Rochester gas pipeline inching through process

October 17th, 2016

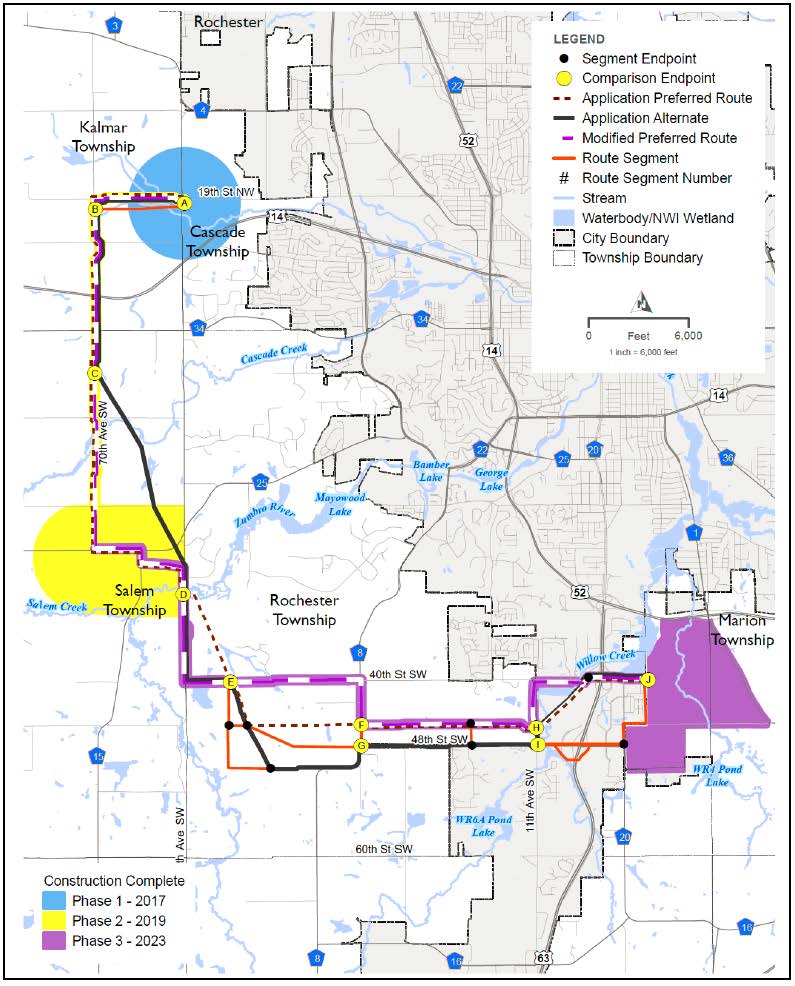

Map from Comparative Environmental Assessment(click for larger version)

Map from Comparative Environmental Assessment(click for larger version)

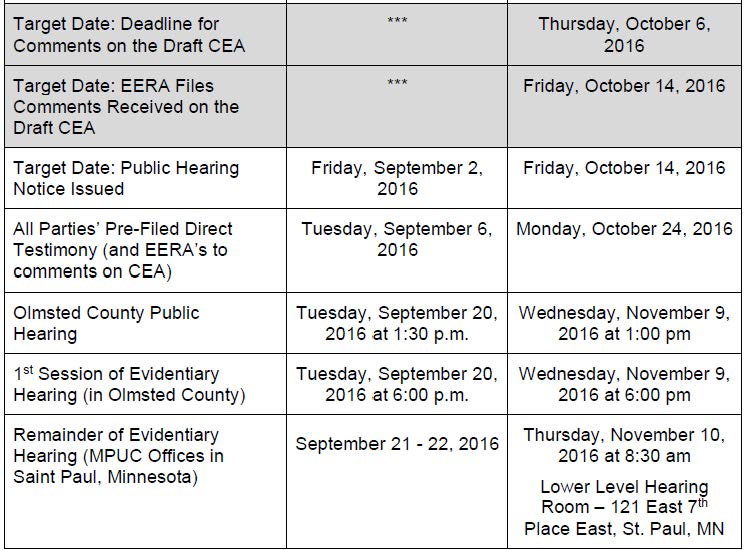

Heads up — there will be a public hearing about this line some time in the future, I’d expect before year end, but who knows… Will find out and post here, and until then, here’s the “target” schedule (click for larger view):

In the meantime, the Draft Comparative Environmental Analysis has been released for the MERC natural gas pipeline around the south and west side of Rochester, yes, a CEA, the environmental review document tossed out in the Sandpiper Appellate Decision OPA150016-091415.

How did I miss this? I see I’m not on the service list — anyone who comments should be. And I know I went to the meeting and handed in comments, and eFiled as well:RRRRRRRRRR. I have two major concerns. First, hiding the RPU gas plant that this will service; second, that if this pipeline goes in, how close will it be to existing development and will the local governments permit development over and next to this gas pipeline, as has been done in Kasson and Byron, to name a few. This is a serious problem and they’d better consider it.

Documents I’d entered in support of Comments at the Scoping meeting back in February:

Sandpiper Appellate Decision-CEA_20165-120948-01 (filed multiple times, ???)

RPU_2012 Infrastructure Update_2012 20164-120802-01

RPU chooses Boldt to build new $62 million power plant 20164-120796-01

Safe separation distances from natural gas transmission pipelines_20164-120797-01

A model for sizing high consequence areas with natural gas pipelines_20164-120800-01

Anyway, looking at the public comments regarding the CEA, PUBLIC COMMENTS HERE, I see that yes, they’re planning on routing this through an area that’s going to be a subdivision, now in the permitting process. The developers have raised concerns. ??? There should be awareness that platting over a pipeline is a major liability exposure for the permit granting jurisdiciton and whoever builds next to a pipeline, what with such broad burn zones. Once more with feeling:

This MERC pipeline is to support the natural gas plant on the west side of town, and as I’d noted before in an earlier post, with some links to primary documents:

First they brought it up at Rochester Public Utilities Board meetings over the summer [2015]:

PUB- Resolution 4315 – Resolution: West Side Energy Station

Westside Energy Station Epc – Bids in Minnesota

And finally, last week, RPU made it’s plans to add new natural gas generation VERY public:

Back in that CapX 2020 Certificate of Need proceeding (PUC Docket 06-1115) it was an issue because the “need” used to justify CapX 2020 transmission to Rochester was so very small that it could be met with this RPU planned natural gas plant. Here’s what I wrote in the 2008 No CapX 2020 Initial Brief:

Leave a Reply