CO2 sequestration is so… like… not happening!

January 26th, 2007

Yes, it’s true, sequestration is the biggest red herring we’ve ever seen…

(stolen from Poplar Bluff School District site!)

To quote David “Just Do It!” Hawkins of the Natural Resources Defense Council in “Stick it where? Public Attitudes toward Carbon Storage:”

The coal industry and the administration seem to think that by labeling a proposal “clean coal,” they will garner political support for coal expansionpolicies. I think this indiscriminate mislabeling is quite shortsighted. Coal is already associated with pollution and harm to the landscape; when the facts about allegec clean coal projects are disclosed, coal advocates will be associated with dishonesty as well.

You tell ’em Hawkins! Oh, but wait… isn’t NDRC the one that took $437,500 from the Joyce Foundation to promote coal gasification?

…and so what are they all doing saying “IGCC is great with capture and sequestration” when they haven’t a clue what they’re talking about? Don’t they get that they’re going to be up for the Legalectric Horse’s Ass Award when the world finds out that it’s not real?

Now remember, when we’re talking about Carbon Capture and Sequestration, there are three distinct parts:

1) Capture (this has been focus of industry studies)

2) Transport

– $60k/inch/mile = $1,080,000/mi for 18″ pipe

– Repressurization stations along the way

3) Sequestration ($3-10/ton, per Sally M. Benson)

Here’s a few choice documents I found, after that DOE Supplement that I just can’t get enough of, little reality check for those not quite conscious yet:

DOE – Supplement to DEIS on Sequestration

Economic Modeling of Carbon Capture and Sequestration Technology

Hydro & Geological Monitoring of CO2 Sequestration Pilot

Electricity without CO2 – Assessing the Costs of CO2 Capture and Sequestration

Geologic Carbon Dioxide Sequestration – Site Evaluation to Implementaion

Electricity – Assessing Costs of CO2 Capture and Sequestration

Are we having fun yet? Get comfy, pour another cup of coffee, and read this!

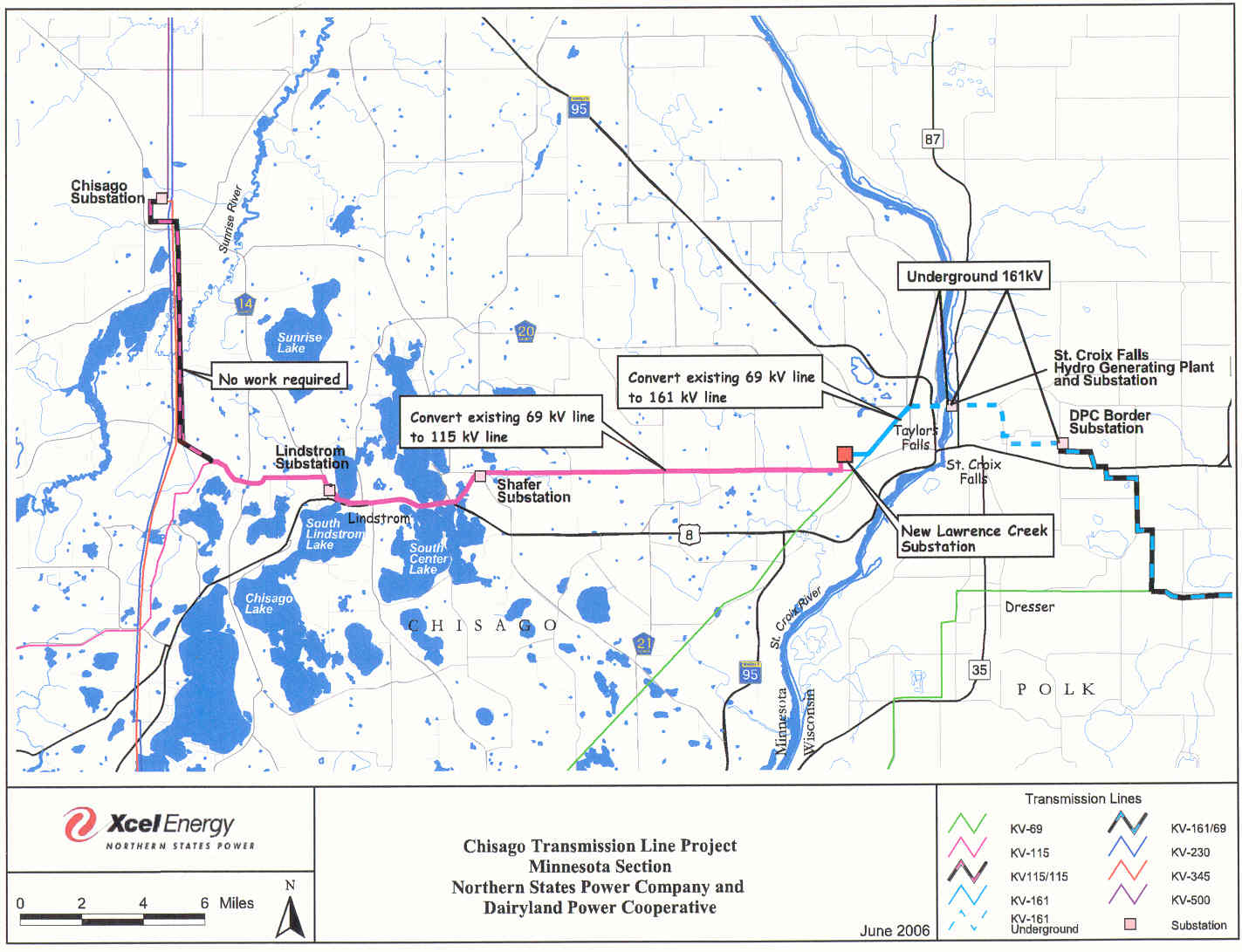

Chisago Project – exclusion and invention

January 25th, 2007

The Chisago Project is back.

Clisk HERE for the state’s Energy Facilities docket.

Public Meeting & Scoping Meeting

February 27, 2007

4:30 – 7:00 p.m.

Lindstrom Community Center

13292 Sylvan Ave

Lindstrom, MN 55045

Worse, it’s moving forward in the PUC Certificate of Need process, and the process there is appalling. I’m hard pressed to find printable words to describe what’s been happening. The Siting and Certificate of Need docket are before the PUC today and a short rundown of the problems: No service of application, removal from service list, no service of Commerce Comment, Commerce and PUC making up “non-contested” process and worse, saying the Chisago Project should use it! What makes them think that this is acceptable, much less LEGAL, and that they can get away with it!

Concerned River Valley Citizens – Reply Comment

To find out what’s happening, pack a bag lunch and a compass. Go to www.puc.state.mn.us and go to “Search Documents” and plug in docket 04-1176. If you ask to be put on a Service List, be sure to let your loved ones know because you never may be heard from again — at best, you won’t be served with the documents and will have no clue what’s going on in the docket.

And let’s be very clear about something… Though the utility has failed to serve applications, clear violations, they’re the utility and we expect them to be that way. The state is the real problem here. The state is the one charged with protecting the public, the public interest, and the ratepayer. They’re the ones really screwing us over.

I really hate it when this happens — it’s so egregious, and yet what options do we have to stop it? I’ve got the Appellate Court reviewing a MERA case of mine, trying to get some clear law about the “violation of rule, standard” aspect of MERA, when that comes down, we’ll know if MERA is a winning approach to this flagrant violation of statutes and rules. They’re begging for a big fat legal slap… OK, fine, whatever…

Blog problems… grrrrrrrrrrr

January 25th, 2007

In case you haven’t noticed, I’ve got blog problems, ones that I don’t understand, but that I hope will be fixed soon.

All I want is something that isn’t a link in planned obsolesence, the same system for at least a year!

The point of USCAP’s promotion of IGCC?

January 23rd, 2007

(something very strange is going on on this blog, oh my, don’t ask me, but it’ll be fixed some day)

Remember USCAP, United States Clean Air Partnership, that coalition of corporations like General Electric and Dupont and “environmental” groups like IGCC promoters Natural Resources Defense Council and Environmental Defense that banded together and are promoting IGCC? Why would anyone promote IGCC? Well, gollllly, look at what one of those corporations is doing — here’s one reason to promote IGCC:

GE invests in Kentucky coal gasification project

BOSTON, Jan 23 (Reuters) – General Electric Co. (GE.N: Quote, Profile , Research) said on Tuesday it has acquired a 20 percent stake in a planned Kentucky power plant that will use coal gasification technology.

Coal gasification converts coal into a gas that can be burned to generate energy, stripping out some pollutants during the process, which allows for lower emissions.

GE did not provide financial details of its 20-percent investment in the ERORA Group LLC, which is developing the 630 net-megawatt plant

Work on the facility in Cash Creek, Kentucky, outside Louisville, is scheduled to begin later this year, with the plant beginning to operate commercially in 2010 or 2011

===========================

A more detailed version from GE Finaicial Services:

GE Unit Makes First Investment in Infrastructure Project Using Gasification Technology

LOUISVILLE, Ky. & STAMFORD, Conn.–(BUSINESS WIRE)–GE Energy Financial Services, a unit of General Electric (NYSE:GE), announced today that it has made its first investment in a plant that will generate power and produce substitute natural gas using coal gasification technology. It is acquiring a 20 percent equity interest in The ERORA Group LLC, which is developing Kentucky�s 630 net megawatt Cash Creek Integrated Gasification Combined Cycle facility, one of the most advanced and largest gasification projects under development in the United States.

Financial details of the transaction with Louisville-based ERORA were not disclosed.

Gasification converts coal into a gas that is cleaned and then can be used to generate power or modified further to produce natural gas, hydrogen, or other basic chemicals. Relative to conventional coal-based power generation technologies, the project would produce fewer air emissions, and would use less water to provide power for 400,000 homes.

�This transaction is an anchor for our plans to grow by investing in gasification � a cleaner, more environmentally friendly power source compared to traditional coal-fired generation �and is consistent with GE�s ecomagination initiative, helping customers meet their environmental challenges,� said Dan Castagnola, a managing director at GE Energy Financial Services. �The investment represents an opportunity to build a coal gasification facility that takes advantage of an abundant, locally produced natural resource in Kentucky, the nation�s third-largest coal-producing state.�

Ecomagination is GE�s commitment to expand its portfolio of cleaner energy products while reducing its own greenhouse gas emissions.

The Cash Creek project�s strategic location in Henderson County along the Green River provides the flexibility to interconnect with three electric grids — the PJM West, MISO and SPP — and is within six miles of both the ANR and TGT interstate gas pipeline connections, enabling efficient transport to end customers of the gas it will produce. Construction of Cash Creek is expected to begin in late 2007, pending financial close and required project approvals, with commercial operation planned in 2010/2011.

In making this investment in The ERORA Group, GE Energy Financial Services joins the New York investment firm D.E. Shaw group, which acquired a majority interest in the company last year.

About GE Energy Financial Services

GE Energy Financial Services� 300 experts invest globally with a long-term view, across the capital spectrum and the energy and water industries, to help their customers and GE grow. With $13 billion in assets, GE Energy Financial Services, based in Stamford, Connecticut, invests more than $5 billion annually in two of the world�s most capital-intensive industries, energy and water. In renewable energy, GE Energy Financial Services has developed a strong record investing in wind, solar, biomass, hydro and geothermal power, and is growing its portfolio of $1.5 billion in renewable energy assets. More information: www.geenergyfinancialservices.com.

About GE

GE (NYSE: GE) is Imagination at Work — a diversified technology, media and financial services company focused on solving some of the world’s toughest problems. With products and services ranging from aircraft engines, power generation, water processing and security technology to medical imaging, business and consumer financing, media content and advanced materials, GE serves customers in more than 100 countries and employs more than 300,000 people worldwide. For more information, visit www.ge.com.

About The ERORA Group

The ERORA Group is a privately owned company headquartered in Louisville, KY. The company�s efforts are focused on coal gasification. ERORA’s management has more than 60 years of combined industry experience and extensive background in utility management, energy marketing and generation asset development.

About the D.E. Shaw Group

The D.E. Shaw group is a global investment and technology development firm. Since its organization in 1988, the firm has earned an international reputation for financial innovation, technological leadership, and an extraordinarily distinguished staff. The D.E. Shaw group encompasses a number of closely related entities, with approximately 1000 employees, $25 billion in aggregate investment capital, and offices in New York, London, Silicon Valley, Houston, Kansas City, San Francisco, the Washington DC area, and Hyderabad, India.

Here’s GE stock over the last 10 years, looking pretty lackluster, or should I say, reflecting the electricity market?

KumBahYahoos rally around CO2… or is it IGCC?

January 21st, 2007

There’s something big tomorrow… maybe the United States Climate Action Partnership has pushed TXU to fill Texas with IGCC plants? Oh yes, that would be a really good idea. But we’ll have to wait until tomorrow. Until then:

From the Joint Statement of the United States Climate Action Partnership:

Toward this end, USCAP urges lawmakers to enact a policy framework for mandatory reductions of GHG emissions from major emitting sectors, including large stationary sources, transportation, and energy use in commercial and residential buildings. The cornerstone of this approach would be a cap-and- trade program. The environmental goal is to reduce global atmospheric GHG concentrations to a level that minimizes large-scale adverse impacts to humans and the natural environment. The group recommends Congress provide leadership and establish short- and mid-term emission reduction targets; a national program to accelerate technology research, development and deployment; and approaches to encourage action by other countries, including those in the developing world, as ultimately the solution must be global.

…

USCAP expects to issue its full report on Monday. In the interim, there have been articles containing incorrect and incomplete information in describing the group’s position on the construction of conventional coal- burning plants. We believe this should be corrected now. The USCAP principles encourage policies to speed the transition to low- and zero emission stationary sources and strongly discourage further construction of stationary sources that cannot easily capture CO2 emissions. This is one of an integrated set of principles and recommendations the group has proposed, and should not be considered in isolation.

…

USCAP consists of market leaders Alcoa, BP America, Caterpillar, Duke Energy, DuPont, FPL Group, General Electric, Lehman Brothers, PG&E, and PNM Resources, along with four leading non-governmental organizations — Environmental Defense, Natural Resources Defense Council, Pew Center on Global Climate Change, and World Resources Institute.

Who benefits from a cap & TRADE scheme? Those trading — it doesn’t do anything at all to plow $$$$ back into conservation and efficiency and renewables, it just lets those who can afford it continue to pollute and enrich those in the market. How is that helpful? Who benefits?

Who’s orchestrated CCX?

Why, the Joyce Foundation – here’s CCX blurb on that.

And another blurb HERE

Joyce’s top “environmental” program priority is:

Energy from Clean Coal. Because fossil fuel emissions create pollution and foster climate changes that threaten the Great Lakes, the Foundation has a long-standing interest in the energy infrastructure of the region. Investment and policy or regulatory decisions about proposed new coal-burning power plants will shape not only our electricity system for the future, but the future of the Lakes as well. We are committed to promoting policies that encourage (through incentives and regulatory structures) the development of clean coal technologies and to ensuring that state agencies approve only those projects that meet state-of-the-art standards for minimizing air pollution and have significant promise for reducing or capturing carbon emissions. The Foundation supports efforts to engage state officials and power plant developers to build the cleanest possible plants to meet the regionâ??s electricity needs.

And who has Joyce funded to promote coal gasification (IGCC)?

$3 million in Joyce Grants to boost clean coal

Once more with feeling… how much did they get?

Natural Resources Defense Council: $437,500

And it’s $7 million over three years! Here’s that announcement

Here’s what Environmental Defense has been doing to make IGCC a household word:

Whatever are they thinking? What do they know about IGCC? It’s apparent what they don’t know, i.e., cost, water contamination, and that the emissions profile is not something to write home about. But here’s their handout, where they claim that “COAL GASIFICATION IS CLEANER.” Uh-huh, right…

=

Anyway, apparently USCAP is getting dissed about something. I’d guess, from the parts I’ve highlighted above, that this is another toady “organization” supporting IGCC, coal gasification! If that’s the case, they should be dissed!

Here’s Natural Resources Defense Council on IGCC:

Suffiice it to say, Environmental Defense and NRDC are overdue to get a packet of stuff about coal gasification from this neck of the woods!

And in our neck of the woods, the Joyce Foundation has funded Clean Wisconsin ($750,000 to Joyce’s Steve Brick’s alma mater) (check this: Clean Coal Study Group); $437,500 to Great Plains Institute’s Coal Gasification Work Group; another $437,500 to NDRC (here they wax on about the Beulah plant, what about the water contamination problems?); and the Clean Air Task Force (CATF IGCC support cited by Micheletti and crew, if THEY like it why don’t you??); Ohio Environmental Council (how’s this for shameless promotion of IGCC with nominal knowledge! Or their “Roadmap” p. 17-23), AAAAAAAGH, I can’t take anymore of this… oh, but btw, note that they gave Rockefeller Family Fund $50,000 for the “ONGOING COAL ADVOCACY ACTIVITIES” OF RE-AMP, oh, they’ve got a “Roadmap” too), oh, so does Great Plains, why, it’s all connected! Here’s the Great Plains Roadmap.

January 19, 2007

A Coalition for Firm Limit on Emissions

By FELICITY BARRINGER

WASHINGTON, Jan. 18 â?? Ten major companies with operations across the economy â?? utilities, manufacturing, petroleum, chemicals and financial services â?? have banded together with leading environmental groups to call for a firm nationwide limit on carbon dioxide emissions that would lead to reductions of 10 to 30 percent over the next 15 years.Introduction of this group, which includes industry giants like General Electric, DuPont and Alcoa, is aimed at adding to the recent impetus for Congressional action on emissions controls and the creation of a market in which allowances to emit carbon dioxide could be traded in a way that achieves the greatest reduction at the lowest cost.

The diversity of the coalition â?? some members had already come out for other forms of emissions control, like a carbon tax or voluntary controls, but others had been silent on climate-change issues until now â?? could send a strong signal that businesses want to get ahead of the increasing political momentum for federal emissions controls, in part to ensure that their long-term interests are protected.

Many energy producers and manufacturers have expressed concern that various state efforts, if not coordinated, could lead to a scattershot system of regulation. Others worry that harsher measures, like a stiff tax on fossil fuels, the biggest contributor to global-warming gases, could be imposed if they do not reach a consensus on a legislative approach.

The groupâ??s formal announcement is scheduled for Monday, the day before President Bush is to deliver his State of the Union address and offer the administrationâ??s newest basket of proposals to promote energy security and combat global warming.

Aside from General Electric and Alcoa, Caterpillar is the leading manufacturing company among the group, which also includes four utilities â?? Duke Energy, based in North Carolina; PG&E of California; the FPL Group of Florida; and PNM Resources of New Mexico. The group counts the multinational oil company BP and Lehman Brothers as members as well.

Jonathan Lash, the president of the World Resources Institute, said Thursday that â??this signals that the differences in the interests between these sectors and within these sectors can be resolved.â?

Peter A. Darbee, chief executive of PG&E, said, â??My hope and expectation is that Congress, the White House and the public will look at these chief executivesâ? and note that companies with a motive to oppose emissions controls are nonetheless saying, â??Hereâ??s a serious problem; it needs to be dealt with, and it needs to be dealt with now.â?

The negotiations, conducted primarily by the chief executives of the companies, did not produce a model piece of legislation, but rather a detailed set of principles that they suggest as a guide to any legislation. In the Senate, there are already four Democratic proposals for limiting carbon emissions and creating a market-based system, under which the government gives or sells permits to businesses, allowing them a certain level of emissions.

Once established, such a system would allow better-performing companies to sell or trade unneeded credits, and all companies involved would be able to determine whether it would be more efficient for them to clean up their own emissions or buy credits from others.

The groupâ??s principles include recommending a range of emissions levels â?? from 100 to 105 percent of current levels within five years, then down to 90 to 100 percent of current levels in 10 years, and 70 to 90 percent of current levels in 15 years. In addition, the chief executives agreed after some discussion, to â??strongly discourage further construction of stationary sources that cannot easily captureâ? carbon dioxide.

This comes close to a rejection of almost all new coal-fired power plants on the drawing boards, including the 11 plants recently proposed by TXU, a Texas utility. The technology that would isolate carbon dioxide emissions and bury them is still in the earliest phases of development, so this near-repudiation of existing coal technology would have a disproportionate impact on utilities that depend largely on coal, like TXU and the Southern Company.

But Jeff Sterba, the chief executive of PNM Resources, whose company gets about two-thirds of its power from coal and is a member of the coalition, explained why he supports such an approach. â??The most important thing for us is to have a viable, diverse portfolio of resources, and coal has got to be part of that mix,â? he said. â??Today, the biggest problem coal has is uncertainty about carbon.â?

The group, called the United States Climate Action Partnership, had its origin in conversations last spring among Mr. Lash; Fred Krupp, the president of Environmental Defense; and Jeffrey R. Immelt, the chief executive of General Electric. Mr. Lash had worked with Mr. Immelt on the rollout of GEâ??s Ecomagination program in 2005 â?? which combined pledges of emissions reductions with a new emphasis on energy-efficient and climate-friendly technologies.

Mr. Sterba and the leaders of the other environmental groups, which also includes Frances Beinecke of the Natural Resources Defense Council and Eileen Claussen of the Pew Center on Global Climate Change, said that an efficient, flexible cap-and-trade system would stimulate the development of new technologies to cut energy use and provide renewable energy.

General Electric claims significant advances in these areas already. According to Peter Oâ??Toole, a company spokesman, â??Revenues from the sale of energy-efficient and environmentally advanced products and services hit $10 billion in 2005,â? up from $6.2 billion in 2004.

The chief executives in the group met for the first time in July. During the meeting, Mr. Krupp said, â??it became clear that cap-and-trade is an element of the deal that is good for everybody.â?

â??Itâ??s good for the environmental community,â? he said, â??because a hard cap guarantees the integrity of the environmentâ? and â??industry likes it because itâ??s so efficient.â?

Timing also played a role in the executivesâ?? thinking. As Mr. Darbee said, â??We have the opportunity to construct something more pragmatic and realistic while President Bush is in office.â? A future political climate, after 2008, he said, might produce â??solutions less sensitive to the needs of business.â?