Mesaba coal gasification in the GRHR

February 26th, 2007

There’s another Letter to the Editor today in the Grand Rapids Herald Review — the writer doesn’t take into account the pollution and health hazards that the Mesaba Proect presents, nor does he address the extreme burden his proposal would place on Minnesota Power, already distressed about the rate impacts of the transmission cost!

Wednesday, February 21st, 2007 10:52:51 AM

Editor:

The Itasca County Board is supporting the construction of an approximately 600 MW coal gasification plant which so far is apparently publicly funded. Part of this public support is the construction of infrastructure and part is the agreement that the project will not pay taxes back to the county in the near future.

On the other hand, other large companies like Blandin and Minnesota Power do pay taxes that benefit Itasca County as well as providing good jobs.

By locating the Mesaba project on its Highway 7 proposed site, the county must construct a short line rail and accept long wait times at rail crossings, extend a gas pipeline, construct a transmission line, dedicate the waters of the Canisteo pit and convert a greenfield site. Why not locate the project in a more suitable location where most of this infrastructure already exists?

If the project were located at the current Boswell plant site, it would be in an industrial location where gas, rail and transmission corridors exist. With lower emissions (as stated by Excelsior), it could replace Units 1 and 2 to the benefit of the environment. Operating costs would be reduced as the cost of coal delivery would be lowered.

It appears that the main objection to the Mesaba project is the chosen site and the exposure of Itasca County taxpayers to risk from funding and operating infrastructure projects. Relocating the project to the Boswell site would address both of these concerns while still preserving the project and the jobs.

Dean Sedgwick

TXU deal goes down — at what price?

February 25th, 2007

Per CNN: TXU buyout may scrap new coal plantsÂ

NRDC’s Hawkins and ED’s Krupp have done a deal with TXU, the Texas mega utility that wants to build 11 stinkin’ coal plants across Texas. TXU’s in the middle of a buy-out/sell-out , and I’d like to see the actual agreement on this deal, the deal, the WHOLE deal, and nothing but the deal. What does this mean to those working against the plants not “dropped” and remember this only includes TXU, and that NRG proposed IGCC plant is not part of this. Why is my stomach turning?

————————–

NEW YORK TIMES

February 25, 2007

In Big Buyout, Utility to Limit New Coal Plants

By FELICITY BARRINGER and ANDREW ROSS SORKIN

Under a proposed $45 billion buyout by a team of private equity firms, the TXU Corporation, a Texas utility that has long been the bane of environmental groups, will abandon plans to build 8 of 11 coal plants and commit to a broad menu of environmental measures, according to people involved in the negotiations.

The roster of commitments came through an unusual process in which the equity firms asked two prominent environmental groups what measures could be taken to win their support. The result is an about-face from the company’s earlier approach to climate-change issues, and includes a goal of returning the carbon-dioxide emissions by TXU to 1990 levels by 2020.

Environmental groups said yesterday that they had never known of a financial deal with such an ambitious built-in environmental component.

Two private equity firms, Kohlberg Kravis Roberts & Company and the Texas Pacific Group, have proposed to buy TXU in what would become the largest leveraged buyout ever.

The transaction will be put to the TXU board for a vote on Sunday.

People involved in the negotiations said that Goldman Sachs, an adviser and lender to the buyers, helped broker peace with environmental groups and sought their support for the transaction. Goldman Sachs has been one of the most aggressive firms on Wall Street about taking action on climate change; the company sends its bankers home at night in hybrid limousines.

For the investor groups, the effort was as much about making a sound business decision to ensure the deal’s completion as it was about any environmental concerns.

By bringing the environmental groups into the process, the buyers may have helped avert years of costly litigation over emissions from their plants. But they may also have raised new questions about how they will meet the energy needs that TXU intended to address by building all 11 plants; the company is said to be examining ways to expand in cleaner forms of energy. None of the parties interviewed was able to provide details.

Environmentalists said they hoped that the TXU deal would represent a turning point in the attitude of energy businesses as they adjust to what many anticipate will be a new regulatory and public-relations landscape in an era of climate change.

“We have history’s largest purchase of a power company, with the new owners wanting to move the company in a direction that is consistent with a world that takes global warming seriously,†said David Hawkins of the Natural Resources Defense Council, one of the two environmental groups invited to the negotiations. That group, and the other participant, Environmental Defense, which often use the courts to confront businesses, are persistent critics of TXU.

The commitments come at a time of uncertainty for utilities that are considering building coal-fired plants. They do not know if such plants will be grandfathered by Congress and excluded from future restrictions on carbon-dioxide emissions, or whether anything they build now will have to operate in a starkly different regulatory environment.

TXU will discard plans to build eight of 11 proposed new coal plants, which would have been major new sources of emissions. Those plants — which would have added more than 9,000 megawatts of new capacity, the equivalent of 3.5 percent of the nation’s current coal-fired power — had been part of a planned $10 billion expansion of coal-fired electricity.

TXU, which is based in Dallas, also intends to expand the renewable energy portion of its portfolio and reduce or offset its emissions significantly, said people who were familiar with the plans.

Less than a week ago, according to Fred Krupp, the president of Environmental Defense, the two environmental groups were approached by representatives of the private-equity buyers. He said he received a call from William K. Reilly, the former Environmental Protection Agency administrator, who is advising the Texas Pacific Group.

Mr. Hawkins, who runs the climate-change program for the Natural Resources Defense Council, said that the investment team was essentially asking “what would it take†to gain environmentalists’ support.

James D. Marston, who runs the Texas energy program for Environmental Defense, yesterday called TXU’s plans “a turning point in the fight against global warming.â€

Mr. Marston had led an intense advertising campaign painting TXU as an environmental outlaw pursuing a strategy that would hurt the climate and perhaps its own bottom line, if federal policy changed and companies were charged for the carbon dioxide they emitted.

But people familiar with the investors’ thinking took pains to say that the investors brought the measures to the environmental groups, and were not acting out of any fear of the groups’ potential to wage a legal and public-relations campaign against them.

Matthew L. Wald contributed reporting.

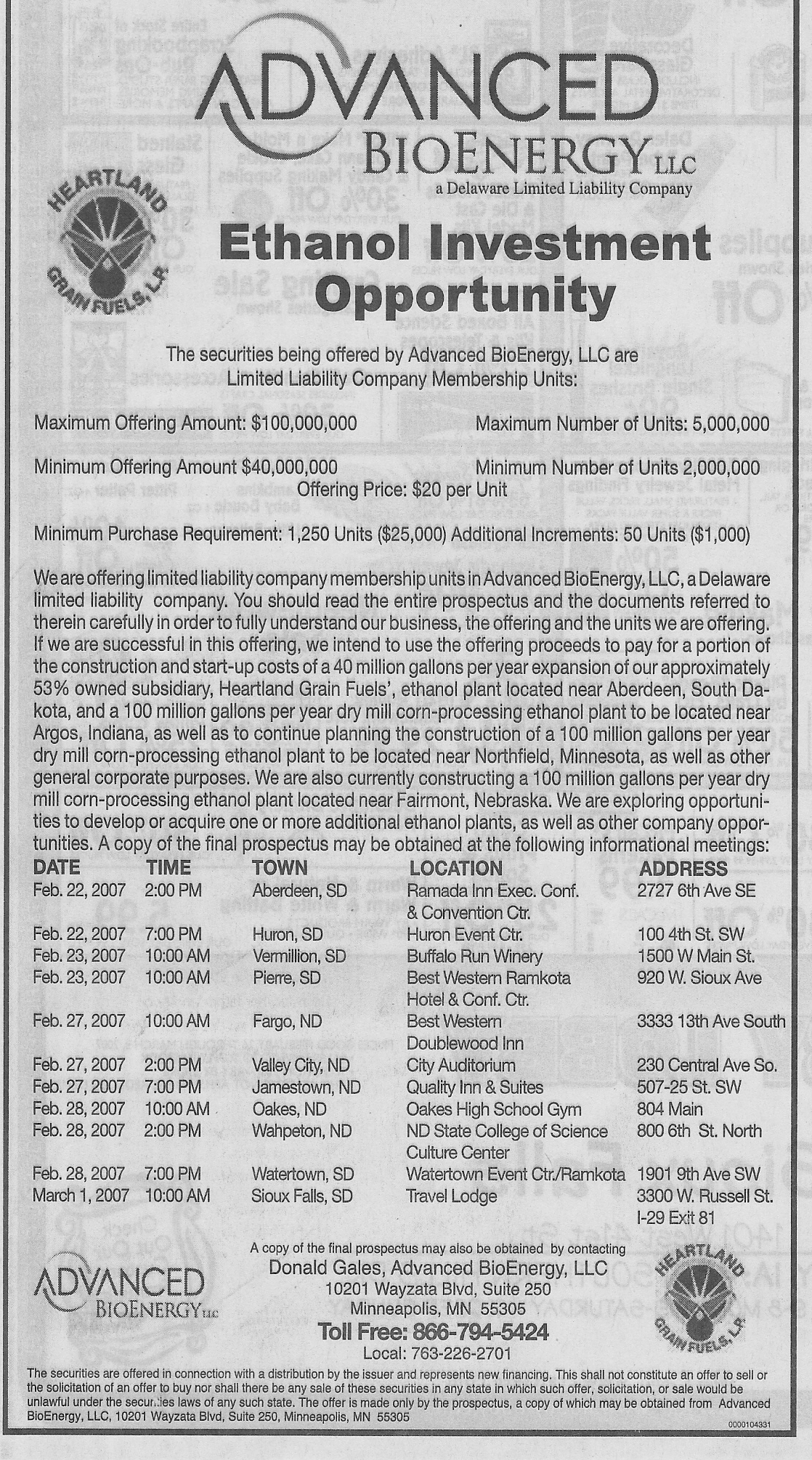

Advanced BioEnergy needs cash

February 25th, 2007

Money makes the world go round…

For those of you following the Advance BioEnergy ethanol plant proposed for Dundas, and who around Rice County isn’t, there’s news… they’re out there and they’re looking for money. Don’t they get that the ethanol market, ethanol future, is spiraling downward, what with water usage problems, smell, __________ (name that problem here). Or is it that investors get the problems with ethanol and its checkered future?

Lo and behold, they’re prowling around North Dakota and South Dakota looking for money. Are they having trouble finding private investors among their usual suspects? I know, this will be hard to read, so below will be a link to pull up the whole thing.

NOTE THEY MENTION THE NORTHFIELD PLANT!!!

Here’s the link: ABE Investor Meetings

Seems to me there ought to be a contingency out on the road with them finding out what the scoop is — sounds like a job for the Northfield News!

My little tico in Costa Rica is calling…

February 25th, 2007

And now it’s a whole new world. I was about ready to dig out my boots and head out and the pups started barking, I saw Lake, the BIG yellow lab bounding through the snow and neighbor Deb catching up with him, and I went to get Kenya fed so I could go out knowing she was settled in, and I look out and there’s Lake’s other compadre out there with a shovel, and the youngerMoen too, AAAAAAAAAGH, by the time I finished getting the dog fed and got out of my bunny slippers, most of the car was dug out. With neighbors like that… well, I’ll just have to bring them all with to Costa Rica!

And these are NOT black and white photos, it’s what this frozen tundra looks like in the winter.  But the haze has cleared and Wisconsin is out there in the distance.

At least 11,500MW mothballed in Texas

February 24th, 2007

Speaking of mothballed fleets… Now we all know that Texas wants to build a gazillion or two megawatts of new coal plants. It’s bad enough that they propose coal plants, and now NRG jumps into the fray and proposes a coal gasification (IGCC) plant. I’ve been talking and emailing with a bunch of people down there of all power plant persuasions, because why aren’t they doing wind and gas combo like we’ve started here? Or wind and concentrated solar given the solar and land resource. In the midst of this, it occurred to me that I’d better take a look at the NERC report and see what they had to say about ERCOT, the Texas region. Well I did, and land sakes, OH MY DOG, so should you!!!

The juicy bit, from p. 15:

However, approximately 7,000 MW of existing mothballed generating capacity is not included as vailable capacity that could potentially be brought back into service in a short time frame.

Did y’all know that five or so years ago they shut down more than a dozen gas-fired plants? NERC reports that now, there are 7,500MW mothballed in ERCOT! And we know NERC is very conservative. AEP shut down a bunch, it’s hard to get a handle on it , one articles says they shut down 1,628 and are looking at another 2,253MW. CenterPoint shut down 3,400MW. TXU shut down 3,612 at least. In 2006, a PSC Commissioner reported that 11,500MW (link GONE, grrrr) was mothballed:

11,500 MW of inefficient, high-heat-rate units retired or mothballed. 1,100 MW of mothballed units have been returned to service for summer 2006.

Suffice it to say, there’s a lot of gas plants sitting around, and I’ll bet Mr. Gas Turbine World has a bunch of turbines to get those plants humming.

Can someone explain to me why anyone would recommend all these new $2 billion coal plants when there’s all this wind already in Texas that could be built around these mothballed plants and use them for back up to the wind? Just LOOK at all the wind:

Or better yet, think about all the open spaces, no trees, and cover it with PV or concentrated solar:

Coal? Whatever are they thinking? Tens of thousands of megawatts of coal?

Next — well, it could take a while, but I want to see a map of where those mothballed plants are compared to the new coal plants and considering “need” if they even bother to claim need. Something tells me we’re being hoodwinked.