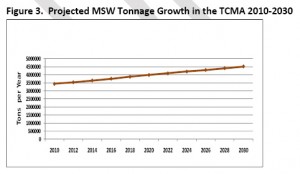

Another big problem is this is classic GIGO. The forecasts are as off as the CapX 2020 electric demand forecasts:

They haven’t gotten the word that demand and growth is down down down, has been since 2007. But they’re basing it on old data and using inflated numbers. “(Note-In order to be conservative, this forecast is based on a high growth scenario…)” p. 10. High growth is NOT conservative, nor is their plan. So the first thing to do is scrap the whole thing because it’s based on old data, then redo the forecasts and start anew.

They admit that “Recycling contributes to the economy of the region,” but they don’t stress increasing recycling. It doesn’t take a rocket scientist to see that that is the highest priority.

And the biggest problem — they seem to accept stagnant recycling levels and rather than a big push on recycling and Zero Waste, they pus for more incineration, and talk of “available unpermitted, but installed capacity of 40,000 tons per year at HERC and 40,000 tons per year of unused permitted capacity at the Red Wing and Mankato RDF combustors,” is the last thing me and my allergies want to see or smell. Up here on the bluff, there are times that the wind blows it right in my windows. And then there’s the breast milk of Inuit women, toxics traced to the burners. Take burning off the table now.

Another thing that sticks in my craw — the notion of “stakeholders.” Who is a stakeholder? It’s the waste industry… specifically, Product Producers, Waste generators (residents, businesses, public entities), Waste industry, Government. I’ve seen the email list, and it’s industry, industry, industry.

Send Comments to:

tina.patton@state.mn.us

or

Metro Solid Waste Policy Plan Comments

MPCA

520 Lafayette Road North

St. Paul, MN 55155-4100

MPCA’s press release:

PJM shell game continues

October 14th, 2010

This week, PJM has “decided” that part of the humongous 500kV buildout isn’t necessary. Well DUH, but…

PJM Press Release – PJM Board authorizes $18 billion in transmission upgrades

And so please explain why the headline isn’t “PJM Board cancels 500-kilovolt (kV) line connecting the Branchburg, Roseland and Hudson substations in northern New Jersey.”

From that PJM board meeting, there was a presentation that looks like a corporate-style WAKE UP call:

Meanwhile, I’m trying to find the primary documentation, something with specifics about what was “approved” and what was “removed” and the basis for it… nada… nothing that I can find on the site. Something else irritating is that when I’m looking up documents on the PJM site, I often just get a blank black page, particularly from the TEAC site.

One interesting presentation was about a Market Efficiency Analysis, in 2014 without Mid-Atlantic Power Pathway (MAPP), Potomac-Appalachian Transmission Highline (PATH), Branchburg-Roseland-Hudson and Susquehanna-Roseland, and from then on without the Branchburg, Roseland and Hudson line:

2010 Market Efficiency Analysis Results Updates – October 6, 2010

And when I try to get closer to the Northern NJ documentation… well, tell me if YOU can get anything:

“File is damaged and could not be repaired.” So I called the number on the PJM press release to see… and was told they’ll call back. Yes, we shall see…

Camp Wolfgang is back?!?!

October 10th, 2010

This is Vera, a beautiful dog up for adoption at Camp Wolfgang, a German Shepherd Rescue in Ennis, Texas.

Camp Wolfgang… sound familiar?

Just one year ago, they were closing amid reports of budget shortfalls and health issues, and there was a frenetic and successful effort to find rescues and homes for over 200 dogs.

If you google “Camp Wolfgang” and “Texas” you’ll get last year’s articles about it. The old website is still down, but there’s a Camp Wolfgang Petfinder site now.

I sent an email asking what’s up, and he’s got 15 dogs with someone to care for them. I’m glad he’s able to keep at it on a smaller scale. There are SO many GSDs who need homes, and who need a rescue to care for them until they’re “found” by their new family.